Do you ever find yourself puzzled by the concept of asset turnover ratio? Well, look no further! In this blog article, we will dive into the fascinating world of asset turnover ratio and explore its significance in evaluating a company’s efficiency. Asset turnover ratio is a powerful metric that measures a company’s ability to generate revenue from its assets. By understanding this concept, you can gain valuable insights into a company’s operational efficiency and financial health. So, let’s embark on this journey of understanding the concept of asset turnover ratio and discover its practical applications in the business world.

Understanding the Concept of Asset Turnover Ratio

The asset turnover ratio is a critical financial metric that provides insights into a company’s efficiency in utilizing its assets to generate revenue. By analyzing this ratio, investors, analysts, and stakeholders can evaluate a company’s operational effectiveness and potential for growth. In this article, we will explore the concept of asset turnover ratio, its significance, how to calculate it, and its implications for businesses.

What is the Asset Turnover Ratio?

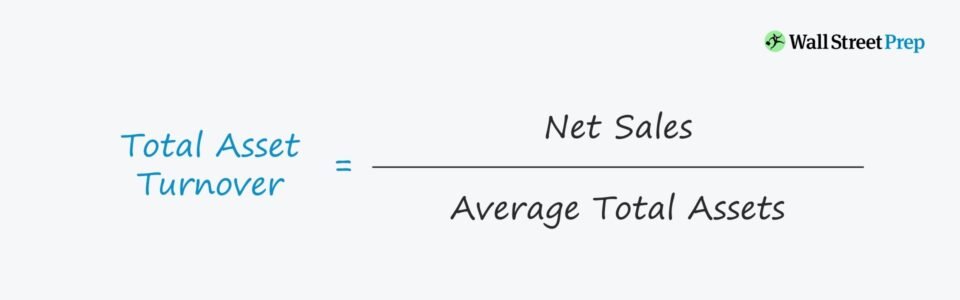

The asset turnover ratio is a financial indicator that measures a company’s ability to generate revenue relative to its total assets. It demonstrates how effectively a company utilizes its assets to generate sales. By dividing a company’s net sales by its average total assets, this ratio quantifies the efficiency of asset utilization. The higher the ratio, the more efficiently a company is using its assets to generate revenue.

For example, if a company generates $1 million in net sales per year and has $500,000 in average total assets, its asset turnover ratio would be 2. This means that the company generates $2 of sales for every $1 of assets.

Why is the Asset Turnover Ratio Important?

The asset turnover ratio is a crucial measure for both internal management and external stakeholders. Here’s why it’s important:

1. Efficiency Assessment:

The asset turnover ratio helps evaluate a company’s efficiency in utilizing its assets to generate revenue. It highlights how productive a company is in utilizing its resources. A higher ratio suggests that a company efficiently converts its investments into revenue, while a lower ratio indicates the opposite. By comparing the ratio with industry peers, analysts can assess a company’s competitive position.

2. Identifying Operational Issues:

A declining asset turnover ratio can indicate operational inefficiencies or changing market conditions. It may reveal problems such as underutilized assets, obsolete inventory, or declining sales. By closely monitoring this ratio, companies can identify areas for improvement and take necessary corrective actions to boost operational efficiency.

3. Performance Benchmarking:

The asset turnover ratio serves as a benchmark for comparing a company’s performance over time or against its competitors. Tracking changes in the ratio can help identify trends, assess operational improvements, or evaluate the impact of strategic decisions. It provides valuable insights for decision-making and future planning.

4. Investment Analysis:

For investors, the asset turnover ratio is an essential tool for evaluating a company’s financial health and potential returns. It helps assess the efficiency of capital utilization and the company’s ability to generate profits. By comparing the ratios of different companies in the same industry, investors can make more informed investment decisions.

How to Calculate the Asset Turnover Ratio

The asset turnover ratio is derived by dividing a company’s net sales by its average total assets. The formula for calculating the asset turnover ratio is as follows:

| Asset Turnover Ratio | = | Net Sales | / | Average Total Assets |

|---|

To calculate the average total assets, add the beginning and ending total assets for a specific period (e.g., a year) and divide the sum by 2.

Let’s consider an example to illustrate the calculation of the asset turnover ratio:

- Net Sales (during the year): $1,500,000

- Beginning Total Assets: $500,000

- Ending Total Assets: $800,000

First, calculate the average total assets:

| Average Total Assets | = | (Beginning Total Assets + Ending Total Assets) | / | 2 |

|---|---|---|---|---|

| (500,000 + 800,000) | / | 2 | = | $650,000 |

Next, use the average total assets to calculate the asset turnover ratio:

| Asset Turnover Ratio | = | Net Sales | / | Average Total Assets |

|---|---|---|---|---|

| $1,500,000 | / | $650,000 | ||

| = | 2.31 |

In this example, the asset turnover ratio is 2.31.

Interpreting the Asset Turnover Ratio

The asset turnover ratio provides valuable insights into a company’s operational efficiency. Here’s how to interpret the ratio:

1. High Asset Turnover Ratio:

A high asset turnover ratio indicates that a company effectively utilizes its assets to generate revenue. It suggests operational efficiency and effective capital utilization. However, a very high asset turnover ratio may also imply aggressive pricing strategies or lower-profit margins. Comparing the ratio with industry peers is essential to gain meaningful insights.

2. Low Asset Turnover Ratio:

A low asset turnover ratio suggests that a company is less efficient in generating sales from its assets. It may indicate underutilized assets, excess inventory, or operational inefficiencies. To improve the ratio, a company may need to streamline operations, optimize inventory management, or explore opportunities to enhance asset utilization.

3. Industry Comparison:

Comparing a company’s asset turnover ratio with industry peers is crucial for meaningful analysis. Industries with different characteristics and business models may have varying asset turnover ratios. Comparing against industry benchmarks provides insights into a company’s competitive positioning and efficiency relative to industry norms.

4. Trends and Change Analysis:

Monitoring the asset turnover ratio over time helps identify trends and changes in a company’s operational efficiency. A declining ratio may signify deteriorating operational effectiveness, while an increasing ratio may indicate operational improvements. Analyzing the reasons behind these trends can guide strategic decision-making.

Limitations of the Asset Turnover Ratio

While the asset turnover ratio is a valuable metric, it has certain limitations that need to be considered:

1. Industry Differences:

Comparing asset turnover ratios across industries can be misleading due to variations in business models and asset requirements. It is crucial to consider industry-specific factors and use appropriate industry benchmarks for meaningful analysis.

2. Capital Intensity:

Companies with significant capital investments may have lower asset turnover ratios compared to those with lesser capital requirements. The ratio alone may not provide a complete picture of a company’s financial performance and efficiency without considering capital intensity.

3. Seasonal and Cyclical Variations:

Some industries experience seasonal or cyclical fluctuations that can impact the asset turnover ratio. For example, retail companies may have higher asset turnover ratios during peak shopping seasons. It is important to consider the timing and seasonality of a company’s operations when interpreting the ratio.

4. Different Accounting Policies:

Differences in accounting policies can affect the asset turnover ratio. For instance, companies using different depreciation methods or inventory valuation methods may report different asset values, influencing the ratio. Understanding the accounting policies of the companies being compared is crucial for accurate analysis.

The asset turnover ratio is a powerful financial metric that provides insights into a company’s operational efficiency and revenue generation capabilities. By assessing how effectively a company utilizes its assets to generate sales, this ratio assists investors, analysts, and stakeholders in evaluating a company’s financial health and performance. It is important to consider industry benchmarks, analyze trends, and be aware of the limitations of the ratio while making informed decisions based on this key financial indicator.

What is the Asset Turnover Ratio?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the asset turnover ratio?

The asset turnover ratio is a financial metric used to measure a company’s efficiency in generating sales revenue from its assets. It indicates how effectively a company utilizes its assets to generate sales.

How is the asset turnover ratio calculated?

The asset turnover ratio is calculated by dividing the net sales of a company by its average total assets. The formula can be expressed as: Asset Turnover Ratio = Net Sales / Average Total Assets.

What does a high asset turnover ratio indicate?

A high asset turnover ratio suggests that a company is effectively using its assets to generate sales revenue. It indicates that the company is efficient in managing and utilizing its assets to generate income.

What does a low asset turnover ratio indicate?

A low asset turnover ratio typically indicates that a company is not utilizing its assets efficiently to generate sales revenue. It may suggest that the company has excess or underutilized assets, leading to lower revenue generation.

How can a company improve its asset turnover ratio?

To improve the asset turnover ratio, a company can focus on optimizing its asset management and utilization. This can be achieved through strategies such as improving production efficiency, reducing excess inventory, and effectively utilizing fixed assets.

What are the limitations of the asset turnover ratio?

While the asset turnover ratio is a useful metric, it does have certain limitations. It does not provide a detailed analysis of profitability or the quality of assets. Additionally, it may vary significantly across industries, making comparisons between companies in different sectors challenging.

Can a company have too high of an asset turnover ratio?

While a high asset turnover ratio is generally desirable, an extremely high ratio may indicate potential issues. It could suggest that the company is relying heavily on short-term assets or taking excessive risks in generating sales. Further analysis is needed to understand the specific factors driving the high ratio.

How does the asset turnover ratio differ from the inventory turnover ratio?

The asset turnover ratio measures the overall efficiency of a company in generating sales from its total assets. On the other hand, the inventory turnover ratio specifically focuses on how well a company manages its inventory by measuring the number of times inventory is sold and replaced within a given period.

What other ratios can be used in conjunction with the asset turnover ratio?

The asset turnover ratio can be analyzed in conjunction with other financial ratios to gain deeper insights into a company’s performance. Some relevant ratios include return on assets (ROA), return on equity (ROE), and gross profit margin. These ratios provide a more comprehensive understanding of a company’s profitability and efficiency.

Final Thoughts

Understanding the concept of asset turnover ratio is essential for businesses to assess their efficiency in utilizing their assets to generate revenue. It is a measure of how effectively a company generates sales from its assets. By dividing net sales by average total assets, businesses can determine the efficiency of their asset utilization. A higher asset turnover ratio indicates better performance, as it implies that the company is generating more sales from its assets. Conversely, a lower ratio may indicate inefficiency and the need for improvements in asset management. Overall, comprehending and analyzing the asset turnover ratio can provide valuable insights into a company’s operational efficiency and help drive informed decision-making.