Understanding investment risk tolerance levels is crucial for any investor looking to navigate the complex world of finance. But what exactly does it mean? In simple terms, it refers to the level of risk an individual is comfortable with when investing their hard-earned money. Some individuals may be willing to take on higher risks in hopes of greater returns, while others may prefer a more conservative approach. By delving into the nuances of investment risk tolerance levels, you can make well-informed decisions that align with your financial goals and personal comfort. So, let’s explore this concept further and gain a deeper understanding of how to assess and evaluate your own risk tolerance.

Understanding Investment Risk Tolerance Levels

Investing is a vital component of wealth creation and financial planning. However, it is important to recognize that all investments carry a certain degree of risk. Risk tolerance refers to an individual’s ability to endure market fluctuations without experiencing undue anxiety or making impulsive investment decisions. By understanding your risk tolerance level, you can make informed investment decisions that align with your financial goals and comfort level. In this article, we will explore the concept of investment risk tolerance and provide strategies to assess and manage it effectively.

The Importance of Understanding Investment Risk Tolerance

Investing in financial markets inherently involves risk. Stock prices can fluctuate, bond values can change, and economic conditions can have a significant impact on investment returns. Understanding your risk tolerance is essential for several reasons:

1. Aligning Investments with Goals: Different individuals have different financial goals, which may include saving for retirement, purchasing a home, or funding their children’s education. By understanding your risk tolerance, you can choose investments that align with your objectives and time horizons.

2. Emotional Well-being: Investment decisions can trigger emotional responses, especially during periods of market volatility. If you are investing beyond your risk tolerance level, you may experience anxiety, fear, or panic during market downturns, leading to impulsive decisions that can undermine your long-term financial success.

3. Long-term Performance: By investing according to your risk tolerance, you are more likely to stay invested during market downturns, enabling you to benefit from the potential long-term returns of your investments. Selling investments at unfavorable times due to emotional reactions can lead to missed opportunities for growth.

Factors Affecting Investment Risk Tolerance

Several factors influence an individual’s risk tolerance level. Understanding these factors can help you assess and manage your risk effectively. Here are some key considerations:

Time Horizon

Your time horizon refers to the length of time you are willing to leave your investments untouched before needing to access the funds. Typically, the longer your time horizon, the greater the ability to withstand short-term market fluctuations. Younger individuals with long investment horizons can generally afford to take on more risk compared to those approaching retirement, who may have a shorter time frame to recover from potential losses.

Financial Goals

Your financial goals play a crucial role in determining your risk tolerance. If your goals require steady, low-risk returns, such as preserving capital for a down payment on a house in the near future, you may have a lower risk tolerance. Conversely, if you have longer-term goals that can benefit from higher-risk investments, such as saving for retirement, you may have a higher tolerance for market volatility.

Financial Situation

Your financial situation, including your income, assets, and liabilities, can impact your risk tolerance. Individuals with stable income sources and sufficient savings may be more comfortable taking on higher risk investments, while those with limited financial resources may prefer safer, low-risk options.

Knowledge and Experience

Your knowledge and experience with investing can influence your risk tolerance. Some individuals may have a deep understanding of investment concepts, market dynamics, and risk management strategies, allowing them to tolerate higher levels of risk. Conversely, those with limited knowledge or experience may feel more comfortable with conservative, lower-risk investments.

Assessing Investment Risk Tolerance

Now that we understand the importance of risk tolerance and the factors influencing it, let’s explore some strategies for assessing your personal risk tolerance:

Questionnaires and Surveys

Many financial institutions and online investment platforms offer risk tolerance questionnaires or surveys. These assessments typically ask a series of questions about your financial situation, investment goals, and feelings about risk. Based on your responses, the questionnaire generates a risk profile that suggests an appropriate asset allocation strategy.

Self-Reflection

Self-reflection can be a powerful tool in assessing your risk tolerance. Consider your comfort level with potential investment losses, your natural inclination towards risk-taking or risk-aversion, and your ability to handle fluctuations in investment values. Assessing your emotional response to market downturns can provide valuable insights into your risk tolerance.

Consulting with Financial Professionals

Financial professionals, such as financial advisors or investment managers, can provide invaluable guidance in assessing your risk tolerance. They can help evaluate your financial goals, analyze your financial situation, and propose investment strategies that align with your risk tolerance level.

Managing Investment Risk Tolerance

Once you have assessed your risk tolerance, it is crucial to manage it effectively to ensure your investments align with your comfort level. Here are some strategies to consider:

Diversification

Diversification is key to managing risk in an investment portfolio. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of a single investment’s performance on your overall portfolio. Diversification helps mitigate the risk of significant losses from any one investment.

Asset Allocation

Asset allocation involves determining the percentage of your portfolio allocated to different asset classes, such as stocks, bonds, and cash. Your risk tolerance should guide your asset allocation decisions. A higher risk tolerance may lead to a higher allocation in growth-oriented assets like stocks, while a lower risk tolerance may result in a greater allocation to more conservative assets like bonds.

Regular Portfolio Review

Regularly reviewing your investment portfolio is essential to ensure it remains aligned with your risk tolerance and financial goals. Market conditions, personal circumstances, and financial goals can change over time, necessitating adjustments in your asset allocation or investment strategy. Periodic review and rebalancing of your portfolio help maintain the desired risk-reward balance.

Staying Informed

Keep yourself informed about market trends, economic indicators, and changes in the investment landscape. Staying up-to-date can help you make informed decisions and understand the potential risks associated with your investments.

Understanding your investment risk tolerance is critical for making informed investment decisions and achieving your financial goals. By considering factors such as time horizon, financial goals, financial situation, and knowledge/experience, you can assess your risk tolerance effectively. Implementing strategies like diversification, proper asset allocation, regular portfolio review, and staying informed can help manage your risk tolerance and build a successful investment portfolio. Remember, risk tolerance is personal and can evolve over time, so periodic reassessment is essential.

How to Determine Your Risk Tolerance Level

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is investment risk tolerance?

Investment risk tolerance refers to the level of risk an investor is willing and able to withstand when investing their money. It reflects an individual’s comfort level with potential fluctuations in the value of their investments.

Why is understanding investment risk tolerance important?

Understanding investment risk tolerance is crucial because it helps investors align their investments with their financial goals and personal preferences. It ensures that the selected investment strategies and assets are in line with their comfort level, reducing the likelihood of making emotionally-driven decisions.

How can I determine my investment risk tolerance level?

To determine your investment risk tolerance level, you can consider factors such as your financial goals, investment timeline, knowledge of investment products, previous investment experiences, and emotional capacity to handle potential losses. Additionally, taking risk tolerance quizzes or consulting with a financial advisor can provide further insights.

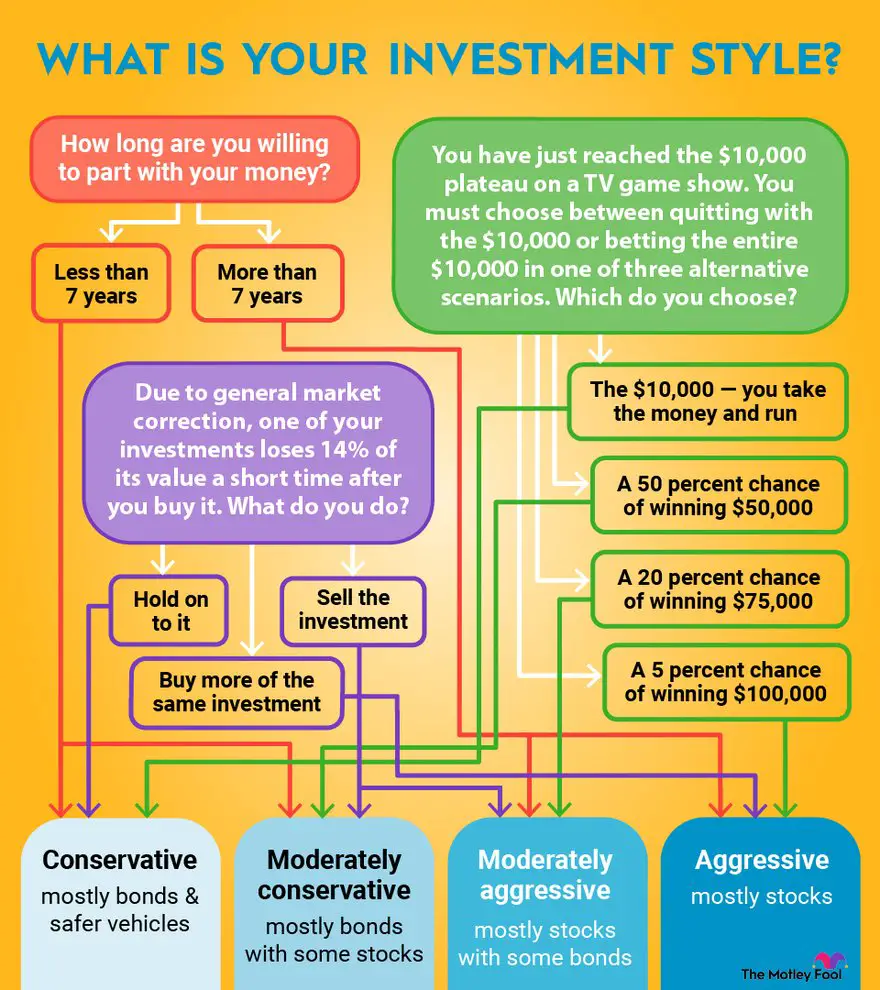

What are the different levels of investment risk tolerance?

Investment risk tolerance levels can differ among individuals, and they generally range from conservative (low risk tolerance) to aggressive (high risk tolerance). Other common categories include moderate, moderately conservative, and moderately aggressive. Each level indicates the willingness to accept potential fluctuations and losses to achieve higher returns.

Should I strive for a high risk tolerance level?

The appropriate risk tolerance level for an investor depends on their personal circumstances and financial goals. While a high risk tolerance may lead to potentially higher returns, it also exposes the investor to greater volatility and potential losses. It is important to strike a balance that aligns with your financial goals, time horizon, and comfort level.

How can I adjust my investment risk tolerance over time?

As circumstances and goals change, it may be necessary to adjust your investment risk tolerance. Regularly reviewing your investment portfolio, financial situation, and factors influencing your risk appetite can help you determine if adjustments are needed. Consulting with a financial advisor can provide valuable guidance during this process.

What are the potential risks associated with higher risk tolerance?

With higher risk tolerance, investors may face the potential risks of increased market volatility, larger fluctuations in the value of their investments, and potential losses during market downturns. It is crucial to carefully assess your risk tolerance and weigh the potential risks against the expected returns before making investment decisions.

Can investment risk tolerance change over time?

Yes, investment risk tolerance can change over time. Factors such as changes in financial goals, life circumstances, market conditions, and investment experiences can influence an individual’s risk tolerance. It is important to periodically reassess and adjust your risk tolerance to ensure that your investment strategy remains aligned with your current situation and goals.

Final Thoughts

Understanding investment risk tolerance levels is crucial for successful investing. By accurately assessing our risk tolerance, we can make informed decisions that align with our financial goals and emotional comfort. It allows us to determine the appropriate balance between risk and return, ensuring a suitable investment portfolio. By acknowledging our risk tolerance, we can avoid making hasty decisions during volatile market conditions, and instead, maintain a disciplined and thoughtful approach. By being aware of our risk tolerance and adjusting our investment strategy accordingly, we can navigate the unpredictable nature of the market and achieve long-term financial success. So, understanding investment risk tolerance levels is an essential aspect of becoming a confident and successful investor.