If you’re looking to understand the pros and cons of payday loans, you’ve come to the right place. Payday loans have become a popular option for individuals in need of quick cash, but it’s crucial to fully grasp the advantages and disadvantages they bring. In this article, we will delve into the ins and outs of payday loans, shedding light on their benefits as well as the potential risks involved. By the end, you’ll have a comprehensive understanding of whether payday loans are the right choice for you. So, let’s jump right in and explore the world of payday loans!

Understanding the Pros and Cons of Payday Loans

Introduction

In today’s world, financial emergencies can arise unexpectedly, leaving individuals in need of quick cash to cover their expenses. Payday loans have emerged as a popular solution for those seeking immediate funds. However, understanding the pros and cons of payday loans is crucial before diving into this financial option. This article will delve into the various aspects of payday loans, carefully analyzing the advantages and disadvantages they offer, so you can make an informed decision regarding your financial needs.

The Pros of Payday Loans

1. Easy and Convenient Application Process

One significant advantage of payday loans is the hassle-free application process. Unlike traditional loans that often require extensive paperwork and several rounds of credit checks, payday loans can be easily applied for online or in-person at local payday lenders’ offices. The application usually involves providing basic personal details, proof of income, and a post-dated check or authorization for automatic loan repayment.

2. Quick Access to Funds

When experiencing a financial emergency, having quick access to funds can be critical. Payday loans are designed to provide immediate financial relief, with funds typically disbursed within a few hours or even minutes upon approval. This quick turnaround time can be incredibly beneficial for urgent situations like unexpected medical bills or car repairs.

3. No Credit Check Requirements

Unlike traditional loans, payday loans do not typically require a credit check. This means individuals with poor or no credit history can still be eligible for a payday loan. Instead of evaluating creditworthiness, payday lenders focus on verifying the borrower’s income source and ability to repay the loan within the agreed-upon timeframe.

4. Flexibility in Loan Use

Payday loans don’t come with any restrictions on how the borrowed funds should be utilized. Unlike mortgage loans or car loans, which are specifically tied to a particular purpose, payday loans can be used for any immediate financial need. Borrowers have the freedom to allocate the funds towards rent, utilities, groceries, or any other necessary expenses.

5. Availability for Individuals with Limited Access to Banking Services

For individuals with limited access to traditional banking services, payday loans can serve as a vital financial lifeline. Some individuals may not have a bank account or a credit card, making it difficult to obtain a loan from traditional financial institutions. Payday loans provide an accessible solution that can bridge the financial gap in emergency situations.

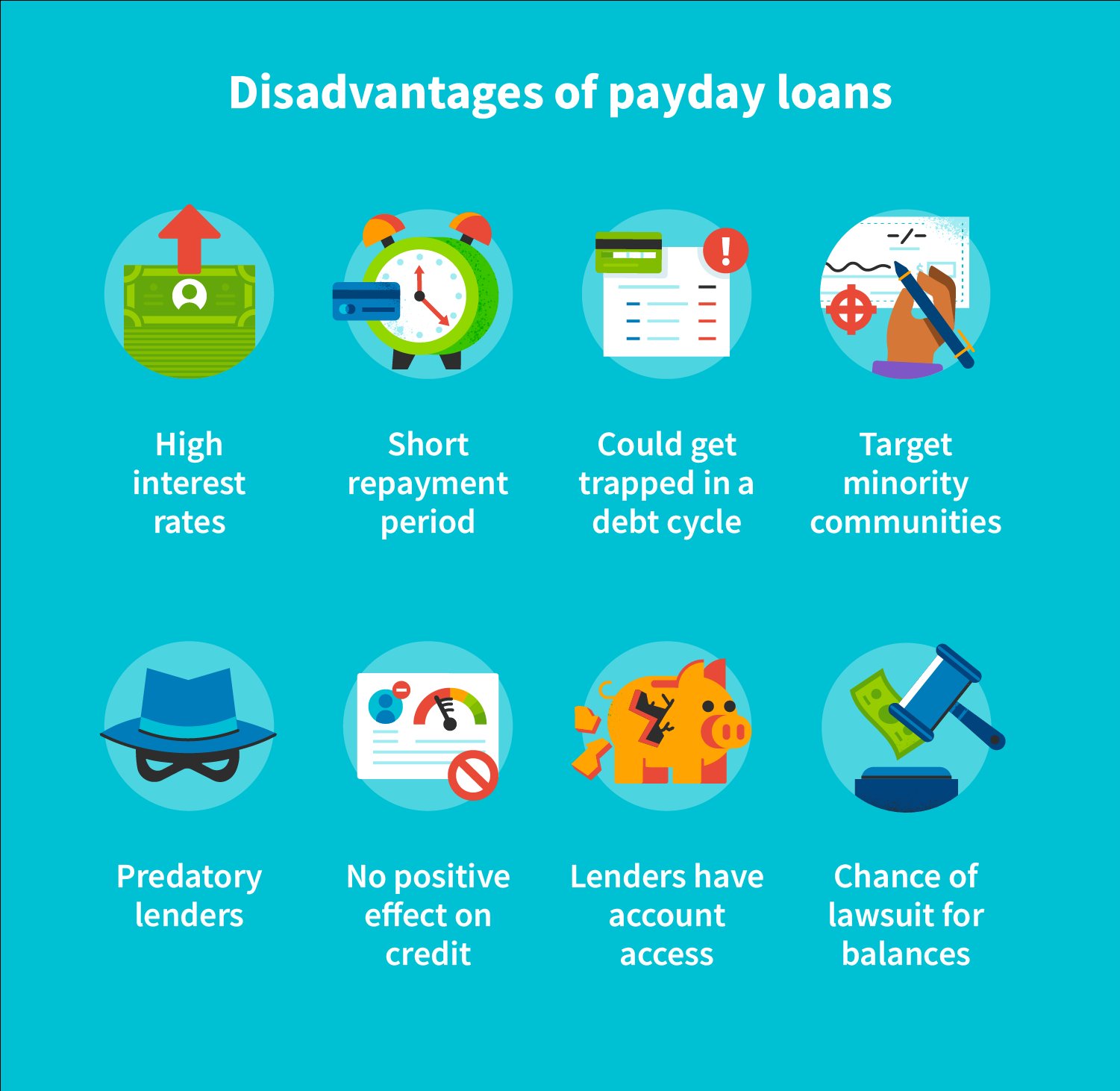

The Cons of Payday Loans

1. High Interest Rates

One of the significant drawbacks of payday loans is the high-interest rates associated with them. Payday lenders typically charge significantly higher interest rates compared to traditional lenders, often resulting in an Annual Percentage Rate (APR) of several hundred percent or more. This means that borrowers end up paying much more in interest compared to other types of loans.

2. Short Repayment Period

Payday loans are intended to be short-term loans that borrowers are expected to repay on their next payday. This means the repayment period is significantly shorter compared to traditional loans, generally ranging from a few days to a few weeks. For individuals already struggling to make ends meet, this short timeframe can put additional financial strain on them.

3. Risk of Debt Cycle

Due to the high-interest rates and short repayment period, payday loans can trap borrowers in a cycle of debt. If individuals are unable to repay the loan on time, they may be tempted to roll over the loan or take out another loan to cover the initial one. This can lead to a dangerous cycle of borrowing and accumulating more debt, making it difficult to break free from the payday loan cycle.

4. Predatory Lending Practices

While there are reputable payday lenders, the industry is also known for its predatory lending practices. Some lenders may engage in unethical practices, such as aggressive advertising, deceptive loan terms, or hidden fees. It is crucial for borrowers to thoroughly research payday lenders and read the loan agreement carefully to avoid falling victim to predatory lenders.

5. Impact on Credit Score

Though payday loans typically don’t require a credit check, failure to repay the loan can still negatively impact an individual’s credit score. In cases where borrowers default on their payday loans, lenders may report the delinquency to credit bureaus, leading to a lower credit score and potential difficulties in obtaining future loans or credit cards.

Conclusion

Payday loans can provide a quick and convenient solution for those facing financial emergencies. They offer easy accessibility, quick disbursal of funds, and flexible usage. However, it is essential to carefully consider the high-interest rates, short repayment period, and potential debt cycle associated with payday loans. Understanding these pros and cons will enable you to make an informed decision regarding your financial needs. If you decide to pursue a payday loan, ensure you borrow responsibly and choose a reputable lender to avoid any potential pitfalls.

Should You Get a Payday Loan? (Pros and Cons)

Frequently Asked Questions

Understanding the Pros and Cons of Payday Loans

1. What are the benefits of payday loans?

Payday loans provide quick access to cash, allowing you to address immediate financial needs. They are processed rapidly, often within 24 hours, and require minimal paperwork or credit checks.

2. Are payday loans a good option for short-term cash needs?

While payday loans can be convenient for handling short-term cash needs, they come with high interest rates and fees. It’s important to consider the overall cost and ensure you can repay the loan on time before taking one.

3. What are the potential drawbacks of payday loans?

One major drawback of payday loans is their high annual percentage rate (APR). These loans often have APRs that are significantly higher than those of traditional loans, making them costly if not repaid promptly. Additionally, payday loans can trap borrowers in cycles of debt if they become reliant on them.

4. How do payday loans affect credit scores?

Payday loans typically do not directly impact credit scores. However, if a borrower fails to repay the loan and it enters collections, it can have a negative effect on their credit rating. It’s important to meet repayment obligations to avoid potential credit damage.

5. Can payday loans be used to improve credit?

Payday loans are generally not designed to improve credit scores. These loans are primarily meant to provide short-term cash flow solutions. Establishing and maintaining a positive credit history is better achieved through responsible use of credit cards, installment loans, and timely bill payments.

6. What alternatives should I consider before opting for a payday loan?

Before resorting to a payday loan, consider alternatives such as borrowing from friends or family, obtaining a personal loan from a bank or credit union, or exploring low-interest credit cards. These options may offer more favorable terms and lower overall costs.

7. How can I avoid falling into a payday loan debt cycle?

To avoid getting caught in a payday loan debt cycle, it’s crucial to borrow only what you can afford to repay within the agreed-upon timeframe. Additionally, budgeting, building an emergency fund, and exploring other financial assistance options can help you avoid dependency on payday loans.

8. Are payday loans regulated?

Yes, payday loans are subject to regulations in various jurisdictions. However, regulations may vary from one region to another. It is important to familiarize yourself with the laws specific to your area, including maximum loan amounts, interest rates, and repayment terms, to make informed borrowing decisions.

Final Thoughts

Understanding the pros and cons of payday loans is crucial when considering this financial option. On the positive side, payday loans provide quick access to funds in times of emergency, without the need for collateral or a credit check. However, the high interest rates and fees associated with payday loans can create a cycle of debt for borrowers. Additionally, the short repayment terms can lead to financial strain. It is important for individuals to carefully weigh the benefits and drawbacks of payday loans before making a decision. By understanding the pros and cons of payday loans, individuals can make informed choices about their financial situations.