Are you curious about the benefits of a balanced mutual fund? Look no further! In this blog article, we will delve into understanding the advantages that come with investing in a balanced mutual fund. Balanced mutual funds offer a well-rounded approach to investment by diversifying portfolios across different asset classes, such as stocks and bonds. By maintaining a balance between risk and returns, these funds provide stability and growth potential for investors. So, let’s explore the reasons why understanding the benefits of a balanced mutual fund is crucial for your financial success.

Understanding the Benefits of a Balanced Mutual Fund

When it comes to investing, there are a plethora of options available in the market. One popular choice among investors is a balanced mutual fund. A balanced mutual fund offers a diversified approach to investment by combining both stocks and bonds in a single portfolio. In this article, we will delve into the various benefits of investing in a balanced mutual fund and explore how it can be a valuable addition to your investment strategy.

Diversification for Reduced Risk

One of the key advantages of a balanced mutual fund is the built-in diversification it provides. By investing in a combination of stocks and bonds, the fund spreads the risk across different asset classes and sectors. This diversification helps to reduce the overall risk of the portfolio, as losses in one area can be offset by gains in another.

Additionally, balanced mutual funds often invest in a wide range of companies, both large and small, across various industries. This further enhances diversification and reduces the impact of any one company or sector on the fund’s performance.

By reducing risk through diversification, a balanced mutual fund can offer a more stable investment option compared to investing in individual stocks or bonds.

Steady Income Generation

Investors seeking a steady income stream can find balanced mutual funds to be an attractive option. These funds typically allocate a portion of their portfolio to fixed-income securities like bonds, which pay regular interest payments.

By including bonds in the portfolio, balanced mutual funds can offer regular income to investors. This income can be especially beneficial for those who rely on their investments to supplement their current income or for retirees who need a steady stream of cash flow.

Furthermore, the income generated from bonds can act as a buffer during periods of stock market volatility. While the stock portion of the portfolio may experience fluctuations, the income from bonds can help stabilize the overall returns of the fund.

Growth Potential through Equity Investments

Alongside fixed-income securities, balanced mutual funds also invest in stocks, providing investors with exposure to the potential growth of the equity markets. The equity portion of the portfolio allows investors to benefit from rising stock prices and capital appreciation.

Investing in a balanced mutual fund enables investors to gain exposure to a diversified portfolio of stocks, reducing the risk associated with investing in individual stocks. This diversification can help mitigate the impact of a poorly performing stock on the overall fund performance.

Furthermore, professional fund managers actively manage balanced mutual funds, striving to identify high-quality stocks and optimize the fund’s performance. Their expertise and research allow investors to benefit from their knowledge and experience without needing to dedicate extensive time and effort to individual stock selection.

Ability to Adjust Portfolio Allocation

Another advantage of a balanced mutual fund is the flexibility it offers in adjusting the portfolio allocation. Fund managers continuously monitor market conditions and make adjustments to ensure the portfolio remains aligned with the fund’s investment objectives.

For example, in times of market volatility or economic uncertainty, fund managers may reduce the allocation to stocks and increase the allocation to bonds to lower the overall risk of the portfolio. On the other hand, during periods of economic growth, managers may increase the allocation to stocks to capture potential market upturns.

This ability to adjust the portfolio allocation provides investors with a dynamic investment strategy that can adapt to changing market conditions. It allows investors to benefit from the expertise of professional fund managers who actively manage the fund’s asset allocation based on their market outlook, research, and analysis.

Convenience and Accessibility

Investing in a balanced mutual fund offers convenience and accessibility to a wide range of investors. Unlike investing in individual stocks or bonds, which requires extensive research and monitoring, a balanced mutual fund provides a ready-made portfolio managed by professionals.

Whether you are a novice investor or someone who prefers a hands-off approach, a balanced mutual fund can be an ideal option. The fund’s professional management team handles the day-to-day investment decisions, saving investors valuable time and effort.

Additionally, balanced mutual funds often have low minimum investment requirements, making them accessible to a broader range of investors. This accessibility allows individuals to start investing with smaller amounts of capital and gradually increase their investment over time.

Long-Term Investment Strategy

Investing in a balanced mutual fund can be an effective long-term investment strategy. By combining both stocks and bonds, the fund provides a balanced approach that seeks to generate both income and growth over time.

For investors with a longer time horizon, the combination of income generation from bonds and potential growth from stocks can help build wealth over the long term. This long-term perspective aligns well with retirement planning or other financial goals that require a sustained approach.

Furthermore, by investing in a balanced mutual fund, investors can benefit from the power of compounding. Reinvesting dividends and capital gains earned by the fund can lead to exponential growth over time.

Risk Factors to Consider

While balanced mutual funds offer several benefits, it is essential to consider the potential risks associated with these investments:

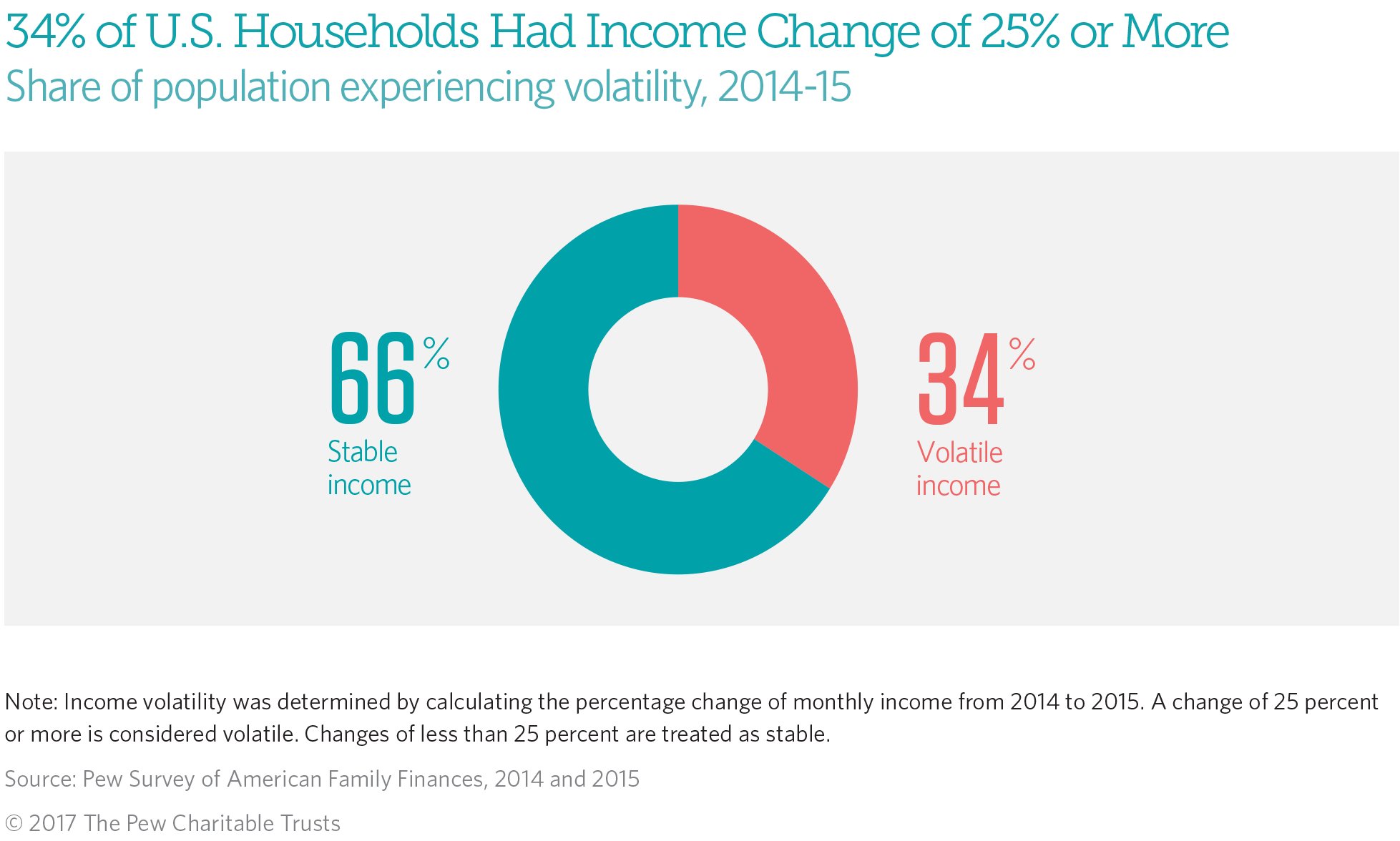

- Market Volatility: The value of stocks and bonds can fluctuate based on market conditions, potentially impacting the performance of the fund.

- Interest Rate Risk: Changes in interest rates can affect the value of bonds held in the fund, leading to potential fluctuations in returns.

- Manager Performance: The success of a balanced mutual fund heavily relies on the expertise and decisions made by the fund managers. Poor performance by the management team can impact the fund’s overall returns.

- Fees and Expenses: Like any investment, balanced mutual funds have associated fees and expenses. It is essential to understand these costs and their impact on the fund’s performance.

Investors should carefully assess their risk tolerance and investment objectives before investing in a balanced mutual fund. It is always recommended to consult with a financial advisor who can provide personalized guidance based on individual circumstances.

Should you invest in Balanced Advantage Funds?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a balanced mutual fund?

A balanced mutual fund is a type of investment that combines both stocks and bonds in a single portfolio. It aims to provide investors with a balanced approach to growth and income by diversifying across different asset classes.

How does a balanced mutual fund work?

A balanced mutual fund works by pooling money from multiple investors to invest in a mix of stocks, bonds, and other securities. The fund manager makes investment decisions on behalf of the investors, aiming to achieve a balance between growth and income.

What are the benefits of investing in a balanced mutual fund?

Investing in a balanced mutual fund offers several benefits, including:

– Diversification: By investing in a mix of stocks and bonds, a balanced mutual fund reduces the risk associated with relying on a single asset class.

– Potential for growth and income: Balanced funds aim to provide both capital appreciation and regular income through dividends and interest payments.

– Professional management: The fund is managed by experienced professionals who make investment decisions based on thorough research and analysis.

What are the risks involved in investing in a balanced mutual fund?

Like any investment, a balanced mutual fund carries risks. These may include:

– Market risk: The value of the fund can fluctuate depending on market conditions, potentially affecting the return on investment.

– Inflation risk: The returns generated by the fund may not keep pace with inflation, reducing the purchasing power of the investor’s money.

– Interest rate risk: Changes in interest rates can impact the value of the bond holdings in the fund.

Are balanced mutual funds suitable for all investors?

Balanced mutual funds can be suitable for investors seeking a moderate level of risk and a diversified investment approach. However, individual suitability depends on factors like investment goals, risk tolerance, and time horizon. It is always advisable for investors to consult with a financial advisor before making any investment decisions.

How can I invest in a balanced mutual fund?

To invest in a balanced mutual fund, you can approach a reputable mutual fund company or a financial advisor. They will guide you through the process of opening an account, selecting a suitable fund, and completing the necessary paperwork.

Can I withdraw my money from a balanced mutual fund anytime?

Yes, generally, you can withdraw your money from a balanced mutual fund at any time. However, it is important to consider any applicable fees, penalties, or tax consequences that may apply before making a withdrawal. It is advisable to review the terms and conditions of the fund or consult with the fund company before initiating a withdrawal.

How often should I review my balanced mutual fund investment?

It is recommended to review your balanced mutual fund investment periodically to ensure it aligns with your investment goals and risk tolerance. Market conditions, performance, and your personal circumstances may change, so regular reviews can help you make any necessary adjustments or rebalancing decisions.

Final Thoughts

A balanced mutual fund offers numerous benefits to investors. Firstly, it provides diversification by investing in a mix of stocks, bonds, and other assets, spreading the risk and potentially generating steady returns. Secondly, it allows investors to benefit from professional fund management, as experienced portfolio managers make investment decisions on their behalf. This saves time and effort for individual investors who may not have the expertise or resources to manage their investments effectively. Additionally, a balanced mutual fund offers flexibility, allowing investors to easily adjust their asset allocation as their financial goals or risk tolerance change. Understanding the benefits of a balanced mutual fund enables investors to make informed decisions and build a well-rounded investment portfolio.