Welcome to the world of option trading strategies! If you’ve been curious about understanding option trading strategies, you’ve come to the right place. In this article, we’ll delve into the intricacies of these strategies, breaking them down into easily digestible pieces that will help you navigate the world of options trading with confidence. So, let’s dive in and explore the power of understanding option trading strategies, demystifying the concepts and providing you with the tools you need to succeed. Ready? Let’s get started!

Understanding Option Trading Strategies

Option trading is a fascinating investment approach that offers traders the opportunity to speculate on the price movements of various financial instruments. With its potential for high returns and flexibility, options can be an excellent addition to any investment portfolio. However, to navigate the complexities of option trading effectively, it is crucial to understand the different strategies involved. In this article, we will delve into the various option trading strategies, exploring their mechanics, risks, and potential benefits.

1. Long Call Strategy

The long call strategy is one of the simplest and most popular option trading strategies. It involves purchasing call options with the expectation that the price of the underlying asset will rise. Here’s how it works:

- Select a specific underlying asset that you believe will increase in value.

- Purchase call options, which gives you the right (but not the obligation) to buy the underlying asset at a predetermined price (strike price) within a specified timeframe (expiration date).

- If the price of the underlying asset rises above the strike price, you can exercise the call option and profit from the price difference.

The long call strategy offers unlimited profit potential as the price of the underlying asset increases. However, it also comes with limited risk since the most you can lose is the premium paid for the options.

2. Long Put Strategy

The long put strategy is the flip side of the long call strategy. It involves purchasing put options with the expectation that the price of the underlying asset will decrease. Here’s how it works:

- Select a specific underlying asset that you believe will decrease in value.

- Purchase put options, which gives you the right (but not the obligation) to sell the underlying asset at a predetermined price (strike price) within a specified timeframe (expiration date).

- If the price of the underlying asset falls below the strike price, you can exercise the put option and profit from the price difference.

Similar to the long call strategy, the long put strategy also offers unlimited profit potential and limited risk. If the price of the underlying asset does not decrease as expected, your maximum loss is limited to the premium paid for the options.

3. Covered Call Strategy

The covered call strategy is a conservative and income-generating options strategy. It involves owning the underlying asset while simultaneously selling call options against it. Here’s how it works:

- Purchase shares of a specific underlying asset.

- Sell call options for the same underlying asset, with a strike price above the current market price.

- If the price of the underlying asset remains below the strike price until the options expire, you keep the premium generated from selling the options, effectively reducing your cost basis for the shares.

- If the price of the underlying asset rises above the strike price, you may be required to sell your shares at the strike price, but you still get to keep the premium.

The covered call strategy provides a regular income stream in the form of options premiums. It can be an effective way to generate extra income while holding a long-term position in a stock.

4. Protective Put Strategy

The protective put strategy, also known as a married put, is a risk management strategy used to protect existing positions against potential downside movements. Here’s how it works:

- Own shares of a specific underlying asset.

- Purchase put options for the same underlying asset, with a strike price below the current market price.

- If the price of the underlying asset decreases significantly, the put options act as insurance, allowing you to sell your shares at the higher strike price, thus limiting your losses.

- If the price of the underlying asset remains stable or increases, you can let the put options expire without exercising them, only losing the premium paid for the options.

The protective put strategy provides downside protection for existing positions, giving traders peace of mind and reducing potential losses in volatile market conditions.

5. Straddle Strategy

The straddle strategy involves simultaneously purchasing a call option and a put option with the same strike price and expiration date. This strategy is used when traders anticipate significant price volatility but are uncertain about the direction of the price movement. Here’s how it works:

- Purchase both a call option and a put option for the same underlying asset, with the same strike price and expiration date.

- If the price of the underlying asset moves significantly in either direction, you can exercise the corresponding option and profit from the price difference.

- If the price of the underlying asset remains relatively stable, you may lose the premiums paid for both options.

The straddle strategy can be beneficial when traders expect a major event or announcement that may cause significant price fluctuations. It allows traders to profit regardless of the direction of the price movement.

6. Iron Condor Strategy

The iron condor strategy is a combination of two vertical spread strategies. It aims to generate income from options premiums while limiting both the potential profit and loss. Here’s how it works:

- Sell an out-of-the-money call option and an out-of-the-money put option, creating a range or “tent” for the price of the underlying asset to stay within.

- Purchase a further out-of-the-money call option and a further out-of-the-money put option to cap both the potential profit and loss.

- If the price of the underlying asset remains within the range defined by the options’ strike prices, you keep the premiums received from selling the options.

- If the price of the underlying asset moves outside the range, you may face potential losses, but they are limited due to the purchased options.

The iron condor strategy is popular among traders who anticipate low volatility in the market. It offers a limited-risk, limited-reward opportunity to profit from time decay and option premiums.

7. Butterfly Spread Strategy

The butterfly spread strategy involves combining both long and short options with the same expiration date to profit from a narrow range of price movement in the underlying asset. Here’s how it works:

- Purchase one in-the-money call option and one in-the-money put option with the same strike price.

- Sell two at-the-money call options and two at-the-money put options with a higher and lower strike price, respectively.

- If the price of the underlying asset remains within the range defined by the options’ strike prices, you can profit from the time decay of the sold options.

- If the price of the underlying asset moves outside the range, the potential losses are limited due to the purchased options.

The butterfly spread strategy is a neutral strategy used when traders anticipate minimal price movement in the underlying asset. It offers a limited-risk, limited-reward opportunity to profit from time decay.

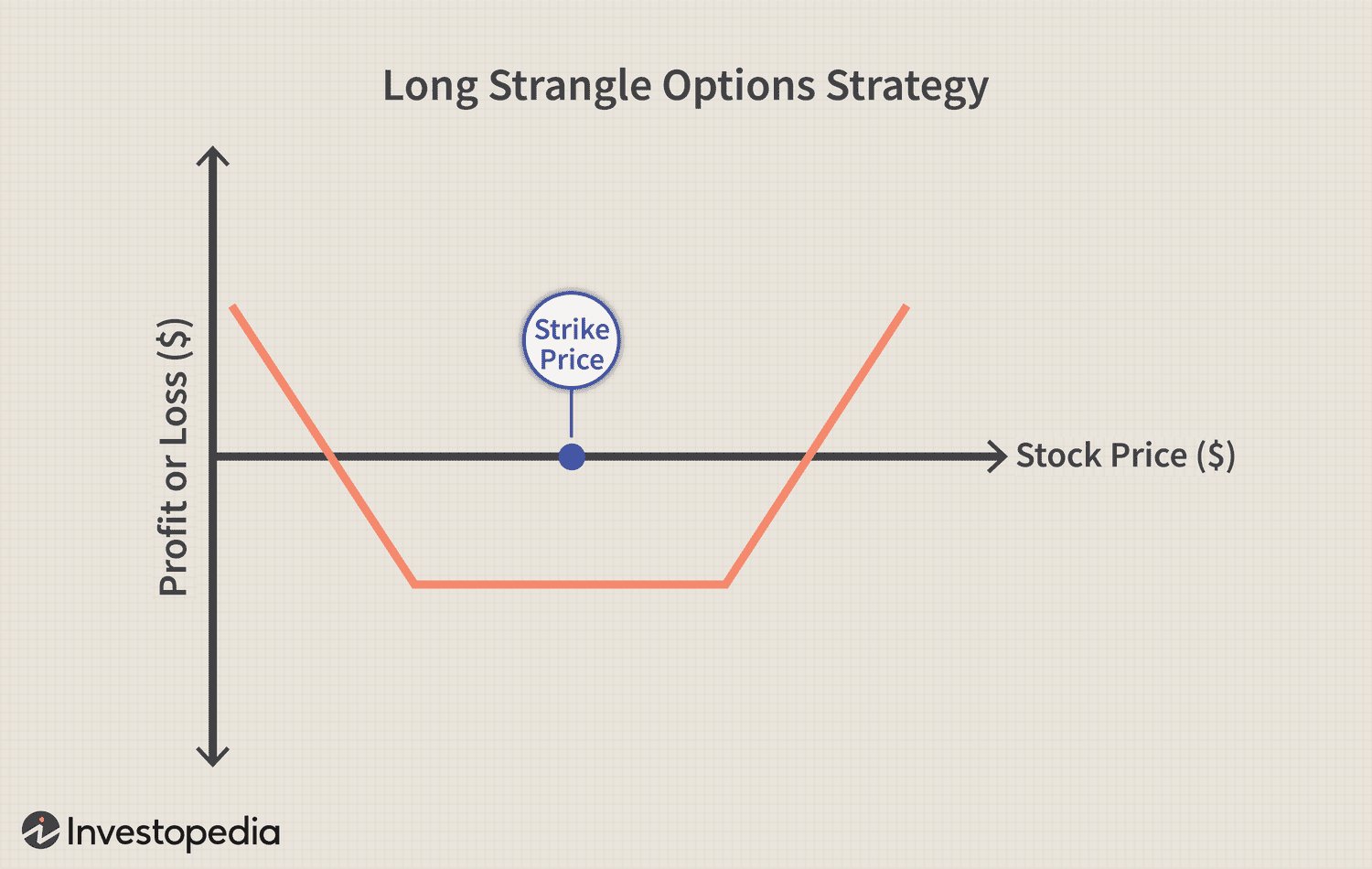

8. Strangle Strategy

The strangle strategy is similar to the straddle strategy, but instead of purchasing both a call option and a put option with the same strike price, the strangle strategy involves purchasing out-of-the-money options with different strike prices. Here’s how it works:

- Purchase both an out-of-the-money call option and an out-of-the-money put option with different strike prices.

- If the price of the underlying asset moves significantly in either direction, you can exercise the corresponding option and profit from the price difference.

- If the price of the underlying asset remains relatively stable, you may lose the premiums paid for both options.

The strangle strategy is employed when traders expect significant price volatility but are uncertain about the direction of the price movement. It offers a lower upfront cost compared to the straddle strategy but requires larger price movements to be profitable.

Understanding option trading strategies is essential for any investor or trader looking to explore the world of options. Each strategy comes with its own unique mechanics, risks, and potential rewards. Whether you prefer a bullish, bearish, or neutral approach, there is an option trading strategy to suit your investment goals and market outlook. By familiarizing yourself with these strategies and practicing in a demo account or with small positions, you can gain the confidence and skills necessary to navigate the exciting world of option trading.

Options Trading for Beginners (The ULTIMATE In-Depth Guide)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are option trading strategies?

Option trading strategies refer to specific methods and approaches employed by traders to make informed decisions when buying or selling options contracts. These strategies are designed to potentially profit from market movements, manage risk, and achieve specific investment goals.

How do option trading strategies work?

Option trading strategies involve the use of various options contracts, such as calls and puts, to take advantage of price movements in underlying assets. Traders analyze market conditions, risk tolerance, and other factors to select the most suitable strategy. These strategies often involve combinations of buying and selling options contracts to hedge, speculate, or generate income.

What are some popular option trading strategies?

1. Covered Call Strategy: This strategy involves selling a call option against a long position in the underlying asset to generate income while limiting potential upside.

2. Protective Put Strategy: Traders use this strategy by purchasing put options to hedge against potential downside risk in an existing position.

3. Long Call Strategy: This strategy involves buying call options to profit from an expected increase in the price of the underlying asset.

4. Long Put Strategy: Traders use this strategy to profit from a decline in the price of the underlying asset by purchasing put options.

5. Straddle Strategy: This strategy consists of buying both a call option and a put option with the same strike price and expiration date. It aims to profit from significant price fluctuations, regardless of the direction.

6. Butterfly Spread Strategy: Traders use this strategy by combining multiple options contracts with different strike prices to profit from limited price movement within a specific range.

7. Iron Condor Strategy: This strategy combines both a bear call spread and a bull put spread to generate income from a range-bound market.

8. Calendar Spread Strategy: Traders use this strategy by simultaneously buying and selling options contracts with different expiration dates to profit from time decay.

What factors should I consider when selecting an option trading strategy?

When choosing an option trading strategy, several key factors need to be considered, including:

– Market outlook and volatility expectations.

– Risk tolerance and investment objectives.

– Time horizon and expiration dates.

– Capital availability and position size.

– Options Greeks, such as delta, gamma, theta, and vega.

– Potential profit potential and maximum risk.

Should I use option trading strategies for short-term or long-term investments?

The choice of using option trading strategies for short-term or long-term investments depends on individual goals and market conditions. Some strategies are better suited for short-term trading, aiming to profit from short-lived market movements. On the other hand, other strategies may be more suitable for long-term investors looking to hedge positions or generate income over an extended period. It is important to align the chosen strategy with your investment objectives and risk tolerance.

What are the risks associated with option trading strategies?

Option trading strategies involve various risks that traders should be aware of, including:

– Loss of the entire investment if the underlying asset price doesn’t move as anticipated.

– Time decay, which can erode the value of options contracts over time.

– Volatility risk, as sudden market fluctuations can impact option prices.

– Counterparty risk if trading options through a brokerage or exchange.

– Liquidity risk, especially with less actively traded options contracts.

– Complexities associated with advanced strategies, requiring a good understanding of options pricing and market dynamics.

Can option trading strategies guarantee profits?

No, option trading strategies cannot guarantee profits. The options market is subject to various uncertainties, including market volatility, unpredictable price movements, and other economic factors. Traders should carefully assess risks, actively manage positions, and continuously monitor market conditions when employing option trading strategies.

Do I need prior experience to use option trading strategies?

While prior experience in trading and understanding options basics is beneficial, beginners can start learning and using option trading strategies with proper education and guidance. It is advisable to educate oneself about options, study different strategies, and practice on paper or with small investments before committing significant capital. Building knowledge, staying updated with market trends, and seeking expert advice can help enhance trading skills and increase the chances of success.

Final Thoughts

Understanding option trading strategies is crucial for anyone looking to participate in the financial markets. By gaining a deep understanding of these strategies, investors can effectively manage risk and potentially maximize their profit potential. Whether it’s buying call options to profit from an increase in the underlying asset’s price or employing a more advanced strategy such as a straddle to capture price volatility, having a solid grasp of option trading strategies can provide a competitive edge. With careful research, analysis, and practice, individuals can navigate the complexities of options trading and make informed decisions that align with their investment goals. Ultimately, understanding option trading strategies is a valuable skill that can lead to success in the world of finance.