Understanding loan amortization schedules can be a complex and daunting task for many. However, fear not! In this blog article, we will guide you through the ins and outs of loan amortization schedules in a conversational and easy-to-understand manner. No more confusion or uncertainty – we’ve got you covered! Whether you’re a first-time borrower or someone looking to refinance, grasping the concept of loan amortization schedules is crucial for making informed financial decisions. So let’s dive right in and unravel the mysteries of understanding loan amortization schedules together.

Understanding Loan Amortization Schedules

Introduction

When it comes to borrowing money for a big-ticket purchase like a house or a car, most people rely on loans. Loans provide a way to make these purchases affordable by spreading the cost over a set period of time. One key aspect of any loan is the loan amortization schedule. In simple terms, a loan amortization schedule outlines how your monthly payments are divided between the principal amount and the interest over the life of the loan.

Understanding loan amortization schedules is essential for anyone looking to take out a loan or manage their existing loans effectively. In this comprehensive guide, we’ll delve into the various components of loan amortization schedules and help you navigate through the complexities.

What Is a Loan Amortization Schedule?

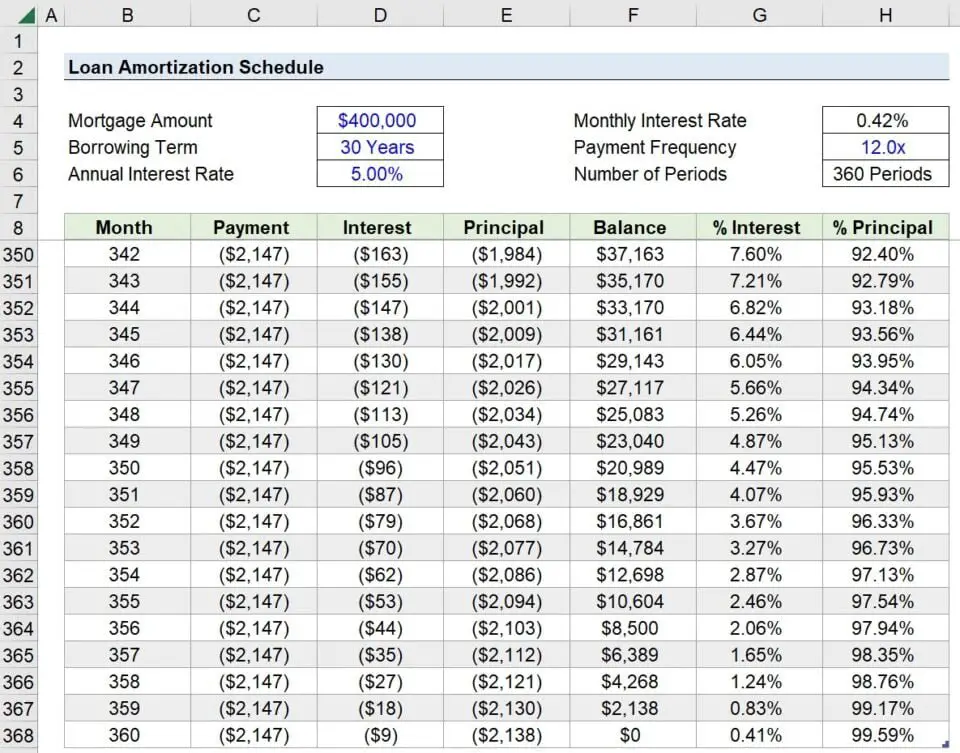

A loan amortization schedule is a table that breaks down each payment you make towards a loan. It provides a detailed overview of how each monthly payment contributes to reducing the principal balance and paying off the interest. The schedule typically includes the payment number, payment amount, interest payment, principal payment, and the remaining balance after each payment.

Components of a Loan Amortization Schedule

To understand loan amortization schedules better, let’s explore the key components typically found in one:

1. Payment Number: This represents the order of each payment, starting from the first payment and ending with the last.

2. Payment Amount: This is the total amount you need to pay each month, including both the principal and the interest.

3. Interest Payment: This component shows the portion of your monthly payment allocated towards the interest charges.

4. Principal Payment: This component highlights the amount of your monthly payment that goes towards reducing the loan’s principal balance.

5. Remaining Balance: This represents the outstanding loan balance after each payment is made.

How Is a Loan Amortization Schedule Calculated?

Loan amortization schedules are calculated using formulas that take into account the loan amount, interest rate, and loan term. The most common formula used for loan amortization is the declining balance method, also known as the reducing balance method.

To calculate the monthly payment for a loan, the formula can be expressed as:

Monthly Payment = P x r x (1 + r)^n / [(1 + r)^n – 1]

Where:

P = Principal loan amount

r = Monthly interest rate

n = Total number of payments

Using this formula, you can calculate the monthly payment amount for a loan and then determine how much of each payment goes towards interest and principal.

The Benefits of Understanding Loan Amortization Schedules

Understanding loan amortization schedules offers several benefits, including:

1. Budgeting: By knowing how much you need to pay each month, you can plan your budget more effectively and ensure you allocate the necessary funds for loan repayment.

2. Debt Management: Loan amortization schedules help you understand the impact of making extra payments or paying off the loan early, empowering you to manage your debt more efficiently.

3. Comparison Shopping: When considering multiple loan options, understanding the loan amortization schedules allows you to compare different loans and choose the one that aligns with your financial goals.

4. Financial Awareness: By studying the loan amortization schedule, you gain a deeper understanding of your financial obligations and can make informed decisions regarding your financial future.

Key Components of a Loan Amortization Schedule

Now let’s dive deeper into the key components of a loan amortization schedule to get a better grasp of how they work.

1. Principal Amount

The principal amount is the initial loan balance—the total amount borrowed before interest is added. As you make monthly payments, the principal amount decreases over time.

2. Interest Rate

The interest rate is the cost of borrowing money and is expressed as a percentage. It determines how much interest you’ll pay on top of the borrowed amount. The interest rate can be fixed or variable depending on the type of loan.

3. Loan Term

The loan term refers to the length of time you have to repay the loan. It is typically expressed in years. The longer the loan term, the lower your monthly payments will be, but the more interest you’ll end up paying over the life of the loan.

4. Monthly Payment

The monthly payment is the amount you need to pay each month to repay the loan over the specified term. It includes both the principal and the interest, and the total amount remains consistent throughout the loan term.

5. Total Interest Paid

Total interest paid represents the cumulative sum of all interest payments made over the life of the loan. It gives you an idea of how much extra you’ll be paying in addition to the principal amount.

6. Total Repayment Amount

The total repayment amount is the sum of the principal borrowed and the total interest paid. It reflects the full amount you’ll have repaid by the end of the loan term.

7. Remaining Balance

The remaining balance is the outstanding loan amount after each monthly payment is made. It decreases with each payment until it reaches zero, indicating that the loan has been fully repaid.

Understanding the Loan Amortization Schedule in Action

Let’s take a closer look at an example to see how all the components of a loan amortization schedule come together.

Suppose you take out a $20,000 car loan with an interest rate of 5% for a term of 5 years. Using the formula mentioned earlier, you can calculate the monthly payment:

Monthly Payment = 20,000 x (0.05 / 12) x (1 + (0.05 / 12))^60 / [(1 + (0.05 / 12))^60 – 1]

After performing the calculations, you find that the monthly payment is approximately $377.42. With this information, you can start creating your loan amortization schedule.

The schedule will show how each monthly payment contributes to reducing the principal and paying off the interest. You’ll notice that in the early stages of the loan, a larger portion of each payment goes towards interest. As time goes on, more of your payment goes towards reducing the principal.

Conclusion

Understanding loan amortization schedules is crucial for borrowers to manage their loans effectively. By knowing how the monthly payments are divided between principal and interest, you can plan your finances better, make informed decisions, and stay on track with your loan repayment.

Remember, loan amortization schedules provide a roadmap for loan repayment, helping you stay organized and in control of your finances. Take the time to thoroughly analyze your loan amortization schedule and use it as a tool to achieve your financial goals.

Amortization Schedule Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a loan amortization schedule?

A loan amortization schedule is a table that outlines the repayment plan for a loan. It shows the breakdown of each payment, including the amount that goes towards the principal balance and the interest. The schedule also displays the remaining balance after each payment.

How does a loan amortization schedule work?

A loan amortization schedule works by dividing the loan amount into equal monthly payments over the loan term. At the beginning, a larger portion of the payment goes towards interest, while over time, more of the payment is applied to the principal. The schedule helps borrowers track their progress in paying off the loan.

Why is it important to understand loan amortization schedules?

Understanding loan amortization schedules is crucial because they provide clarity on how payments are applied to the loan balance. It allows borrowers to plan their finances, see the impact of different payment amounts, and determine the total interest paid over the life of the loan.

Can I change my loan amortization schedule?

In most cases, you cannot change the loan amortization schedule. However, certain types of loans, such as adjustable-rate mortgages, may allow for adjustments in the schedule based on interest rate changes or refinancing options. It’s important to check with your lender for specific details.

What factors affect the loan amortization schedule?

Several factors can impact the loan amortization schedule, including the loan amount, interest rate, loan term, and any additional payments made towards the principal. These variables determine the size of the monthly payments and the speed at which the loan balance is reduced.

How can I use a loan amortization schedule to save money?

By utilizing a loan amortization schedule, you can identify opportunities to save money. Making additional payments towards the principal or refinancing at a lower interest rate can help reduce the total interest paid over the course of the loan. The schedule helps visualize the impact of these actions.

What happens if I miss a loan payment?

If you miss a loan payment, it can have various consequences depending on the lender’s policies. Usually, there may be a late fee and it can negatively impact your credit score. It’s essential to contact your lender as soon as possible to discuss the situation and explore potential solutions.

Can I pay off my loan early using a loan amortization schedule?

Yes, a loan amortization schedule allows you to determine the time and amount required to pay off your loan early. By making additional principal payments, you can reduce the total interest paid and shorten the loan term. The schedule provides visibility into the impact of these early payments.

Final Thoughts

Understanding loan amortization schedules is crucial for anyone seeking financial stability and responsible borrowing. By grasping the mechanics of these schedules, borrowers can gain clarity on their repayment plans, interest payments, and outstanding loan balances. With a clear understanding of the amortization process, individuals can make informed decisions about their loans and better manage their finances. By familiarizing themselves with the specifics of loan amortization schedules, borrowers can confidently navigate the repayment journey and ensure they stay on track towards achieving their financial goals.