If you’ve ever wondered about the risks involved in real estate crowdfunding, understanding real estate crowdfunding risks is essential for making informed investment decisions. In this article, we’ll dive into the potential pitfalls of this increasingly popular investment avenue. By examining the various risks involved, including market volatility, property-specific challenges, and platform reliability, we aim to equip you with the knowledge needed to navigate the world of real estate crowdfunding confidently. So, whether you’re a curious investor or simply seeking to expand your financial literacy, join us as we explore the ins and outs of understanding real estate crowdfunding risks.

Understanding Real Estate Crowdfunding Risks

Real estate crowdfunding has emerged as a popular investment option for individuals looking to diversify their portfolios and tap into the lucrative real estate market. With the rise of technology platforms that connect investors with real estate projects, crowdfunding has become more accessible and attractive. However, like any investment, real estate crowdfunding comes with its own set of risks that investors need to be aware of. In this article, we will explore and dissect these risks to help you make informed investment decisions.

Risk #1: Lack of Liquidity

Investing in real estate crowdfunding involves tying up your capital in illiquid assets. Unlike publicly-traded stocks or bonds, real estate investments are not easily bought or sold on an exchange. When you invest in a crowdfunded real estate project, your money is typically locked in for a specified period of time, often several years, until the project is completed or sold.

This lack of liquidity means that you may not be able to access your invested capital when you need it most. If an unexpected financial need arises, you could find yourself unable to liquidate your investment without incurring financial penalties or selling at a discounted price.

Risk #2: Property Market Fluctuations

Real estate values are subject to fluctuations based on market conditions, economic factors, and local dynamics. When investing in real estate crowdfunding, it’s important to understand that the value of the underlying properties can go up or down, potentially resulting in a loss of investment capital.

Market downturns can significantly impact real estate values, and in the event of a recession or economic crisis, property prices may plummet. It’s crucial to thoroughly research the market conditions and consider the potential risks associated with investing in specific locations or property types.

Risk #3: Project and Developer Risk

Another key risk in real estate crowdfunding is the risk associated with the specific project and developer. Not all real estate developers or projects are created equal, and investing in an unreliable or inexperienced developer can lead to financial losses.

Before investing, it’s essential to assess the track record and reputation of the developer behind the project. Evaluate their past projects, their ability to execute, and their financial stability. Lack of due diligence in this area could result in delays, budget overruns, or even project failure, leading to potential investment losses.

Risk #4: Regulatory and Legal Risks

Real estate crowdfunding operates within a regulatory framework set by the governing authorities. Changes in regulations or legal challenges can have a significant impact on the viability and profitability of crowdfunding investments.

Understanding the regulatory landscape and staying informed about potential changes is crucial for investors. Additionally, legal disputes or unforeseen legal issues surrounding the property or the project can create delays, litigation expenses, and even the complete loss of investment capital.

Risk #5: Potential Lack of Diversification

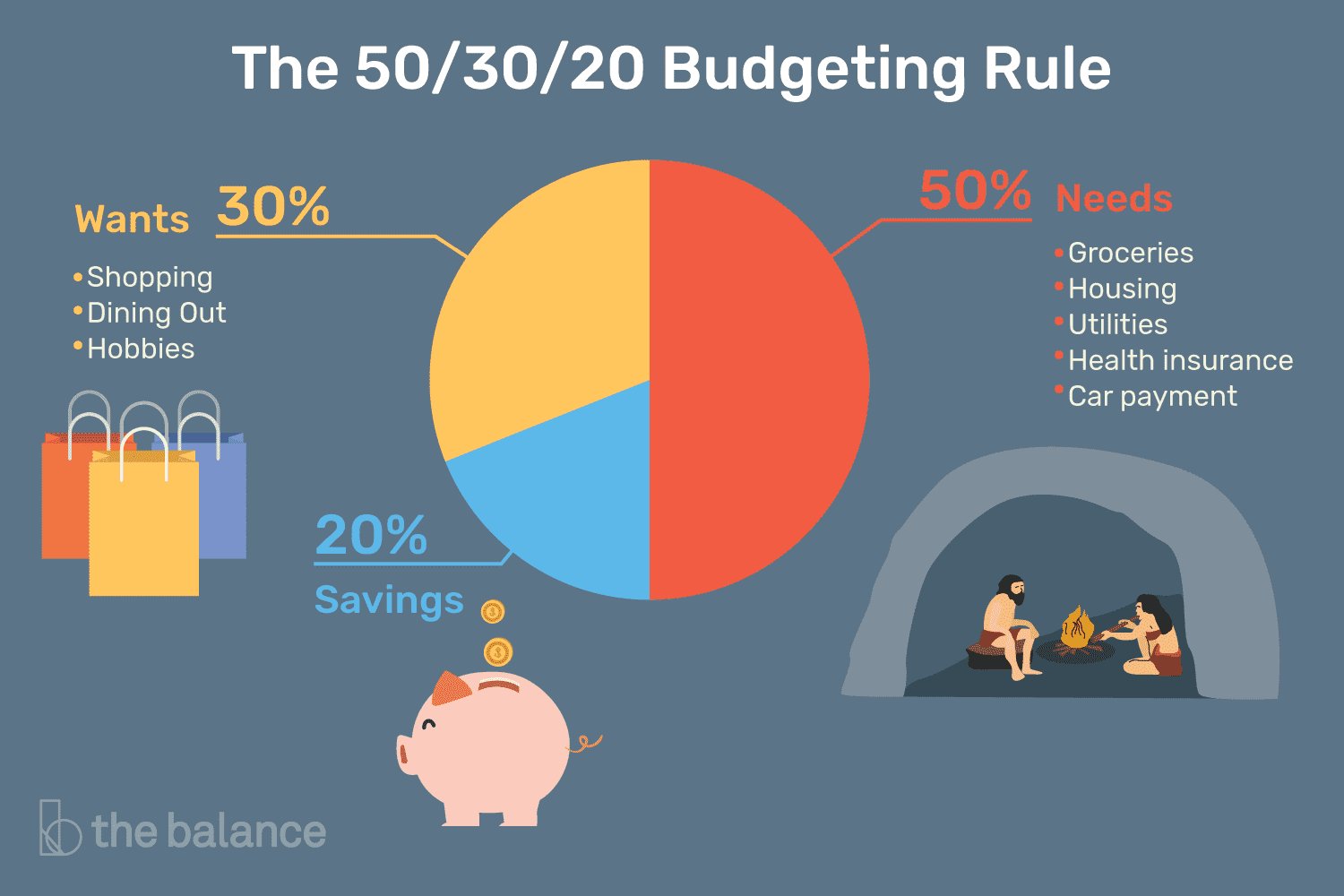

While real estate crowdfunding offers opportunities to diversify your investment portfolio, it also carries the risk of potential lack of diversification. By investing solely in real estate, you may not have exposure to other asset classes that could provide a buffer during economic downturns.

It’s important to consider your overall investment strategy and ensure that real estate crowdfunding aligns with your risk tolerance and diversification goals. Diversifying across different investment types and sectors can help mitigate risks associated with any single asset class.

Risk #6: Platform Risk

Investing in real estate crowdfunding requires utilizing a platform that facilitates the transactions between investors and real estate projects. These platforms act as intermediaries and provide access to a range of investment opportunities. However, not all platforms are created equal, and there are risks associated with the platform itself.

Platform risk encompasses aspects such as platform stability, security, transparency, and track record. It’s important to research and choose a reputable and transparent platform that has a proven track record of successfully executing crowdfunding projects.

Risk #7: Lack of Control

When investing in real estate crowdfunding, you are essentially entrusting the decision-making and execution of the project to the developer and platform. This lack of control means you have limited ability to influence the outcome or mitigate risks directly.

You must thoroughly evaluate the capabilities and reputation of the developer and the platform before making any investment decisions. Understand their decision-making processes, risk management strategies, and their approach to project management.

Risk #8: Crowd Dilution

Real estate crowdfunding involves pooling funds from multiple investors to finance a project. While this provides opportunities for smaller investors to participate in larger projects, it also introduces the risk of crowd dilution.

Crowd dilution occurs when a project raises additional capital after the initial crowdfunding round, leading to a reduction in individual ownership stakes. This dilution can impact the potential return on investment, and you may end up with a smaller share of the project than initially anticipated.

Risk #9: Lack of Transparency

Transparency is crucial for investors to make informed decisions and understand the potential risks associated with a real estate crowdfunding investment. However, not all platforms or projects offer the same level of transparency.

Before investing, carefully review the information provided by the platform regarding the project, financials, and risk factors. Lack of transparency or missing information can make it challenging to assess the true risks and make an informed investment decision.

Risk #10: Limited Track Record

Real estate crowdfunding is a relatively new investment model, and many platforms and developers have limited track records. This lack of historical performance data can make it challenging for investors to assess the potential risks and rewards accurately.

When considering investing in a specific project or platform, look for any available historical performance data and assess how similar investments performed in the past. It’s important to rely on thorough due diligence and research to gauge the credibility and viability of the investment opportunity.

Real estate crowdfunding can provide individuals with access to the real estate market and the potential for attractive returns. However, it’s crucial to thoroughly understand and evaluate the risks involved before making any investment decisions. Lack of liquidity, market fluctuations, project and developer risks, regulatory and legal risks, potential lack of diversification, platform risk, lack of control, crowd dilution, lack of transparency, and limited track record are all significant risks to consider. By conducting thorough due diligence, diversifying your investments, and choosing reputable platforms and developers, you can navigate these risks and make informed investment choices in the real estate crowdfunding space.

Real Estate Crowdfunding Explained Benefits and Risks

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What risks are involved in real estate crowdfunding?

Real estate crowdfunding, like any investment, carries its fair share of risks. Some of the potential risks include the possibility of losing your invested capital, lack of liquidity, project delays, market fluctuations, and regulatory changes. It is essential to thoroughly understand these risks before committing your funds.

How can I minimize the risks associated with real estate crowdfunding?

While risks cannot be completely eliminated, there are steps you can take to minimize them. Research the crowdfunding platform and its track record, review the details of the project thoroughly, and assess the experience and expertise of the project sponsor. Diversifying your investments across different properties and platforms can also help reduce risk.

Can I lose all my money in real estate crowdfunding?

Yes, there is a possibility of losing your entire investment in real estate crowdfunding. If a project fails or experiences financial difficulties, there may not be enough funds to repay investors fully. It is crucial to carefully evaluate the risks and assess your risk tolerance before investing in crowdfunding.

Are real estate crowdfunding platforms regulated?

Yes, real estate crowdfunding platforms are subject to regulations to ensure investor protection. However, the level of regulation may vary depending on the jurisdiction and the type of crowdfunding (e.g., debt or equity-based). It is important to choose platforms that adhere to relevant regulations and follow industry best practices.

What happens if a real estate crowdfunding project fails?

If a real estate crowdfunding project fails, investors may experience a loss of their invested capital. The outcome depends on the specific terms of the investment agreement and the actions taken by the project sponsor or platform. In some cases, investors may be able to recover a portion of their investment through legal proceedings or negotiations.

Is real estate crowdfunding suitable for novice investors?

Real estate crowdfunding can be suitable for novice investors, provided they have a good understanding of the risks involved and conduct thorough research. It is important to start with smaller investments, diversify the portfolio, and seek professional advice if needed. Novice investors should also carefully read the project documentation and terms before making any commitments.

What is the typical duration of a real estate crowdfunding investment?

The duration of a real estate crowdfunding investment varies depending on the project. Some investments may have a short-term duration of several months, while others can extend up to several years. It is important to review the project details to understand the anticipated holding period before committing your funds.

Can I withdraw my investment before the project’s completion?

Real estate crowdfunding investments often have limited liquidity, and early withdrawal may not be possible. Most investments have lock-in periods, during which investors cannot access their funds. It is crucial to carefully review the terms and conditions of each investment to understand the liquidity limitations before making a commitment.

Final Thoughts

Understanding real estate crowdfunding risks is essential for investors looking to participate in this alternative investment strategy. By comprehending the potential downsides and challenges, individuals can make informed decisions and mitigate the associated risks. Real estate crowdfunding carries the risk of project failure, lack of liquidity, and uncertain returns. Additionally, investors should be aware of the credibility and reputation of the crowdfunding platform they choose to invest through. Conducting thorough due diligence, diversifying investments, and monitoring market conditions are crucial in managing these risks effectively and maximizing the potential benefits of real estate crowdfunding.