Margin trading can be an enticing opportunity for investors to potentially amplify their gains in the financial markets. But before diving headfirst into the world of margin trading, it is essential to understand the risks involved. So, what exactly are the risks of margin trading? In this article, we will delve into the potential pitfalls and drawbacks that come with margin trading. By comprehending these risks, investors can make informed decisions and navigate the markets with caution and confidence. Let’s explore the intricacies of understanding the risks of margin trading and how they can impact your investment journey.

Understanding the Risks of Margin Trading

Margin trading can be an appealing option for traders looking to maximize their potential profits in the financial markets. By leveraging borrowed funds, traders can amplify their trading positions and potentially earn higher returns. However, it’s important to note that margin trading also carries significant risks that can lead to substantial losses. In this article, we will explore the various risks associated with margin trading and provide insights to help you make informed decisions.

What is Margin Trading?

Before delving into the risks, let’s first understand what margin trading entails. Margin trading allows traders to buy or sell assets using borrowed funds from a brokerage firm or exchange. By using leverage, traders can control larger positions than they would be able to with their own capital alone.

When engaging in margin trading, traders are required to deposit an initial margin, which serves as collateral and protects the brokerage firm from potential losses. The remaining funds needed to finance the trade are provided by the broker in the form of a loan. The loaned funds, along with any profits or losses incurred, are typically settled when the position is closed.

Risk of Loss Amplification

One of the primary risks of margin trading is loss amplification. While leverage can potentially magnify gains, it can also exponentially increase losses. If a trade goes against you, the losses incurred may exceed the initial investment, leading to a margin call.

A margin call occurs when the account’s equity drops below a certain threshold set by the broker or exchange. In this situation, the trader is required to either deposit additional funds into the account or close the position to cover the losses. Failing to meet a margin call can result in forced liquidation of assets at unfavorable prices, further exacerbating the losses.

Market Volatility

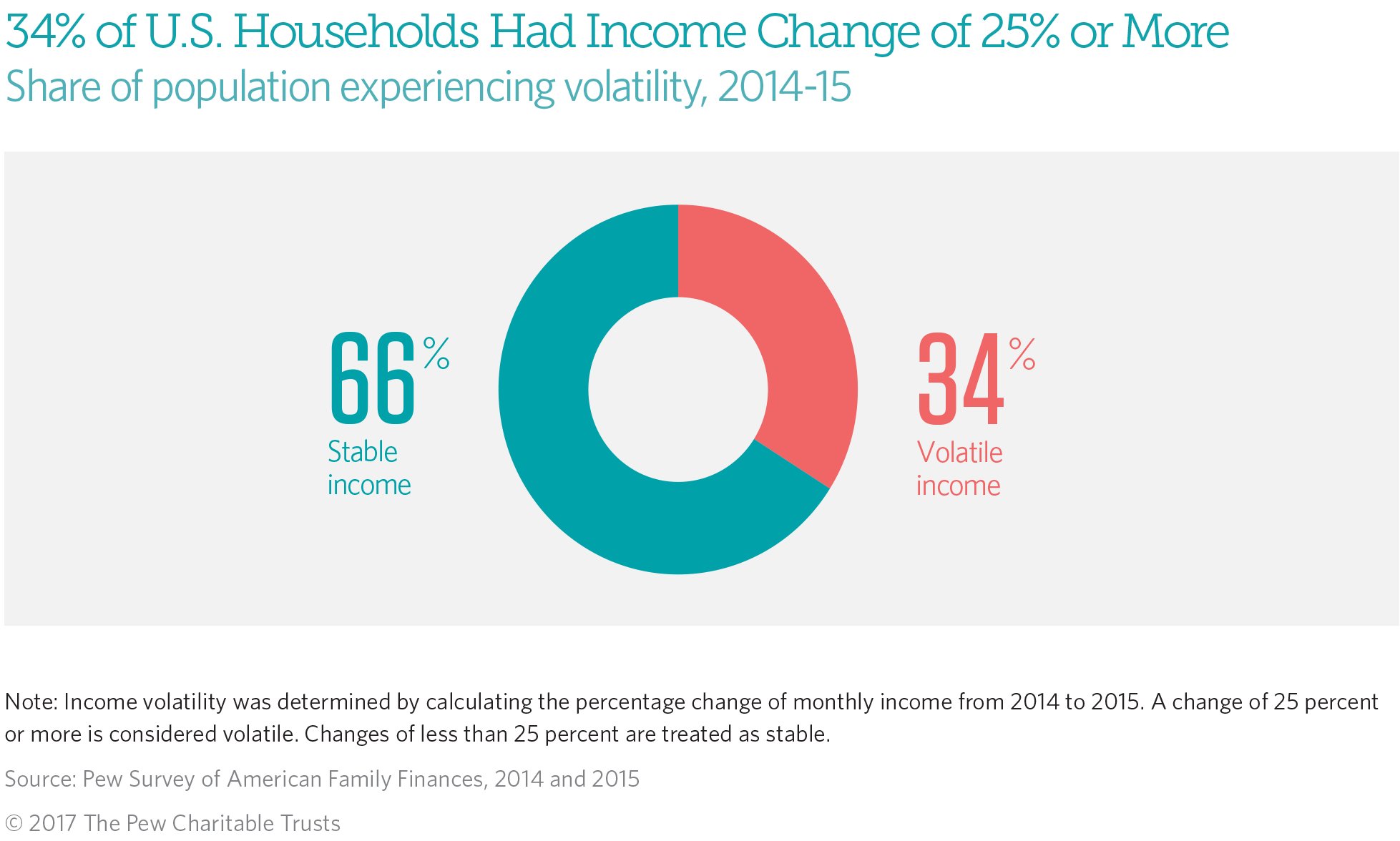

Another risk associated with margin trading is heightened exposure to market volatility. The use of leverage amplifies price movements, making positions more susceptible to rapid and significant fluctuations. While volatility can present opportunities for profit, it also increases the likelihood of losses.

In a highly volatile market, prices can change rapidly and unexpectedly. This can trigger margin calls or result in slippage, where orders are executed at a different price than anticipated. Traders must carefully monitor market conditions and exercise caution to mitigate the risks associated with increased volatility.

Interest and Fees

Margin trading involves borrowing funds, and as with any loan, there are associated costs. Traders must pay interest on the borrowed funds for the duration of the trade. These interest charges can add up over time and impact the profitability of the trade.

Additionally, brokerage firms may charge fees for margin trading services. These fees can include commission charges, financing costs, or maintenance fees. It’s important to understand the fee structure of your chosen platform and factor these costs into your trading strategy.

Lack of Risk Management

Margin trading requires a thorough understanding of risk management principles. Traders who do not implement effective risk management strategies may expose themselves to higher levels of risk. Some common pitfalls that traders may face include:

- Overleveraging: Utilizing excessive leverage without considering potential losses.

- Insufficient Diversification: Concentrating investments in a single asset or market, which increases exposure to specific risks.

- Lack of Stop-loss Orders: Failing to set stop-loss orders to limit potential losses in case the market moves against the trade.

- Emotional Decision-making: Allowing fear or greed to drive trading decisions rather than adhering to a well-thought-out strategy.

To mitigate these risks, traders should adopt sensible risk management practices, including setting realistic profit and loss targets, diversifying their portfolios, and implementing appropriate stop-loss orders.

Regulatory and Counterparty Risks

Margin trading also carries regulatory and counterparty risks that traders should be aware of. Regulatory risks arise from changes in laws or regulations governing margin trading, which can impact trading conditions, eligibility criteria, or even lead to the suspension of margin trading services.

Counterparty risks refer to the possibility of default or insolvency of the brokerage firm or exchange. If the counterparty fails to fulfill its obligations, traders may face challenges in withdrawing funds or settle their trades. It is essential to carefully consider the reputation and credibility of the trading platform before engaging in margin trading activities.

While margin trading offers potential opportunities for enhanced profits, it is important to approach it with caution and a thorough understanding of the associated risks. Loss amplification, market volatility, interest and fees, lack of risk management, and regulatory and counterparty risks are key factors that traders should carefully consider before engaging in margin trading.

By adopting effective risk management strategies, conducting thorough research, and staying informed about market conditions, traders can mitigate the risks and increase their chances of success in margin trading. Remember to carefully assess your risk tolerance, set realistic goals, and seek professional advice when needed. Margin trading can be a powerful tool, but only when used responsibly and with a clear understanding of the potential risks involved.

Forex Leverage: 90% Of Beginners Make This Mistake When Trading With Margin…

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is margin trading?

Margin trading is a practice where investors borrow funds from a broker to trade larger positions than they can afford with their own capital. This allows traders to amplify potential profits, but it also increases the potential for losses.

How does margin trading work?

In margin trading, investors open a margin account with a broker and deposit a certain amount of collateral. The broker then lends a multiple of that collateral, allowing traders to place trades with borrowed funds. The amount that can be borrowed is determined by the broker’s margin requirements.

What are the risks of margin trading?

Margin trading involves higher risks compared to regular trading. The main risks include the potential loss of more than the initial investment, known as a margin call, and the possibility of liquidation if the account value falls below the required margin level. Additionally, market volatility and sudden price movements can quickly lead to substantial losses.

How can I manage the risks of margin trading?

To manage the risks of margin trading, it is crucial to set clear risk management strategies. This includes setting stop-loss orders to limit potential losses, diversifying your trades, and carefully monitoring the market conditions. It is also important to only risk what you can afford to lose and to maintain sufficient margin levels to avoid liquidation.

Is margin trading suitable for beginners?

Margin trading is generally recommended for experienced traders who are familiar with its risks and have a good understanding of the market. Beginners are advised to gain experience and knowledge in regular trading before considering margin trading, as the risks involved can be higher and more complex to manage.

Can I lose more than my initial investment in margin trading?

Yes, it is possible to lose more than your initial investment in margin trading. Since margin trading allows you to trade larger positions with borrowed funds, any losses incurred will be magnified accordingly. This is why it is crucial to have a clear risk management plan and to trade with caution.

What happens if I receive a margin call?

A margin call occurs when the account value falls below the required margin level. In such a situation, you will be required to deposit additional funds into your account to meet the margin requirements. Failing to do so may result in the broker liquidating some or all of your positions to cover the losses.

Are there any alternative investment strategies to margin trading?

Yes, there are alternative investment strategies that do not involve margin trading. Some popular alternatives include long-term investing, diversifying your portfolio with different asset classes, and utilizing risk management techniques such as stop-loss orders. It’s advisable to consider these alternatives based on your risk tolerance and investment goals.

Final Thoughts

Margin trading can be an enticing opportunity for investors looking to maximize their returns. However, it is essential to understand the risks involved before diving into this complex financial strategy. By understanding the risks of margin trading, investors can make informed decisions and protect themselves from potential losses. One of the main risks is the possibility of magnified losses due to leverage, which can result in substantial financial setbacks. Additionally, margin calls can force investors to make quick and potentially hasty decisions. Lastly, market volatility can lead to significant fluctuations in the value of the investment. Therefore, it is crucial to thoroughly understand the risks of margin trading to avoid potential financial pitfalls.