Imagine being able to retire early and have the freedom to pursue your passions while still enjoying financial security. Understanding the concept of early retirement might seem like a distant dream for many, but it is actually within reach with the right knowledge and strategies. So, how can you make this dream a reality? In this article, we will delve into the concept of early retirement, exploring the strategies and mindset shifts that can help you achieve financial independence and retire early. Whether you’re just starting your career or are already well into it, understanding the concept of early retirement is the first step towards designing a life of financial freedom and fulfillment. Let’s dive in!

Understanding the Concept of Early Retirement

Early retirement has become a popular topic in recent years as more individuals seek to achieve financial independence and enjoy their golden years at a younger age. This article will delve deep into the concept of early retirement, exploring its meaning, benefits, and strategies to attain it. Whether you dream of traveling the world, pursuing your passions, or simply spending more time with loved ones, understanding early retirement is the first step towards making it a reality.

What is Early Retirement?

Early retirement refers to the practice of leaving the workforce and enjoying the freedom of not having to work full-time before reaching the standard retirement age. It gives individuals the opportunity to retire in their 40s, 50s, or early 60s, rather than waiting until their late 60s or early 70s. Early retirement allows people to escape the traditional career trajectory and explore new possibilities in life.

The Benefits of Early Retirement

Early retirement offers a range of benefits that go beyond the obvious freedom from work. Here are some key advantages:

1. Financial Independence: Early retirement gives individuals the ability to achieve financial independence at a younger age. By diligently saving, investing, and managing their finances, early retirees can enjoy a comfortable lifestyle without relying on a regular paycheck.

2. Improved Health and Well-being: Leaving the workforce early can have a positive impact on overall health and well-being. It reduces work-related stress, allows for more time to focus on personal care, and provides opportunities for pursuing physical activities and hobbies that contribute to a healthier lifestyle.

3. More Time for Family and Relationships: Early retirement allows individuals to spend quality time with family and loved ones. It creates opportunities to strengthen relationships, create lasting memories, and be present for important milestones in the lives of family members.

4. Pursue Passions and Hobbies: With the added free time, early retirees can finally dedicate themselves to their passions and hobbies. Whether it’s writing a book, starting a business, or exploring new artistic endeavors, early retirement provides the space and time to pursue personal interests.

5. Flexibility and Travel: Early retirement enables individuals to have greater flexibility in their daily lives. They can plan trips without the constraints of limited vacation days and immerse themselves in different cultures, explore new destinations, and broaden their horizons.

Strategies to Achieve Early Retirement

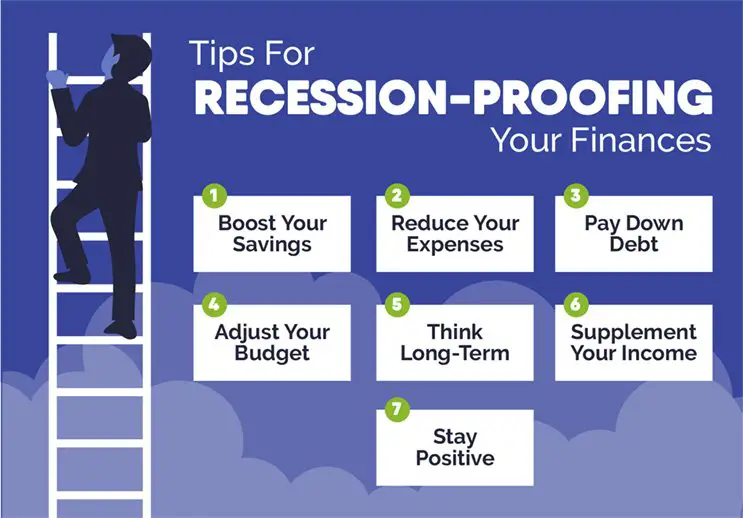

Achieving early retirement requires careful planning and disciplined financial habits. Here are some strategies to consider:

1. Save Aggressively: Saving a significant portion of your income is crucial for early retirement. Aim to save at least 50% of your income and invest it wisely. Consider maximizing contributions to retirement accounts like 401(k)s and IRAs to take advantage of tax benefits and employer matches.

2. Reduce Expenses: Minimizing expenses is essential to increase your savings rate. Analyze your spending habits and identify areas where you can cut back without sacrificing the quality of life. Consider downsizing your home, reducing transportation costs, and adopting a frugal lifestyle.

3. Invest Wisely: Once you’ve accumulated savings, invest your money wisely to generate passive income. Diversify your investments across stocks, bonds, real estate, and other assets based on your risk tolerance and long-term goals. Consulting with a financial advisor can help you develop a solid investment strategy.

4. Generate Passive Income: Building passive income streams can provide a stable financial foundation during early retirement. Rental properties, dividend-paying stocks, peer-to-peer lending, and online businesses are just a few examples of passive income sources that can contribute to your financial independence.

5. Continuously Educate Yourself: Financial literacy is crucial to successful early retirement. Stay informed about investment strategies, tax optimization, and personal finance by reading books, attending seminars, and following reputable financial blogs. Continuously educating yourself will empower you to make informed decisions and adapt to changing economic landscapes.

Pitfalls to Avoid

While the idea of early retirement is enticing, it’s important to be aware of potential pitfalls that can derail your plans. Avoid the following mistakes:

1. Underestimating Expenses: Many individuals fail to estimate their future expenses accurately. Consider healthcare costs, inflation, and potential emergencies when calculating your retirement needs. It’s better to overestimate expenses to ensure you have enough funds to sustain your lifestyle.

2. Neglecting Health Insurance: Health insurance is an essential aspect of retirement planning. Ensure you have a suitable health insurance plan to cover medical expenses during retirement. Explore options such as Medicare, Medicaid, or private insurance to find the best coverage for your needs.

3. Focusing Only on Money: Early retirement is not just about financial wealth; it’s about holistic well-being. Don’t neglect your physical and mental health, relationships, and personal growth. Prioritize a balanced approach to life and find fulfillment beyond financial freedom.

4. Not Having a Plan: A well-thought-out retirement plan is vital to achieve early retirement. Set clear goals, create a roadmap, and regularly track your progress towards financial independence. Be adaptable and make adjustments along the way to ensure you stay on track to reach your goals.

In conclusion, early retirement is a concept that offers individuals the freedom and flexibility to retire from full-time work at a younger age than traditional retirement norms. By understanding the meaning, benefits, and strategies associated with early retirement, individuals can embark on a journey towards financial independence and a fulfilling life. Incorporate the strategies, avoid the pitfalls, and stay committed to your goals to make early retirement a reality. Remember, early retirement is not an easy feat, but with dedication and perseverance, you can create a future where work becomes optional, and your dreams take center stage.

What No One Tells You About Early Retirement (The Truth)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the concept of early retirement?

Early retirement refers to the practice of leaving the workforce before the standard retirement age, usually in one’s 50s or even earlier. It allows individuals to enjoy more leisure time, pursue personal interests, or engage in new ventures while still maintaining financial stability.

How can I financially prepare for early retirement?

To financially prepare for early retirement, you should start by creating a comprehensive budget and identifying areas where you can save. It’s crucial to build an emergency fund, pay off debts, and make strategic investments for future income. Consulting a financial advisor can also help you develop a customized plan.

What are the main benefits of early retirement?

Early retirement offers several benefits, including the freedom to pursue personal passions, spend more time with loved ones, and maintain a healthier work-life balance. It also provides an opportunity to travel, engage in hobbies, and focus on self-development.

What are the potential challenges of early retirement?

While early retirement can be fulfilling, it may also present challenges. Some common obstacles include the need for careful financial planning, potential boredom or lack of purpose, and difficulties re-entering the workforce if necessary. It’s essential to consider these factors and prepare accordingly.

Is early retirement feasible for everyone?

Early retirement is not always feasible for everyone. It requires careful financial planning, disciplined saving habits, and a realistic assessment of one’s financial situation. Factors such as health, dependents, and lifestyle choices also play a crucial role in determining the feasibility of early retirement.

What role does investing play in early retirement?

Investing plays a vital role in early retirement by helping your money grow over time. It allows you to build a diversified portfolio that generates passive income, potentially supplementing your savings and providing financial security during retirement. Understanding investment strategies and seeking professional advice can maximize your chances of success.

How does early retirement impact social security benefits?

Early retirement can impact social security benefits, as claiming benefits before reaching full retirement age may result in reduced monthly payments. It is essential to understand the implications and consider this when making decisions about early retirement. Consulting with a social security specialist can provide valuable insights in this regard.

Are there any risks associated with early retirement?

Yes, there are risks associated with early retirement. These risks include outliving your savings, the potential for unexpected medical expenses, inflation, and market volatility. Creating a comprehensive retirement plan that factors in potential risks and uncertainties is crucial to mitigate these challenges.

Final Thoughts

Understanding the concept of early retirement is crucial for those who desire financial independence and freedom. By carefully planning and managing one’s finances, it becomes possible to retire earlier than the traditional retirement age. Early retirement entails making wise investment decisions, minimizing expenses, and increasing savings. It requires disciplined saving habits and a clear understanding of financial goals. Moreover, investing in assets that generate passive income can significantly contribute to achieving early retirement. By understanding the concept of early retirement and implementing the necessary strategies, individuals can pave their way towards a financially secure and fulfilling future.