Payday loans: one of those terms that often sparks concern and curiosity. What exactly are they, and what risks do they entail? Understanding payday loans and their risks is essential, whether you’re considering taking one out or simply want to be well-informed. In this article, we’ll delve into the world of payday loans, providing you with a clear understanding of how they work and the potential pitfalls to watch out for. So, let’s get started on this journey of unraveling the mysteries behind payday loans.

Understanding Payday Loans and Their Risks

Introduction:

Payday loans have become increasingly popular in recent years as a quick and convenient way to access cash in times of financial need. However, it’s important to fully understand the concept of payday loans and the associated risks before considering them as a viable option. In this article, we will delve into the world of payday loans, exploring their features, benefits, and potential pitfalls. By understanding the ins and outs of payday loans, readers will be equipped to make informed decisions regarding their financial well-being.

What Are Payday Loans?

Payday loans are short-term, high-interest loans typically taken out by individuals who need immediate funds to cover unexpected expenses or bridge the gap until their next paycheck. These loans are often marketed as a quick and hassle-free way to access cash, with minimal paperwork and credit checks. The loan amount is usually based on the borrower’s income and is expected to be repaid in full, along with the accrued interest, by the next payday.

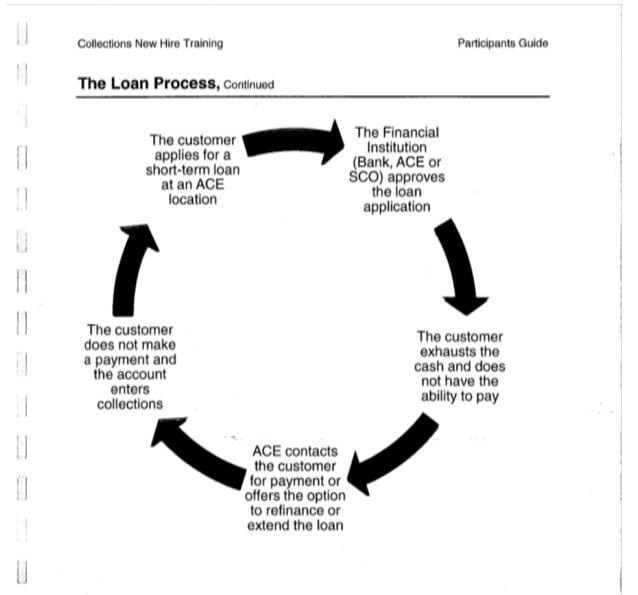

How Do Payday Loans Work?

To obtain a payday loan, borrowers typically visit a payday lender’s physical location or apply online. The borrower provides proof of income, identification, and a post-dated check or authorization for automatic withdrawal from their bank account for the loan amount plus fees. If approved, the borrower receives the requested funds, minus the lender’s fees, which can be quite substantial.

On the due date, the borrower must repay the loan in full, either by allowing the lender to cash the post-dated check or by ensuring there are sufficient funds in their bank account for the automatic withdrawal. If the borrower is unable to repay the loan on time, they may have the option to roll over the loan by paying an additional fee. This can create a cycle of debt, as the borrower continues to accumulate interest and fees without making significant progress toward repaying the principal amount.

The Benefits of Payday Loans

While payday loans have garnered a negative reputation, it’s important to acknowledge that they do offer certain benefits for specific situations. Some advantages of payday loans include:

1. Accessibility: Payday loans are often available to individuals with poor credit or no credit history, making them an option for those who may not qualify for traditional loans.

2. Speed: Payday loans can be processed quickly, allowing borrowers to access funds within a short period, usually within a day or two.

3. Convenience: The application process for payday loans is typically straightforward, requiring minimal documentation and paperwork compared to traditional loans.

4. Flexibility: Borrowers have the freedom to use payday loan funds for various purposes, whether it’s to cover medical bills, car repairs, or other unexpected expenses.

The Risks of Payday Loans

While payday loans may seem like a convenient solution, they come with significant risks and potential drawbacks that borrowers should carefully consider:

1. High interest rates: Payday loans often carry exorbitant interest rates, ranging from 300% to 600% or higher on an annual basis. These rates can quickly compound, making it difficult for borrowers to repay the loan in a timely manner.

2. Short repayment terms: Payday loans typically have a short repayment period, usually requiring full repayment within two to four weeks. This compressed timeline can put strain on borrowers, especially if they are already facing financial challenges.

3. Debt cycle: Due to the high interest rates and short repayment terms, many borrowers find themselves trapped in a cycle of debt. Unable to repay the loan in full, they often roll over the loan by paying additional fees, resulting in a never-ending cycle of borrowing and indebtedness.

4. Predatory lending practices: Some payday lenders engage in predatory practices, taking advantage of vulnerable individuals in dire financial situations. They may employ aggressive collection tactics or add hidden fees and charges, further burdening borrowers.

5. Impact on credit score: Defaulting on a payday loan or being unable to repay it on time can negatively impact a borrower’s credit score, making it more challenging to secure credit in the future.

Alternatives to Payday Loans

Considering the risks associated with payday loans, exploring alternative options is highly recommended. Here are a few alternatives to consider:

1. Personal loans from traditional lenders: Banks and credit unions offer personal loans with lower interest rates and more favorable repayment terms than payday loans. It’s advisable to compare rates and terms from different lenders to find the most suitable option.

2. Credit card cash advances: If a borrower has a credit card with available credit, a cash advance may be a more viable option. However, it’s important to note that cash advances often carry higher interest rates and additional fees, so careful consideration is necessary.

3. Borrowing from friends or family: In some cases, turning to loved ones for temporary financial assistance may be a better alternative than payday loans. It’s essential to establish clear repayment terms and maintain open communication to avoid straining relationships.

4. Negotiating with creditors: If the financial challenge is temporary, contacting creditors to explain the situation and request temporary relief or revised payment terms can be a helpful approach. Many creditors are willing to work with borrowers facing genuine hardships.

Conclusion:

While payday loans may seem like an attractive solution for immediate financial needs, understanding the risks and potential consequences is crucial. Borrowers should carefully evaluate their financial situation, consider alternative options, and only opt for payday loans as a last resort. By making informed decisions and being aware of the potential pitfalls, individuals can protect themselves from falling into a cycle of debt and financial instability.

Are Payday Loans Ever a Good Idea?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a payday loan?

A payday loan is a short-term loan that is typically due to be repaid on the borrower’s next payday. It is designed to provide quick access to cash for individuals facing unexpected financial emergencies.

How do payday loans work?

To obtain a payday loan, borrowers usually need to provide proof of income and a bank account. They then receive the loan amount in cash, or it is directly deposited into their bank account. The loan is usually due to be repaid in full, including fees and interest, by the next payday.

What are the risks associated with payday loans?

Payday loans often come with high interest rates, making them an expensive borrowing option. If borrowers are unable to repay the loan by the due date, they can face additional fees and charges, leading to a cycle of debt. These loans can also negatively impact credit scores if not managed responsibly.

Are payday loans legal?

Payday loans are regulated differently in different countries and states. While they may be legal in some jurisdictions, they are prohibited or subject to strict regulations in others. It is important to check the laws and regulations in your specific location before considering a payday loan.

Can payday loans help improve my credit score?

Payday loans are generally not designed to help improve credit scores. In fact, if not repaid on time, they can have a negative impact on your credit rating. It is advisable to explore alternative options for building credit, such as using a secured credit card or making timely payments on existing debts.

What alternatives are there to payday loans?

There are several alternatives to payday loans that may be more affordable and less risky. These include borrowing from family or friends, negotiating with creditors for extended payment terms, seeking assistance from local nonprofit organizations, or exploring low-interest personal loans from banks or credit unions.

How can I avoid the risks associated with payday loans?

To minimize the risks associated with payday loans, it is important to borrow only what you can afford to repay comfortably. Carefully review the loan agreement, including the interest rate and fees. Make a budget to ensure you can meet the repayment obligations, and consider seeking financial advice or counseling if you find yourself relying on payday loans frequently.

Are there any regulations in place to protect borrowers from payday loan scams?

Yes, many jurisdictions have implemented regulations to protect borrowers from payday loan scams and predatory lending practices. These regulations may include limits on interest rates, fee caps, and requirements for lenders to disclose all terms and conditions clearly. It is essential to research and choose reputable lenders who comply with these regulations.

Final Thoughts

Understanding payday loans and their risks is crucial before considering this financial option. These short-term loans often come with high interest rates and fees, making them an expensive choice. Borrowers should be aware of the potential for a cycle of debt if they cannot repay the loan on time. Additionally, the predatory practices of some lenders may lead to further financial struggles. It is essential to carefully evaluate the terms and conditions of payday loans and explore alternative options before making a decision. By understanding the risks involved, individuals can make informed choices and protect their financial well-being.