Are you curious about the importance of a diversified portfolio? Look no further! Understanding the significance of a diversified portfolio is key to achieving financial success. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can minimize risks and maximize potential gains. In this article, we will explore why diversification is essential in the world of investing and how it can help you reach your financial goals. So, let’s dive in and unravel the power of a diversified portfolio!

Understanding the Importance of a Diversified Portfolio

Investing is a powerful way to grow your wealth and secure your financial future. However, it’s important to understand that not all investments are created equal. One of the key principles of successful investing is diversification, which refers to spreading your investments across different asset classes, sectors, and geographic regions. In this article, we will explore the importance of a diversified portfolio and why it is crucial for long-term financial success.

What is a Diversified Portfolio?

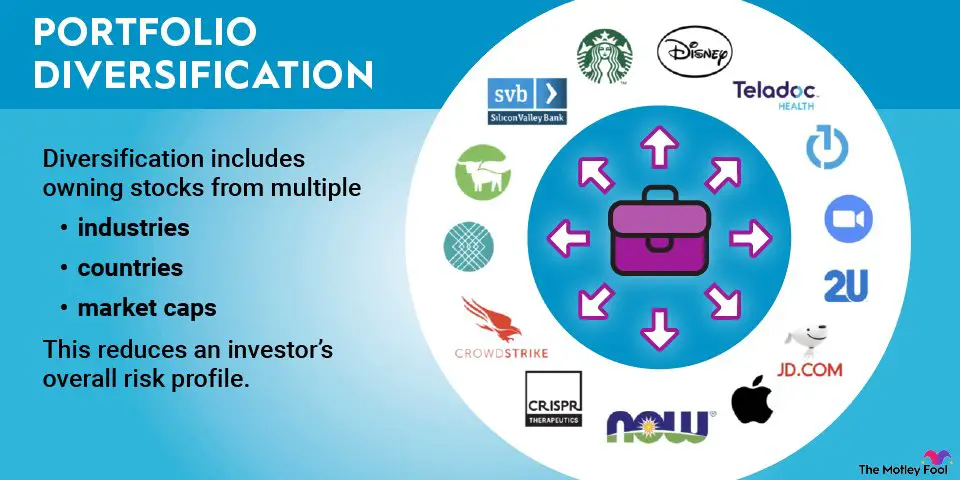

A diversified portfolio is a collection of investments that includes a wide range of assets. The goal is to distribute your investments in a way that reduces risk and maximizes returns. By investing in different asset classes, such as stocks, bonds, real estate, and commodities, you can potentially offset losses in one area with gains in another.

Furthermore, diversification isn’t limited to just asset classes. It also involves investing in a variety of sectors and regions. For example, instead of just investing in technology stocks, a diversified portfolio would include companies from various industries such as healthcare, finance, and consumer goods. Similarly, a portfolio that includes investments in different countries or regions can help mitigate the risks associated with a particular market or economy.

Benefits of a Diversified Portfolio

A diversified portfolio offers several important benefits:

- Risk Reduction: By spreading your investments across different assets, sectors, and regions, you decrease the impact of a single investment’s poor performance. This can help protect your portfolio from significant losses during market downturns.

- Improved Returns: While diversification is primarily about risk reduction, it can also lead to improved overall returns. By capturing gains in various areas, you have the potential to outperform a concentrated portfolio over the long term.

- Stability: A well-diversified portfolio is generally more stable and less volatile than one that is concentrated in a few investments. This stability can help you stay on track with your long-term financial goals without being overly affected by short-term market fluctuations.

- Flexibility: A diversified portfolio provides flexibility and adaptability. It allows you to adjust your holdings based on changing market conditions, economic trends, and your risk tolerance. This ability to pivot can be crucial in navigating uncertain market environments.

Understanding Risk and Return

In investing, risk and return are inextricably linked. Generally, higher returns come with greater risks. By diversifying your investments, you aim to strike a balance between risk and return. Here’s why diversification is effective in managing risk:

- Systematic Risk: Also known as market risk, systematic risk refers to the overall risks inherent in the financial market. Factors such as interest rates, inflation, and geopolitical events affect all investments to some degree. Diversification helps reduce the impact of systematic risk by spreading investments across different asset classes and sectors.

- Unsystematic Risk: Unsystematic risk, also called specific risk or company risk, refers to risks that are unique to a particular investment or industry. Examples include management changes, product recalls, or industry-specific regulations. Diversification helps mitigate unsystematic risk by not relying heavily on a single investment or industry.

By diversifying your portfolio, you can potentially reduce the impact of both systematic and unsystematic risks, resulting in a more stable investment journey.

Rebalancing Your Portfolio

While diversification is essential, it is not a one-time task. Markets and economies fluctuate, and the performance of different assets, sectors, and regions varies over time. To maintain an optimal level of diversification, you need to regularly review and rebalance your portfolio.

Rebalancing involves realigning your investments to their original target allocation. For example, if your target allocation is 60% stocks and 40% bonds, and due to market performance, the stock portion of your portfolio has increased to 70%, you would sell some stocks and buy more bonds to bring the allocation back to 60/40.

Rebalancing ensures that your portfolio remains diversified and aligned with your risk tolerance and long-term goals. It helps you avoid becoming overly exposed to certain assets or sectors that have performed well in the short term but may carry higher risks.

Diversification Strategies

There are various approachesto achieving diversification in your portfolio. Here are some popular strategies:

Asset Allocation:

Asset allocation refers to determining the proportion of your portfolio allocated to different asset classes, such as stocks, bonds, and cash equivalents. The goal is to create a mix that aligns with your risk tolerance, investment goals, and time horizon. Asset allocation is a fundamental diversification strategy that helps balance risk and return.

Sector Diversification:

By diversifying across different sectors, you can reduce the impact of industry-specific risks. For instance, if you invest heavily in the technology sector and there is a significant downturn in that industry, your portfolio could suffer. However, by including investments in other sectors like healthcare, finance, and energy, you can mitigate that risk.

Geographic Diversification:

Investing in different countries or regions can help protect your portfolio from country-specific risks. Economic and political conditions vary across the globe, and by diversifying geographically, you can reduce the impact of a single country’s economic downturn or geopolitical events on your investments.

Investment Vehicles:

Diversification can also be achieved by investing in different types of investment vehicles. For example:

- Stocks: Consider investing in a mix of large-cap, mid-cap, and small-cap stocks across different industries.

- Bonds: Diversify your bond holdings by including government, corporate, and municipal bonds with different maturities.

- Real Estate: Explore opportunities in residential, commercial, or industrial real estate, either directly or through real estate investment trusts (REITs).

- Commodities: Consider adding commodities like gold, oil, or agricultural products to your portfolio for further diversification.

It’s important to research and understand each investment vehicle and determine how it fits into your overall diversification strategy.

Monitoring and Reviewing Your Portfolio

Regularly monitoring and reviewing your portfolio is crucial to ensure the effectiveness of your diversification strategy. Here are some key considerations:

- Performance: Assess the performance of each investment and compare it to relevant benchmarks. Identify underperforming assets and analyze whether adjustments are warranted.

- Market Trends: Stay informed about market trends and changes in economic conditions. Monitor factors that could impact your investments, such as interest rates, inflation, or regulatory shifts.

- Rebalancing: Regularly rebalance your portfolio to maintain your desired diversification and risk profile. Revisit your asset allocation and make adjustments as needed.

- Professional Advice: Consider consulting with a financial advisor or investment professional to gain insights and expertise in portfolio management. They can help you review your portfolio and provide guidance on potential adjustments.

In Conclusion

A well-diversified portfolio is an essential component of a successful investment strategy. By spreading your investments across different asset classes, sectors, and regions, you protect yourself against unnecessary risks and position yourself for long-term growth. Remember, diversification is not a one-time action, but an ongoing process that requires periodic review and adjustments. By regularly monitoring your portfolio and staying informed about market trends, you can ensure your investments remain well-diversified and aligned with your financial goals.

It's important to have a well-diversified portfolio for investors, says Ray Dalio

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Why is understanding the importance of a diversified portfolio necessary?

Understanding the importance of a diversified portfolio is necessary because it helps reduce the risk associated with investing. By spreading your investments across different asset classes and sectors, you can minimize the impact of any single investment or market downturn on your overall portfolio.

How does diversification protect against market volatility?

Diversification protects against market volatility by allocating investments across different types of assets, such as stocks, bonds, real estate, and commodities. When one asset class underperforms, others may still generate returns, offsetting potential losses and reducing overall volatility.

What are the benefits of a diversified portfolio?

A diversified portfolio offers several benefits, including potential for higher returns, reduced risk, improved liquidity, and increased flexibility. It allows investors to participate in various market opportunities while mitigating the impact of market fluctuations.

How does diversification help in achieving long-term financial goals?

Diversification helps in achieving long-term financial goals by providing a balanced approach to investment. By spreading investments across different assets, industries, and regions, you can capture growth potential and mitigate the impact of market downturns, ensuring a more stable and consistent portfolio performance over time.

What are some common mistakes to avoid when diversifying a portfolio?

When diversifying a portfolio, it’s important to avoid common mistakes such as over-diversification, neglecting to regularly rebalance the portfolio, and not considering the correlation between different investments. It’s also crucial to diversify across different asset classes and not solely within a single asset class.

How can I diversify my investment portfolio?

You can diversify your investment portfolio by including a mix of different asset classes, such as stocks, bonds, real estate, and commodities. Within each asset class, consider diversifying further by investing in different industries, sectors, and geographic regions. Additionally, you may consider using investment vehicles like mutual funds or exchange-traded funds (ETFs) that offer built-in diversification.

What role does risk tolerance play in portfolio diversification?

Risk tolerance plays a crucial role in portfolio diversification as it determines the extent to which you are comfortable with taking on investment risk. Understanding your risk tolerance allows you to choose an appropriate mix of investments that align with your financial goals and the level of risk you are willing to accept.

How often should I review and rebalance my diversified portfolio?

It is recommended to review and rebalance your diversified portfolio at least annually or whenever there are significant changes in your financial situation or investment objectives. Regularly monitoring and rebalancing your portfolio ensures that your investments remain aligned with your goals and risk tolerance.

Final Thoughts

Understanding the importance of a diversified portfolio is crucial for any investor. By spreading investments across various asset classes and sectors, one can mitigate risks and potentially enhance returns. A diversified portfolio allows one to take advantage of different market conditions and avoid overexposure to any single investment. It provides a level of protection during market downturns and helps to preserve wealth over the long term. Therefore, investors must prioritize diversification to ensure their investment portfolio is well-balanced and resilient. In today’s dynamic and uncertain markets, understanding the importance of a diversified portfolio is essential for successful and prudent investing.