Are you curious about understanding the concept of lifetime income? Wondering how you can ensure financial stability throughout your life? Look no further! In this article, we will delve into the intriguing concept of lifetime income and provide you with the tools and knowledge to grasp its significance. We’ll explore the various ways to generate a reliable stream of income that will support you throughout your lifetime. So, let’s get started on this enlightening journey to understanding the concept of lifetime income and how it can shape your financial future.

Understanding the Concept of Lifetime Income

What is Lifetime Income?

When it comes to financial planning, one of the most important considerations is ensuring a steady stream of income that can support you throughout your lifetime. Lifetime income refers to the income you receive from various sources, such as pensions, annuities, investments, and Social Security, that continues to provide for your needs even after you retire.

While many people rely on regular paychecks during their working years, the transition into retirement can often bring uncertainty and new financial challenges. The concept of lifetime income aims to address this by providing a stable and predictable source of income for the remainder of your life.

The Importance of Planning for Lifetime Income

Planning for lifetime income is crucial because it ensures that you have a steady financial foundation throughout your retirement years. Here are some reasons why understanding and prioritizing lifetime income is essential:

1. **Lifestyle Maintenance**: Lifetime income allows you to maintain your desired lifestyle, cover living expenses, and enjoy retirement without worrying about financial constraints.

2. **Inflation Protection**: As the cost of living increases over time due to inflation, lifetime income sources with inflation-adjusted payouts help protect your purchasing power.

3. **Longevity Risk Mitigation**: With advancements in healthcare and increased life expectancy, ensuring a lifetime income becomes even more critical. Lifetime income provides a safety net against the risk of outliving your savings.

4. **Peace of Mind**: Having a consistent income stream throughout retirement offers peace of mind, reducing financial stress and allowing you to focus on other aspects of your life and well-being.

Types of Lifetime Income Sources

Understanding the different sources of lifetime income can help you develop a comprehensive financial plan. Here are some common types of lifetime income sources to consider:

Social Security

Social Security is a government program that provides retirement benefits to eligible individuals. The amount you receive is based on your earnings history and the age at which you choose to start receiving benefits. Social Security benefits continue for your entire life, ensuring a basic level of income.

Pensions

Pensions are retirement plans typically offered by employers to provide their employees with a consistent income stream during retirement. These plans often offer monthly payments based on factors like years of service and average salary. Pensions can be an essential source of lifetime income, especially for those in the public sector or certain industries.

Annuities

Annuities are financial products offered by insurance companies that provide guaranteed income for a set period or for life. They can be purchased with a lump sum payment or through regular contributions. Annuities offer the advantage of predictable income, and certain types, like longevity annuities, address the risk of outliving your savings.

Retirement Accounts

Retirement accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), can also contribute to lifetime income. By strategically managing your withdrawals and investing in income-focused assets, you can create a reliable income stream during retirement. Options like systematic withdrawals and required minimum distributions (RMDs) help ensure you don’t exhaust your savings too quickly.

Factors to Consider in Planning for Lifetime Income

Creating a plan for lifetime income involves careful consideration of various factors to ensure your needs are met. Here are some key factors to keep in mind:

Expense Assessment

Understanding your anticipated expenses in retirement is crucial for calculating how much lifetime income is necessary. Consider factors such as housing, healthcare, leisure activities, and any outstanding debts. By estimating your expenses, you can determine how much income you need to cover your lifestyle.

Longevity Projections

Estimating your life expectancy can help determine how long your lifetime income needs to last. Consider your family history, current health, and lifestyle choices. While it’s impossible to predict precisely how long you’ll live, estimating a reasonable lifespan can guide you in planning for a sufficient income duration.

Inflation Protection

Given the impact of inflation on purchasing power over time, it’s important to consider income sources that adjust for inflation. Social Security benefits and certain annuity products often offer inflation protection, ensuring your income keeps pace with rising costs.

Investment Strategy

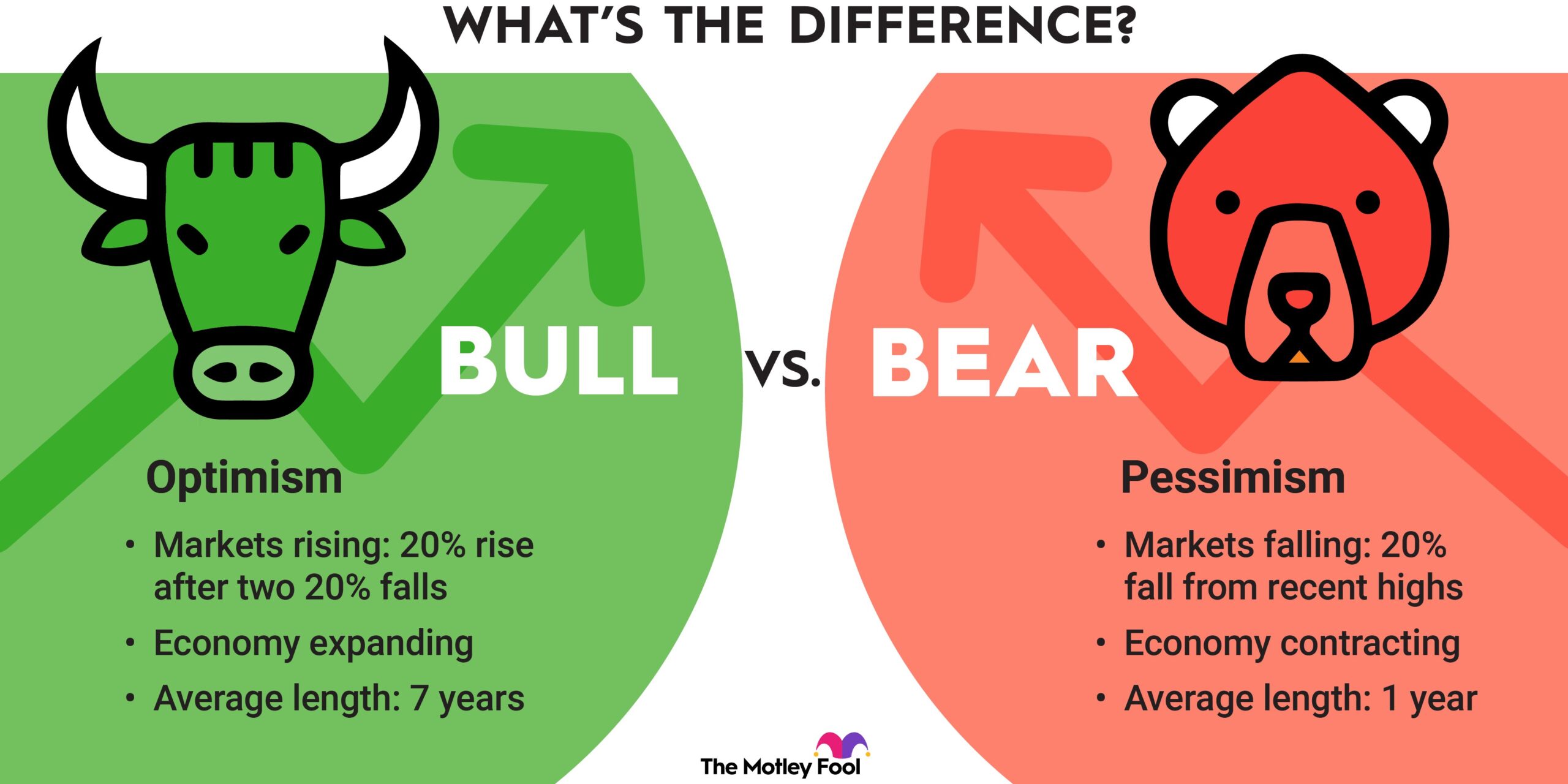

Investments play a significant role in generating lifetime income. Balancing risk and return becomes crucial when selecting income-focused assets for your retirement portfolio. Consulting with a financial advisor can help you develop a suitable investment strategy that aligns with your risk tolerance and income goals.

Strategies for Maximizing Lifetime Income

Now that we have explored the concept of lifetime income and its significance, let’s consider some strategies to maximize your lifetime income potential:

Delaying Social Security Benefits

Delaying your Social Security benefits beyond the eligible age can result in increased monthly payments. By waiting to claim benefits, you can receive a higher payout for the rest of your life. This strategy can be advantageous if you are in good health and have alternative income sources during the waiting period.

Consider Longevity Annuities

Longevity annuities, also known as deferred income annuities, provide guaranteed income starting at a future date. By purchasing a longevity annuity early in retirement, you can secure additional income for later years when other sources might decline. This strategy helps address longevity risk and ensures a steady stream of income when you may need it most.

Portfolio Diversification

Diversifying your investment portfolio can help mitigate risk and increase the potential for higher returns. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can create a well-rounded portfolio that generates income from various sources. A diversified portfolio helps balance risk and can provide stable income throughout retirement.

Professional Financial Guidance

Seeking guidance from a financial advisor who specializes in retirement planning can be invaluable. A professional advisor can help assess your financial situation, understand your goals, and recommend suitable strategies to maximize your lifetime income. They can also provide ongoing support and adjustments as your circumstances evolve.

Understanding the concept of lifetime income is essential for a secure and stress-free retirement. By comprehending the different income sources available, considering factors like expenses and longevity, and implementing strategies to optimize your income, you can ensure a financially comfortable life throughout retirement. Remember, planning early and seeking professional guidance can significantly enhance your lifetime income potential. Start planning today to secure a financially stable and fulfilling retirement.

How Does a Lifetime Income Annuity Work?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the concept of lifetime income?

The concept of lifetime income refers to receiving a regular stream of income for the duration of an individual’s life. It is designed to provide financial security and support throughout retirement, ensuring a steady source of funds to cover living expenses.

How does lifetime income differ from traditional retirement savings?

Unlike traditional retirement savings, which may be depleted over time, lifetime income solutions aim to guarantee a continuous income stream throughout retirement. This allows individuals to have a predictable and stable source of income, even if they live longer than expected.

What are the benefits of understanding the concept of lifetime income?

Understanding the concept of lifetime income can bring several benefits. It allows individuals to plan for their retirement with confidence, ensuring they have enough funds to cover expenses throughout their lifetime. It also helps in making informed financial decisions and provides peace of mind, knowing that one’s financial needs are taken care of.

Are there different types of lifetime income solutions available?

Yes, various lifetime income solutions are available, such as annuities, pension plans, and Social Security. Each type offers different features and benefits, and individuals can choose the one that best aligns with their financial goals and retirement needs.

What factors should be considered when selecting a lifetime income solution?

When selecting a lifetime income solution, it is crucial to consider factors such as the financial stability of the provider, the level of income guaranteed, flexibility in accessing funds, potential for growth or inflation protection, and any associated fees or expenses. Assessing these factors can help individuals choose the most suitable option.

Can lifetime income solutions be customized to individual needs?

Yes, lifetime income solutions can often be customized to individual needs. Providers may offer options to select the desired payment frequency, determine beneficiaries, add features like cost-of-living adjustments, or incorporate additional guarantees. Consulting with a financial advisor can help in tailoring the solution to meet specific requirements.

Is lifetime income only meant for retirees?

While lifetime income solutions are commonly associated with retirement, they can also be considered by individuals who want to secure a guaranteed income stream for their future. These solutions can be utilized as part of a comprehensive financial plan for individuals at different life stages.

Can I access a lump sum from my lifetime income solution if needed?

Depending on the terms and conditions of the specific lifetime income solution, some may allow individuals to access a lump sum if needed. However, it is important to understand that withdrawing a lump sum may impact the guaranteed income stream and should be carefully evaluated before making any decisions.

Final Thoughts

Understanding the concept of lifetime income is essential for financial planning. Lifetime income refers to a steady stream of income that lasts throughout one’s lifetime, ensuring financial stability and security. This concept enables individuals to plan for retirement, cover essential expenses, and maintain their desired lifestyle. By comprehending the importance of lifetime income, individuals can make informed decisions about savings, investments, and retirement plans. They can strategize and allocate resources to generate a reliable income source that will sustain them throughout their life. Understanding the concept of lifetime income is crucial for long-term financial well-being and peace of mind.