Have you ever wondered how you can make the most out of your savings? Look no further! Understanding the benefits of high-yield savings accounts can be the solution you’ve been searching for. These accounts offer a higher interest rate compared to traditional savings accounts, allowing your money to grow at a faster pace. Imagine earning more without having to exert any extra effort – sounds enticing, right? In this article, we will delve into the advantages of high-yield savings accounts and explore how they can help you achieve your financial goals. So, let’s dive in and uncover the potential of these accounts!

Understanding the Benefits of High-Yield Savings Accounts

Introduction

In today’s financial landscape, it’s important to make the most of your savings. High-yield savings accounts have gained popularity as a valuable tool for individuals looking to grow their money while keeping it easily accessible. With their higher interest rates compared to traditional savings accounts, these accounts offer a range of benefits that can help you achieve your financial goals faster.

What Is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that generally offers a higher interest rate than a standard savings account. These accounts are typically offered by online banks, credit unions, or smaller financial institutions. The interest rates on high-yield savings accounts are variable and can fluctuate depending on market conditions.

The Benefits of High-Yield Savings Accounts

High-yield savings accounts offer several advantages over traditional savings accounts. Let’s delve into the key benefits:

1. Competitive Interest Rates

One of the primary benefits of a high-yield savings account is the higher interest rate it provides. Traditional savings accounts usually offer interest rates that barely keep up with inflation, whereas high-yield savings accounts offer rates that are significantly higher. This means that your money can grow faster, helping you achieve your financial goals sooner.

2. Easy Accessibility

Contrary to popular belief, high-yield savings accounts are just as accessible as traditional savings accounts. While they may be offered by online banks, you can still deposit and withdraw funds easily. Most high-yield savings accounts allow you to link them to your existing checking account, facilitating seamless transfers between the two.

3. FDIC Insurance

Just like traditional savings accounts, high-yield savings accounts are typically FDIC-insured. This means that even if the bank were to face financial difficulties, your funds would still be protected up to the FDIC insurance limit (currently $250,000 per depositor, per insured bank). This assurance of the safety of your money provides peace of mind.

4. No Minimum Balance Requirements

Unlike some investment accounts or certificates of deposit (CDs), high-yield savings accounts generally do not require a minimum balance. This flexibility allows individuals with varying savings amounts to take advantage of the higher interest rates without worrying about maintaining a significant sum of money in their account.

5. Low or No Fees

Another perk of high-yield savings accounts is that they typically have low or no monthly maintenance fees. While traditional savings accounts might have monthly fees attached, high-yield savings accounts are designed to minimize costs and maximize the growth of your savings.

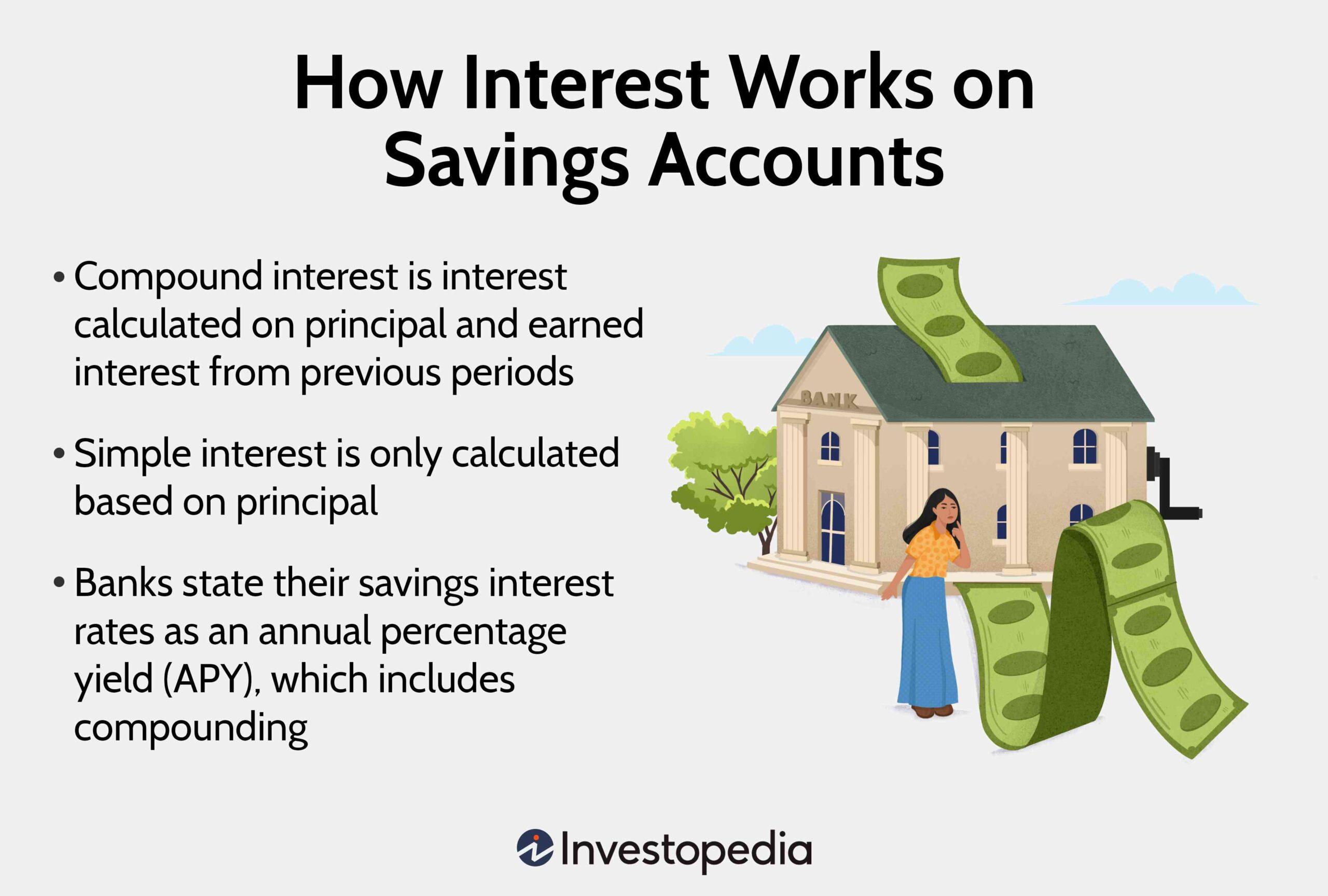

6. Compounding Interest

High-yield savings accounts use compounding interest, which means that you earn interest not only on your initial deposit but also on the interest you’ve already earned. Over time, this compounding effect can significantly boost your savings and accelerate your progress towards your financial goals.

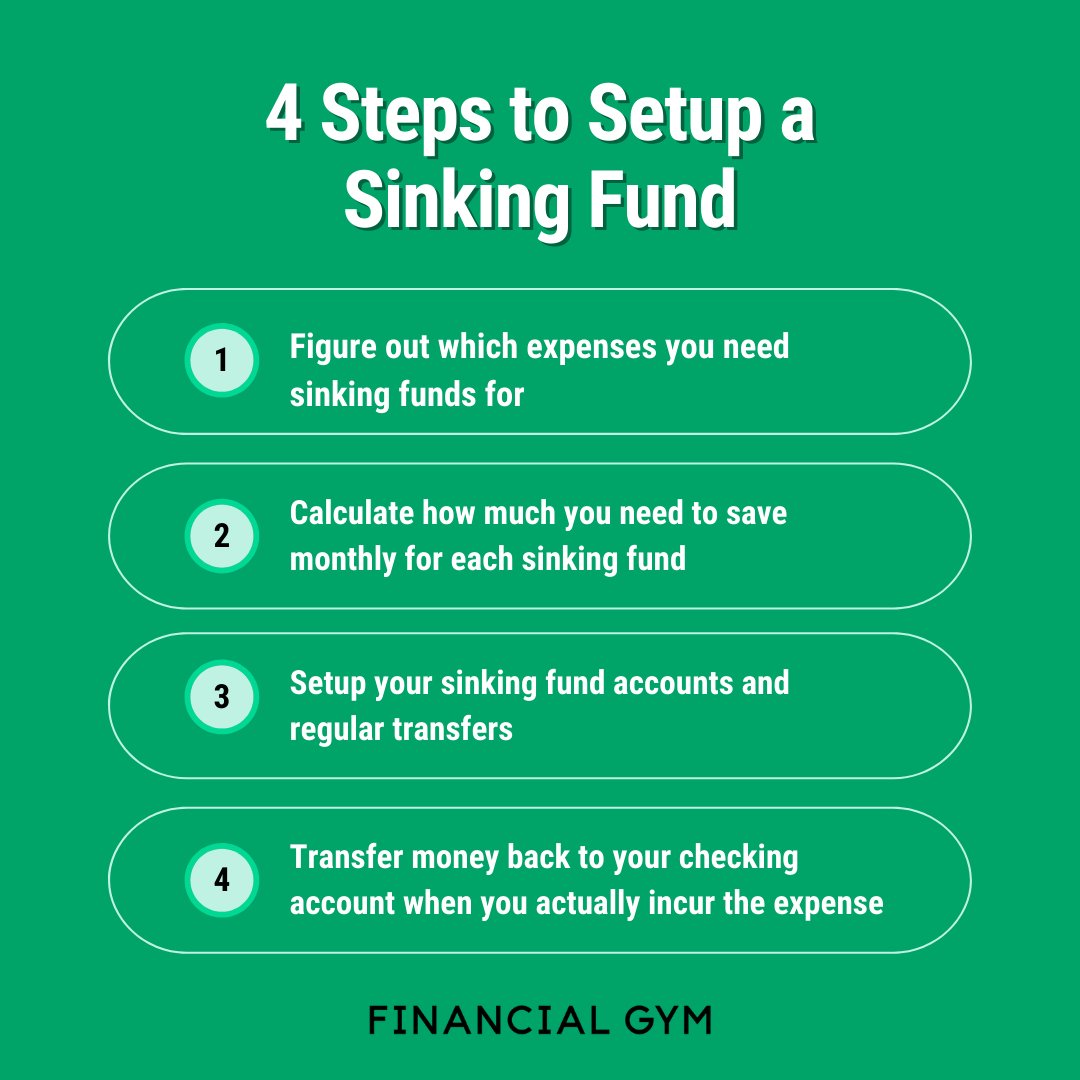

7. Goal-Oriented Savings

For individuals with specific financial goals, such as saving for a down payment on a house or an emergency fund, high-yield savings accounts can be a powerful tool. These accounts allow you to set aside money and watch it grow, ensuring it’s readily available when you need it. With the higher interest rates, you can reach your goals faster and more efficiently.

8. Online Banking Convenience

High-yield savings accounts are often offered by online banks. This means you can easily access your account and manage your funds from the comfort of your own home, at any time of the day. Online banking offers convenience and flexibility, allowing you to stay in control of your finances without the need to visit a physical branch.

In conclusion, high-yield savings accounts are an excellent tool for individuals looking to grow their savings while maintaining accessibility. With competitive interest rates, easy accessibility, FDIC insurance, no minimum balance requirements, low or no fees, compounding interest, and goal-oriented savings, these accounts provide a host of benefits that can help you achieve your financial objectives faster. Whether you’re saving for short-term goals or building a long-term nest egg, a high-yield savings account can be a valuable addition to your financial strategy.

Ready to start growing your savings? Consider opening a high-yield savings account and harness the benefits it offers. Take control of your finances and watch your money flourish.

Pros and Cons of High Yield Savings Accounts – You Won't Believe What We Found!

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a high-yield savings account?

A high-yield savings account is a type of savings account that offers a higher interest rate compared to traditional savings accounts. It allows individuals to earn more on their savings while still having easy access to their funds.

How does a high-yield savings account differ from a regular savings account?

The main difference between a high-yield savings account and a regular savings account is the interest rate. High-yield savings accounts typically offer higher interest rates, allowing individuals to earn more on their deposited funds.

What are the benefits of a high-yield savings account?

A high-yield savings account offers several benefits, including:

– Higher interest rates: With a high-yield savings account, individuals can earn a higher return on their savings compared to regular savings accounts.

– Easy access to funds: Individuals can withdraw money from their high-yield savings account whenever they need it, providing flexibility and convenience.

– FDIC insurance: Like regular savings accounts, high-yield savings accounts are also FDIC insured, offering protection for deposited funds up to the maximum allowed by law.

Are there any minimum balance requirements for high-yield savings accounts?

The minimum balance requirements for high-yield savings accounts can vary depending on the financial institution. Some banks may require a minimum initial deposit to open the account, while others may have ongoing minimum balance requirements to maintain the high-yield interest rate. It’s important to check with the specific bank or credit union to understand their requirements.

Can I link my high-yield savings account to my checking account?

Yes, many financial institutions allow you to link your high-yield savings account to your checking account. This makes it convenient to transfer funds between the two accounts and manage your finances efficiently.

Are there any fees associated with high-yield savings accounts?

While high-yield savings accounts generally do not have monthly maintenance fees, some financial institutions may charge fees for certain transactions or services. These fees may include excessive withdrawal fees, overdraft fees (if linked to a checking account), or fees for additional services like wire transfers. It’s important to review the account terms and conditions to understand any potential fees.

Is the interest on a high-yield savings account taxable?

Yes, the interest earned on a high-yield savings account is generally taxable income. It is important to include the interest earned when filing your annual income tax return.

How can I find the best high-yield savings account for my needs?

To find the best high-yield savings account, it’s recommended to compare the interest rates, minimum balance requirements, fees, and other account features offered by different financial institutions. Online research, reading customer reviews, and consulting with a financial advisor can help you make an informed decision based on your specific needs and preferences.

Final Thoughts

Understanding the benefits of high-yield savings accounts is crucial for anyone looking to maximize their savings. These accounts offer a higher interest rate compared to traditional savings accounts, allowing your money to grow at a faster pace. With the power of compounding, even small deposits can accumulate significant earnings over time. Additionally, high-yield savings accounts typically have low or no fees, ensuring that more of your money stays in your pocket. Whether you are saving for a short-term goal or building an emergency fund, high-yield savings accounts provide a secure and efficient way to grow your savings.