Do you find yourself perplexed by the concept of stock market corrections? Don’t worry, you’re not alone. Understanding stock market corrections may seem like a daunting task, but fear not, as we’re here to simplify the process for you. In this article, we’ll delve into the world of stock market corrections, unraveling its intricacies and shedding light on what it means for investors like yourself. So, let’s embark on this journey of comprehension and gain a clearer understanding of stock market corrections together. Ready? Let’s dive in!

Understanding Stock Market Corrections

In the world of investing, the stock market is a dynamic and ever-changing landscape. One term that you may often hear in relation to the stock market is “correction.” But what exactly does it mean when the stock market undergoes a correction? In this article, we will delve into the intricacies of stock market corrections, providing you with a comprehensive understanding of this important aspect of investing.

What is a Stock Market Correction?

A stock market correction refers to a temporary decline in stock prices, typically characterized by a drop of 10% or more from recent highs. It is important to note that stock market corrections are a normal and healthy part of a market cycle. They occur when stock prices have risen to unsustainable levels and need to realign with the underlying fundamental factors that drive the market. While corrections can cause short-term anxiety and uncertainty among investors, they also present opportunities for long-term investors to enter or add to their positions at more favorable prices.

There are various reasons that can trigger a stock market correction. Economic factors such as changes in interest rates, inflation concerns, or geopolitical tensions can all contribute to a correction. Additionally, market sentiment, investor behavior, and even unexpected events can play a role in initiating a correction. It’s important to note that stock market corrections are often difficult to predict accurately, as they can occur spontaneously and without warning.

The Difference Between a Correction and a Bear Market

While both a stock market correction and a bear market involve declining stock prices, there is a distinct difference between the two. A correction is a relatively short-term phenomenon characterized by a decline of 10% or more from recent market highs. On the other hand, a bear market is a more prolonged period of declining stock prices, typically marked by a drop of 20% or more from recent highs.

Bear markets are often associated with broader economic downturns and can last for months or even years. They are generally characterized by pessimism, widespread selling, and a lack of investor confidence. Bear markets can be challenging for investors, as they require patience and a long-term perspective. However, it’s important to note that bear markets also present unique buying opportunities for those who are well-prepared and have the ability to identify undervalued assets.

Historical Perspective on Stock Market Corrections

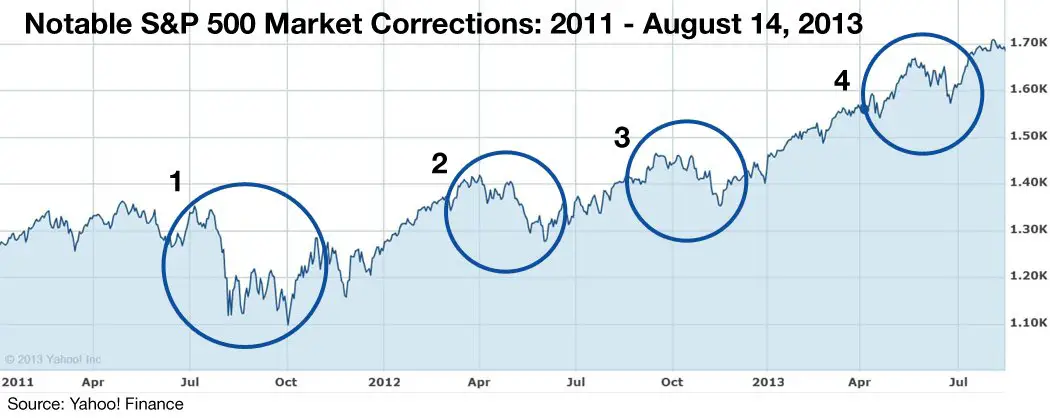

To gain a better understanding of stock market corrections, let’s take a closer look at some noteworthy historical examples. By examining past corrections, we can gain insights into how the stock market has behaved over time and how it has recovered from downturns.

1. The Dot-Com Bubble (2000-2002): During the late 1990s, the stock market experienced a rapid rise in technology stocks, fueled by the emergence of the internet and the promise of the “new economy.” However, by March 2000, the bubble burst, and the stock market entered into a correction. Over the following two years, the technology-heavy NASDAQ index plummeted by around 78%. The correction wiped out trillions of dollars in market value but eventually paved the way for a more sustainable growth trajectory.

2. The Financial Crisis (2007-2009): The financial crisis of 2008 was one of the most severe economic downturns in history. It was triggered by the collapse of the subprime mortgage market, leading to a global banking crisis and a subsequent stock market correction. The S&P 500, a widely followed index of U.S. stocks, lost more than 50% of its value from peak to trough. However, in the years following the crisis, the stock market rebounded and experienced a prolonged bull market.

3. COVID-19 Pandemic (2020): In early 2020, the emergence of the COVID-19 pandemic brought significant uncertainty and volatility to the stock market. As countries implemented lockdown measures and economic activity came to a halt, stock prices experienced a rapid decline. The S&P 500 and other major indices plunged into a correction, with some sectors, such as travel and hospitality, being particularly hard-hit. However, global stimulus measures and vaccine developments helped fuel a remarkable recovery, leading to new market highs.

How to Navigate a Stock Market Correction

Experiencing a stock market correction can be unsettling for investors, but it’s essential to keep a long-term perspective and avoid making impulsive decisions. Here are some strategies to help navigate a stock market correction:

1. Stay Informed: Stay updated on market news and developments. Follow reputable financial news sources and keep an eye on economic indicators that may impact the market. However, be cautious of sensationalist headlines or short-term predictions.

2. Review Your Portfolio: Take the opportunity to review your investment portfolio. Assess your asset allocation, diversification, and risk tolerance. Consider rebalancing your portfolio if necessary to maintain your desired risk profile.

3. Focus on Quality: Look for high-quality companies with strong fundamentals that are well-positioned to weather market downturns. These companies often have a track record of consistent earnings growth, solid balance sheets, and sustainable competitive advantages.

4. Dollar-Cost Averaging: Consider employing a dollar-cost averaging strategy. By investing a fixed amount of money at regular intervals, such as monthly or quarterly, you can take advantage of market downturns by purchasing more shares when prices are lower.

5. Avoid Emotional Decision-Making: Emotions can cloud judgment and lead to irrational investment decisions. Avoid making impulsive trades based on fear or greed. Instead, stick to your long-term investment plan and avoid reacting to short-term market fluctuations.

6. Seek Professional Advice: If you feel overwhelmed or unsure about navigating a stock market correction, consider seeking advice from a qualified financial professional. They can provide guidance tailored to your specific financial situation and investment goals.

The Importance of Patience and Long-Term Investing

Stock market corrections are a natural part of investing and should be viewed as opportunities rather than threats. By maintaining a long-term focus and adhering to sound investment principles, investors can weather market downturns and position themselves for potential future gains. It’s important to remember that successful investing requires patience, discipline, and a well-diversified portfolio.

In conclusion, understanding stock market corrections is crucial for any investor. By recognizing that corrections are normal and temporary, investors can avoid panic and make informed decisions. By staying informed, reviewing portfolios, focusing on quality, practicing dollar-cost averaging, avoiding emotional decision-making, and seeking professional advice when needed, investors can navigate stock market corrections with confidence. Remember, a correction can provide an opportunity to buy quality assets at discounted prices and potentially benefit from long-term market growth.

What is a stock market correction?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a stock market correction?

A stock market correction refers to a temporary decline in stock prices after a sustained period of upward movement. It is usually characterized by a drop of around 10% or more from the recent peak. Corrections are a natural part of market cycles and often occur due to factors such as economic indicators, investor sentiment, or changes in monetary policy.

How long do stock market corrections typically last?

The duration of a stock market correction can vary. Some corrections may last only a few weeks, while others can extend for several months. The length of a correction depends on various factors, including the severity of the decline, market sentiment, and the catalysts that triggered the correction. It is important to note that not all corrections follow a specific timeline and can be challenging to predict accurately.

What are the main causes of stock market corrections?

Stock market corrections can be triggered by a variety of factors, such as economic events, political instability, changes in interest rates, or unexpected corporate news. For example, an economic recession or a global financial crisis can lead to a significant correction in the stock market. Additionally, investor behavior and sentiment play a crucial role in amplifying or prolonging the impact of these triggers.

How should investors react during a stock market correction?

During a stock market correction, it is essential for investors to remain calm and avoid making impulsive decisions. Trying to time the market or panic-selling can often lead to poor investment outcomes. Instead, it is advisable to review your investment portfolio, ensure it aligns with your long-term goals, and consider the potential buying opportunities that may arise during a correction. Consulting with a financial advisor can provide valuable guidance during such periods.

Are stock market corrections a sign of a bear market?

A stock market correction does not necessarily indicate the onset of a bear market. While corrections can sometimes precede or coincide with a bear market, they are not a definitive signal of a prolonged downturn. Bear markets are generally characterized by a sustained drop of 20% or more and often involve economic recession or other significant events. It is important to assess multiple factors before concluding whether a correction is a precursor to a bear market.

How often do stock market corrections occur?

Stock market corrections are a regular occurrence in financial markets. While the frequency can vary, history has shown that corrections happen periodically. They are considered a normal part of the market cycle and can happen multiple times within a year or over several years. The timing and frequency of corrections depend on numerous factors, including economic conditions, market sentiment, and external events.

Can stock market corrections present buying opportunities?

Yes, stock market corrections can provide buying opportunities for investors. When stock prices decline during a correction, it may be an opportune time to purchase quality stocks at lower prices. However, it is crucial to conduct thorough research and consider fundamental factors before making any investment decisions. It is also advisable to diversify investments and follow a disciplined approach rather than trying to time the market.

How can one protect their investments during a stock market correction?

To protect investments during a stock market correction, diversification is key. Spreading investments across different asset classes, sectors, and regions can help mitigate risks associated with individual stocks or industries. Additionally, maintaining a long-term perspective and avoiding emotional decisions can contribute to protecting investments during market downturns. Regularly reviewing and rebalancing portfolios, as well as seeking professional advice, can also be beneficial in navigating stock market corrections.

Final Thoughts

Understanding stock market corrections is essential for investors to navigate through the ups and downs of the financial world. These corrections, although often feared, are a natural part of the market cycle and can provide opportunities for long-term growth. By recognizing that corrections are temporary setbacks rather than permanent declines, investors can maintain a balanced perspective and make informed decisions. It is crucial to stay updated with reliable sources, understand the underlying factors driving the correction, and focus on long-term investment goals. Understanding stock market corrections empowers investors to navigate uncertain times and capitalize on potential opportunities.