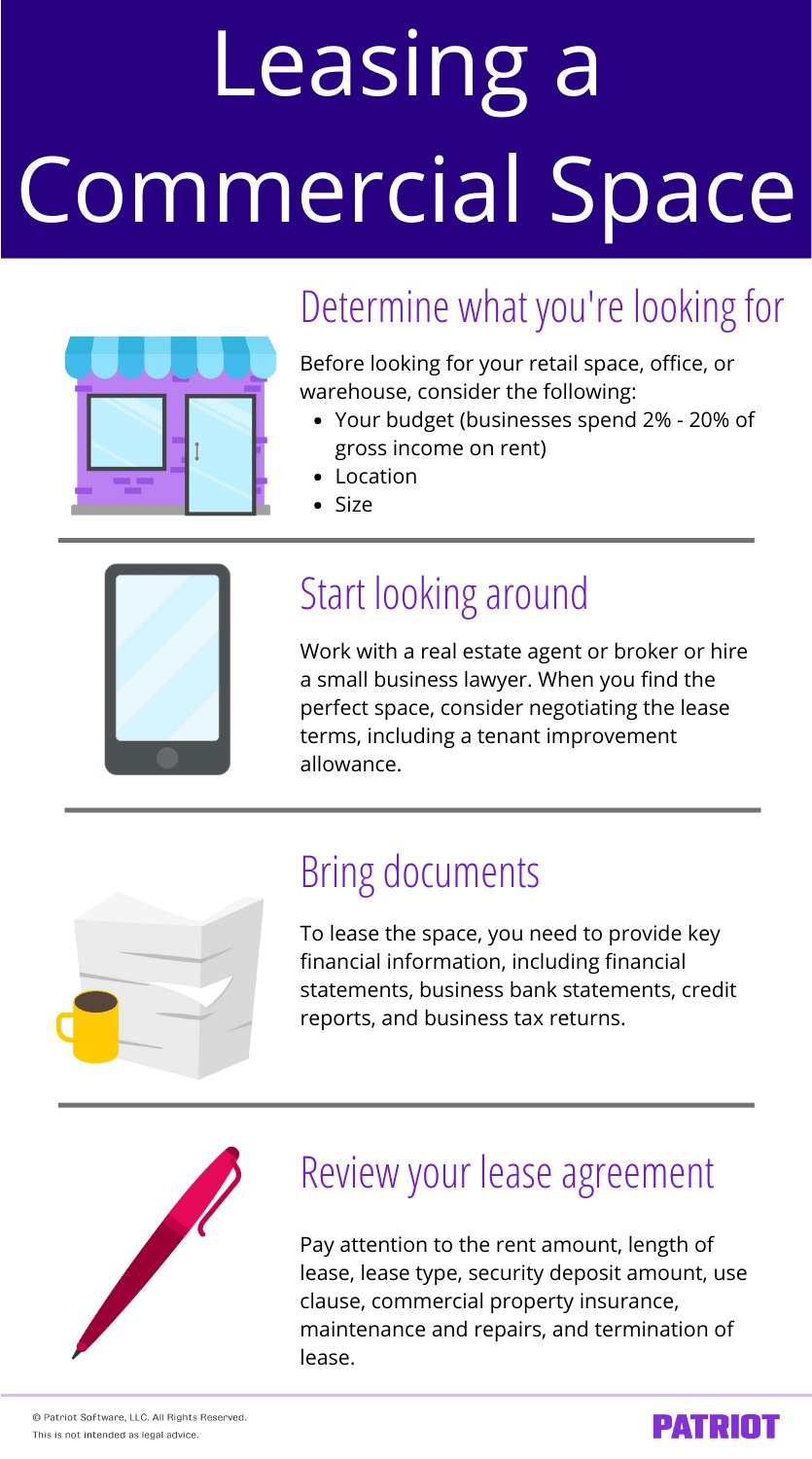

Understanding lease agreements for business spaces can be a complex task, but fear not! We’ve got you covered. In this blog article, we will dive deep into the intricacies of lease agreements, providing you with the knowledge and tools to navigate this crucial aspect of your business with confidence. Whether you’re a new entrepreneur or a seasoned business owner, having a solid understanding of lease agreements is essential for making informed decisions and ensuring a smooth operation. So, let’s get started on our journey to demystify the world of lease agreements for business spaces.

Understanding Lease Agreements for Business Spaces

Lease agreements are a fundamental aspect of renting commercial spaces for businesses. Whether you’re a small startup or an established company looking to expand your operations, it’s crucial to have a clear understanding of lease agreements and their terms. In this article, we will delve into the intricacies of lease agreements for business spaces, providing you with the knowledge you need to make informed decisions. From common terms and conditions to negotiating strategies, we will cover it all.

I. The Basics of Lease Agreements

A lease agreement is a legally binding contract between a landlord (the lessor) and a tenant (the lessee). It outlines the terms and conditions under which the tenant can rent a business space from the landlord. Before signing any lease agreement, it’s essential to familiarize yourself with the following key elements:

1. Lease Term:

– The lease term specifies the duration of the tenancy, typically ranging from one to ten years.

– Longer lease terms often offer more stability, especially for businesses looking to establish a long-term presence.

– However, shorter lease terms provide flexibility and the ability to adapt to changing business needs.

2. Rent:

– The lease agreement should clearly define the rent amount and the frequency of rent payments (e.g., monthly, quarterly).

– It’s crucial to understand any provisions related to rent increases during the lease term.

– Additional charges, such as maintenance fees, utilities, or property taxes, should also be clearly outlined.

3. Security Deposit:

– Landlords may require tenants to provide a security deposit as financial protection against any potential damages or unpaid rent.

– The lease agreement should specify the amount of the security deposit, its refundability, and any conditions for its return.

4. Use of Premises:

– The lease agreement should clearly state the permitted uses of the rented space.

– It’s important to ensure that the designated use aligns with your business needs and any zoning or licensing requirements.

II. Types of Lease Agreements

Lease agreements come in various forms, each with its own advantages and considerations. Understanding the different types can help you choose which one suits your business best. Here are the most common types of lease agreements for business spaces:

1. Gross Lease:

– In a gross lease, the tenant pays a fixed rent amount that includes all operating expenses, such as property taxes, insurance, and maintenance costs.

– This type of lease offers simplicity and predictability as tenants don’t have to worry about additional expenses.

– However, gross leases often have higher rent amounts to account for the included expenses.

2. Net Lease:

– Net leases, on the other hand, require tenants to pay a lower base rent, while also assuming responsibility for a portion of the operating expenses.

– There are three main types of net leases: single net lease, double net lease, and triple net lease.

– Single net leases require tenants to pay property taxes in addition to the base rent.

– Double net leases include property taxes and insurance costs.

– Triple net leases encompass property taxes, insurance, and maintenance expenses.

– Net leases offer more control over expenses but can introduce financial variability for the tenant.

3. Percentage Lease:

– Percentage leases are commonly used in retail and commercial spaces, where the rent is determined as a percentage of the tenant’s gross sales.

– This type of lease enables landlords to share in the success of thriving businesses.

– However, tenants must be mindful of the potential increase in rent if their sales increase significantly.

III. Negotiating Lease Terms

Negotiating lease terms is a critical step to ensure that the agreement aligns with your business goals and financial capabilities. Here are some key points to consider when negotiating a lease for your business space:

1. Rent and Lease Term:

– Evaluate the market rates for similar spaces in the area to determine a fair rent amount.

– Negotiate for a lease term that strikes a balance between long-term stability and flexibility.

2. Maintenance and Repairs:

– Clarify the responsibilities for maintenance and repairs, ensuring that the lease agreement is explicit about who is responsible for what, especially for structural repairs and major maintenance work.

3. Improvements and Modifications:

– If you plan to make any modifications to the premises, such as renovations or additions, discuss these with the landlord before signing the lease agreement.

– Establish clear guidelines for upgrades, alterations, and who will bear the costs.

4. Subleasing and Assignment:

– Consider negotiating terms that allow for subleasing or assigning the lease to another party, providing you with additional flexibility in case your business needs change.

IV. Legal Considerations and Professional Assistance

Lease agreements are legal documents, and it’s essential to understand the legal implications before signing. While seeking professional legal advice is highly recommended, familiarizing yourself with the following legal considerations is a good starting point:

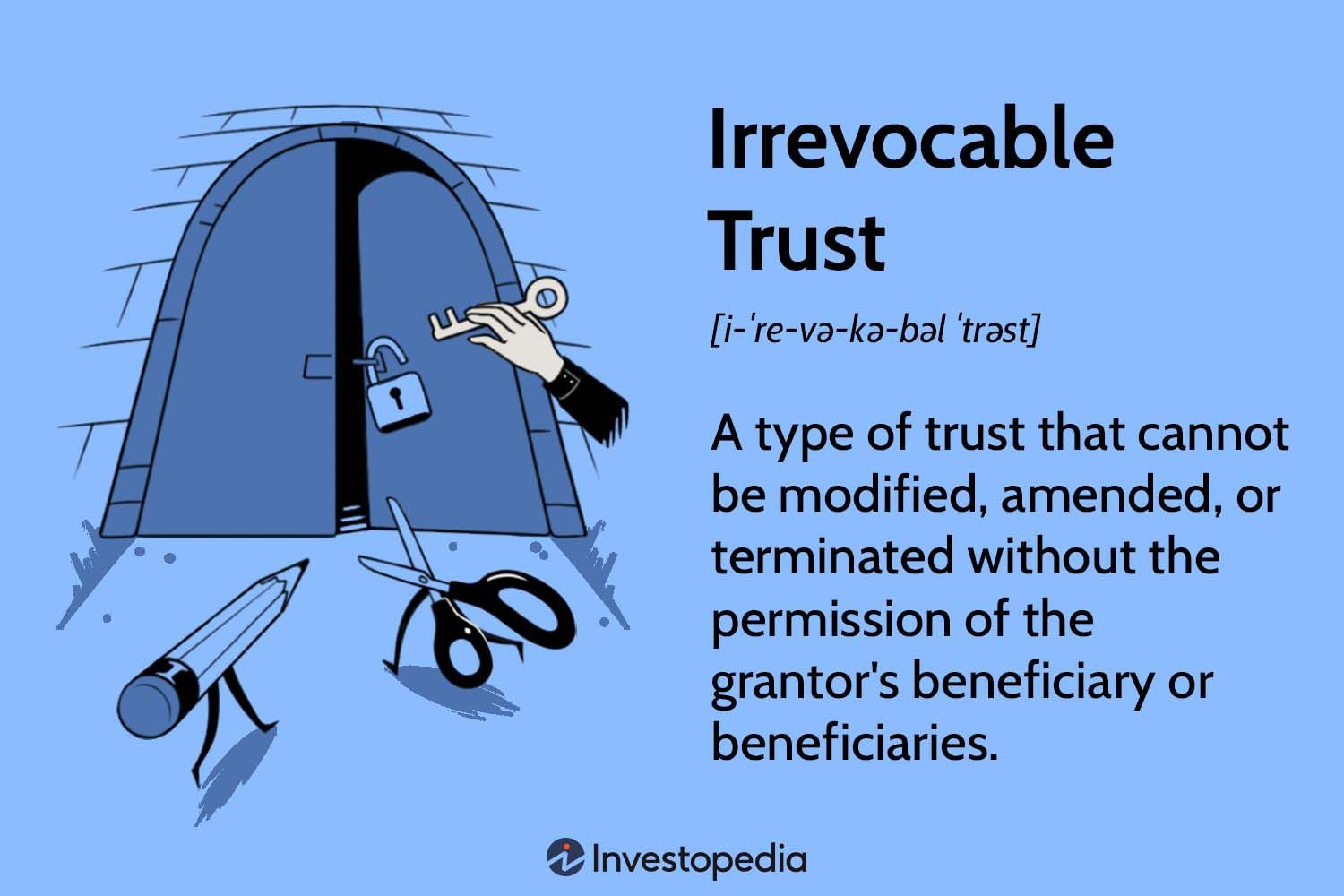

1. Lease Termination:

– Review the lease agreement for terms related to early termination, including penalties or conditions that may allow either party to terminate the lease prematurely.

– Understand the notice period required should you decide to terminate the lease.

2. Default and Remedies:

– Familiarize yourself with the lease agreement’s provisions related to default, such as missed rent payments or violations of other terms.

– Ensure you understand the remedies available to both parties and any associated penalties.

3. Lease Renewal:

– Determine whether the lease agreement includes an option for renewal or negotiation of new terms at the end of the initial lease term.

– Understand the timeline and process for discussing renewals or renegotiations.

4. Professional Assistance:

– Engaging the services of a commercial real estate attorney can provide valuable guidance and ensure that you fully understand the legal implications of the lease agreement.

In Conclusion

Understanding lease agreements for business spaces is paramount to protect your interests and ensure a smooth and successful tenancy. By familiarizing yourself with the basics of lease agreements, exploring different lease types, and considering negotiation strategies, you can make informed decisions that align with your business objectives. Remember to seek professional advice whenever necessary, as lease agreements can be complex legal documents. Armed with this knowledge, you’ll be better equipped to secure a business space that suits your needs and sets the stage for growth and success.

Commercial Lease Agreement – EXPLAINED

Frequently Asked Questions

Understanding Lease Agreements for Business Spaces

Frequently Asked Questions (FAQs)

1. What is a lease agreement for a business space?

A lease agreement for a business space is a legally binding contract between a landlord and a tenant that outlines the terms and conditions of renting a space for business purposes.

2. What are the key components of a lease agreement for business spaces?

The key components of a lease agreement for business spaces typically include the duration of the lease, rent amount and payment terms, security deposit requirements, maintenance responsibilities, and any specific provisions or restrictions.

3. How long is a typical lease agreement for a business space?

The duration of a lease agreement for a business space can vary, but it is typically for a fixed term, such as one to five years. However, shorter or longer lease terms can be negotiated based on the specific needs of the tenant and landlord.

4. Are lease agreements for business spaces negotiable?

Yes, lease agreements for business spaces can be negotiable. Both parties can negotiate terms such as rent amount, lease duration, renewal options, and specific provisions based on their individual requirements and priorities.

5. What is a security deposit and how much is typically required?

A security deposit is a sum of money paid by the tenant to the landlord as a form of protection against potential damages or unpaid rent. The amount of the security deposit can vary but is usually equivalent to one to three months’ rent.

6. Can a tenant make alterations to the business space?

The extent to which a tenant can make alterations to a business space is typically outlined in the lease agreement. Minor alterations, such as painting or installing shelves, may be allowed with prior written consent from the landlord. Major alterations may require landlord approval and restoration at the end of the lease term.

7. What happens if a tenant wants to terminate a lease agreement early?

If a tenant wishes to terminate a lease agreement before the agreed-upon lease term, they may be subject to penalties or obligations as specified in the lease agreement. It is advisable to review the termination clauses in the lease agreement to understand the implications and discuss potential options with the landlord.

8. What are the renewal options for lease agreements?

Lease agreements for business spaces often include renewal options. The specific terms for renewal, such as notice period, rent adjustment, and duration, should be outlined in the original lease agreement. It is important for tenants to review these provisions to determine the available options for extending the lease beyond the initial term.

Final Thoughts

Understanding lease agreements for business spaces is essential for any business owner or entrepreneur. These agreements serve as the foundation for the landlord-tenant relationship and outline the rights and responsibilities of both parties. By carefully reviewing the lease terms and seeking legal advice if necessary, business owners can ensure they are entering into a fair and beneficial agreement. It is crucial to pay attention to details such as lease duration, rent amount, maintenance responsibilities, and any additional clauses or provisions. By thoroughly understanding lease agreements for business spaces, entrepreneurs can protect their interests and make informed decisions about their commercial real estate needs.