Have you ever wondered about the intricacies of the money market in economics? Understanding this concept is crucial for anyone seeking to navigate the complex world of finance. In this blog article, we will delve into the depths of the money market, unraveling its mysteries and shedding light on its significance in the economic landscape. Whether you’re a student, a professional, or simply curious about how money moves in the economy, this article is for you. So, let’s embark on this journey of comprehending the money market in economics together. Ready? Let’s dive in!

Understanding the Money Market in Economics

The money market is a crucial aspect of the financial system and plays a vital role in the functioning of the economy. In this article, we will delve into the intricacies of the money market in economics, exploring its various components, functions, and its significance in shaping the overall economic landscape.

I. What is the Money Market?

The money market refers to the marketplace where short-term borrowing and lending of funds take place. It consists of various financial institutions, such as banks, mutual funds, and government institutions, where participants engage in buying and selling of highly liquid and low-risk instruments.

A. Participants in the Money Market

The money market involves the following key participants:

1. Commercial Banks: Banks play a significant role in the money market by providing loans, accepting deposits, and facilitating the buying and selling of money market instruments.

2. Non-Banking Financial Institutions: Non-banking financial institutions, such as mutual funds and pension funds, engage in money market transactions to diversify their portfolios and generate returns.

3. Central Banks: Central banks, like the Federal Reserve in the United States, actively participate in the money market to implement monetary policy and regulate the supply of money in the economy.

B. Money Market Instruments

To facilitate borrowing and lending, various money market instruments are traded in the money market. These instruments are characterized by their short maturity periods, high liquidity, and low credit risk. Let’s explore some common money market instruments:

1. Treasury Bills: Treasury bills are short-term debt instruments issued by the government to raise funds. These are usually issued for a period of one year or less, and investors can purchase them at a discount from their face value.

2. Certificates of Deposit (CDs): Certificates of Deposit are time deposits issued by banks, usually for a fixed term. They offer higher interest rates compared to regular savings accounts.

3. Commercial Paper: Commercial paper is a short-term unsecured promissory note issued by corporates to raise funds for their short-term financing needs. It is generally issued for a period of 1 to 270 days.

4. Repurchase Agreements (Repos): Repos involve the sale of securities with an agreement to repurchase them at a predetermined price and date in the future. It serves as a collateralized short-term borrowing mechanism.

II. Functions of the Money Market

The money market performs several important functions within the economy. Let’s delve into some of these functions:

A. Facilitates Liquidity Management

The money market allows individuals and organizations to manage their short-term liquidity needs. Participants can invest excess funds and easily convert them into cash when required, providing a high degree of liquidity.

B. Source of Short-Term Financing

Companies and governments utilize the money market to meet their short-term financing needs. By issuing money market instruments, they can raise funds quickly and at lower interest rates compared to long-term debt.

C. Monetary Policy Implementation

Central banks use the money market to implement and control monetary policy. By buying or selling money market instruments, central banks adjust the money supply in the economy, influencing interest rates and inflation.

D. Price Discovery

The money market plays a crucial role in price discovery for short-term financial instruments. The supply and demand dynamics in the money market help determine the prevailing interest rates and yields on various money market instruments.

III. Significance of the Money Market in Economics

The money market’s significance extends beyond its immediate functions. It has a broader impact on the overall economy. Let’s explore the key aspects of the money market’s significance:

A. Interest Rate Determination

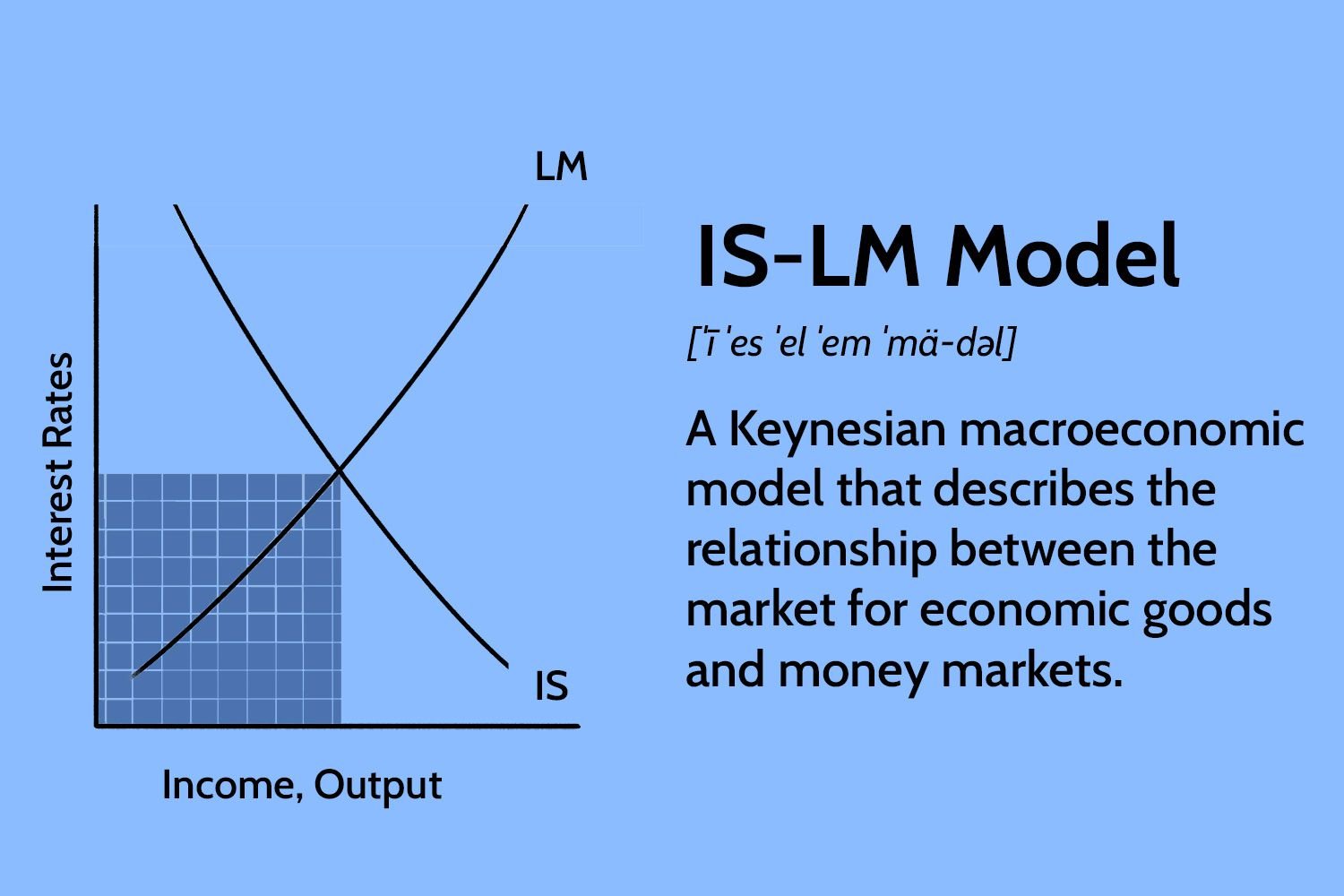

The money market, through its supply and demand dynamics, affects short-term interest rates. Changes in interest rates influence borrowing costs for individuals and businesses, impacting investment decisions and overall economic activity.

B. Economic Stability

The money market contributes to the stability of the financial system by providing a platform for liquidity management and short-term financing. Well-functioning money markets ensure the smooth flow of funds within the economy, reducing the risk of financial crises.

C. Transmission Mechanism for Monetary Policy

Central banks utilize the money market as a key transmission mechanism for implementing monetary policy. By influencing interest rates in the money market, central banks can impact borrowing costs, credit availability, and overall economic activity.

D. Indicator of Economic Conditions

The performance of the money market can serve as an indicator of the broader economic conditions. Fluctuations in money market interest rates and yields reflect changes in market sentiment, investor confidence, and economic expectations.

IV. The Money Market and Macroeconomic Factors

Several macroeconomic factors influence the functioning of the money market. Let’s explore how these factors impact the money market:

A. Inflation

Inflation, the rate at which the general price level of goods and services increases, has a significant impact on the money market. Inflation erodes the purchasing power of money, leading to higher interest rates to compensate for the loss in real value.

B. Economic Growth

The state of economic growth affects the money market dynamics. During periods of robust economic growth, the demand for money market instruments may increase, leading to higher prices and lower yields.

C. Central Bank Policy

Central bank policies, such as changes in interest rates and open market operations, directly impact the money market. By adjusting these policy tools, central banks aim to influence money market interest rates, liquidity, and credit conditions.

V. Conclusion

The money market plays a crucial role in the economy by providing a platform for short-term borrowing and lending. Its functions extend beyond the immediate liquidity management to influencing interest rates, implementing monetary policy, and acting as an indicator of economic conditions. Understanding the money market’s intricacies is essential for comprehending the broader economic landscape and the factors that shape it. By exploring the various components and functions of the money market, we gain valuable insights into the inner workings of the financial system and its impact on the economy.

The Money Market (1 of 2)- Macro Topic 4.5

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the money market in economics?

The money market refers to a part of the financial market where short-term borrowing and lending of funds occur. It is a place where financial instruments with high liquidity and short maturities are traded.

How does the money market function?

In the money market, financial institutions and governments issue short-term securities such as treasury bills, certificates of deposit, and commercial paper. Investors, including individuals and corporations, buy these securities to earn a return on their excess cash.

What are the main participants in the money market?

The main participants in the money market include commercial banks, central banks, corporations, governments, and individuals. They engage in borrowing, lending, and trading of short-term financial instruments.

What is the role of central banks in the money market?

Central banks play a crucial role in regulating the money market. They use various tools like open market operations, reserve requirements, and discount rates to control the money supply, manage interest rates, and stabilize the economy.

What are the benefits of participating in the money market?

Participating in the money market allows individuals and institutions to earn short-term returns on their idle funds. It provides them with a safe and liquid avenue for investment and helps in efficient allocation of financial resources.

How does the money market differ from the capital market?

While the money market deals with short-term debt instruments, the capital market is concerned with long-term debt and equity securities. The money market focuses on meeting short-term funding requirements, while the capital market supports long-term investments and financing.

What factors affect the interest rates in the money market?

Interest rates in the money market are influenced by factors such as central bank policies, inflation expectations, supply and demand for money, and overall economic conditions. Changes in these factors can lead to fluctuations in interest rates.

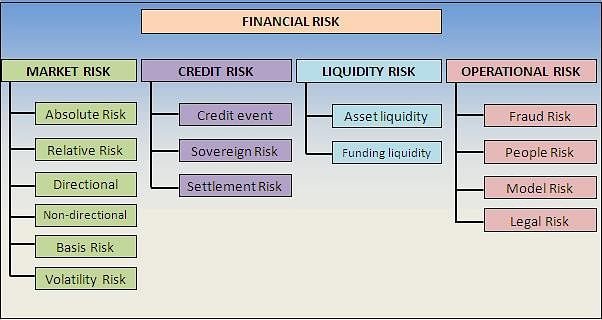

What risks are associated with investing in the money market?

Although the money market is considered relatively safe, there are certain risks to be aware of. These include interest rate risk, credit risk, liquidity risk, and reinvestment risk. It is essential to assess these risks before investing in money market instruments.

What are some common money market instruments?

Common money market instruments include treasury bills, commercial paper, repurchase agreements, certificates of deposit, and money market mutual funds. These instruments provide short-term funding options with varying levels of risk and return.

Final Thoughts

Understanding the money market in economics is essential for anyone looking to comprehend the dynamics of financial systems. It involves analyzing the supply and demand of money, as well as the interest rates that influence borrowing and lending activities. By grasping how the money market functions, individuals can make informed decisions about investments, savings, and monetary policy. Recognizing the interplay between government interventions and market forces is crucial for navigating economic landscapes. Ultimately, mastering the intricacies of the money market empowers individuals to make sound financial choices and adapt to ever-changing economic conditions.