Understanding the economic indicators affecting investments is essential for any savvy investor. In this blog article, we will delve into the intricacies of these indicators and how they can impact your investment decisions. From analyzing GDP growth rates to monitoring inflation levels, we will explore the key factors that drive the economy and ultimately influence the performance of your investments. By the end of this article, you will gain a comprehensive understanding of the economic indicators that matter most and how to interpret them effectively. So, let’s dive right in and demystify the world of investment economics.

Understanding the Economic Indicators Affecting Investments

Investing in financial markets can be a daunting task. With numerous variables at play, it’s crucial to have a solid understanding of the economic indicators that impact investments. These indicators provide valuable insights into the health and future prospects of the economy, helping investors make informed decisions. In this article, we will explore the key economic indicators and delve into how they affect investments.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP) is one of the most important economic indicators and provides a measure of a country’s economic output. It represents the total value of all goods and services produced within a specific period. Investors closely monitor GDP as it reflects the overall health and growth potential of an economy. A higher GDP indicates a robust economy, which can lead to increased investment opportunities. Conversely, a decline in GDP may signify a recession or slowdown, potentially impacting investment returns.

Unemployment Rate

The unemployment rate is another crucial economic indicator that affects investments. It measures the percentage of the labor force that is unemployed and actively seeking employment. A lower unemployment rate indicates a strong job market and consumer spending power, which can drive economic growth and boost investment prospects. On the other hand, a high unemployment rate may lead to reduced consumer spending and weakened investor confidence. Investors should consider the unemployment rate when assessing the potential profitability of their investments.

Inflation Rate

The inflation rate measures the rate at which the general level of prices for goods and services is rising and, subsequently, the purchasing power of currency is falling. Inflation erodes the value of money over time and directly impacts investment returns. Understanding the inflation rate is vital because it helps investors determine whether their investments are outpacing inflation. When inflation is high, investors may need to adjust their investment strategies to account for the diminishing purchasing power of their returns.

Interest Rates

Interest rates play a significant role in investment decisions. They not only influence borrowing costs but also impact the return on investment for various asset classes. When interest rates are high, borrowing becomes more expensive, which can lead to reduced consumer spending and slower economic growth. This scenario may negatively affect certain investments, such as those tied to consumer spending. Conversely, low interest rates can stimulate economic activity and boost investment returns. Investors should be aware of interest rate trends and consider them when making investment decisions.

Consumer Spending

Consumer spending is a critical component of economic growth, making it an essential economic indicator for investors to monitor. Higher consumer spending is an indication of increased confidence in the economy, which can have a positive impact on businesses and investments. When consumers are spending, companies generate higher revenues, leading to potential stock price increases and higher returns. Monitoring consumer spending patterns and trends can provide insights into investment opportunities across various sectors.

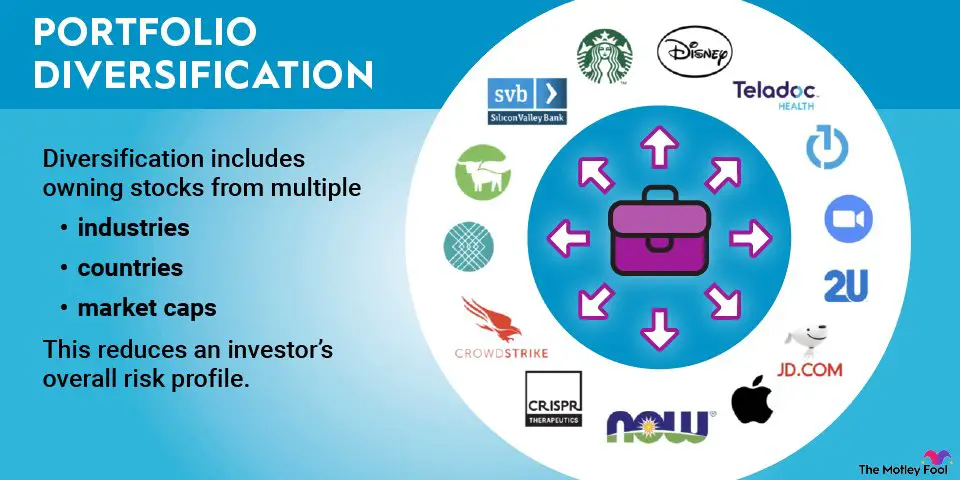

Stock Market Performance

While not a direct economic indicator, the performance of the stock market can provide valuable insights into the overall health of the economy. Stock market indices, such as the S&P 500 or Dow Jones Industrial Average, highlight the collective performance of a basket of stocks. A rising stock market generally suggests investor optimism and economic growth, which can encourage further investments. However, abrupt declines or increased market volatility may signal economic uncertainty, impacting investor sentiment and potentially leading to a decrease in investment activity.

International Trade and Exchange Rates

International trade and exchange rates have a significant impact on investments, particularly for companies engaged in global operations. Shifts in exchange rates can affect the price competitiveness of exports and imports, ultimately influencing corporate profits and stock performance. Additionally, trade policies and geopolitical events can introduce uncertainties that affect investment decisions. Investors should stay informed about trade agreements, tariffs, and global economic developments to assess the potential risks and opportunities associated with their investments.

Housing Market Indicators

The housing market is an essential sector of the economy and can be a significant driver of investment opportunities. Several housing market indicators, such as housing starts, home sales, and prices, offer insights into the demand and supply dynamics of the real estate market. A robust housing market indicates a healthy economy and potential investment opportunities in construction, homebuilding, and related industries. Conversely, a slowdown in the housing market can signal economic weakness and impact investments in real estate and related sectors.

Understanding the economic indicators that affect investments is crucial for successful investing. By monitoring these indicators, investors can gain valuable insights into the overall health of the economy and make informed decisions. The GDP, unemployment rate, inflation rate, interest rates, consumer spending, stock market performance, international trade, and housing market indicators all play a role in shaping investment opportunities. By staying informed and analyzing these indicators, investors can navigate the complex world of investments with confidence and increase their chances of achieving favorable returns.

Understanding the role of economic indicators in investing

Frequently Asked Questions

Frequently Asked Questions (FAQs)

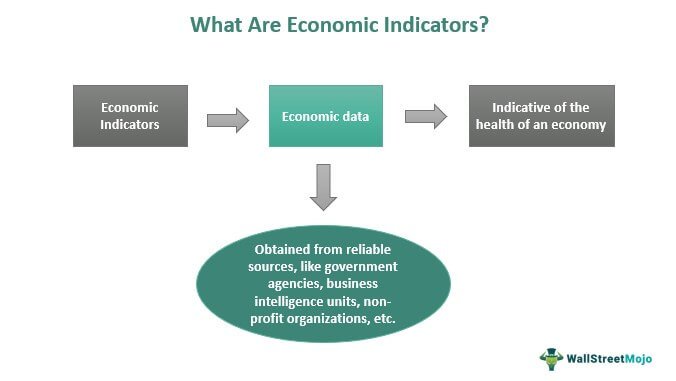

What are economic indicators?

Economic indicators are statistical data points that provide insights into the overall health and performance of an economy. These indicators help investors understand the current and future economic conditions, which in turn can affect investment decisions.

How do economic indicators affect investment decisions?

Economic indicators serve as important signals for investors to assess the potential risks and opportunities associated with their investment choices. By analyzing indicators such as GDP growth, inflation rates, employment data, and consumer confidence, investors can make informed decisions on when, where, and how to invest.

Which economic indicators have the greatest impact on investments?

While there are numerous economic indicators, some of the key ones that significantly impact investments include GDP growth, interest rates, inflation rates, employment data, stock market performance, and consumer spending patterns.

How does GDP growth affect investments?

GDP growth is a crucial indicator as it reflects the overall expansion or contraction of an economy. Higher GDP growth rates often indicate increased business activity and potential investment opportunities, while lower growth rates may signal economic slowdown, affecting investment strategies.

Why are interest rates important for investors?

Interest rates play a vital role in investment decisions. Changes in interest rates can impact borrowing costs, the cost of capital, and the attractiveness of various investment options. Higher interest rates can discourage borrowing and lead to a shift from riskier investments to safer ones, while lower rates can stimulate investment and economic growth.

How does inflation affect investments?

Inflation refers to the rate at which the general price level of goods and services rises over time. Inflation erodes the purchasing power of money and can have significant implications for investments. Investors need to consider the impact of inflation on interest rates, asset prices, and the overall performance of their investment portfolio.

What role does employment data play in investment decisions?

Employment data, including the unemployment rate and job creation figures, provide insights into the strength of the labor market and overall economic conditions. Positive employment trends can indicate increased consumer spending and business growth, influencing investment decisions in various sectors.

How does stock market performance impact investments?

Stock market performance is a widely tracked indicator that reflects the overall sentiment and confidence of investors. Bull markets, characterized by rising stock prices, often signal positive economic conditions and can attract more investment. Conversely, bear markets, marked by declining stock prices, may indicate economic uncertainties and impact investment strategies.

How does consumer spending affect investments?

Consumer spending is a key driver of economic growth and can significantly impact investments. Higher consumer spending signals a robust economy and may favor investments in sectors such as retail, hospitality, and leisure. On the other hand, lower consumer spending can indicate a weak economy, influencing investment strategies towards more stable sectors.

Final Thoughts

Understanding the economic indicators affecting investments is crucial for successful financial decision-making. By analyzing factors such as GDP, inflation rates, interest rates, and employment figures, investors can gain valuable insights into the current and future state of the economy. These indicators help to predict market trends, assess risks, and identify opportunities. Furthermore, a comprehensive understanding of economic indicators enables investors to adjust their strategies accordingly, mitigating potential losses and maximizing returns. Therefore, staying well-informed and continuously monitoring these indicators is essential for making informed investment choices.