Have you ever wondered about the crucial role actuaries play in the world of finance? Understanding the role of an actuary in finance is essential for anyone seeking to comprehend the intricate workings of the industry. Actuaries are the masterminds behind the scenes, analyzing and managing risks, determining probabilities, and ensuring financial security. From insurance companies to investment firms, their expertise is vital for organizations making informed decisions. In this article, we will delve into the fascinating world of actuaries in finance, uncovering their indispensable contributions and shedding light on their exceptional skills. So, let’s dive right in and explore the captivating realm of the actuarial profession in finance.

Understanding the Role of an Actuary in Finance

Introduction

The field of finance is a complex and ever-evolving industry that relies on data analysis, risk assessment, and strategic planning. One of the key professionals in the financial world is an actuary. Actuaries play a crucial role in assessing and managing financial risk by using their expertise in mathematics, statistics, and economics. In this article, we will explore the role of an actuary in finance and how they contribute to the smooth functioning and success of various financial institutions and organizations.

The Basics of Actuarial Science

Before diving into the specific role of actuaries in finance, let’s take a moment to understand the basics of actuarial science. Actuarial science is a discipline that applies mathematical and statistical methods to assess and manage risk and uncertainty in various industries, including finance, insurance, and pension systems. Actuaries use their analytical skills to evaluate the likelihood and financial impact of future events and provide strategic advice to mitigate potential risks.

Actuarial Exams and Qualifications

Becoming an actuary involves a rigorous educational path and a series of exams to obtain professional qualifications. Actuarial exams cover a wide range of topics, including mathematics, probability, statistics, economics, finance, and insurance principles. These exams are designed to test the knowledge and skills necessary to excel in the field of actuarial science. Actuaries also need to meet specific experience requirements to become fully qualified professionals.

Applications of Actuarial Science in Finance

Actuaries have a broad range of responsibilities within the finance industry. Their expertise is highly valued in various sectors, such as insurance, banking, investment firms, and government organizations. Let’s explore some of the key applications of actuarial science in finance:

1. Insurance

Actuaries have a crucial role in the insurance industry. They assess risks, determine pricing strategies for insurance policies, and help insurance companies maintain a financially stable position. Here are some specific areas where actuaries contribute in the insurance sector:

- Estimating insurance premiums: Actuaries use statistical models and historical data to calculate the appropriate premiums for different types of policies, considering factors such as age, location, health status, and risk profiles of policyholders.

- Reserving and claims management: Actuaries analyze insurance claims data to estimate future liabilities and set aside reserves to cover potential claims. They also develop strategies to manage claims effectively and minimize financial losses.

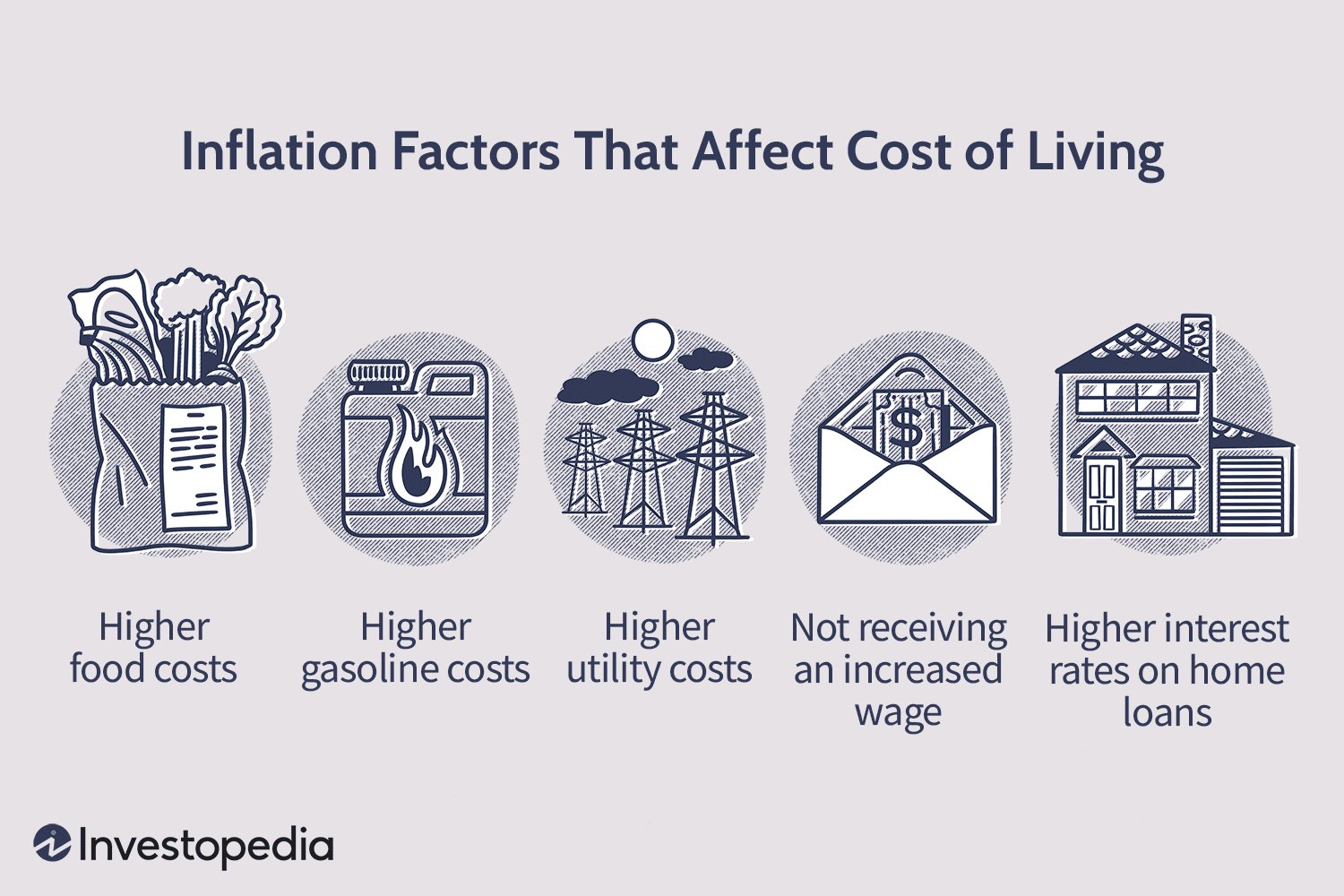

- Risk management: Actuaries help insurance companies identify and assess potential risks, such as natural disasters or economic downturns, and develop risk management strategies to protect the company’s financial stability.

2. Investment and Asset Management

In the realm of investment and asset management, actuaries provide valuable insights to make informed decisions and maximize returns. They utilize their expertise in risk assessment and financial modeling to:

- Portfolio analysis: Actuaries assess the risk and return characteristics of different investment portfolios, helping clients or organizations optimize their investment strategies based on their financial goals and risk tolerance.

- Asset liability management: Actuaries help organizations manage their assets and liabilities by matching their cash flow requirements with appropriate investment strategies and risk profiles.

- Hedging strategies: Actuaries develop hedging strategies to reduce the impact of market fluctuations and volatility on investment portfolios.

3. Risk Assessment and Management

Risk assessment and management are vital aspects of finance, and actuaries play a significant role in this domain. Their expertise helps organizations evaluate and manage various types of risks, including:

- Financial risk: Actuaries analyze market trends, economic indicators, and company-specific data to assess financial risks, such as credit risk, liquidity risk, and market risk. They develop risk management strategies to protect organizations from potential financial downturns.

- Operational risk: Actuaries evaluate operational processes and identify potential risks associated with business operations. They help organizations develop effective controls and risk management frameworks to mitigate operational risks.

- Enterprise risk management: Actuaries contribute to the development and implementation of comprehensive risk management frameworks that consider both financial and non-financial risks across all aspects of an organization.

Skills and Qualities of a Successful Actuary in Finance

To excel in the role of an actuary within the finance industry, individuals must possess a unique blend of technical skills, business acumen, and personal qualities. Here are some essential skills and qualities that contribute to the success of actuaries in finance:

1. Strong Analytical Skills

Actuaries need to have excellent analytical skills to work with complex financial data and solve intricate problems. They must be able to interpret data effectively, identify patterns and trends, and draw meaningful insights to make informed decisions.

2. Mathematical and Statistical Proficiency

Mathematics and statistics are the foundation of actuarial science. Actuaries should have a deep understanding of mathematical concepts, statistical methods, and advanced modeling techniques. These skills allow them to develop accurate models, quantify risks, and perform complex calculations.

3. Business Knowledge

Actuaries in finance need to have a solid understanding of the business environment in which they operate. They should be aware of financial markets, industry trends, regulatory frameworks, and other factors influencing financial decision-making. This knowledge enables them to provide relevant and valuable insights to stakeholders.

4. Effective Communication

Actuaries often work in teams and interact with stakeholders from different backgrounds. Effective communication skills are crucial to convey complex concepts and findings to both technical and non-technical audiences. Clear communication helps bridge the gap between technical analysis and business decision-making.

5. Problem-Solving Abilities

Actuaries are problem solvers by nature. They should have strong problem-solving abilities to tackle complex financial challenges and find innovative solutions. Actuaries often face unique situations that require critical thinking and creativity to develop strategies that meet the organizational objectives.

Actuaries play a vital role in the finance industry by analyzing and managing financial risks. Their expertise in mathematics, statistics, and economics allows them to make data-driven decisions, assess insurance premiums, optimize investment portfolios, and develop comprehensive risk management strategies. Actuaries possess a unique skill set, including strong analytical skills, mathematical proficiency, business knowledge, effective communication, and problem-solving abilities. With their contributions, actuaries contribute to the success and stability of financial institutions and help ensure a sustainable future in the world of finance.

Actuary Salary | Pacific Life

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the role of an actuary in finance?

Actuaries play a crucial role in finance by assessing and managing the financial risks associated with uncertain events. Their primary responsibility is to analyze data, develop models, and provide insights to help organizations make informed decisions to mitigate risk and ensure financial stability.

How do actuaries contribute to financial planning?

Actuaries contribute to financial planning by using their expertise in mathematics, statistics, and financial theory to analyze potential risks and uncertainties. They provide insights into factors such as life expectancy, market trends, and investment performance, enabling businesses to develop effective strategies and make sound financial decisions.

What skills do actuaries bring to the finance industry?

Actuaries possess a unique blend of analytical, mathematical, and problem-solving skills. They are proficient in statistical analysis, programming, and financial modeling. Additionally, they have a solid understanding of risk management, insurance principles, and business strategy, making them valuable assets in the finance industry.

Can actuaries help businesses optimize their financial outcomes?

Yes, actuaries can help businesses optimize their financial outcomes by assessing and managing risks. They use advanced modeling techniques to evaluate different scenarios, identify potential challenges, and recommend strategies to improve financial performance. By providing insights into areas such as pricing, investment strategies, and capital management, actuaries can help businesses maximize profitability.

Are actuaries involved in the evaluation of investment opportunities?

Absolutely. Actuaries are actively involved in evaluating investment opportunities. With their strong background in finance and risk analysis, they assess the potential risks and returns associated with various investment options. By considering factors such as market conditions, regulatory requirements, and long-term financial goals, actuaries can help businesses make informed investment decisions.

Do actuaries play a role in managing insurance risks?

Yes, managing insurance risks is a core aspect of an actuary’s role. Actuaries assess the risks associated with insurance products and develop models to determine appropriate premiums, reserves, and policy terms. They also analyze claim data, monitor trends, and make recommendations to ensure the financial stability of insurance companies.

How can actuaries contribute to strategic decision-making in finance?

Actuaries contribute to strategic decision-making in finance by providing valuable insights into risk management and financial forecasting. Through their expertise in analyzing complex data and modeling potential scenarios, actuaries enable businesses to make informed decisions about capital allocation, growth strategies, and long-term financial planning.

What educational qualifications are required to become an actuary in finance?

To become an actuary in finance, individuals typically need a strong educational background in mathematics, statistics, or actuarial science. They often pursue professional qualifications from esteemed actuarial organizations, which involve passing a series of rigorous exams to demonstrate proficiency in various areas of actuarial practice. Continual professional development is also essential to stay updated with evolving industry practices.

Final Thoughts

Understanding the role of an actuary in finance is vital for anyone seeking a successful career in this field. Actuaries play a crucial role in managing the financial risks faced by businesses and individuals. By utilizing their strong analytical skills and specialized knowledge, actuaries provide valuable insights and recommendations on risk assessment, pricing strategies, and financial planning. They ensure the stability and profitability of insurance companies, pension funds, and other financial institutions. Actuaries are in high demand due to their ability to navigate complex financial models and make informed decisions based on data analysis and statistical techniques. With their expertise, they contribute significantly to the overall growth and stability of the finance industry.