Interested in understanding the basics of income investing? Look no further! Income investing is a strategy that focuses on generating a steady stream of income from your investments. It involves selecting assets that pay regular dividends or interest, such as bonds, dividend stocks, or real estate investment trusts (REITs). By incorporating these income-generating assets into your portfolio, you can potentially create a reliable source of cash flow to supplement your income or achieve your financial goals. Ready to delve into the world of income investing? Let’s get started!

Understanding the Basics of Income Investing

Income investing is a popular strategy for investors who are looking to generate regular income from their investments. It involves selecting investments that provide a steady stream of income, such as dividends from stocks or interest payments from bonds. This strategy can be particularly appealing to individuals who are retired or nearing retirement, as it can provide a consistent source of cash flow. In this article, we will dive into the key concepts of income investing and explore various subtopics that will help you gain a thorough understanding of this investment approach.

I. Introduction to Income Investing

Income investing, also known as yield investing, focuses on generating income from investments rather than solely relying on price appreciation. The goal is to build a portfolio that provides a steady stream of cash flow, often in the form of periodic dividend or interest payments. This approach can provide investors with a reliable income stream and potentially higher yields than traditional savings accounts.

II. Benefits of Income Investing

There are several benefits to adopting an income investing strategy. These include:

1. Regular Income: One of the primary advantages of income investing is the ability to generate regular income. This can be especially beneficial for individuals who rely on investment income to cover living expenses or supplement their retirement savings.

2. Diversification: Income investing allows for diversification across different asset classes, such as stocks, bonds, and real estate investment trusts (REITs). By spreading investments across multiple income-generating assets, investors can reduce their exposure to any single investment and potentially mitigate risk.

3. Potential for Capital Growth: While income investing primarily focuses on generating income, there is also the potential for capital growth. Some income investments, such as certain dividend-paying stocks, can also appreciate in value over time, providing investors with the opportunity for capital appreciation.

4. Inflation Hedge: Some income investments, such as inflation-protected bonds or real estate investments, can act as a hedge against inflation. These assets have the potential to increase in value in line with inflation, helping to preserve purchasing power over the long term.

III. Types of Income Investments

Income investments come in various forms, each with its own characteristics and risk profiles. Let’s explore some common types of income investments:

1. Dividend-Paying Stocks: Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. These dividends can provide a regular income stream to investors. Dividend stocks can be further classified into three categories based on their dividend payment frequency: monthly, quarterly, or annually.

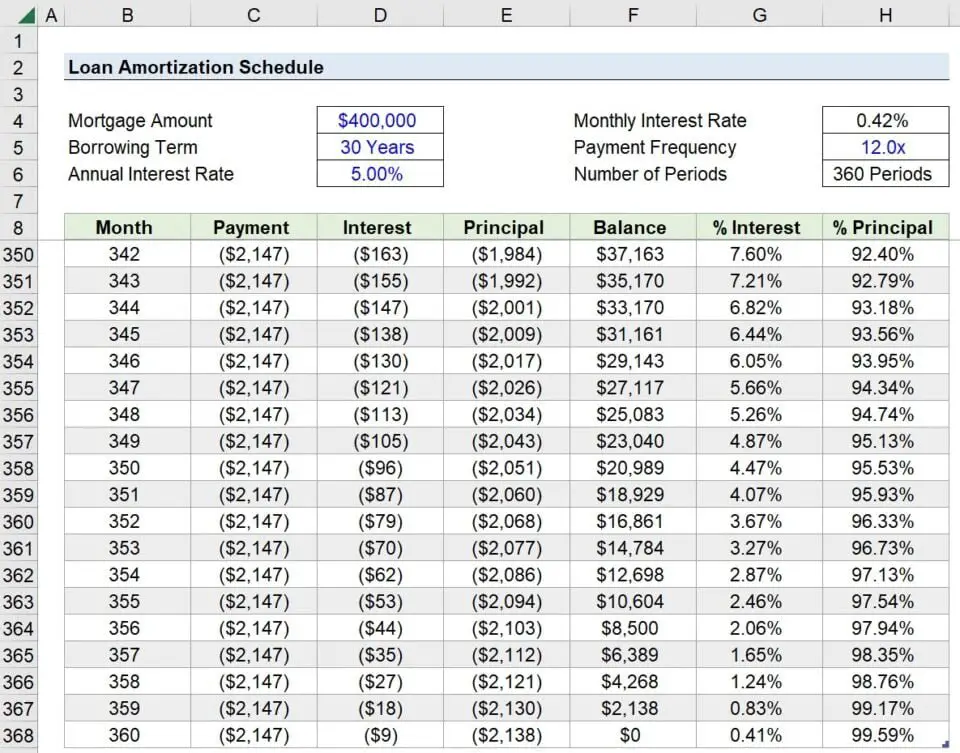

2. Bonds: Bonds are debt instruments issued by corporations, municipalities, or governments to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds offer a fixed income stream with lower risks compared to stocks.

3. Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate properties. By investing in REITs, individuals can gain exposure to the real estate market without the need to directly own physical properties. REITs typically generate income through rental income or property appreciation.

4. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual lenders, providing an alternative to traditional lending institutions. Investors can earn interest income by lending money to individuals or small businesses through these platforms. However, it’s important to note that peer-to-peer lending can carry higher risks compared to other income investments.

5. Preferred Stocks: Preferred stocks represent ownership in a company and typically offer fixed dividend payments. These stocks have a higher claim on assets and earnings than common stocks, making them less volatile. Preferred stocks are often considered hybrid investments, offering characteristics of both stocks and bonds.

IV. Factors to Consider in Income Investing

When embarking on an income investing strategy, it’s crucial to consider various factors to make informed investment decisions. Some key factors to consider include:

1. Yield: Yield is a measure of the return generated by an income investment, expressed as a percentage of the investment’s price. It is important to evaluate both current yield (income generated divided by the investment price) and potential future yield.

2. Risk Profile: Different income investments carry varying levels of risk. It’s essential to assess the risk profile of each investment, considering factors such as credit risk, interest rate risk, and market volatility. Diversification can help mitigate overall portfolio risk.

3. Investment Horizon: Your investment horizon, or the length of time you plan to hold an investment, is crucial in income investing. Some investments, such as bonds with longer maturities, may be more suitable for long-term income generation, while others may provide shorter-term income opportunities.

4. Tax Implications: Income generated from investments is subject to taxation. It’s important to consider the tax implications of different income investments and evaluate the impact on your overall after-tax income.

V. Building an Income Investment Portfolio

Constructing a well-diversified income investment portfolio requires careful consideration of various factors. Here are some steps to help you build an income investment portfolio:

1. Set Investment Goals: Define your income needs and investment objectives. Determine the amount of income you need, your risk tolerance, and your desired investment horizon.

2. Asset Allocation: Allocate your investments across different asset classes to achieve diversification. Consider the proportion of your portfolio allocated to stocks, bonds, REITs, or other income-generating assets.

3. Research and Select Investments: Conduct thorough research on potential income investments. Analyze factors such as historical performance, dividend or interest payment history, company financials, and future prospects. Select investments that align with your investment goals and risk tolerance.

4. Monitor and Rebalance: Regularly monitor your income investment portfolio to ensure it remains aligned with your goals. Rebalance your portfolio periodically to maintain the desired asset allocation.

VI. Conclusion

Income investing offers a compelling strategy for investors seeking a steady stream of cash flow from their investments. By understanding the basics of income investing and considering factors such as investment type, risk tolerance, and investment horizon, individuals can build a well-constructed income investment portfolio. Remember to conduct thorough research, diversify your investments, and monitor your portfolio regularly. With careful planning and implementation, income investing can contribute to long-term financial stability and potentially enhance overall investment returns.

REIT Basics | Income Investing Course

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is income investing?

Income investing refers to a strategy where individuals or organizations focus on investing in assets or securities that generate regular income. The primary objective of income investing is to earn a steady stream of cash flow from investments such as bonds, dividend-paying stocks, real estate investment trusts (REITs), or fixed income securities.

How does income investing differ from growth investing?

Unlike growth investing, which focuses on capital appreciation, income investing emphasizes generating regular income through dividends, interest, or rental payments. While growth investors prioritize stocks with high growth potential, income investors seek assets that offer consistent income streams, regardless of their growth potential.

What are the advantages of income investing?

Income investing offers several advantages, including a potential source of regular income, reduced volatility compared to growth investments, and the ability to diversify a portfolio. Additionally, income investments often come with a lower risk profile, making them more attractive to conservative or risk-averse investors.

What are some common income-generating investments?

Common income-generating investments include bonds, treasury securities, certificates of deposit (CDs), money market funds, dividend-paying stocks, real estate investment trusts (REITs), and rental properties. These investments provide regular income to investors through interest payments, dividends, or rental income.

How do I choose suitable income investments?

Choosing suitable income investments requires considering factors such as risk tolerance, investment goals, time horizon, and current market conditions. It is important to conduct thorough research on potential investments, evaluate their historical performance, assess their sustainability, and analyze the associated risks before making investment decisions.

What are the risks involved in income investing?

Although income investing is often considered lower risk compared to growth investing, it is not entirely risk-free. Some common risks include interest rate risk, credit risk, inflation risk, and market volatility. Investors need to understand these risks and diversify their income investments to mitigate potential losses.

Can income investing be suitable for retirement planning?

Yes, income investing can be a suitable strategy for retirement planning. By investing in income-generating assets, individuals can create a steady stream of income to support their retirement lifestyle. However, it is essential to align the investment strategy with retirement goals, risk tolerance, and anticipated income needs during retirement.

What is the importance of diversification in income investing?

Diversification is crucial in income investing as it helps reduce potential risks. By spreading investments across different asset classes, sectors, or geographic regions, investors can minimize the impact of a single investment’s performance. Diversification also provides an opportunity to balance high-risk investments with more stable income-generating assets.

How can I manage the tax implications of income investing?

Managing the tax implications of income investing involves understanding the tax rules applicable to specific income-generating investments. It is advisable to consult with a tax professional who can provide guidance on tax-efficient strategies, such as using tax-advantaged accounts like IRAs or maximizing tax deductions related to investment expenses.

Final Thoughts

Understanding the basics of income investing is crucial for anyone seeking to maximize their investment returns. By focusing on investments that generate regular income, such as dividend-paying stocks or bonds, investors can enjoy a steady stream of cash flow while also aiming for long-term capital appreciation. Income investing allows individuals to create a reliable source of passive income, which can be particularly beneficial for retirement planning or achieving financial independence. By diversifying their income investments and conducting thorough research, individuals can make informed decisions and potentially enhance their overall investment portfolio. With a solid understanding of income investing, investors can take control of their financial future and work towards achieving their goals.