Financial autonomy is a concept that many people aspire to understand and achieve. It involves taking control of your finances, making informed decisions, and ultimately gaining the freedom to live life on your own terms. But how can we truly grasp the concept of financial autonomy? The answer lies in developing a deep understanding of our financial situation, setting clear goals, and taking proactive steps towards financial independence. In this article, we will delve into the intricacies of financial autonomy, exploring the key principles and strategies needed to attain this level of financial empowerment. So, let’s embark on this enlightening journey of understanding the concept of financial autonomy.

Understanding the Concept of Financial Autonomy

Financial autonomy refers to the ability to have control over one’s finances, making independent decisions to achieve financial goals and secure a stable future. It encompasses various aspects, including managing income, budgeting, saving, investing, and avoiding debt. Being financially autonomous means being self-reliant and capable of making informed choices regarding personal finance.

The Importance of Financial Autonomy

Financial autonomy is crucial for individuals and families as it provides numerous benefits and opportunities. Let’s explore some of the key reasons why understanding and achieving financial autonomy is essential:

- Reduced Stress and Anxiety: When you have control over your finances, you experience less stress and anxiety about money matters. Financial autonomy allows you to make decisions based on your priorities and goals, ensuring peace of mind.

- Greater Freedom and Flexibility: With financial autonomy, you have the freedom to choose your career path, pursue entrepreneurial endeavors, take sabbaticals, or retire early. It provides the flexibility to make choices that align with your values and aspirations.

- Improved Overall Well-being: Achieving financial autonomy contributes to improved overall well-being. It allows you to take care of your physical and mental health, invest in personal growth, and spend quality time with loved ones without financial constraints.

- Increased Opportunities for Generational Wealth: Financial autonomy enables you to build generational wealth by making strategic financial decisions. It provides the opportunity to leave a lasting legacy for future generations.

- Protection Against Unexpected Events: Being financially autonomous helps create a safety net to deal with unexpected events like medical emergencies, job loss, or economic downturns. It provides a sense of security and reduces vulnerability.

Building Financial Autonomy

Building financial autonomy requires a combination of knowledge, discipline, and proactive decision-making. Let’s delve into some key strategies and practices that can help individuals achieve financial autonomy:

1. Budgeting and Expense Management

A budget is a fundamental tool for managing personal finances effectively. It involves tracking income and expenses, allocating funds for different categories, and ensuring that spending aligns with financial goals. Here are some tips for effective budgeting:

- Track your income and expenses: Maintain a record of all sources of income and expenses to gain a clear understanding of your financial inflows and outflows.

- Identify needs vs. wants: Distinguish between essential expenses and discretionary spending. Prioritize needs and allocate funds accordingly.

- Set realistic financial goals: Define short-term and long-term financial goals, such as saving for retirement, buying a home, or starting a business. Your budget can help you allocate funds towards achieving these goals.

- Review and adjust regularly: Regularly review your budget to ensure it reflects your current financial situation. Adjust as necessary to accommodate changes in income or expenses.

2. Saving and Emergency Fund

Saving is a crucial component of financial autonomy. It allows you to build a safety net and prepare for future expenses. Here are some strategies for effective saving:

- Pay yourself first: Allocate a portion of your income towards savings before considering other expenses. Treat savings as a non-negotiable expense.

- Automate savings: Set up automatic transfers from your checking account to a dedicated savings account. This ensures consistency and eliminates the temptation to spend the money elsewhere.

- Create an emergency fund: Build an emergency fund that covers three to six months’ worth of living expenses. This fund provides a buffer during unexpected situations, such as job loss or medical emergencies.

- Explore different savings options: Consider various savings vehicles, such as high-yield savings accounts, certificates of deposit (CDs), or investment accounts, to maximize returns on your savings.

3. Debt Management

Debt can hinder financial autonomy, but with proper management, it can be overcome. Here are some strategies for effective debt management:

- Understand your debts: Identify and understand the different types of debts you have, including credit cards, student loans, mortgages, or car loans.

- Create a repayment plan: Prioritize your debts based on interest rates and outstanding balances. Develop a plan to pay off high-interest debts first while making minimum payments on others.

- Consider debt consolidation: If you have multiple high-interest debts, explore options for consolidating them into a single loan with a lower interest rate. This can simplify repayment and potentially save money.

- Seek professional help if needed: If you find it challenging to manage your debt on your own, consider seeking guidance from a financial advisor or credit counseling service.

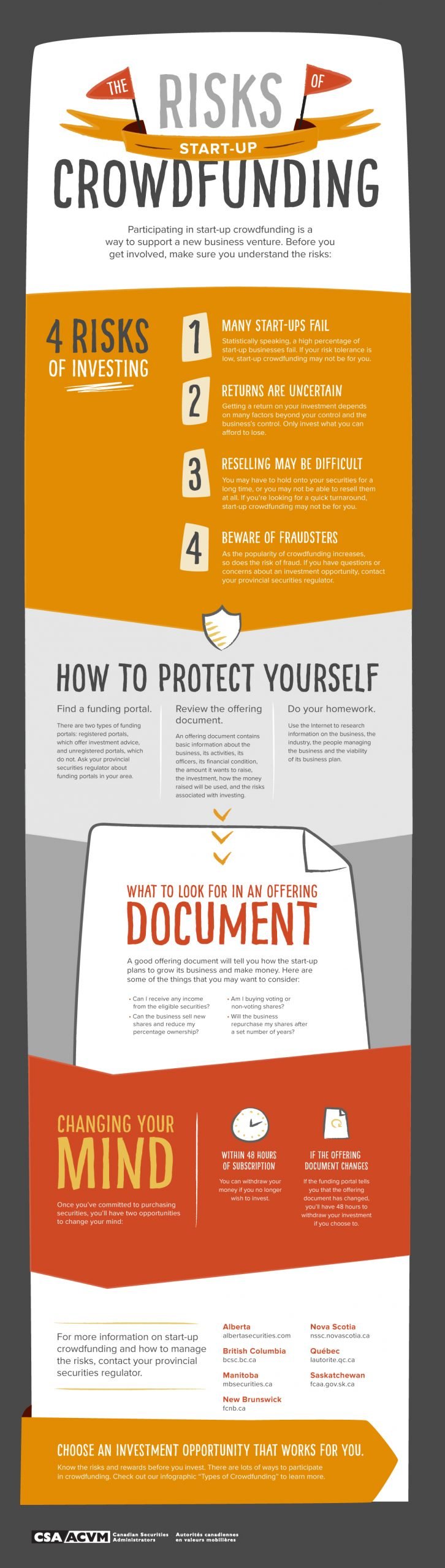

4. Investment and Wealth Building

Investing is an essential component of building long-term wealth and achieving financial autonomy. Here are some considerations for effective investing:

- Define your investment goals: Determine your investment objectives, such as funding retirement, saving for education expenses, or achieving a specific financial milestone.

- Understand risk tolerance: Assess your risk tolerance to determine the appropriate investment strategy. Consult with a financial advisor if needed.

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk. Consider a mix of stocks, bonds, real estate, and other investment options.

- Stay informed and review regularly: Stay updated on market trends and review your investment portfolio regularly. Make adjustments as necessary based on your evolving goals and market conditions.

Cultivating Financial Autonomy Mindset

In addition to the practical strategies mentioned above, cultivating a financial autonomy mindset is essential. Here are some key mindset shifts that can help individuals on their journey towards financial autonomy:

1. Take Ownership of Your Finances

Acknowledge that you are in control of your financial well-being. Take responsibility for your financial decisions and actions. Avoid relying solely on others for financial advice and actively educate yourself about personal finance.

2. Value Financial Education

Invest in your financial education by reading books, attending seminars, or taking online courses. The more you learn about personal finance, the better equipped you’ll be to make informed decisions and navigate the complexities of the financial world.

3. Embrace Delayed Gratification

Practice delayed gratification by avoiding impulsive spending and prioritizing long-term goals over short-term pleasures. Understand that financial autonomy requires discipline and the willingness to make sacrifices in the present for a better future.

4. Seek Continuous Improvement

Embrace a growth mindset and continuously seek ways to improve your financial situation. Stay curious, learn from your mistakes, and adapt your strategies as needed. Financial autonomy is a journey, and there will always be room for growth and refinement.

Financial autonomy is not just about earning a high income; it’s about understanding and taking control of your personal finances. By implementing effective budgeting, saving, debt management, and investment strategies, you can gradually achieve financial autonomy and enjoy the associated benefits. Cultivating the right mindset and continuously working on improving your financial knowledge are equally important. Start your journey towards financial autonomy today and pave the way for a secure and prosperous future.

FINANCIAL AUTONOMY INTRODUCTORY VIDEO

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is financial autonomy?

Financial autonomy refers to the ability to manage one’s finances independently, without relying on others for financial support or assistance.

Why is understanding the concept of financial autonomy important?

Understanding the concept of financial autonomy is important as it allows individuals to take control of their financial decisions, achieve financial stability, and work towards their long-term financial goals.

How can I achieve financial autonomy?

Achieving financial autonomy requires a combination of financial literacy, discipline, and proactive financial planning. It involves developing a budget, saving for emergencies, reducing debt, and investing wisely.

What are the benefits of attaining financial autonomy?

Attaining financial autonomy offers several benefits, including financial security, the freedom to make choices that align with one’s values and goals, reduced stress related to money matters, and the ability to plan for a comfortable retirement.

What are some common barriers to achieving financial autonomy?

Common barriers to achieving financial autonomy include lack of financial education, excessive debt, low income, impulsive spending habits, and a lack of long-term financial planning.

How can I improve my financial literacy?

Improving financial literacy involves actively seeking knowledge about personal finance, reading books and articles on the subject, attending financial workshops or courses, and seeking advice from financial professionals.

What are some practical steps to become financially autonomous?

Practical steps to become financially autonomous include setting financial goals, creating a budget and tracking expenses, saving a portion of your income regularly, paying off debts, diversifying income sources, and investing for the future.

Is financial autonomy achievable for everyone?

Yes, achieving financial autonomy is possible for everyone, regardless of their current financial situation. It may require time, effort, and discipline, but with the right mindset and financial strategies, anyone can work towards attaining financial autonomy.

Final Thoughts

Financial autonomy is a crucial aspect of personal and professional growth. It empowers individuals to take charge of their financial well-being and make informed decisions. By understanding the concept of financial autonomy, people can actively manage their income, expenses, and investments. This understanding allows them to set financial goals, create budgets, and save for the future. Financial autonomy also provides individuals with the freedom to pursue their passions, take calculated risks, and secure their financial stability. By embracing financial autonomy, individuals can live a life of financial independence and peace of mind.