Imagine waking up one day to find that the money you diligently saved over the years has lost its value overnight. Understanding the effects of inflation on savings is essential for anyone who wants to protect and grow their hard-earned money. In this article, we will explore the impact of inflation on savings and provide practical tips to help you navigate this financial challenge. Let’s delve into the world of inflation and its repercussions, ensuring that your savings remain secure and give you peace of mind for the future.

**Understanding the Effects of Inflation on Savings**

Introduction

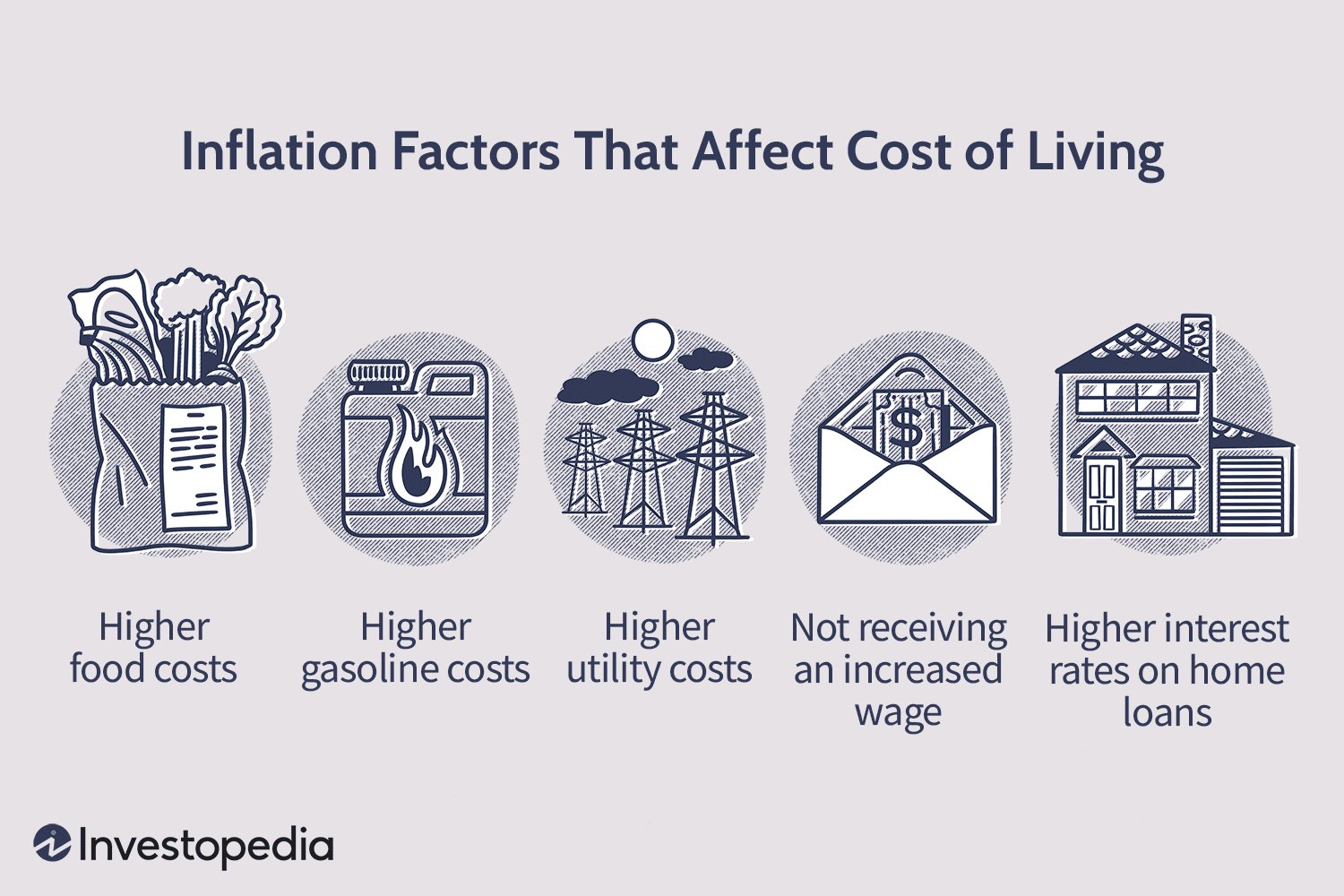

Inflation is a term that often comes up when discussing the economy, but what does it actually mean for us as individuals and our personal finances? In simple terms, inflation refers to the increase in prices of goods and services over time. While it may seem like a small increase here and there, the cumulative effect can significantly impact our savings.

In this article, we will delve deeper into the effects of inflation on savings and explore strategies to mitigate its impact. Whether you are a seasoned investor or just starting to save, understanding the dynamics of inflation is crucial for long-term financial success.

Why Inflation Matters for Savers

1. Diminished Purchasing Power

One of the main effects of inflation on savings is the erosion of purchasing power. As prices rise, the same amount of money can buy less over time. For example, if you were able to purchase a loaf of bread for $2 last year and inflation is at 3%, you would need $2.06 this year to buy the same loaf of bread. This decrease in purchasing power affects all aspects of our lives, from groceries to housing and everything in between.

Example:

Let’s say you have $10,000 in savings that you intend to use for a down payment on a house in five years. Assuming an average inflation rate of 2% each year, the value of your $10,000 savings will effectively decrease over time. In five years, that $10,000 will only be worth approximately $9,184 in today’s dollars. This means you will need to save an additional $816 to maintain the same purchasing power.

2. Impact on Retirement Savings

Inflation also poses a significant challenge for retirement savings. Most retirement plans, such as 401(k)s or IRAs, are invested in a variety of assets like stocks and bonds. While these investments have the potential to grow over time, inflation can eat away at their real value.

If the return on your investments is not keeping pace with inflation, your retirement savings may not be able to support the lifestyle you envisioned during your golden years. It is crucial to consider inflation when planning for retirement and ensure your investments are diversified and adjusted to account for its impact.

3. Rising Interest Rates

In response to inflation, central banks often raise interest rates to slow down the economy. While these rate hikes are intended to curb inflation, they can have unintended consequences for savers. Higher interest rates mean that borrowing becomes more expensive. This can make it harder for individuals to acquire loans for mortgages, cars, or business ventures, hindering their ability to grow their wealth.

Additionally, higher interest rates on savings accounts, certificates of deposit (CDs), and bonds attract investors seeking better returns. While this might seem like a positive aspect for savers, it can also lead to increased competition for these investment options and potentially lower returns in the long run.

Strategies to Mitigate the Effects of Inflation on Savings

Now that we have a better understanding of how inflation can impact our savings, let’s explore some strategies to mitigate its effects and protect our hard-earned money.

1. Invest in Assets That Outpace Inflation

One way to combat the eroding effects of inflation is to invest in assets that have historically outperformed inflation over the long term. Here are a few investment options to consider:

- Stocks: Historically, stocks have provided higher returns than inflation. However, they also come with higher volatility and risks.

- Real Estate: Investing in real estate, either residential or commercial properties, can be an effective hedge against inflation. Real estate values tend to rise with inflation, protecting the value of your investment.

- Commodities: Investing in commodities like gold, silver, or oil can also help preserve wealth during inflationary periods.

- Inflation-Indexed Bonds: Governments issue inflation-indexed bonds that adjust their value based on the prevailing inflation rate. These bonds provide a fixed return above inflation, protecting your purchasing power.

It’s important to note that these investment options come with their own risks and potential rewards. Therefore, it is advisable to consult with a financial advisor and conduct thorough research before making any investment decisions.

2. Diversify Your Portfolio

Diversification is a time-tested strategy in investing that involves spreading your investments across different asset classes, sectors, and geographical regions. By diversifying your portfolio, you can potentially reduce risk and increase the likelihood of earning positive returns.

When it comes to combating inflation, diversification is essential. Certain investments, like stocks or real estate, may perform well during periods of inflation, while others, like bonds or cash, may not. By diversifying your investments, you can better position yourself to withstand the effects of inflation on savings.

3. Adjust Your Savings and Budget

While investing in assets that outpace inflation is important, it is equally crucial to monitor your spending and adjust your savings and budget accordingly. Here are a few tips to consider:

- Save More: To counteract the effects of inflation, it may be necessary to increase the amount you save each month. This will help ensure that you maintain or grow your purchasing power over time.

- Control Expenses: Take a closer look at your expenses and find areas where you can cut back. This could involve reducing discretionary spending or finding ways to save on everyday expenses.

- Explore Alternative Income Streams: Increasing your income through side hustles or additional part-time work can provide extra funds for savings and help combat the effects of inflation.

- Investigate High-Yield Savings Accounts: Look for savings accounts that offer higher interest rates to help offset the impact of inflation. These accounts may provide better returns than traditional savings accounts.

By actively managing your savings and budget, you can better adapt to the changing economic landscape and protect yourself from the erosion of purchasing power caused by inflation.

Understanding the effects of inflation on savings is crucial for maintaining long-term financial stability. Inflation erodes the purchasing power of our money over time, impacting everything from daily expenses to retirement savings. However, by investing in assets that outpace inflation, diversifying our portfolios, and adjusting our savings and budgets, we can mitigate the effects of inflation and protect our hard-earned money.

Remember, inflation is an inevitable part of the economy, but with careful planning and informed decision-making, we can navigate its challenges and secure a brighter financial future.

Frequently Asked Questions

Q: How often does inflation occur?

A: Inflation occurs on an ongoing basis in most economies. Central banks and governments strive to keep inflation rates at manageable levels.

Q: Can I completely eliminate the effects of inflation on my savings?

A: While it may not be possible to eliminate the effects of inflation entirely, taking proactive steps such as investing in inflation-beating assets and adjusting your savings and budget can significantly mitigate its impact.

Q: What is the average inflation rate?

A: The average inflation rate varies across countries and time periods. It is essential to stay informed about the inflation rate in your specific region to make informed financial decisions.

Understanding the Impact of Inflation on Savings and Investing

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How does inflation impact savings?

Inflation erodes the purchasing power of money over time. This means that as the general level of prices in the economy rises, the value of your savings decreases. Inflation can diminish the real returns on your savings and affect your ability to meet future financial goals.

Is inflation a threat to long-term savings?

Yes, inflation poses a threat to long-term savings. Over extended periods, even moderate inflation can significantly reduce the value of your savings. It is important to account for inflation when planning for long-term financial goals and consider investment options that have the potential to outpace inflation.

How can I protect my savings from the effects of inflation?

To protect your savings from the effects of inflation, you can consider investing in assets that have historically provided returns higher than the rate of inflation. Some options include stocks, real estate, and inflation-protected securities. Diversifying your investment portfolio can also help mitigate the impact of inflation.

What are inflation-protected securities?

Inflation-protected securities, also known as Treasury Inflation-Protected Securities (TIPS), are bonds issued by the US Treasury that provide protection against inflation. The value of these securities adjusts with changes in the Consumer Price Index (CPI), ensuring that the purchasing power of the investment is maintained.

How does inflation impact different types of savings accounts?

Inflation affects different types of savings accounts differently. Regular savings accounts, especially those with low interest rates, may not keep pace with inflation, resulting in a loss of purchasing power. However, certain types of accounts, such as high-yield savings accounts or investments like stocks and bonds, have the potential to generate returns that outpace inflation.

Can inflation have positive effects on savings?

Inflation can have positive effects on savings in certain situations. When inflation is accompanied by economic growth, it can lead to higher returns on investments and increased wages. However, these positive effects may be offset if the rate of inflation exceeds the growth in wages or investment returns.

How can I calculate the impact of inflation on my savings?

You can calculate the impact of inflation on your savings using the following formula:

Adjusted Savings = Initial Savings / (1 + Inflation Rate)^Number of Years

This formula helps you estimate the future value of your savings after taking inflation into account.

What steps can I take to counter the effects of inflation on my savings?

To counter the effects of inflation on your savings, you can take several steps. These include regularly reviewing and adjusting your investment portfolio, exploring options with higher potential returns than inflation, diversifying your investments, and staying informed about economic trends that may affect inflation rates. Additionally, consulting with a financial advisor can provide valuable insights and tailored strategies.

Final Thoughts

Understanding the effects of inflation on savings is crucial for anyone seeking to protect and grow their financial resources. Inflation erodes the purchasing power of money over time, resulting in a decrease in the real value of savings. This means that if the rate of inflation is higher than the interest earned on savings, the purchasing power can actually diminish. To mitigate the impact of inflation, individuals should consider investing in assets that have the potential to outpace inflation, such as stocks, real estate, or inflation-protected securities. Additionally, regularly reviewing and adjusting savings strategies can help maintain the value of savings in the face of inflation. By staying informed and proactive, individuals can better navigate the challenges posed by inflation and preserve the value of their hard-earned savings.