Do you find yourself confused when it comes to understanding the difference between APR and APY? Well, fret not! In this article, we will shed light on this commonly misunderstood topic, presenting a clear and concise explanation to help you grasp these financial terms with ease. Whether you’re a seasoned investor or just starting to dabble in the world of finance, understanding the difference between APR and APY is crucial to making informed decisions about your money. So, let’s dive right in and demystify these terms once and for all.

Understanding the Difference Between APR and APY

When it comes to managing your finances, understanding the various terms and concepts is essential. Two commonly used terms in the realm of banking and loans are APR and APY. While they may seem similar, they actually represent different aspects of interest rates. In this article, we will delve into the differences between APR and APY, explore their significance, and help you grasp their importance in making informed financial decisions.

What is APR?

APR stands for Annual Percentage Rate. It is a measure of the cost of borrowing money, typically expressed as a yearly interest rate. APR includes both the interest rate and any additional fees or costs associated with a loan. This gives borrowers a better understanding of the true cost of borrowing.

When you see an APR, it represents the cost you will pay over the course of a year for borrowing money. It covers not only the interest charges but also any upfront fees or other costs involved in obtaining the loan. Lenders are required to disclose the APR to borrowers for transparency and to facilitate comparison between different loan options.

How is APR Calculated?

Calculating APR can be a bit complex. To determine the APR, lenders consider the interest rate and any additional costs associated with the loan. These costs can include origination fees, application fees, closing costs, and other charges. The lender combines the interest and fees, spreads them over the loan term, and calculates the APR.

It’s important to note that APR does not take compounding into account. In other words, it assumes that the interest does not compound over time. APR is a useful tool for comparing loans or credit cards, as it allows you to make an apples-to-apples comparison of the overall costs.

What is APY?

APY stands for Annual Percentage Yield. While APR focuses on the cost of borrowing, APY relates to the return on investment for deposit accounts such as savings accounts or certificates of deposit (CDs). APY takes into consideration both the interest rate and the compounding frequency to give a more accurate representation of the earnings potential.

Unlike APR, which is relevant for loans and credit cards, APY is important for individuals who want to earn interest on their savings or investments. APY helps you understand the total amount of interest you can earn over a year, factoring in compounding.

How is APY Calculated?

To calculate APY, you need to consider the interest rate and the compounding frequency. Compounding refers to the process of adding the interest earned to the initial principal, allowing it to earn more interest over time.

The formula for calculating APY is:

APY = (1 + (r / n))^n – 1

Where:

– r is the interest rate

– n is the number of compounding periods per year

For example, if you have a savings account with an interest rate of 5% that compounds annually, the APY would be:

APY = (1 + (0.05 / 1))^1 – 1 = 0.05 or 5%

If the same account compounds quarterly, the APY would be:

APY = (1 + (0.05 / 4))^4 – 1 = 0.050945 or 5.0945%

As you can see, the APY is higher when the compounding frequency is more frequent, allowing your money to grow faster.

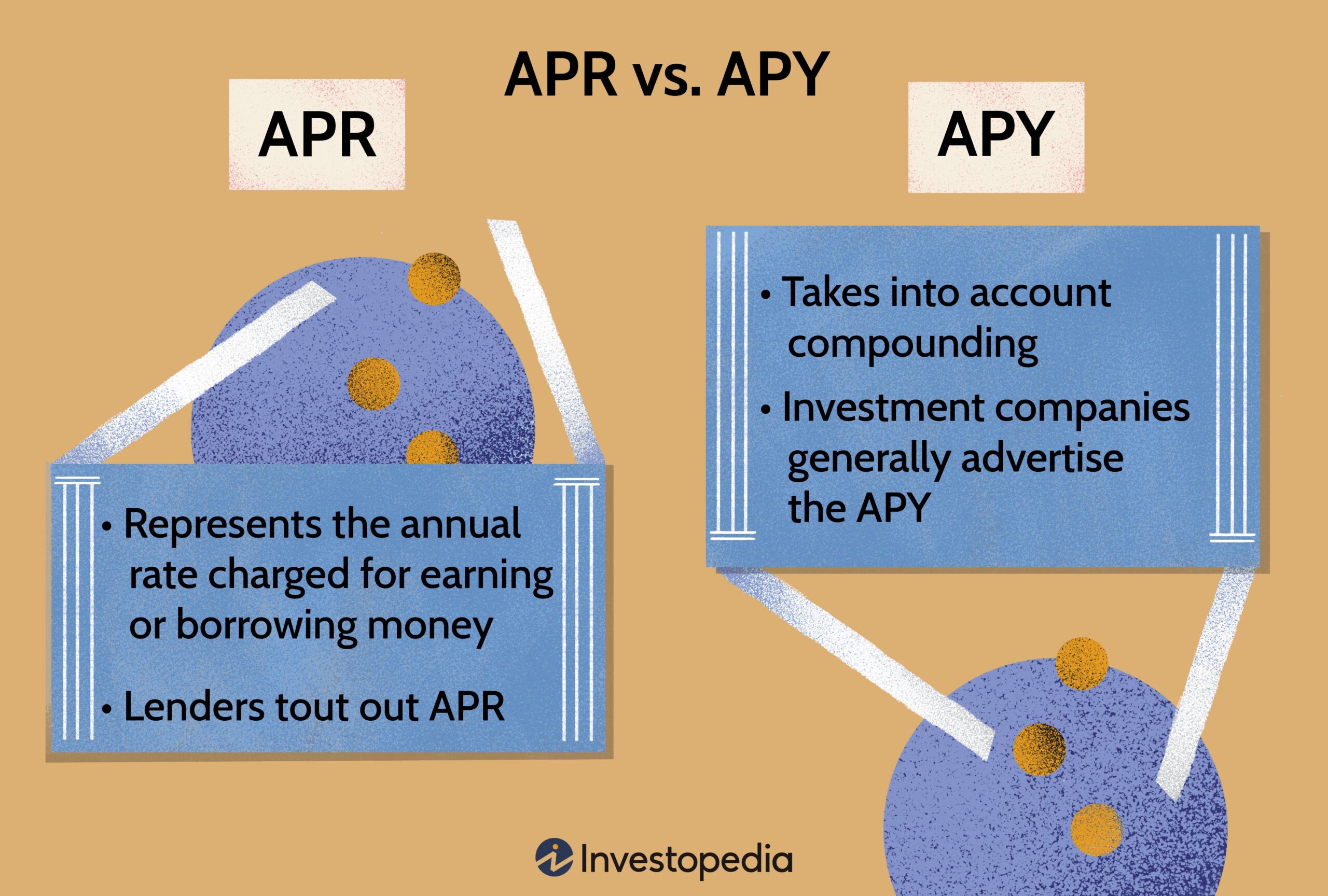

The Key Differences Between APR and APY

Now that we understand what APR and APY stand for, let’s take a closer look at their differences:

1. Purpose: APR is used to determine the cost of borrowing money, while APY is used to calculate the earnings on savings or investments.

2. Calculation Factors: APR considers the interest rate and any associated fees, while APY factors in the interest rate and the compounding frequency.

3. Application: APR is relevant for loans, credit cards, and other forms of borrowing, while APY is applicable to savings accounts, CDs, and investments.

4. Comparability: APR allows for easy comparison between different loan options, ensuring transparency for borrowers. APY helps savers compare the earnings potential of different deposit accounts.

5. Timeframe: Both APR and APY are expressed as annual rates, allowing for consistent comparison over time.

Understanding the Significance

Now that we have explored the differences between APR and APY, let’s understand their significance in practical terms:

1. Informed Borrowing: APR helps you assess the true cost of borrowing by considering both the interest rate and associated fees. When comparing loan options, focusing on APR ensures you choose the most cost-effective option.

2. Accurate Savings Planning: APY enables you to estimate the growth of your savings or investments by considering both the interest rate and compounding frequency. It helps you make informed decisions about where to keep your money to maximize your earnings.

3. Financial Decision Making: Understanding the differences between APR and APY allows you to evaluate the impact of both borrowing and saving options on your overall financial situation. It empowers you to make sound decisions that align with your goals.

4. Transparency and Fairness: The disclosure of APR and APY by lenders and financial institutions ensures transparency and allows consumers to make informed choices. It promotes fair competition and protects borrowers and savers from hidden costs or misleading information.

In summary, APR and APY are vital concepts to understand when managing your finances. APR reveals the true cost of borrowing, including fees, while APY helps you gauge the potential earnings on savings or investments, considering compounding. By grasping the significance of both, you can make informed decisions that align with your financial goals and navigate the world of loans, credit cards, and deposit accounts with confidence. Always remember to compare loan and savings options using these metrics to ensure you are getting the best deal possible.

What’s the Difference Between APR and APY? | Credit Intel by American Express

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the difference between APR and APY?

The Annual Percentage Rate (APR) and Annual Percentage Yield (APY) are both used to calculate the cost of borrowing or investing money, but they differ in how they account for compound interest.

How is APR calculated?

APR is calculated by taking into account the nominal interest rate and any additional fees or costs associated with the loan or credit product. It represents the yearly cost of borrowing expressed as a percentage.

How is APY calculated?

APY takes into consideration compound interest, which means it considers the effect of earning interest on previously earned interest. APY is calculated by compounding the interest rate over a specific period, often annually.

Which is more important, APR or APY?

The importance of APR or APY depends on your financial goals. If you are borrowing money, APR is more relevant as it helps you understand the true cost of the loan. On the other hand, if you are investing or saving, APY is more important as it reflects the actual growth of your money over time.

Can APR and APY be the same?

No, APR and APY cannot be the same. APR does not account for compound interest, while APY does. Therefore, APY will always be higher than or equal to the APR for a given interest rate.

Are APR and APY always mentioned for financial products?

Yes, financial institutions are legally required to disclose both APR and APY for loans, credit cards, mortgages, and other interest-earning or interest-charging products. This ensures transparency and helps consumers make informed decisions.

When is it appropriate to focus on APR?

APR is particularly useful when comparing different loan or credit options. It allows you to determine which option is more affordable by considering the interest rate and any associated fees or charges.

When is it appropriate to focus on APY?

APY is most relevant when comparing different investment or savings options. It helps you understand which option will provide the highest return on your investment by factoring in compound interest.

Can APR and APY change over time?

Yes, the APR and APY can change for certain financial products, such as adjustable-rate mortgages or variable-interest savings accounts. It is important to regularly review the terms and conditions to stay informed about any changes that may affect the cost or return on your investment.

Final Thoughts

Understanding the difference between APR and APY is crucial when it comes to managing your finances effectively. APR, or annual percentage rate, represents the cost of borrowing money or the interest you pay on loans, while APY, or annual percentage yield, is the total return on an investment including compound interest. APR helps you compare loan offers, while APY helps you evaluate investment options. By distinguishing between the two, you can make informed decisions about loans and investments, ensuring you maximize your financial growth. Understanding APR and APY empowers you to navigate the intricacies of personal finance confidently.