Understanding seasonal trends in stock markets is crucial for investors looking to make informed decisions and maximize their returns. So, what exactly are these seasonal trends? Well, they refer to predictable patterns that occur in the stock market at specific times of the year. By recognizing and analyzing these trends, investors can gain valuable insights into when to buy, sell, or hold certain stocks. In this article, we will delve into the fascinating world of seasonal trends in stock markets, unraveling the factors that drive them and exploring how investors can leverage this knowledge to their advantage. So, let’s dive in and uncover the secrets behind understanding seasonal trends in stock markets.

Understanding Seasonal Trends in Stock Markets

Investing in the stock market requires a deep understanding of various market dynamics, including the influence of seasonal trends. As an investor, it is crucial to recognize these patterns and leverage them to make informed decisions. In this article, we will delve into the complexities of understanding seasonal trends in stock markets, exploring their significance, common patterns, and strategies to capitalize on them.

What are Seasonal Trends?

Seasonal trends in stock markets refer to the recurring patterns and behavior exhibited by the market during specific times of the year. These trends can be influenced by a range of factors, such as the time of the year, cultural events, economic cycles, and investor sentiment. By studying these trends, investors can identify potential opportunities and adjust their investment strategies accordingly.

The Significance of Seasonal Trends

Understanding and analyzing seasonal trends can provide valuable insights into the stock market. Here are some key reasons why seasonal trends are significant:

1. Historical Patterns: Seasonal trends are based on historical data that showcases the consistent behavior of the market during specific periods. Analyzing this data can help identify recurring patterns and potential opportunities.

2. Predictive Indicators: Seasonal trends can serve as predictive indicators, allowing investors to anticipate market movements and make strategic decisions. By identifying periods of strength or weakness, investors can adjust their portfolios accordingly.

3. Risk Management: By recognizing seasonal trends, investors can better manage their risk exposure. Understanding when certain sectors or stocks tend to perform well or poorly can guide investment decisions and help mitigate potential losses.

Common Seasonal Patterns

While every year may exhibit unique market conditions, certain seasonal patterns tend to recur in stock markets. Let’s explore some of the most common seasonal trends observed by investors:

1. January Effect

The January Effect is a well-known seasonal pattern observed in stock markets. It refers to the tendency of small-cap stocks to outperform large-cap stocks at the beginning of the year. This phenomenon is believed to result from year-end tax strategies, year-end bonuses, and portfolio rebalancing by institutional investors.

2. Sell in May and Go Away

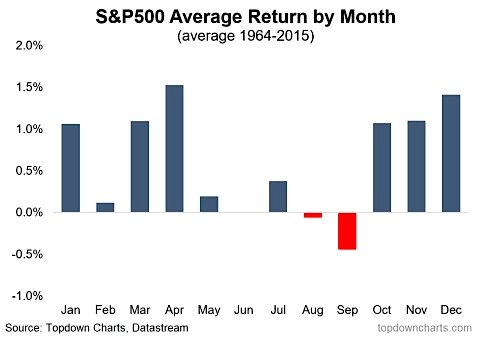

The adage “Sell in May and go away” refers to the historically weaker performance of stock markets during the summer months. This pattern suggests that investors should sell their holdings in May and reinvest in the market during October. It is believed to stem from reduced trading activity during summer vacations and a lull in corporate earnings announcements.

3. Santa Claus Rally

The Santa Claus Rally is a seasonal trend that occurs towards the end of the year, typically in the week between Christmas and New Year’s Day. During this period, stock markets often experience a temporary uptick in prices. This rally is attributed to increased consumer spending during the holiday season and a generally positive market sentiment.

4. Sector-Specific Seasonal Trends

In addition to broader market patterns, certain sectors exhibit their own seasonal trends. For example:

– Retail: Retail stocks tend to perform well during the holiday shopping season when consumer spending is at its peak.

– Energy: Energy stocks may experience higher prices during the winter months due to increased demand for heating.

– Technology: Technology companies often benefit from increased sales around the launch of new products or during the holiday season.

Strategies for Capitalizing on Seasonal Trends

To make the most of seasonal trends in stock markets, investors can employ various strategies. Here are a few commonly used approaches:

1. Sector Rotation

Sector rotation involves shifting investments between sectors based on their historical performance during specific periods. By identifying sectors that historically perform well at certain times of the year, investors can allocate their funds accordingly. For example, if historical data suggests that technology stocks tend to rally during the holiday season, an investor may increase their exposure to the technology sector.

2. Event-Based Trading

Certain events, such as earnings reports, government announcements, or cultural celebrations, can significantly impact stock prices. By staying informed about upcoming events and their potential influence on specific stocks or sectors, investors can make informed trading decisions. For instance, an investor may choose to buy shares of a retail company ahead of its earnings report during the holiday season, anticipating a positive price movement.

3. Options Strategies

Options strategies provide investors with additional flexibility when it comes to capitalizing on seasonal trends. For instance, an investor can use options to implement a bullish or bearish position on a specific stock or sector during a particular timeframe. Options allow investors to profit from both upward and downward price movements, depending on their market outlook.

4. Long-Term Investment Approach

While short-term strategies can be effective in leveraging seasonal trends, a long-term investment approach can also yield significant benefits. By focusing on a company’s fundamentals and long-term potential, investors can identify undervalued stocks that may perform well beyond seasonal variations. Warren Buffett, one of the most successful investors, has consistently emphasized a long-term investment horizon.

In conclusion, understanding seasonal trends in stock markets is crucial for investors looking to optimize their investment strategies. By recognizing the significance of seasonal trends, analyzing common patterns, and implementing appropriate strategies, investors can navigate the dynamic nature of stock markets more effectively. It is important to note that while seasonal trends provide valuable insights, thorough research and analysis should always accompany investment decisions.

Stock market seasonal patterns that work. Larry Williams Trader. #trading #futurestrading

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are seasonal trends in stock markets?

Seasonal trends in stock markets refer to patterns or tendencies that occur at certain times of the year, affecting the performance of stocks or specific sectors within the market.

Why is understanding seasonal trends important for investors?

Understanding seasonal trends can provide valuable insights for investors, enabling them to make more informed decisions about when to buy, sell, or hold stocks. It helps investors anticipate potential market movements and adjust their strategies accordingly.

How can I identify seasonal trends in stock markets?

One way to identify seasonal trends is by analyzing historical data and looking for recurring patterns or trends that have consistently appeared during certain times of the year. This can be done through technical analysis, studying charts, and using various indicators.

What are some common examples of seasonal trends in stock markets?

Some common examples of seasonal trends include the “January Effect,” where stocks tend to perform well in January; the “Santa Claus Rally,” which occurs near the end of the year; and the “summer slump,” where markets may experience a decrease in trading activity during the summer months.

Do seasonal trends guarantee consistent profits in the stock market?

No, seasonal trends do not guarantee consistent profits as the stock market is influenced by various factors, including economic conditions, geopolitical events, and unexpected news. While seasonal trends can provide helpful insights, it is essential to conduct thorough research and consider other indicators before making investment decisions.

Are seasonal trends the only factor to consider when investing in stocks?

No, seasonal trends should not be the sole factor considered when investing in stocks. Other fundamental and technical analysis, company performance, market conditions, and investor sentiment should also be taken into account. A comprehensive approach to investment analysis is recommended.

Can seasonal trends be applied to all stocks and sectors?

While seasonal trends can be observed in various stocks and sectors, their impact may differ. Some sectors, such as retail or tourism, may be more influenced by seasonal patterns, while others may be driven by different factors. It is important to analyze specific industries and stocks to determine the relevance of seasonal trends.

How often do seasonal trends repeat in the stock market?

Seasonal trends can vary in their frequency of occurrence. Some trends may repeat annually, while others may follow multi-year cycles. It is important to track and analyze historical data to identify the consistency and reliability of specific seasonal trends in the stock market.

Final Thoughts

Understanding seasonal trends in stock markets is crucial for investors seeking to optimize their investment strategies. By analyzing historical data, investors can identify recurring patterns and make informed decisions based on these trends. These seasonal patterns can be driven by a variety of factors, such as economic indicators, market sentiment, and specific industry dynamics. By studying these trends, investors can potentially capitalize on favorable seasonal periods and adjust their portfolios accordingly. Whether it’s the “January Effect” or the “Santa Claus Rally,” understanding seasonal trends in stock markets can provide valuable insights into market behavior and potential investment opportunities.