Are you curious about understanding the dynamics of stock buybacks? If so, you’re in the right place. Stock buybacks play a crucial role in the financial world, affecting companies, shareholders, and the overall market. In this article, we’ll delve into the intricacies of stock buybacks, exploring their purpose, mechanics, and implications. Whether you’re an investor looking to grasp this concept or simply interested in the inner workings of the stock market, this article will provide you with valuable insights. So, let’s dive right in and explore the fascinating world of stock buybacks.

Understanding the Dynamics of Stock Buybacks

Stock buybacks, also known as share repurchases, have become increasingly common in the world of finance. Companies use this strategy to buy back their own shares from the market, reducing the number of outstanding shares available to investors. Understanding the dynamics of stock buybacks is essential for investors and financial enthusiasts alike. In this article, we will delve into the intricacies of stock buybacks, explore the reasons behind their popularity, and examine their impact on the stock market and shareholders.

What is a Stock Buyback?

A stock buyback occurs when a company repurchases its own shares from the stock market. Instead of investing in new projects, paying dividends, or holding excess cash, a company decides to use its available funds to buy back its outstanding shares. The repurchased shares are then retired or held as treasury stock, reducing the total number of shares available in the market.

Stock buybacks can be carried out in various ways, including open market purchases, tender offers, or negotiated transactions. Open market purchases involve buying shares on the open stock market, similar to how individual investors purchase shares. Tender offers, on the other hand, involve the company making an offer to its shareholders to repurchase a specific number of shares at a predetermined price. Negotiated transactions occur when a company directly negotiates with a specific shareholder or group of shareholders to repurchase their shares.

Motives for Stock Buybacks

There are several reasons why a company may choose to engage in a stock buyback:

- Enhancing Shareholder Value: By reducing the number of outstanding shares, companies can increase their earnings per share (EPS) and potentially boost their stock price. This benefits existing shareholders as their ownership stake becomes more valuable.

- Capital Allocation: If a company believes its stock is undervalued, it may choose to allocate excess capital towards buying back shares instead of investing in new projects or acquisitions.

- Tax Efficiency: Shareholders can benefit from stock buybacks as they often provide a more tax-efficient way of distributing company profits compared to dividends.

- Executive Compensation: Stock buybacks can also indirectly benefit executives by increasing the value of their stock-based compensation packages.

It’s important to note that stock buybacks are not always driven by positive motives. Some companies may engage in buybacks to manipulate their stock prices or artificially inflate their earnings per share. Such practices can be detrimental to long-term shareholders and can lead to negative consequences.

The Impact of Stock Buybacks

The dynamics of stock buybacks can have several implications for both the stock market and shareholders. Let’s explore some of the key impacts:

1. Stock Price and Earnings per Share (EPS) Impact

Stock buybacks can potentially drive up a company’s stock price by reducing the number of outstanding shares. As the earnings per share (EPS) are divided by a smaller share count, the ratio tends to increase. This can create a positive perception among investors, leading to an increase in demand for the stock and, subsequently, a higher stock price.

2. Shareholder Value

Stock buybacks can benefit existing shareholders by increasing their ownership stake in the company. As the number of outstanding shares decreases, shareholders’ portion of the company’s earnings and assets becomes relatively larger, potentially enhancing overall shareholder value.

3. Financial Ratios

Stock buybacks can impact various financial ratios used to assess a company’s financial health. For example:

- Earnings per Share (EPS): As mentioned earlier, stock buybacks can increase EPS, making the company appear more profitable.

- Return on Investment (ROI) and Return on Equity (ROE): Since buybacks reduce the equity portion of the balance sheet, ROI and ROE may appear higher than they would have been without the buyback.

- Debt-to-Equity Ratio: Stock buybacks can increase a company’s debt-to-equity ratio as the equity portion decreases.

4. Shareholder Dilution

While stock buybacks can enhance shareholder value for existing shareholders, they can also lead to shareholder dilution. Companies may issue new shares in the future, offsetting the impact of the buyback and diluting the ownership stake of existing shareholders.

5. Market Perception

Stock buybacks can influence investor sentiment and market perception of a company. If investors interpret buybacks as a positive signal, it can foster confidence in the company’s future prospects and lead to increased demand for its shares. However, if investors view buybacks as a way to manipulate stock prices, it can erode trust and negatively impact the company’s reputation.

6. Opportunity Cost

By allocating funds towards stock buybacks, companies forego opportunities to invest in research and development, new projects, acquisitions, or paying dividends. Investors should consider the potential opportunity cost of buybacks and evaluate whether the returns from buybacks outweigh the benefits of alternative investments.

Regulations and Limitations on Stock Buybacks

Stock buybacks are subject to regulations and limitations imposed by regulatory bodies, such as the Securities and Exchange Commission (SEC), to protect investors and maintain market integrity. Some of the key regulations and limitations include:

- Insider Trading Restrictions: Companies and their executives are prohibited from conducting stock buybacks while in possession of material non-public information that could influence the stock price.

- Disclosure Requirements: Companies engaging in stock buybacks must disclose relevant information, such as the method of repurchase, timing, and amount of shares repurchased, in their financial reports.

- Timing Restrictions: Companies may face restrictions on the timing of stock buybacks, preventing them from engaging in buybacks during certain periods, such as blackout periods around earnings announcements.

The Debate Around Stock Buybacks

Stock buybacks have been a subject of debate and criticism in recent years. While proponents argue that buybacks enhance shareholder value and provide a tax-efficient way of distributing profits, opponents raise concerns about income inequality, short-termism, and manipulation of stock prices. Some key arguments in the debate include:

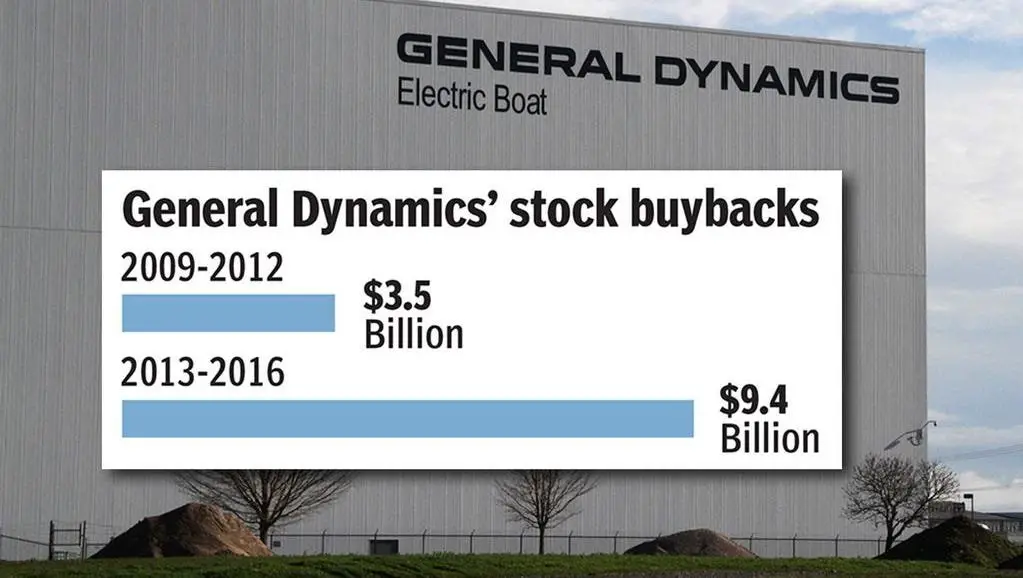

- Income Inequality: Critics argue that stock buybacks primarily benefit wealthy shareholders and executives, exacerbating income inequality.

- Short-term Focus: Detractors claim that buybacks encourage a short-term focus on maximizing shareholder value at the expense of long-term investments in research, development, and innovation.

- Market Manipulation: Critics raise concerns about companies using buybacks to manipulate stock prices, artificially inflating earnings per share or boosting executive compensation.

- Capital Misallocation: Opponents argue that funds used for buybacks could be better allocated towards productive investments, job creation, or employee compensation.

The debate around stock buybacks highlights the need for careful evaluation and transparency in the use of this financial strategy.

Understanding the dynamics of stock buybacks is crucial for investors to make informed decisions and assess the impact of this financial strategy on companies, markets, and shareholders. Stock buybacks can enhance shareholder value, influence financial ratios, and impact market perceptions. However, they can also raise concerns about income inequality and short-termism. As with any investment strategy, it is essential to consider the motives and potential consequences of stock buybacks while evaluating the overall financial health and long-term prospects of a company.

Ep 10 What's Wrong with Buybacks?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are stock buybacks?

Stock buybacks, also known as share repurchases, are when a company buys back its own shares from existing shareholders. This reduces the number of outstanding shares in the market, effectively increasing the ownership stake of each remaining shareholder.

Why do companies engage in stock buybacks?

Companies engage in stock buybacks for various reasons, including increasing shareholder value, signaling confidence in the company’s future prospects, boosting earnings per share, and utilizing excess cash reserves in a tax-efficient manner.

How are stock buybacks different from dividends?

Stock buybacks and dividends are both ways for companies to return value to shareholders. While dividends distribute a portion of the company’s profits directly to shareholders, stock buybacks involve repurchasing shares from the market, which can have a similar effect of increasing shareholder value.

What impact do stock buybacks have on stock prices?

Stock buybacks can potentially increase stock prices by reducing the supply of shares in the market, which can create a higher demand and drive up prices. However, the overall impact on stock prices can be influenced by various factors, including market conditions, investor sentiment, and the company’s financial performance.

How are stock buybacks funded?

Stock buybacks are typically funded using a company’s cash reserves, borrowing funds, or reallocating resources from other activities such as reducing capital expenditures or cutting dividends. The specific method depends on the financial situation and strategy of each company.

What are the potential benefits of stock buybacks for shareholders?

Stock buybacks can provide benefits to shareholders, such as increasing their ownership stake and potentially boosting the value of their remaining shares. Additionally, buybacks can improve metrics like earnings per share, which may attract more investors and lead to increased stock prices.

Do all companies engage in stock buybacks?

No, not all companies engage in stock buybacks. The decision to initiate a buyback program depends on factors such as the company’s financial situation, growth prospects, available cash reserves, and management’s assessment of the best use of funds to create value for shareholders.

Are stock buybacks always beneficial for shareholders?

While stock buybacks can have benefits, their impacts on shareholders can vary depending on the specific circumstances. Buybacks may be seen as a positive move if they are conducted at reasonable valuations and result in increased shareholder value. However, if buybacks are done at inflated prices or funded through excessive borrowing, they may not be beneficial in the long run.

Final Thoughts

Understanding the dynamics of stock buybacks is crucial for investors seeking to make informed decisions. Stock buybacks, or share repurchases, occur when a company purchases its own shares from the open market. These buybacks can indicate that a company believes its shares are undervalued or that it wants to improve its earnings per share. By reducing the number of outstanding shares, buybacks can also increase shareholder value. However, it is essential to analyze the underlying reasons and financial implications of buybacks before drawing conclusions about a company’s future prospects. By understanding the dynamics of stock buybacks, investors can navigate the market with greater confidence and make well-informed investment choices.