Curious about debt covenants? Look no further! Understanding the concept of debt covenants is essential for anyone involved in finance or business. These agreements, often included in loan contracts, provide guidelines and restrictions to ensure borrowers meet certain financial requirements. But don’t worry, deciphering the intricacies of debt covenants doesn’t have to be daunting. In this article, we’ll break down the fundamentals and shed light on how these provisions affect businesses and lenders alike. So, let’s dive in and explore the world of debt covenants together!

Understanding the Concept of Debt Covenants

Debt covenants are an essential part of financial agreements between lenders and borrowers. These covenants serve to protect the interests of the lender while providing guidelines for the borrower’s financial management. In this article, we will delve into the concept of debt covenants, exploring their types, significance, and common examples. By the end of this article, you will have a comprehensive understanding of how debt covenants function and their impact on borrowers.

Types of Debt Covenants

1. Positive Covenants

Positive covenants, often referred to as “affirmative covenants,” are conditions that require the borrower to fulfill certain actions or meet specific financial criteria. These obligations are designed to ensure that the borrower remains financially healthy and capable of repaying the debt. Some common examples of positive covenants include:

- Maintaining a certain level of working capital

- Meeting specific financial ratio requirements, such as debt-to-equity ratio or interest coverage ratio

- Providing regular financial statements and reports to the lender

- Paying taxes and other obligations on time

- Restricting the use of funds for specific purposes

Positive covenants are intended to provide reassurance to lenders that the borrower is acting responsibly and taking steps to ensure their ability to repay the debt.

2. Negative Covenants

Negative covenants, also known as “restrictive covenants,” impose limitations and restrictions on the borrower’s actions to protect the lender’s interests. These covenants aim to prevent the borrower from engaging in activities that could potentially jeopardize their ability to repay the debt. Some common examples of negative covenants include:

- Restricting the borrower from taking on additional debt without the lender’s consent

- Prohibiting the borrower from selling or disposing of significant assets without prior approval

- Limiting dividend payments or share repurchases

- Preventing the borrower from entering into certain types of contracts or agreements

- Restricting the borrower from merging or acquiring another company without the lender’s permission

Negative covenants serve as a safeguard for lenders, ensuring that the borrower’s actions do not compromise their ability to repay the debt.

3. Financial vs. Non-Financial Covenants

Debt covenants can be further categorized as either financial or non-financial covenants.

Financial covenants are related to the borrower’s financial performance and are typically measured using specific financial metrics, such as profitability, liquidity, or leverage ratios. These covenants help the lender assess the borrower’s financial stability and ability to meet their repayment obligations.

On the other hand, non-financial covenants focus on the borrower’s operational and managerial aspects, rather than financial metrics. These covenants may include requirements related to the borrower’s business strategy, management team, or regulatory compliance. Non-financial covenants help lenders evaluate the borrower’s overall business practices and ensure they are aligned with the risk tolerance of the lender.

The Significance of Debt Covenants

Debt covenants play a crucial role in mitigating risks for lenders and protecting their investments. Here are some key reasons why debt covenants are significant:

1. Risk Mitigation for Lenders

Lending money always involves a certain level of risk. Debt covenants provide lenders with contractual safeguards that help minimize their exposure to potential risks. By imposing limitations and requirements on borrowers, lenders can mitigate the risks associated with loan defaults, declining financial performance, or mismanagement of funds.

2. Improved Borrower Accountability

Debt covenants hold borrowers accountable for their financial and operational decisions. By setting specific criteria and obligations, lenders can ensure that borrowers maintain financial discipline, make sound business decisions, and manage their operations in a responsible manner. This accountability helps protect the lender’s investment and enhances the borrower’s commitment to meeting their financial obligations.

3. Enhanced Communication and Monitoring

Debt covenants require regular reporting and communication between borrowers and lenders. This ongoing dialogue allows lenders to monitor the borrower’s financial health, identify potential issues early on, and take appropriate actions to address them. By staying informed about the borrower’s performance, lenders can proactively manage risks and provide necessary support when needed.

4. Preserving the Lender’s Rights

Debt covenants often include clauses that give lenders certain rights in case of covenant breaches or defaults. These rights may include the ability to accelerate loan repayment, impose penalties or fees, or even exercise control over the borrower’s assets. By including these provisions, lenders can protect their interests and have recourse in situations where borrowers fail to meet their obligations.

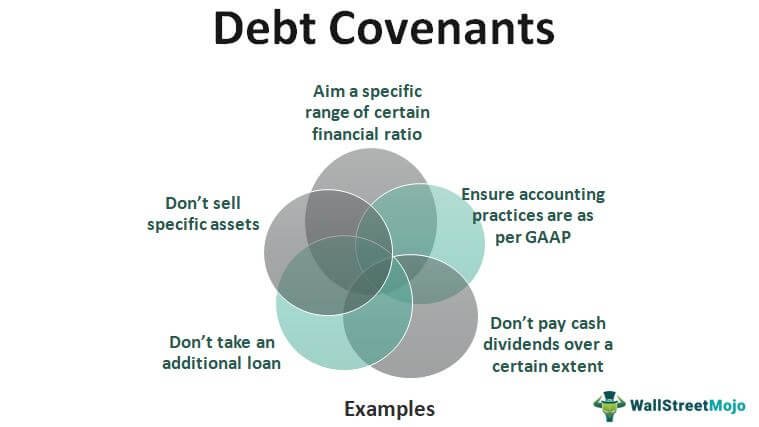

Examples of Debt Covenants

Debt covenants can vary depending on the nature of the loan, the industry, and the specific needs of the lender. Here are a few examples of common debt covenants:

1. Debt Service Coverage Ratio (DSCR)

The DSCR is a financial covenant that measures a borrower’s ability to cover their debt payments with their available cash flow. Lenders often require a minimum DSCR to ensure that borrowers can generate sufficient cash flow to meet their debt obligations. For example, a lender may require a DSCR of at least 1.2, meaning the borrower must have 1.2 times more cash flow than their debt payments.

2. Limitation on Additional Debt

To protect their investment, lenders may restrict borrowers from taking on additional debt without their consent. This covenant ensures that borrowers do not overextend their financial capacity, which could increase the risk of default.

3. Maintenance of Financial Ratios

Lenders may require borrowers to maintain specific financial ratios, such as leverage ratios or interest coverage ratios. These ratios provide insights into a borrower’s financial stability and liquidity. By setting minimum or maximum thresholds for these ratios, lenders can monitor the borrower’s financial health and take action if the ratios deviate significantly.

4. Asset Disposal Restrictions

Lenders may impose restrictions on the borrower’s ability to sell or dispose of significant assets without their approval. This prevents borrowers from selling key assets that could affect their ability to generate cash flow or repay the debt.

5. Limitations on Dividends and Share Repurchases

To protect their investment, lenders may limit the borrower’s ability to distribute dividends or repurchase shares. These limitations ensure that cash is retained within the business to support its financial health and debt repayment.

Debt covenants are an integral part of financial agreements, providing lenders with protections and borrowers with guidelines for financial management. Both positive and negative covenants play critical roles in mitigating risks and fostering accountability. By understanding the concept of debt covenants, borrowers can better navigate their financial obligations and lenders can safeguard their investments. It is essential for borrowers to thoroughly review and understand the covenants in their loan agreements, seeking professional advice if needed, to ensure compliance and maintain a healthy lender-borrower relationship.

Debt Covenants

Frequently Asked Questions

Understanding the Concept of Debt Covenants

Frequently Asked Questions (FAQs)

What are debt covenants?

Debt covenants are contractual agreements between a borrower and lender that outline specific terms and conditions the borrower must adhere to during the loan term.

Why are debt covenants important?

Debt covenants are important because they help protect the lender’s interests by reducing the borrower’s risk of default. They also provide a framework for measuring the borrower’s financial performance and ensure compliance with agreed-upon financial ratios.

What types of debt covenants exist?

There are two main types of debt covenants: affirmative covenants and negative covenants. Affirmative covenants require the borrower to fulfill certain actions, while negative covenants prohibit specific actions.

How do financial covenants work?

Financial covenants involve the borrower’s financial performance. They typically include metrics such as debt-to-equity ratio, interest coverage ratio, or minimum working capital requirements. The borrower must meet these criteria as specified in the loan agreement.

What happens if a borrower breaches a debt covenant?

If a borrower breaches a debt covenant, it can trigger consequences such as higher interest rates, penalties, or immediate repayment of the loan. The lender may also have the right to demand additional collateral or take legal action to recover the outstanding debt.

What role do debt covenants play in financial analysis?

Debt covenants provide valuable insights into a borrower’s financial health and stability. By monitoring compliance with these covenants, lenders and investors can assess the borrower’s ability to fulfill its obligations and make informed decisions about their investments.

Who sets the terms of debt covenants?

The terms of debt covenants are usually negotiated between the borrower and the lender during the loan agreement process. Sometimes, lenders may have standard covenant templates, while in other cases, they can be tailored to specific borrower needs.

Can debt covenants be modified or waived?

Yes, debt covenants can be modified or waived if both parties agree to the changes. This usually requires renegotiating the terms of the loan agreement and obtaining the lender’s consent to modify or waive specific covenants.

What are the risks of debt covenants for borrowers?

Debt covenants can pose risks for borrowers as they impose restrictions on their financial decisions and operations. Breaching a covenant can have severe consequences, including higher borrowing costs, loss of financial flexibility, and damage to the borrower’s creditworthiness. It’s crucial for borrowers to carefully assess and understand the covenants before agreeing to them.

Please note that the content provided here is a general guideline and does not constitute professional financial or legal advice. It is advisable to consult with a financial or legal expert for specific information related to your circumstances.

Final Thoughts

Understanding the concept of debt covenants is crucial for both lenders and borrowers. Debt covenants are contractual agreements that set certain conditions and restrictions on a borrower to ensure their ability to repay the debt. These covenants may include financial ratios, limits on additional borrowing, or requirements for providing financial statements. By complying with these covenants, borrowers can maintain a good relationship with lenders and secure future financing. Furthermore, lenders can assess the borrower’s creditworthiness and mitigate their risk. Overall, comprehending and adhering to debt covenants is essential for successful borrowing and lending relationships.