The subprime mortgage crisis, a complex event that shook the global economy, is not easily understood. But fear not, for this article is here to help you navigate the murky waters of this crisis. So, what exactly is the subprime mortgage crisis? Well, simply put, it refers to the collapse of the housing market in the late 2000s, triggered by an onslaught of mortgage defaults. But there’s much more to it than meets the eye. Let’s delve into the depths of this crisis to get a clear understanding of what really happened.

Understanding the Subprime Mortgage Crisis

Introduction:

The subprime mortgage crisis, which unfolded in the late 2000s, had a significant impact on global financial markets and led to the Great Recession. This crisis exposed the vulnerabilities in the housing and financial sectors, causing millions of homeowners to face foreclosure and resulting in widespread economic turmoil. In this article, we will delve into the subprime mortgage crisis, its causes, consequences, and the lessons learned from this devastating event.

I. What is a Subprime Mortgage?

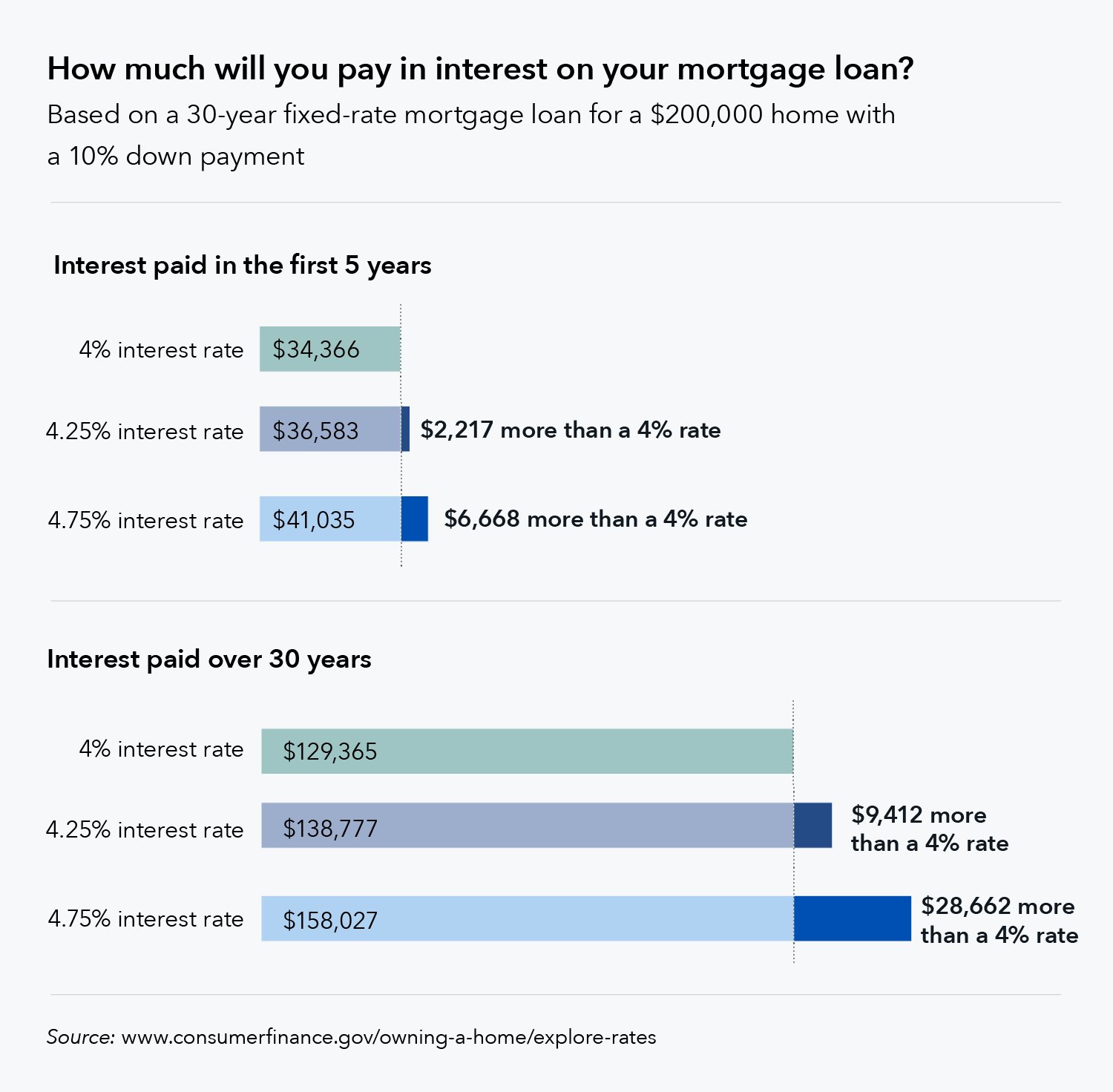

A subprime mortgage is a type of loan offered to borrowers who have less-than-perfect credit scores or limited financial resources. These loans carry higher interest rates than prime mortgages due to the increased risk associated with lending to borrowers with a higher likelihood of default. Subprime mortgages typically have more flexible lending criteria, allowing borrowers with lower credit scores to become homeowners.

II. Understanding the Housing Bubble

A. Causes of the Housing Bubble

1. Low Interest Rates: The Federal Reserve lowered interest rates in the early 2000s to stimulate economic growth after the dot-com bubble burst. This led to a surge in demand for housing, as borrowing became more affordable.

2. Loose Lending Standards: Lenders relaxed their lending criteria, allowing borrowers to obtain mortgages with minimal income verification or down payment requirements. This fueled the housing market’s rapid expansion and encouraged excessive borrowing.

3. Speculative Investing: Investors, driven by the expectation of high returns, started buying houses and properties with the intention of quick resale for profit. This speculative behavior further inflated housing prices.

B. Consequences of the Housing Bubble

1. Overvaluation of Housing: The influx of demand and speculative investing caused housing prices to skyrocket, surpassing their true market values. This created a housing bubble, where prices became detached from the actual worth of the properties.

2. Increased Risk in Financial Institutions: Financial institutions, enticed by the prospect of large profits, began offering subprime mortgages without fully understanding the risks involved. These risky assets were bundled together and sold as mortgage-backed securities (MBS) to investors, spreading the risk throughout the financial system.

III. The Unraveling of the Subprime Mortgage Crisis

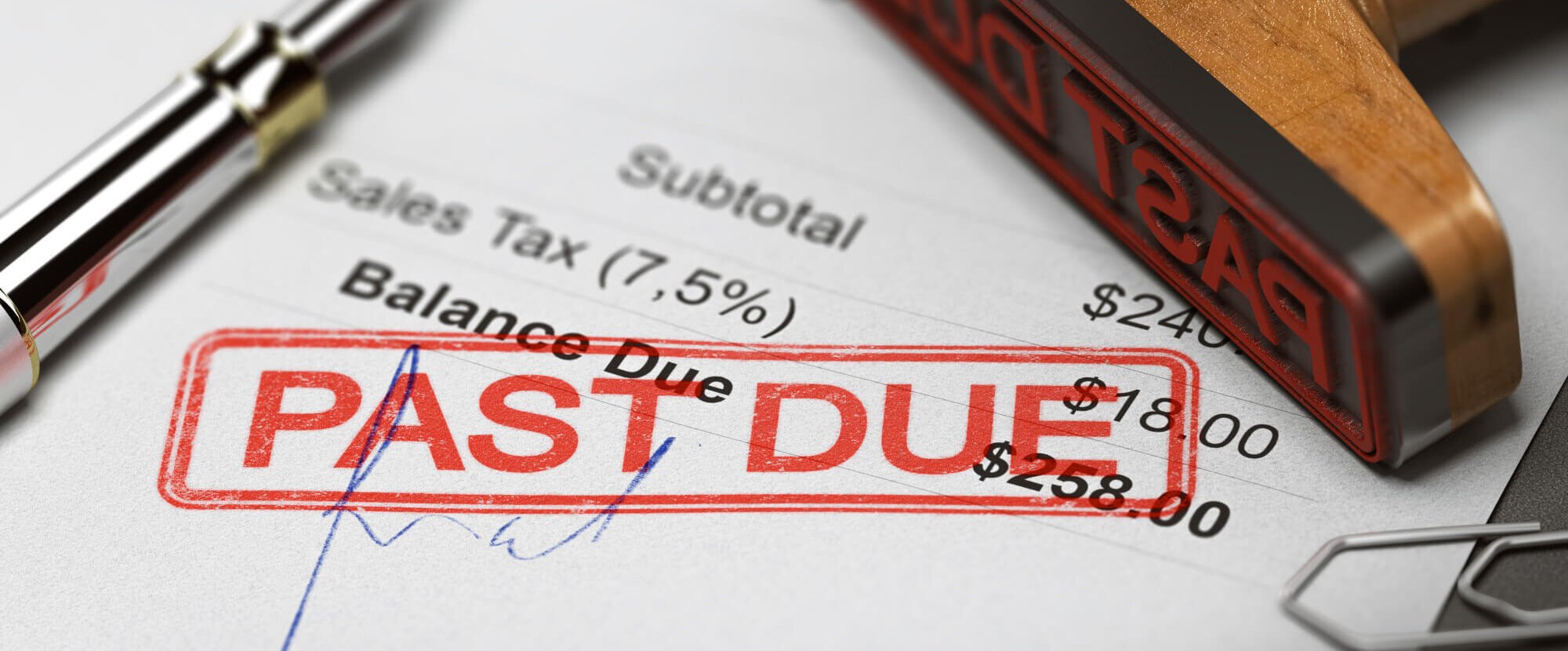

A. Subprime Mortgage Defaults

1. Resetting Adjustable-Rate Mortgages: Many subprime mortgages had initially low teaser rates, which reset to significantly higher rates after an introductory period. As interest rates increased, borrowers struggled to make monthly mortgage payments, leading to a surge in defaults and foreclosures.

2. Negative Equity: During the housing bubble, homeowners took advantage of rising prices to borrow against their homes’ values. However, when the bubble burst, many homeowners found themselves owing more on their mortgages than the actual value of their properties, leading to widespread negative equity and defaults.

B. Collapse of Financial Institutions

1. Global Financial Crisis: The subprime mortgage crisis exposed the true extent of the financial system’s vulnerability. As default rates rose, the value of mortgage-backed securities plummeted, causing significant losses for investors and financial institutions.

2. Bank Failures and Bailouts: Major financial institutions faced insolvency, requiring government intervention and bailouts to prevent a complete collapse of the financial system. Lehman Brothers, one of the largest investment banks, filed for bankruptcy, triggering a global financial panic.

IV. Lessons Learned and Reforms Implemented

A. Tighter Lending Standards

1. Stricter Mortgage Regulations: In response to the crisis, regulatory agencies implemented new rules to ensure that lenders adhere to more rigorous lending standards. This included income verification, higher credit score requirements, and reduced loan-to-value ratios.

2. Ability-to-Repay Rule: The Dodd-Frank Wall Street Reform and Consumer Protection Act introduced the ability-to-repay rule, which mandates lenders to assess a borrower’s ability to repay a mortgage before granting the loan.

B. Enhanced Risk Management Practices

1. Improved Risk Assessment: Financial institutions have incorporated more sophisticated risk management models to evaluate the creditworthiness of borrowers and the potential risks associated with mortgage-backed securities.

2. Strengthened Capital Requirements: Regulatory bodies increased capital requirements for financial institutions to ensure they have enough capital to withstand economic downturns and safeguard against potential losses.

V. Conclusion:

The subprime mortgage crisis was a watershed moment in global finance, exposing the vulnerabilities in the housing and financial sectors. Loose lending standards, speculative investing, and the bursting of the housing bubble led to a surge in defaults and foreclosures, causing a domino effect on financial institutions. However, the crisis also prompted regulatory reforms to tighten lending standards and improve risk management practices. By understanding the subprime mortgage crisis, we can learn valuable lessons to prevent similar events in the future and foster a more stable and resilient financial system.

Good Explanation of the Subprime Mortgage Crisis

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the subprime mortgage crisis?

The subprime mortgage crisis refers to a period in the late 2000s when there was a significant increase in mortgage defaults, particularly among borrowers with subprime, or less than ideal, credit. This crisis led to a collapse in the housing market and had a profound impact on the global economy.

What caused the subprime mortgage crisis?

The subprime mortgage crisis was caused by a combination of factors. One key factor was the relaxed lending standards that allowed borrowers with poor credit histories to obtain mortgages. This led to a high number of risky loans being issued. Additionally, the creation and sale of complex financial products based on these risky loans further exacerbated the crisis when the housing market collapsed.

How did the subprime mortgage crisis impact the economy?

The subprime mortgage crisis had a widespread impact on the economy. The collapse of the housing market led to a sharp decline in real estate values, causing many homeowners to lose a significant portion of their wealth. This, in turn, led to a decrease in consumer spending, which is a major driver of economic growth. The crisis also resulted in extensive job losses and had a ripple effect on various industries, contributing to the global financial downturn.

Who was most affected by the subprime mortgage crisis?

The subprime mortgage crisis had the most severe impact on borrowers with subprime credit who were unable to afford their mortgage payments. Many of these borrowers faced foreclosure or had to sell their homes at significant losses. However, the crisis also affected financial institutions, as many of them held mortgage-backed securities that became worthless when borrowers defaulted on their loans.

How did the government respond to the subprime mortgage crisis?

In response to the subprime mortgage crisis, the government implemented various measures to stabilize the economy. These included the creation of programs to help struggling homeowners modify their mortgages and prevent foreclosures. Additionally, financial institutions were subjected to increased regulation and oversight to prevent similar crises in the future.

What lessons were learned from the subprime mortgage crisis?

The subprime mortgage crisis highlighted the importance of responsible lending practices and the need for strong regulation in the financial sector. It demonstrated the dangers of excessive risk-taking and the potential for a housing bubble to burst. The crisis also underscored the interconnectedness of the global economy and the need for coordinated responses to address financial crises.

How long did it take for the housing market to recover from the subprime mortgage crisis?

The recovery of the housing market from the subprime mortgage crisis varied across different regions. In some areas, it took several years for home prices to stabilize and start to rise again. In other regions, the recovery was relatively quicker. Overall, it took several years for the housing market to fully recover from the effects of the crisis.

What are the current regulations in place to prevent another subprime mortgage crisis?

Since the subprime mortgage crisis, there have been several regulatory reforms to mitigate the risk of another crisis. These include stricter lending standards, increased transparency in financial transactions, and more rigorous oversight of financial institutions. Additionally, measures have been taken to strengthen consumer protection and ensure that borrowers have access to clear and accurate information when obtaining mortgages.

Final Thoughts

Understanding the subprime mortgage crisis is crucial in comprehending the factors that led to one of the most significant financial downturns in recent history. The crisis originated from a combination of predatory lending practices, low interest rates, and a housing bubble that eventually burst. Many borrowers with poor credit histories were approved for loans, which created a high risk of defaults. As a result, when housing prices plummeted, numerous homeowners found themselves owing more than their homes were worth. This led to a wave of foreclosures, bank failures, and ultimately, a global financial crisis. Understanding the subprime mortgage crisis helps us to evaluate the importance of responsible lending practices and regulatory oversight to prevent such economic disruptions in the future.