Have you ever wondered what a stock split is and how it can impact your investments? Understanding the stock split and its impact is key to navigating the dynamic world of the stock market. In simple terms, a stock split occurs when a company divides its existing shares into multiple shares, effectively increasing the number of shares available. This can often lead to a decrease in the price per share, making the stock more accessible to a wider range of investors. In this article, we will delve into the intricacies of stock splits, exploring their purpose, benefits, and potential effects on investors. So, let’s dive in and unravel the mysteries of understanding the stock split and its impact.

Understanding the Stock Split and Its Impact

Introduction:

The stock market can be a complex and intimidating place for many investors. One concept that often confuses people is the stock split. In this article, we will explore the ins and outs of stock splits, what they mean for investors, and how they can impact the overall market. By the end, you will have a clear understanding of stock splits and be better equipped to navigate the world of investing.

What is a Stock Split?

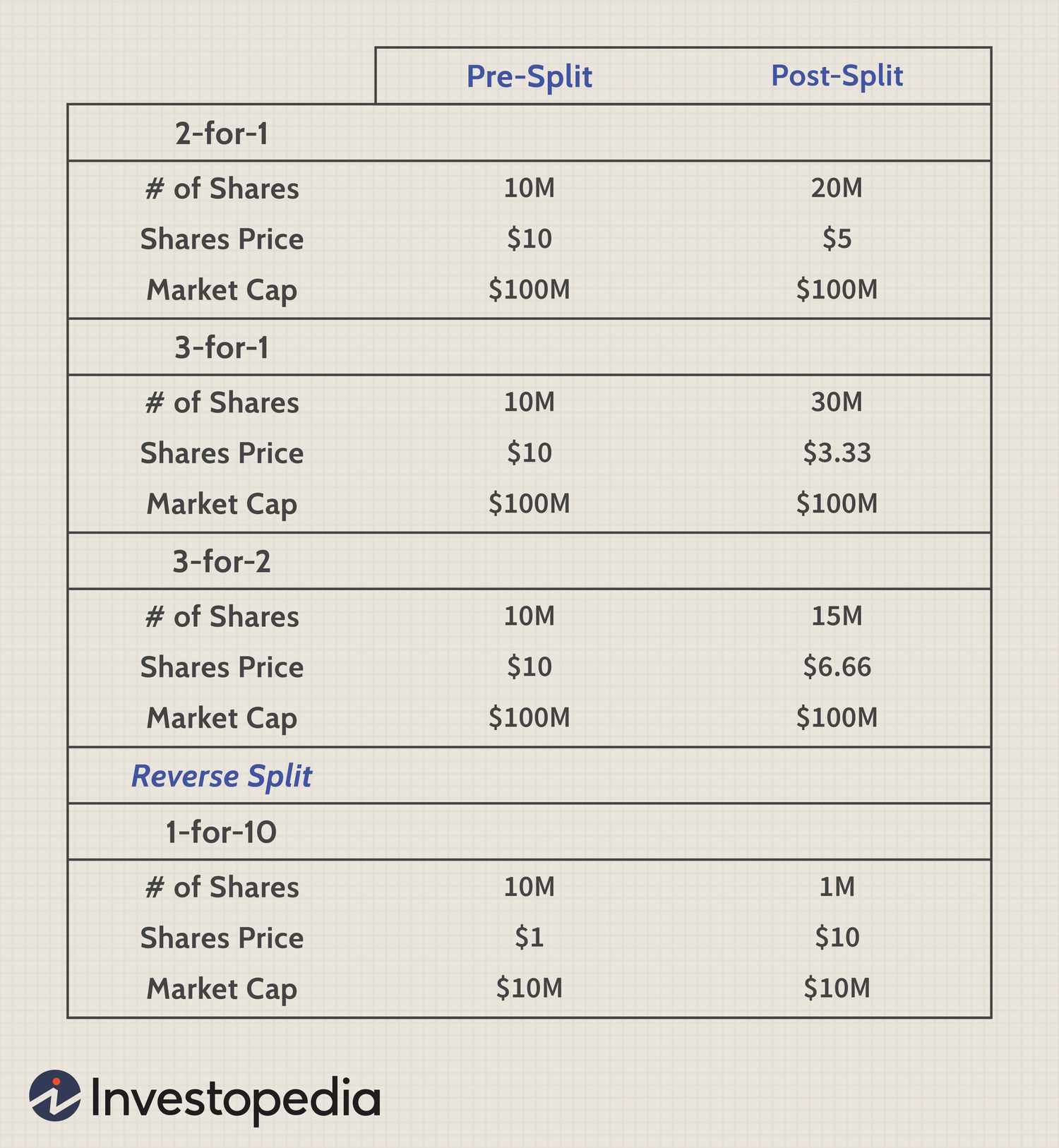

A stock split is a corporate action in which a company divides its existing shares into multiple shares. The total market capitalization remains the same, but the number of outstanding shares increases. Stock splits are typically expressed as a ratio, such as 2-for-1 or 3-for-1, indicating the number of shares a shareholder will receive for each share they own.

Reasons for Stock Splits:

1. Liquidity Enhancement:

One of the primary reasons companies execute stock splits is to increase liquidity in their shares. By increasing the number of outstanding shares, a stock becomes more accessible to a broader range of investors. This increased liquidity can lead to more activity in the stock, potentially attracting more investors and improving overall market efficiency.

2. Lowering Share Price:

Stock splits are often used to lower the share price of a company’s stock. A lower share price can make the stock more affordable for individual investors, leading to increased demand. This can result in a broader shareholder base and potentially drive up the stock price over time.

3. Psychological Impact:

Stock splits can also have a psychological impact on investors. When a stock splits, it can create the perception that the stock is more affordable or undervalued. This perception can attract new investors who may be hesitant to buy a higher-priced stock.

Impact on Investors:

1. Increased Market Participation:

With a stock split, more shares become available, making it easier for individual investors to enter the market. This increased market participation can lead to higher trading volumes and improved liquidity, benefiting both existing and new investors.

2. Potential for Price Appreciation:

While a stock split does not directly impact the fundamental value of a company, it can create an atmosphere of excitement and confidence among investors. This positive sentiment, combined with increased market activity, can contribute to upward pressure on the stock price.

3. Dividend Adjustments:

When a company executes a stock split, they may need to adjust their dividend payout to maintain a consistent yield. If the split results in a lower share price, the company might increase the dividend per share to offset the decrease in price. This adjustment can be an additional benefit for dividend-seeking investors.

4. Tax Implications:

Stock splits generally have no immediate tax consequences for shareholders. The cost basis per share is adjusted proportionally to reflect the split, ensuring that the total investment value remains the same. However, tax implications can arise when shares are sold in the future, as the adjusted cost basis will affect capital gains or losses.

Case Study: Apple Inc.

To provide a real-life example, let’s look at the stock split of Apple Inc. In August 2020, Apple executed a 4-for-1 stock split. Prior to the split, each share was trading at around $500. After the split, shareholders received three additional shares for each share they owned, and the stock price adjusted accordingly.

The impact of the split was significant. While the split did not change Apple’s market capitalization, it made the stock more affordable for individual investors. The lower share price attracted more buyers, increasing demand and subsequently driving up the stock price. This price appreciation benefited existing shareholders and attracted new investors to the company.

Conclusion:

Stock splits are a common occurrence in the financial world, and understanding their impact is crucial for investors. By increasing liquidity, lowering share prices, and creating a psychological impact, stock splits can drive market participation, potentially lead to price appreciation, and affect dividend payouts. It is essential for investors to stay informed about stock splits, as they can offer opportunities for both existing and new shareholders.

FAQs:

1. Are stock splits a sign of a healthy company?

Stock splits are not necessarily an indication of a company’s financial health. While they can be a positive signal, companies may choose to split their stock for various reasons, including liquidity enhancement and psychological factors.

2. Do stock splits always lead to a higher stock price?

While stock splits can contribute to increased demand and potentially drive up the stock price, there is no guarantee that the price will rise. Stock prices are influenced by various factors, including market conditions, company performance, and investor sentiment.

3. Can stock splits occur in both up and down markets?

Yes, stock splits can occur in both up and down markets. The decision to execute a stock split is typically based on the company’s strategic considerations and not directly tied to market conditions.

4. Will I receive more dividends after a stock split?

The dividend payout per share may be adjusted after a stock split to maintain a consistent yield. However, the total dividend payout received by an investor will typically remain the same.

Stock Splits Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a stock split?

A stock split is a corporate action where a company divides its existing shares into multiple shares. For example, in a 2-for-1 stock split, each shareholder would receive two shares for every one share they owned before the split. The total value of the investment remains the same, but the number of shares increases, effectively reducing the price per share.

Why do companies choose to do a stock split?

Companies often choose to do a stock split to make their shares more affordable and accessible to a wider range of investors. By lowering the price per share, a company can attract new investors who may have been deterred by a higher share price. Additionally, a stock split can increase the liquidity of the company’s shares in the market.

What is the impact of a stock split on existing shareholders?

A stock split does not change the total value of an investor’s holdings. While the number of shares increases, the price per share decreases proportionally. Therefore, existing shareholders will own more shares, but the value of each share will be adjusted accordingly. Essentially, the split has a neutral impact on the value of the investment.

Does a stock split affect the company’s market capitalization?

No, a stock split does not have any impact on the company’s market capitalization. Market capitalization is calculated by multiplying the number of outstanding shares by the current market price per share. Since both the number of shares and the price per share are adjusted proportionally in a stock split, the market capitalization remains the same.

Is a stock split a positive sign for investors?

A stock split itself is not an indication of the company’s performance or future prospects. It is simply a corporate action to adjust the share price and increase accessibility. However, a stock split can sometimes be viewed positively by investors as it may attract more attention and potentially increase liquidity in the stock, which can be beneficial for long-term investors.

Can a stock split impact the price volatility of a stock?

Stock splits generally do not have a direct impact on the price volatility of a stock. The volatility is influenced by various factors such as market conditions, company performance, and investor sentiment. While a stock split may attract more investors and potentially increase trading activity, it does not directly affect the inherent volatility of the stock.

Do all companies choose to do stock splits?

No, not all companies choose to do stock splits. It is a decision made by individual companies based on their specific circumstances and objectives. Some companies may prefer to maintain a higher share price to project an image of exclusivity or to meet certain listing requirements. Stock splits are more common among companies with higher share prices.

Are there any risks associated with a stock split?

There are generally no significant risks associated with a stock split itself. However, it is important for investors to consider the reasons behind the stock split and evaluate the overall health and performance of the company. It is also advisable to assess the potential impact on liquidity and trading volume, as well as the company’s long-term growth prospects, before making investment decisions.

Final Thoughts

Understanding the stock split and its impact is crucial for investors. A stock split occurs when a company divides its existing shares into multiple shares. This division increases the number of outstanding shares but reduces the price of each share proportionally. The main goal of a stock split is to make the shares more affordable to a wider range of investors. By reducing the share price, companies hope to increase liquidity and attract new investors. Furthermore, a stock split can often result in increased trading volume and market activity. Overall, understanding the stock split and its impact is essential for investors looking to make informed decisions in the stock market.