Stock dilution in startups can be a complex and often misunderstood concept. But fear not, understanding stock dilution is essential for anyone involved in the startup ecosystem. In this article, we’ll delve into the ins and outs of stock dilution, breaking it down into simple terms that even beginners can grasp. So, whether you’re an entrepreneur, an investor, or simply curious about how startups handle their ownership structure, this guide will provide you with the knowledge you need to navigate the world of understanding stock dilution in startups. Let’s jump right in!

Understanding Stock Dilution in Startups

Stock dilution is an important concept to understand for anyone considering investing in or working for a startup company. When a startup raises additional capital or issues new shares of stock, it can impact the ownership and value of existing shares. In this article, we will delve into the details of stock dilution in startups, explaining what it means, why it happens, and how it can affect shareholders.

What is Stock Dilution?

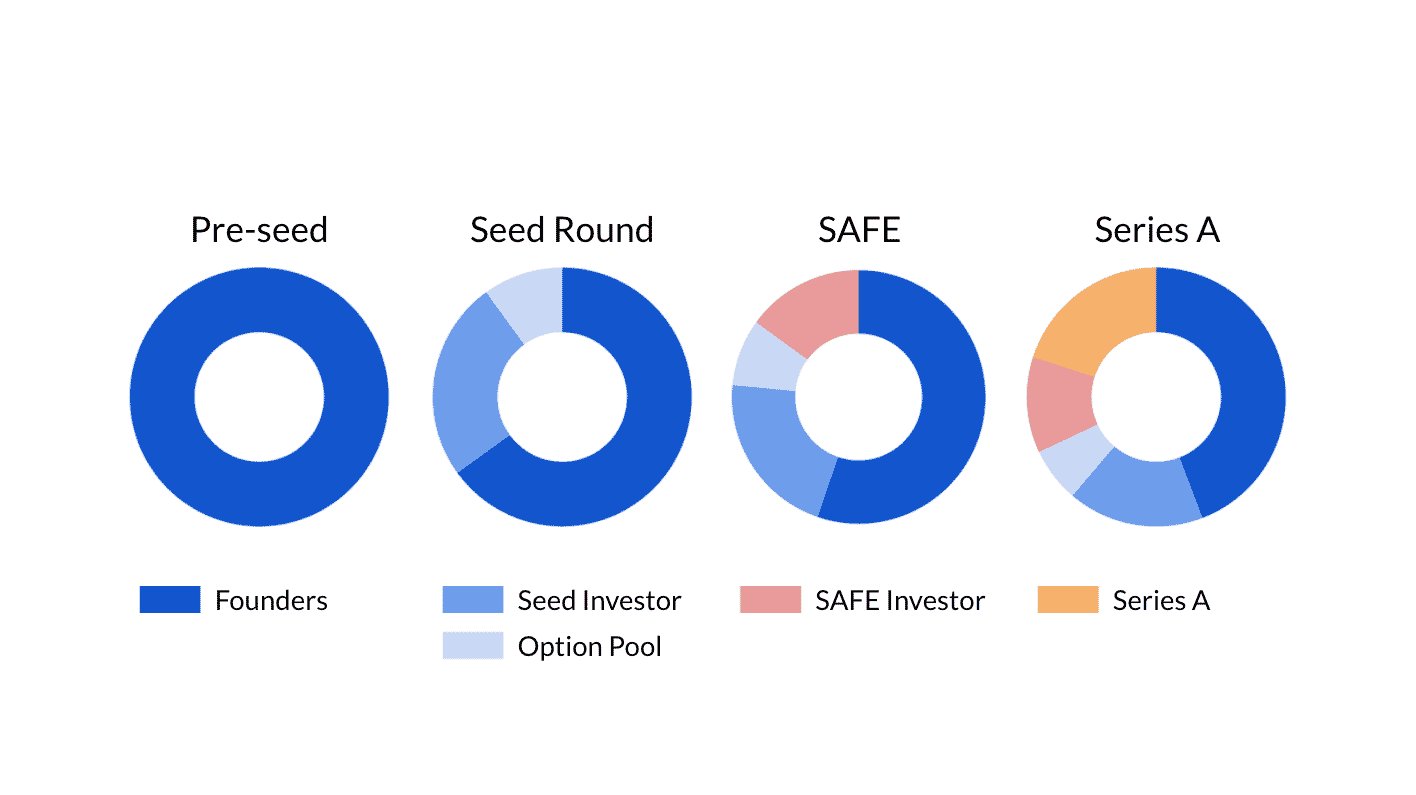

Stock dilution occurs when a company issues new shares of stock, thereby reducing the ownership percentage of existing shareholders. This dilution can happen through various methods, such as issuing new shares in exchange for funding from investors, granting stock options to employees, or converting convertible securities like convertible notes or preferred stock into common stock.

When new shares are issued, the existing shares represent a smaller percentage of the total ownership in the company. This decrease in ownership can impact the voting power and potential financial returns for existing shareholders.

Why Does Stock Dilution Happen?

Stock dilution typically occurs when a startup seeks to raise additional capital to fund its operations and growth. Startups often need to secure funding to develop new products, expand into new markets, or invest in infrastructure and talent. By issuing new shares, the company can raise money from investors, which can be crucial for their continued growth and success.

Besides raising capital, stock dilution also occurs when startups offer stock options or equity compensation to attract and retain talented employees. These stock-based incentives provide employees with the opportunity to benefit from the company’s success and align their interests with long-term company goals.

Methods of Stock Dilution

Stock dilution can occur through various mechanisms. Here are a few common methods of stock dilution in startups:

1. Equity Financing: Startups often raise capital by selling shares to external investors, such as venture capital firms or angel investors. This influx of new capital helps fund the company’s operations but dilutes the ownership of existing shareholders.

2. Convertible Securities: Startups may issue convertible securities like convertible notes or preferred stock that can be converted into common stock at a later date. When these securities are converted, additional shares are issued, leading to stock dilution.

3. Stock Options and Equity Compensation: Startups use stock options and equity compensation to attract and retain employees. When employees exercise their stock options or receive equity grants, new shares are issued, resulting in dilution for existing shareholders.

Impact of Stock Dilution on Shareholders

Stock dilution can have both positive and negative effects on shareholders, depending on various factors such as the valuation of the company, the terms of the dilution, and the growth prospects of the startup. Here are some key considerations regarding the impact of stock dilution:

1. Ownership Percentage: As new shares are issued, existing shareholders own a smaller percentage of the company. This can diminish their voting power and influence over key decisions.

2. Earnings per Share (EPS): Stock dilution can lead to a decrease in earnings per share, as the company’s net income is divided among a larger number of shares. This can reduce the potential financial returns for shareholders, especially if the company’s performance does not improve proportionately.

3. Valuation: The impact of stock dilution on shareholders may depend on the valuation of the company. If the valuation increases significantly due to the new funding, the dilution may be offset by the potential growth in the company’s value.

4. Future Funding: Dilution can also impact a company’s ability to attract future funding. If existing shareholders are heavily diluted, it may be more challenging to secure additional capital in subsequent funding rounds.

Protecting Against Stock Dilution

While stock dilution is a common occurrence in startups, there are measures that shareholders can take to protect their interests. Here are some ways to mitigate the impact of stock dilution:

1. Anti-Dilution Provisions: Investors can negotiate anti-dilution provisions in their investment agreements to protect against future dilution. These provisions adjust the conversion price of convertible securities or provide for additional shares in case of future stock issuances at a lower price.

2. Participating Preferred Stock: In certain cases, preferred stockholders may have participating rights, allowing them to receive additional proceeds upon the sale or liquidation of the company. This can provide some protection against dilution for preferred stockholders.

3. Employee Stock Option Plans (ESOPs): Startups can structure their ESOPs in a way that minimizes dilution for existing shareholders. This can include setting appropriate strike prices for stock options or implementing vesting schedules to incentivize long-term commitment.

Understanding stock dilution is crucial for anyone involved in startups, whether as an investor, employee, or founder. Stock dilution occurs when new shares are issued, reducing the ownership percentage of existing shareholders. It happens when startups raise capital, grant stock options, or convert convertible securities. While stock dilution can impact ownership and financial returns, there are strategies to protect against it, such as anti-dilution provisions and well-designed ESOPs. By comprehending the implications of stock dilution, stakeholders in startups can make more informed decisions and navigate the complexities of equity ownership.

Fully Diluted Shares and Startup Stock Ownership

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is stock dilution in startups?

Stock dilution in startups refers to the reduction in the percentage ownership of existing shareholders when additional shares are issued. It occurs when a startup raises capital by issuing new shares to investors, employees, or through stock options, which leads to the dilution of the ownership stakes of existing shareholders.

Why do startups experience stock dilution?

Startups often experience stock dilution because they need to raise capital to fund their growth and operations. By issuing additional shares, they can attract new investors and employees who contribute capital, skills, and expertise to the company. Stock dilution is a common way for startups to secure the necessary funding for expansion.

How does stock dilution affect existing shareholders?

Stock dilution affects existing shareholders by reducing their ownership percentage in the company. As new shares are issued, the overall ownership pie gets bigger, resulting in a smaller slice for existing shareholders. This dilution can impact voting rights, control, and potential future returns for existing shareholders.

What is the impact of stock dilution on a startup’s valuation?

Stock dilution can impact a startup’s valuation by reducing the value of each existing share. When new shares are issued, the ownership stake of existing shareholders is diluted, which can lead to a decrease in the per-share value. However, if the capital raised through dilution enables the company to grow and increase its overall value, the impact on valuation may be positive in the long run.

How can startups manage stock dilution?

Startups can manage stock dilution through various strategies, such as implementing equity vesting schedules, using stock options with exercise prices equal to the fair market value, and considering alternative fundraising methods like debt financing. Additionally, startups can negotiate terms with investors to minimize dilution and protect the interests of existing shareholders.

What are the potential benefits of stock dilution to startups?

Stock dilution can bring several benefits to startups, including access to additional capital for growth and expansion, attracting talented employees through stock options, and establishing partnerships through strategic investors. Dilution can also provide liquidity for existing shareholders if they choose to sell a portion of their shares during funding rounds.

Are there any risks associated with stock dilution?

Yes, there are risks associated with stock dilution. Dilution can result in a loss of control for existing shareholders if their ownership percentage decreases significantly. Additionally, if the price per share declines due to dilution, it may affect the potential return on investment for existing shareholders.

How can investors protect themselves from excessive stock dilution?

Investors can protect themselves from excessive stock dilution by negotiating safeguards and protective provisions in their investment agreements. These provisions can include anti-dilution clauses, pre-emptive rights, and board representation to ensure their interests are adequately protected and to limit the potential negative impact of dilution on their investment.

Please note that these FAQs provide general information and should not be considered as legal or financial advice. It is recommended to consult professionals with expertise in equity dilution and startups for specific guidance.

Final Thoughts

Understanding stock dilution in startups is crucial for investors and shareholders. Stock dilution occurs when a company issues additional shares, which can result in a decrease in the ownership percentage and value of existing shares. This can affect the overall financial health of a startup and impact investors’ returns. It is essential for individuals to analyze the reasons behind stock dilution, such as fundraising or employee stock options, and evaluate its potential impact on their investment. By comprehending the concept of stock dilution in startups, stakeholders can make informed decisions and navigate the complexities of the investment landscape successfully.