Market volatility can be overwhelming and unpredictable, leaving many investors unsure of how to navigate its effects. Understanding market volatility and its effects is crucial for anyone looking to make informed investment decisions. In this blog article, we will explore the concept of market volatility, its causes, and the potential ramifications it can have on portfolios. By gaining a deeper understanding of this phenomenon, you will be better equipped to navigate the ever-changing financial landscape with confidence and optimize your investment strategies. So, let’s delve into the intricacies of market volatility and explore its far-reaching impacts.

Understanding Market Volatility and Its Effects

Market volatility is a term that is often used in financial discussions, but what exactly does it mean? How does it affect investors, businesses, and the overall economy? In this article, we will explore the concept of market volatility, its causes, effects, and strategies to navigate through uncertain times.

What is Market Volatility?

Market volatility refers to the rapid and significant price fluctuations of financial assets, such as stocks, bonds, commodities, and currencies. It is a measure of the degree of variation or dispersion in the returns of these assets over a specified period. A highly volatile market experiences large price swings, while a low-volatility market has relatively stable prices.

Volatility can be caused by various factors, including economic events, geopolitical risks, changes in market sentiment, company-specific news, or even natural disasters. It is important to note that market volatility can occur in both upward and downward directions, meaning that prices can rise sharply or plummet unexpectedly.

Why Does Market Volatility Happen?

There are several underlying causes of market volatility that investors should be aware of:

1. Economic Factors

Economic indicators, such as GDP growth, inflation, interest rates, and employment data, have a significant impact on market volatility. Adverse economic news or unexpected shifts in these indicators can lead to market fluctuations. For example, a higher-than-expected inflation report may cause investors to worry about rising prices and prompt them to sell off assets, thereby increasing volatility.

2. Geopolitical Events

Geopolitical events, such as wars, political instability, trade disputes, or terrorist attacks, can create uncertainty in the markets. These events can disrupt supply chains, impact global trade, and affect investor sentiment. As a result, market volatility tends to increase during periods of heightened geopolitical tensions.

3. Investor Psychology

Investor psychology plays a crucial role in market volatility. Fear and greed are common emotions that drive investors to make decisions based on short-term market movements rather than long-term fundamentals. When fear dominates, investors may panic-sell, causing prices to drop rapidly. Conversely, during periods of excessive optimism or greed, investors may engage in speculative buying, leading to unsustainable price increases and subsequent corrections.

The Effects of Market Volatility

Market volatility has wide-ranging effects on various stakeholders, including investors, businesses, and the overall economy:

1. Investors

Market volatility can have both positive and negative impacts on investors:

– Increased risk: Higher market volatility implies increased uncertainty and risk for investors. Prices can change rapidly, potentially resulting in significant gains or losses.

– Emotional stress: Frequent market fluctuations can lead to emotional stress for investors, especially those who are more risk-averse or have a short-term investment horizon.

– Investment opportunities: Volatile markets can present opportunities for savvy investors. The ability to buy undervalued assets during market downturns or sell overvalued assets during market upswings can yield significant returns.

2. Businesses

Market volatility affects businesses in various ways:

– Stock prices: Publicly traded companies may experience significant fluctuations in their stock prices, which can impact their ability to raise capital or finance expansion plans.

– Cost of capital: Volatile markets may lead to higher borrowing costs for businesses, as lenders seek compensation for increased risks.

– Consumer confidence: Market volatility can influence consumer confidence levels, impacting their willingness to spend or invest. Reduced consumer spending can negatively impact business revenues.

3. Overall Economy

Market volatility can have broader implications for the overall economy:

– Economic growth: Extended periods of high market volatility can lead to decreased economic growth as businesses become reluctant to invest and consumers reduce spending.

– Job market: Businesses may become more cautious about hiring or even downsize during volatile market conditions, leading to potential job losses.

– Investor sentiment: Market volatility can influence investor sentiment and confidence in the economy. Positive market conditions often result in increased investments, while prolonged volatility can discourage investors.

Strategies for Navigating Market Volatility

While market volatility cannot be entirely avoided, there are strategies that investors can employ to mitigate its impact and potentially take advantage of the opportunities it presents:

1. Diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and regions. By diversifying their portfolios, investors can reduce their exposure to the volatility of individual securities or markets. This approach can potentially help cushion the impact of market downturns.

2. Long-Term Investing

Taking a long-term investing approach can help investors ride out short-term market volatility. By focusing on their investment goals and maintaining a diversified portfolio, investors can avoid making impulsive decisions based on temporary market fluctuations.

3. Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy takes advantage of market volatility by buying more shares when prices are low and fewer shares when prices are high. Over time, this approach can average out the impact of market fluctuations.

4. Regular Portfolio Rebalancing

Regularly rebalancing a portfolio involves adjusting the allocation of assets to maintain a desired risk profile. By selling overperforming assets and buying underperforming ones, investors can take advantage of market volatility to ensure their portfolio remains aligned with their investment objectives.

5. Seek Professional Advice

During periods of significant market volatility, seeking professional advice from financial advisors or investment professionals can provide valuable guidance. They can help investors navigate through uncertain times, make informed decisions, and develop personalized strategies based on individual risk tolerance and financial goals.

Market volatility is an inherent aspect of the financial markets. Understanding its causes, effects, and implementing appropriate strategies can help investors navigate through uncertain times and potentially achieve their investment objectives. By diversifying portfolios, taking a long-term approach, and seeking professional advice, investors can better manage the impact of market volatility and position themselves for long-term success. Remember, investing always carries some degree of risk, and staying informed is essential to make informed decisions.

What is volatility?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is market volatility?

Market volatility refers to the rapid and significant price fluctuations that occur in financial markets. It is a measure of the rate at which the price of a security or market index increases or decreases for a given set of returns. Higher volatility indicates greater uncertainty and risk in the market.

Why does market volatility occur?

Market volatility occurs due to various factors such as economic news, geopolitical events, changes in interest rates, company earnings reports, and investor sentiments. These factors can create uncertainty and lead to rapid price movements in the market.

What are the effects of market volatility?

Market volatility can have several effects, including:

– Increased risk: Volatile markets can lead to higher risks for investors as asset prices can fluctuate rapidly and unpredictably.

– Lower investor confidence: High volatility can erode investor confidence, leading to a decrease in market participation.

– Opportunities for profit: Volatility can also present opportunities for traders and investors to profit from short-term price movements.

– Impact on retirement savings: For individuals with investments linked to the market, volatility can impact the overall value of their retirement savings.

How can market volatility impact long-term investments?

Market volatility can impact long-term investments in several ways:

– Paper losses: During periods of volatility, the value of investments may decline temporarily, resulting in paper losses. However, holding onto investments can allow them to recover over the long term.

– Diversification benefits: Volatility emphasizes the importance of diversifying investment portfolios, spreading risks across different asset classes and sectors.

– Rebalancing opportunities: Market volatility can present opportunities to rebalance portfolios by buying undervalued assets and selling overvalued ones.

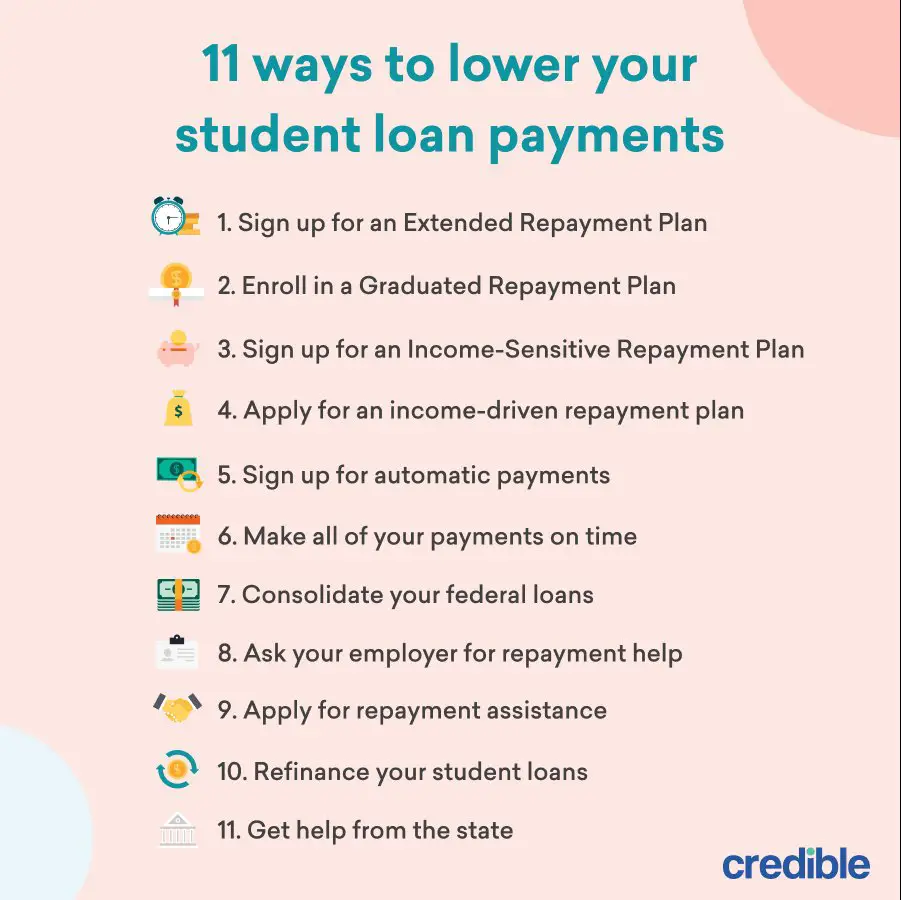

What strategies can be used to manage market volatility?

Some strategies to manage market volatility include:

– Diversification: Spreading investments across different asset classes, sectors, and geographical regions can help reduce the impact of volatility on a portfolio.

– Dollar-cost averaging: Investing a fixed amount at regular intervals can help mitigate the effects of short-term market fluctuations by buying more shares when prices are low and fewer shares when prices are high.

– Setting realistic goals: Having a long-term investment strategy and aligning it with realistic goals can help investors stay focused during periods of market volatility.

– Staying informed: Keeping up with market news, performing thorough research, and seeking expert advice can help investors make informed decisions and avoid impulsive actions.

Is market volatility always a bad thing?

Market volatility is not always a bad thing. While it can create uncertainty and risks, it also presents opportunities for investors to buy assets at lower prices and potentially earn higher returns in the long term. However, it is crucial for investors to understand their risk tolerance and investment goals before taking advantage of volatility.

How long does market volatility typically last?

The duration of market volatility can vary significantly. It can range from a short-term period of a few days or weeks to more prolonged periods lasting months or even years, depending on the underlying factors driving the volatility. It is important to note that predicting the exact duration of market volatility is challenging, and it is prudent for investors to focus on their long-term investment strategy.

Final Thoughts

Understanding market volatility and its effects is crucial for investors and traders alike. It allows them to make informed decisions and navigate the unpredictable nature of financial markets. By studying market volatility, individuals can grasp the extent of price fluctuations and the potential risks involved in different market scenarios. Moreover, comprehending the effects of volatility helps investors to manage their portfolios effectively and adjust their strategies accordingly. Overall, a deep understanding of market volatility empowers individuals to stay ahead of the game and make well-informed financial decisions.