Are you curious about how inflation affects your hard-earned savings? Understanding the effects of inflation on savings is crucial for anyone looking to secure their financial future. In this article, we will explore the impact of inflation on your savings and provide practical tips to mitigate its negative consequences. So whether you’ve just started saving or have been at it for a while, it’s important to grasp how inflation can erode the value of your money over time. Let’s dive in and uncover the hidden truths about inflation and its impact on your savings.

Understanding the Effects of Inflation on Savings

Introduction

Inflation is a key concept in economics that affects various aspects of our financial lives. One area where inflation has a significant impact is savings. In this article, we will explore the effects of inflation on savings, helping you understand how it can erode the value of your hard-earned money over time.

What is Inflation?

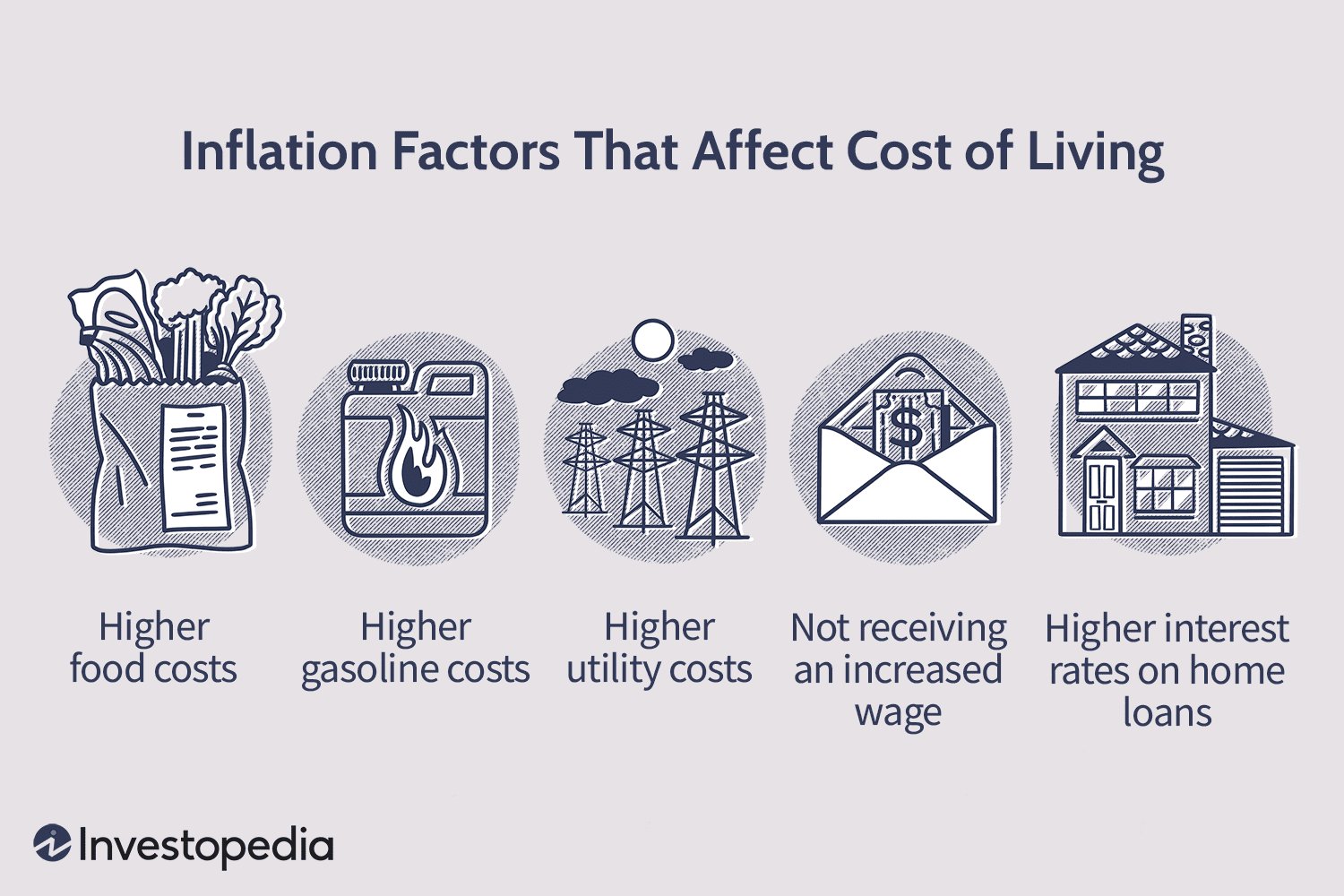

To comprehend the effects of inflation on savings, it’s important to first understand what inflation is. Inflation refers to the general increase in prices of goods and services over time. When inflation occurs, each unit of currency buys fewer goods or services compared to the past.

Inflation is typically calculated using a common measure such as the Consumer Price Index (CPI), which tracks the changes in prices for a basket of goods and services commonly purchased by households.

How Inflation Affects Savings

Now that we have a basic understanding of inflation, let’s delve into how it impacts our savings. Inflation diminishes the purchasing power of money, meaning that over time, the same amount of money can buy fewer goods or services. This can lead to the following effects:

1. Loss of Real Value

When you save money, whether in a savings account, a certificate of deposit (CD), or under your mattress, you expect it to retain its value over time. However, inflation erodes the purchasing power of your savings. For example, if inflation is at 3% per year and your savings account earns only 1% interest, your savings effectively lose 2% of their value each year.

2. Reduced Future Purchasing Power

Inflation can significantly impact your ability to achieve your financial goals in the future. Let’s say you’re saving for a down payment on a house, and it will take you five years to accumulate the necessary funds. If inflation averages 2% per year, the price of houses will likely increase by a similar percentage. This means that you’ll need to save more money to keep up with rising house prices, making it harder to reach your goal within the expected timeframe.

3. Lower Returns on Fixed-Income Investments

When inflation rises, it often leads to an increase in interest rates by central banks. As a result, fixed-income investments like bonds and Treasury bills may offer higher yields to compensate investors for the effects of inflation. However, if you have already invested in fixed-income assets at lower interest rates, the purchasing power of the returns you receive may be eroded by inflation. This is because the fixed interest rates do not keep pace with rising prices.

Protecting Your Savings from Inflation

While inflation can have detrimental effects on savings, there are strategies you can employ to mitigate its impact and protect your hard-earned money. Consider the following approaches:

1. Invest in Assets that Outpace Inflation

One way to combat the impact of inflation is to invest in assets that have historically outperformed inflation rates. These assets may include stocks, real estate, or commodities. By diversifying your investments and including assets with potential for higher returns, you increase the likelihood of preserving the purchasing power of your savings.

2. Consider Inflation-Linked Investments

Inflation-linked investments, such as Treasury Inflation-Protected Securities (TIPS), are specifically designed to protect against inflation. The principal value of these securities adjusts with changes in the CPI, ensuring that your investment keeps pace with inflation. By investing in TIPS or similar instruments, you can safeguard your savings from erosion caused by rising prices.

3. Maximize Returns with High-Yield Savings Accounts

While traditional savings accounts may offer low interest rates, online high-yield savings accounts often provide higher rates of returns. By moving your funds to these accounts, you can potentially earn more interest and offset the effects of inflation to some extent. It’s important to compare rates and fees among different providers to find the best option for your savings.

4. Invest in Dividend-Paying Stocks

Dividend-paying stocks can be another effective strategy for combating inflation. Companies that consistently pay dividends often increase their payouts over time, which can help counteract the impact of rising prices. Additionally, reinvesting dividends can accelerate the growth potential of your investments, providing a buffer against inflation.

5. Review and Adjust Regularly

Inflation is a dynamic economic factor that can change over time. It is crucial to regularly review and adjust your savings and investment strategies to adapt to changing economic conditions. By staying informed and proactive, you can ensure that your savings are effectively protected against the effects of inflation.

Understanding the effects of inflation on savings is vital for successfully managing your finances. By recognizing how inflation erodes the value of your money over time, you can take appropriate measures to protect your savings. Whether it’s investing in assets that outpace inflation, considering inflation-linked investments, or maximizing returns with high-yield savings accounts, there are strategies available to safeguard your savings. Remember to regularly review and adjust your savings plan to stay ahead of inflation and maintain the purchasing power of your hard-earned money.

Understanding the Impact of Inflation on Savings and Investing

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is inflation and how does it affect savings?

Inflation refers to the general increase in prices of goods and services over time. When inflation occurs, the purchasing power of money decreases. This means that the value of savings also diminishes over time if the interest earned on them does not keep up with inflation.

How does inflation impact the value of savings accounts?

As the prices of goods and services increase due to inflation, the same amount of money held in a savings account will be able to buy fewer goods and services in the future. This can erode the purchasing power of savings and reduce their real value over time.

Can inflation ever have a positive effect on savings?

Inflation can have a positive effect on savings if the interest rate on savings accounts or investments exceeds the rate of inflation. In such cases, the real value of savings can grow, allowing individuals to retain or increase their purchasing power.

Why is it important to consider inflation when planning for the future?

Considering inflation is crucial for effective financial planning because it helps individuals understand the impact of rising prices on their savings. Ignoring inflation may lead to overestimating the value of savings and falling short of future financial goals.

What strategies can be adopted to protect savings from inflation?

To protect savings from the effects of inflation, individuals can consider investing in assets that tend to outpace inflation rates, such as stocks, bonds, real estate, or commodities. Diversifying investments and regularly reviewing and adjusting them can also help manage the impact of inflation.

Are all savings accounts impacted equally by inflation?

No, all savings accounts are not impacted equally by inflation. Some savings accounts offer higher interest rates compared to others, which can help counterbalance the effects of inflation. It is crucial to choose savings accounts that provide competitive interest rates to mitigate the impact of inflation on your savings.

Does inflation affect short-term savings differently than long-term savings?

Inflation tends to have a more significant impact on long-term savings compared to short-term savings. This is because long-term savings have a longer period for inflation to erode their value. Short-term savings, on the other hand, may experience a lesser impact as they are typically used or spent within a shorter time frame.

How can individuals preserve the value of their savings in an inflationary environment?

Preserving the value of savings in an inflationary environment requires proactive steps. Apart from considering investments with returns that surpass inflation, individuals can also explore options like Treasury Inflation-Protected Securities (TIPS), which adjust with inflation, or investing in assets like gold or other commodities that historically retain value during inflationary periods.

Final Thoughts

Understanding the effects of inflation on savings is important for individuals looking to preserve and grow their hard-earned money. Inflation erodes the purchasing power of savings over time, as the cost of goods and services increases. This means that the value of savings may slowly diminish, making it essential to consider inflation when making financial plans. Being aware of the rate of inflation and finding investment options that outpace inflation can help mitigate its impact on savings. By actively managing savings in light of inflation, individuals can better protect their wealth and achieve their long-term financial goals.