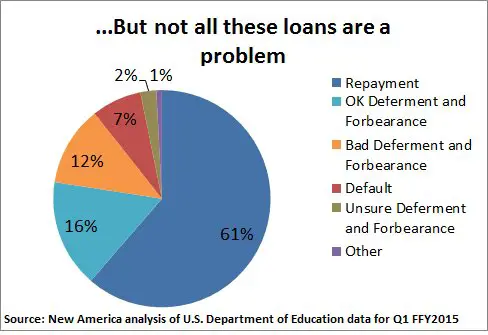

Are you struggling to manage your student loan payments? Understanding student loan deferment and forbearance could be the solution you’re seeking. These options provide temporary relief from making payments, giving you some breathing room to overcome financial challenges or pursue further education. With deferment, you can postpone payments without accruing interest on certain types of loans, while forbearance allows you to temporarily stop or reduce your payments, but interest continues to accrue. Let’s delve deeper into the details of understanding student loan deferment and forbearance to help you navigate these options effectively.

Understanding Student Loan Deferment and Forbearance

Introduction

Student loans have become a common way for students to finance their higher education. While they provide an opportunity for individuals to invest in their future, they can also become a burden for borrowers. Thankfully, there are options available to help alleviate the financial strain that occurs when repaying student loans. Two such options are deferment and forbearance. In this article, we will explore what student loan deferment and forbearance are, when they can be used, and how they differ from each other.

What is Student Loan Deferment?

Student loan deferment is a temporary pause in loan repayment that allows borrowers to postpone making payments on their federal student loans. During the deferment period, interest generally does not accrue on subsidized federal loans, meaning the government pays the interest. However, interest may accrue on unsubsidized federal loans and private loans.

Eligibility for Deferment

To qualify for a deferment, borrowers must meet certain criteria, including:

- Being enrolled in school at least half-time

- Being in a graduate fellowship program or an approved rehabilitation training program

- Experiencing unemployment or economic hardship

- Serving on active duty in the military or in the Peace Corps

Types of Deferment

There are several types of deferment available, including:

In-School Deferment

This deferment is for borrowers who are enrolled in school on at least a half-time basis. It typically lasts for the duration of the student’s academic program and is automatically applied as long as the school reports the enrollment status to the loan servicer.

Graduate Fellowship Deferment

Graduate fellowship deferment is available to borrowers who are participating in a fellowship program or similar postgraduate training. It typically lasts for the duration of the fellowship program and requires the borrower to provide documentation of their participation to the loan servicer.

Unemployment Deferment

Borrowers who are actively seeking, but unable to find, full-time employment may qualify for an unemployment deferment. This type of deferment is typically granted for up to three years in total, with each year requiring the borrower to submit documentation of their efforts to find employment.

Economic Hardship Deferment

Economic hardship deferment is available to borrowers who are experiencing financial difficulties but do not qualify for other deferment options. It usually lasts for up to three years, during which the borrower must provide documentation of their income and expenses to demonstrate their inability to make loan payments.

Military Service and Peace Corps Deferment

Borrowers who serve on active duty in the military or as Peace Corps volunteers may be eligible for deferment. The duration of the deferment depends on the length of service and can vary for each specific situation.

What is Student Loan Forbearance?

Student loan forbearance is another option available to borrowers experiencing financial hardship. It allows borrowers to temporarily reduce or suspend their loan payments. Unlike deferment, interest accrues on all types of student loans during forbearance, including both federal and private loans.

Eligibility for Forbearance

Borrowers may qualify for forbearance if they are facing financial difficulties but do not meet the criteria for deferment. Forbearance can be granted at the discretion of the loan servicer and is typically used for short-term financial challenges.

Types of Forbearance

There are two types of forbearance available: discretionary forbearance and mandatory forbearance.

Discretionary Forbearance

Discretionary forbearance is granted at the discretion of the loan servicer. It is typically used for borrowers who do not qualify for deferment but are experiencing financial difficulties. Discretionary forbearance can be requested for reasons such as illness, job loss, or other financial hardships. It is important to note that interest continues to accrue during discretionary forbearance.

Mandatory Forbearance

Mandatory forbearance requires the loan servicer to grant forbearance under specific circumstances. Borrowers may be eligible for mandatory forbearance if they are serving in a medical or dental internship or residency program, if their monthly student loan payments exceed a certain percentage of their income, or if they qualify for the Department of Defense Student Loan Repayment Program, among other reasons.

Key Differences Between Deferment and Forbearance

While both deferment and forbearance provide temporary relief from making student loan payments, there are some important distinctions between the two.

Interest Accrual

- In deferment, interest does not accrue on subsidized federal loans, but it does accrue on unsubsidized federal loans and private loans.

- In forbearance, interest accrues on all types of student loans, including both federal and private loans.

Duration

- Deferment can last for an extended period, depending on the type of deferment and the borrower’s circumstances.

- Forbearance is generally granted for shorter periods and is often used for temporary financial challenges.

Qualification Criteria

- Deferment has specific eligibility requirements based on different circumstances, such as enrollment status, unemployment, economic hardship, and military or volunteer service.

- Forbearance can be granted at the discretion of the loan servicer, typically for borrowers experiencing financial difficulties that do not meet deferment criteria.

Student loan deferment and forbearance offer temporary relief for borrowers facing financial hardships. Deferment allows borrowers to pause loan repayment without accruing interest on subsidized federal loans. Forbearance, on the other hand, provides a temporary reduction or suspension of loan payments, with interest accruing on all types of loans. Understanding the differences between these options and their eligibility criteria can help borrowers make informed decisions about managing their student loan debt. It is important to contact the loan servicer to discuss individual circumstances and explore the best option for each situation. Remember, the goal is to find temporary relief while maintaining a plan to eventually repay the loans in full.

Everything You Need to Know About Student Loan Deferment & Forbearance

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is student loan deferment?

Student loan deferment is a temporary period during which you are not required to make payments on your student loans. It is typically granted for specific reasons such as returning to school, unemployment, or economic hardship.

How long can I defer my student loans?

The length of time you can defer your student loans varies depending on the type of loan and the deferment reason. Generally, deferments can range from a few months to several years. It is important to check with your loan servicer or lender for specific eligibility and time limits.

What is student loan forbearance?

Student loan forbearance is another option that allows you to temporarily pause or reduce your student loan payments. Unlike deferment, forbearance can be granted for various reasons, including financial difficulties, illness, or other personal circumstances.

How do I apply for student loan deferment or forbearance?

To apply for student loan deferment or forbearance, you need to contact your loan servicer or lender. They will provide you with the necessary forms and instructions to complete the application process. It is important to submit your application as early as possible to avoid any disruptions in your loan repayment.

Will interest still accrue during deferment or forbearance?

In most cases, interest will continue to accrue on your student loans during deferment or forbearance. This means that even though you are not making payments, the interest will be added to the principal balance of your loan. It is wise to consider paying at least the interest that accrues during this period to prevent it from increasing your overall loan amount.

Can I defer private student loans?

Deferment options for private student loans may vary depending on the lender. Some private lenders offer deferment programs similar to federal loan deferments, while others may have their own specific policies. It is essential to contact your private loan lender for information about deferment options and eligibility criteria.

Are there any consequences to deferring or forbearing my student loans?

Deferring or forbearing your student loans can provide temporary relief, but it is important to understand that there may be consequences. During deferment or forbearance, interest may still accrue, potentially increasing your loan balance. Additionally, extending the repayment period may result in paying more interest over the life of the loan. It is important to carefully consider the long-term implications before deciding to defer or forbear your student loans.

What should I do if I don’t qualify for deferment or forbearance?

If you don’t qualify for student loan deferment or forbearance, there are other options available to help manage your student loan payments. These options may include income-driven repayment plans, loan consolidation, or loan refinancing. Contact your loan servicer or lender to explore alternative solutions that best fit your circumstances.

Final Thoughts

Student loan deferment and forbearance are crucial options for individuals facing financial hardship or unable to make their loan payments. Deferment allows borrowers to temporarily pause their repayment, while forbearance provides a period of reduced or postponed payments. By understanding these two options, borrowers can effectively manage their student loan obligations and mitigate the financial strain they may face. Whether it’s due to unemployment, illness, or other unforeseen circumstances, student loan deferment and forbearance can provide much-needed relief and prevent default. Therefore, grasping the concepts and requirements of deferment and forbearance is essential for anyone navigating the world of student loans.