If you’ve ever wondered about understanding the basics of a secured loan, you’ve come to the right place. A secured loan is a type of loan that requires collateral, such as a car or a house, to secure the lender’s investment. This means that if the borrower fails to make the loan payments, the lender has the right to seize the collateral to recoup their losses. But don’t worry, understanding the ins and outs of secured loans doesn’t have to be overwhelming. In this article, we’ll break down the key elements and provide you with all the information you need to navigate this type of loan confidently. So let’s dive right in!

Understanding the Basics of a Secured Loan

A secured loan is a type of loan that requires the borrower to provide collateral in order to obtain the funds they need. This collateral can be any valuable asset, such as a home, car, or other property. The lender holds onto the collateral until the loan is fully repaid, providing them with a level of security in case the borrower defaults on their payments.

How Does a Secured Loan Work?

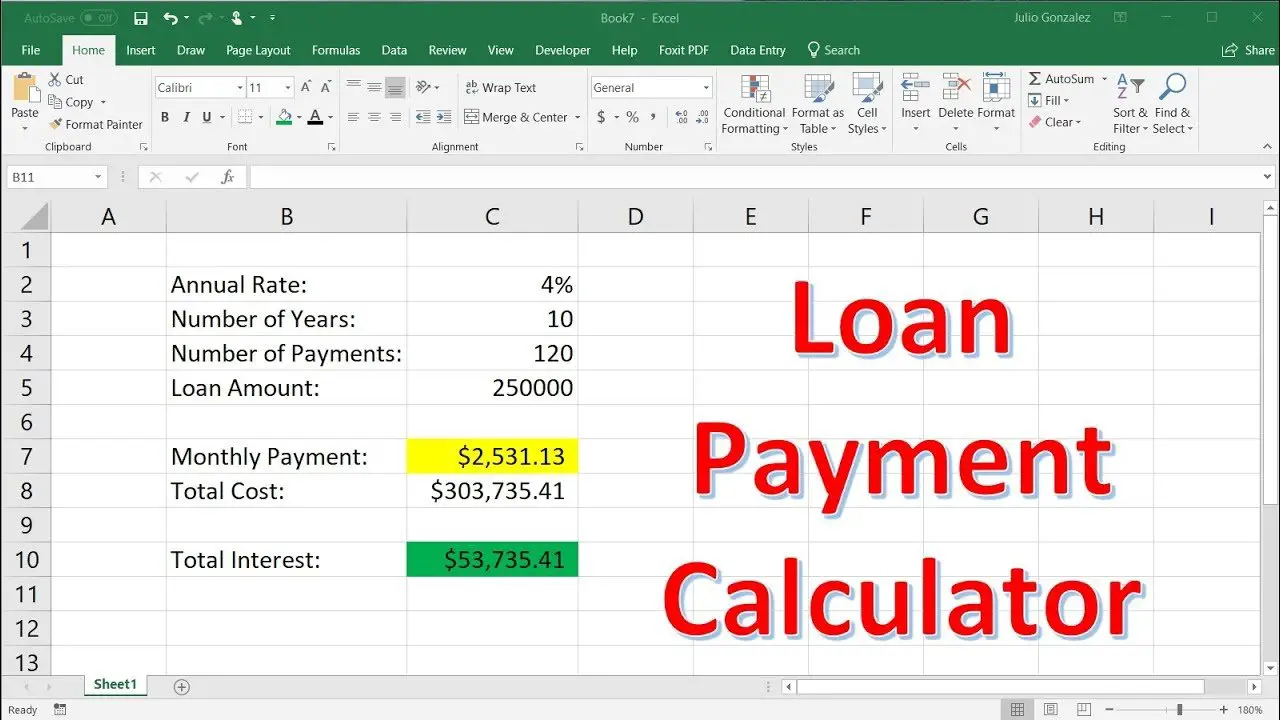

When you apply for a secured loan, the lender will evaluate the value of the collateral you are offering and determine the maximum amount they are willing to lend to you. The loan amount is typically a percentage of the collateral’s appraised value, with lenders typically offering up to 80% of the collateral’s value.

Once the loan is approved, you will receive the funds and begin making regular monthly payments to repay the loan. If you fail to make the payments as agreed, the lender has the legal right to take possession of the collateral and sell it to recover their losses.

Benefits of Secured Loans

- Lower interest rates: Secured loans often come with lower interest rates compared to unsecured loans since the collateral reduces the lender’s risk.

- Higher borrowing limits: With a secured loan, you can typically borrow larger amounts of money compared to unsecured loans.

- Easier approval: Since the lender has the collateral as security, they are more likely to approve your loan application even if your credit score is not perfect.

Risks of Secured Loans

- Possible loss of collateral: If you default on your loan payments, the lender has the right to take possession of your collateral and sell it to recover the outstanding amount.

- Longer repayment terms: Secured loans typically have longer repayment periods, which means you will be in debt for a longer period of time.

- Impact on your credit score: Failing to make timely payments or defaulting on a secured loan can negatively impact your credit score, making it harder to obtain future credit.

Types of Secured Loans

There are several types of secured loans available, each suited for different purposes:

Mortgages

A mortgage is a loan used to finance the purchase of a home or property. The property itself serves as collateral for the loan. If you fail to make your mortgage payments, the lender can foreclose on the property and sell it to recover their losses.

Auto Loans

An auto loan is a secured loan used to finance the purchase of a vehicle. The car itself acts as collateral, and if you default on the loan, the lender can repossess the vehicle and sell it to recoup their losses.

Home Equity Loans

A home equity loan allows homeowners to borrow against the equity they have built in their homes. The equity serves as collateral, and the lender can foreclose on the property if you fail to repay the loan.

Secured Personal Loans

A secured personal loan is a loan where you provide an asset as collateral, such as a savings account, certificate of deposit, or other valuable possessions. The lender can seize the collateral if you default on the loan.

Factors to Consider Before Taking a Secured Loan

Before deciding to take out a secured loan, it’s important to consider the following factors:

Loan Amount and Interest Rates

Ensure that the loan amount you need aligns with the value of the collateral. Additionally, compare interest rates from different lenders to find the best deal.

Repayment Terms

Review the repayment terms, including the duration and frequency of payments. Make sure they are manageable and fit within your financial means.

Penalties and Fees

Read the fine print and understand any penalties or fees associated with the loan, such as prepayment penalties or late payment fees.

Collateral Evaluation

Have a clear understanding of how the lender will evaluate the collateral and determine its value. This will affect the loan amount you can receive.

Financial Stability

Assess your financial stability and ability to make consistent loan payments. Taking on a secured loan requires a level of financial responsibility.

A secured loan can be a viable option for individuals in need of a larger loan amount or those with a less-than-perfect credit history. By understanding the basics of a secured loan, including how they work, their benefits, and risks involved, you can make an informed decision about whether it is the right choice for you. Remember to carefully consider factors such as loan amount, interest rates, repayment terms, penalties, and your own financial stability before proceeding with a secured loan.

Secured Loans Explained – A quick guide to what you need to know before you borrow

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a secured loan?

A secured loan is a type of loan that is backed by collateral, such as a home or a car. The collateral serves as security for the lender, reducing the risk of non-payment. If the borrower fails to repay the loan, the lender has the right to seize and sell the collateral to recover the outstanding balance.

How does a secured loan differ from an unsecured loan?

Unlike a secured loan, an unsecured loan does not require collateral. Instead, it is based solely on the borrower’s creditworthiness. Because there is no collateral involved, unsecured loans typically come with higher interest rates and stricter qualification criteria compared to secured loans.

What are the advantages of getting a secured loan?

Secured loans often come with lower interest rates compared to unsecured loans since they are less risky for lenders. Additionally, secured loans may offer higher borrowing limits and longer repayment terms, making it easier for borrowers to manage their monthly payments. They can also be a useful tool for building credit when payments are made on time.

What can I use as collateral for a secured loan?

Common forms of collateral for secured loans include real estate properties, vehicles, savings accounts, or other valuable assets. The specific types of collateral accepted may vary depending on the lender and the nature of the loan.

How does the collateral affect the loan terms?

The value and type of collateral can impact the terms of a secured loan. Lenders may offer more favorable interest rates and flexibility if the collateral holds significant value or is easily marketable. Additionally, the loan amount may be determined by the value of the collateral.

What happens if I default on a secured loan?

If you fail to meet the repayment obligations of a secured loan and default, the lender has the right to take possession of the collateral. The lender can sell the collateral to recover the outstanding balance, potentially resulting in the loss of your asset. Defaulting on a secured loan can also have a negative impact on your credit score.

Can I get a secured loan with bad credit?

Secured loans may be more accessible to individuals with bad credit compared to unsecured loans. Since the collateral reduces the risk for the lender, they may be more willing to approve the loan even if the borrower has a less-than-perfect credit history. However, it is important to note that bad credit may still affect the interest rate and terms offered.

How long does it take to get approved for a secured loan?

The approval process for a secured loan can vary depending on the lender and the complexity of the loan. It typically involves completing an application, providing necessary documentation, and undergoing a credit check. The time it takes to get approved can range from a few days to a couple of weeks.

Final Thoughts

Understanding the basics of a secured loan is crucial when considering borrowing options. A secured loan is one that requires collateral, such as a property or vehicle, which serves as security for the lender. This type of loan often offers lower interest rates and higher borrowing limits compared to unsecured loans. However, it is important to fully comprehend the risks involved, as failure to repay the loan could result in the loss of the collateral. By understanding the basics of a secured loan, individuals can make informed decisions when seeking financial assistance.