Investing can be an exciting and potentially rewarding endeavor, but it also comes with its fair share of risks. Understanding various types of investment risks is crucial for any investor looking to navigate the unpredictable world of finance. So, what exactly are these risks? How do they affect your investment decisions? In this article, we will delve into the different types of investment risks you may encounter and provide insights to help you make informed choices. Whether you’re a novice investor or a seasoned pro, gaining a thorough understanding of investment risks is paramount to safeguarding your financial future.

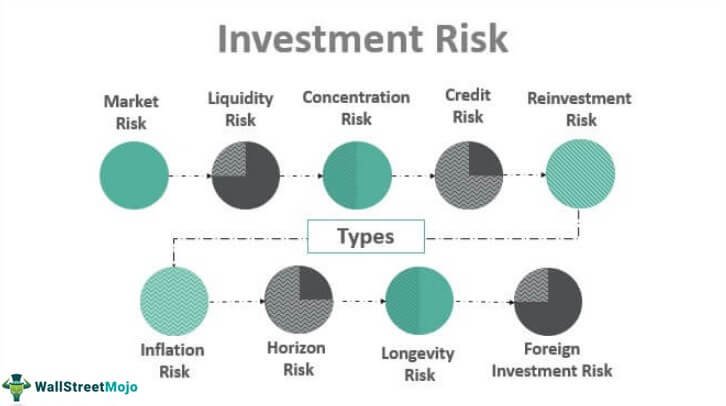

Understanding Various Types of Investment Risks

Investing can be a great way to grow your wealth and secure your financial future. However, it is important to understand that all investments come with some level of risk. By fully comprehending the various types of investment risks, you can make informed decisions that align with your risk tolerance and financial goals. In this article, we will explore the different types of investment risks, including market risk, inflation risk, interest rate risk, credit risk, and liquidity risk.

Market Risk

Market risk refers to the potential for investments to decline in value due to market-wide factors. This risk is primarily associated with fluctuations in the overall stock market, which can be influenced by economic conditions, geopolitical events, and investor sentiment. It affects all types of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Here are some key points to understand about market risk:

- Market risk is unpredictable and can result in both positive and negative returns.

- Investors with a long-term investment horizon may be better positioned to weather market fluctuations.

- Diversification across different asset classes can help mitigate market risk.

- Understanding the historical performance and volatility of specific investments is crucial in assessing their market risk.

Inflation Risk

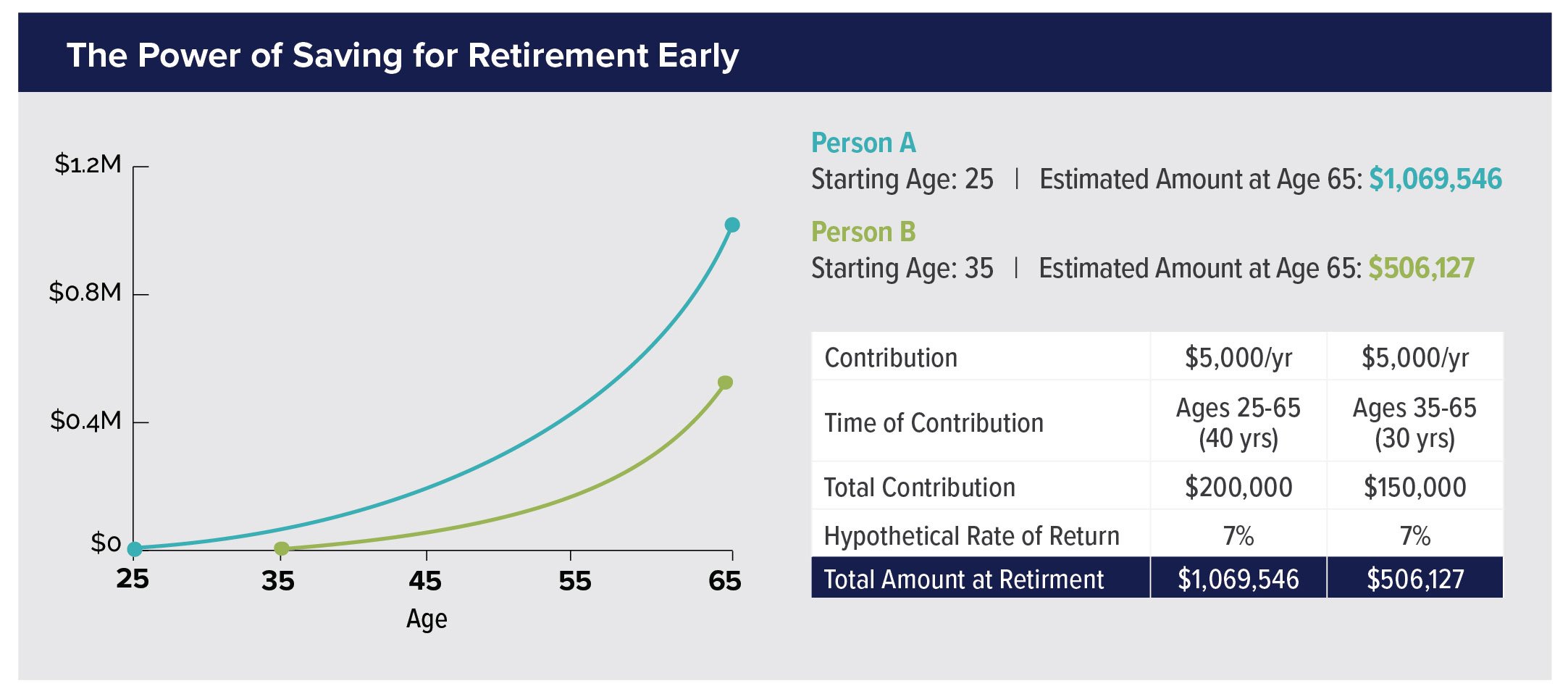

Inflation risk, also known as purchasing power risk, refers to the potential for the value of money to erode over time. As the general level of prices rises, each unit of currency buys fewer goods and services. This risk can have a significant impact on the performance of investments, particularly those with fixed interest rates or returns. Here are some important considerations regarding inflation risk:

- Investments that offer returns below the inflation rate may result in a loss of purchasing power.

- Assets such as stocks and real estate have historically outperformed inflation over the long term.

- Investors can hedge against inflation by diversifying their investments across various asset classes.

- Monitoring inflation rates and adjusting investment strategies accordingly is essential.

Interest Rate Risk

Interest rate risk refers to the potential for changes in interest rates to affect the value of fixed-income investments. When interest rates rise, existing bonds with lower interest rates become less attractive to investors. This can lead to a decline in bond prices. Conversely, when interest rates fall, existing bonds with higher interest rates may increase in value. Consider the following points about interest rate risk:

- Bond prices and interest rates have an inverse relationship.

- Long-term bonds are typically more sensitive to interest rate changes than short-term bonds.

- Investors can manage interest rate risk by diversifying bond holdings and staying informed about market conditions.

- Other investments, such as stocks, can also be indirectly affected by changes in interest rates.

Credit Risk

Credit risk, also known as default risk, is the potential for a borrower or issuer to fail to make timely payments of interest or principal on their debt obligations. It primarily affects investments in corporate bonds, municipal bonds, and other fixed-income securities. Understanding credit risk is crucial when evaluating the stability of potential investments. Consider the following points about credit risk:

- Investments with higher credit risk typically offer higher yields or interest rates to compensate for the added risk.

- Rating agencies assess the creditworthiness of issuers and assign credit ratings to help investors evaluate credit risk.

- Diversifying bond holdings across issuers and industries can help mitigate credit risk.

- Investors should regularly monitor the financial health of issuers and any changes in their credit ratings.

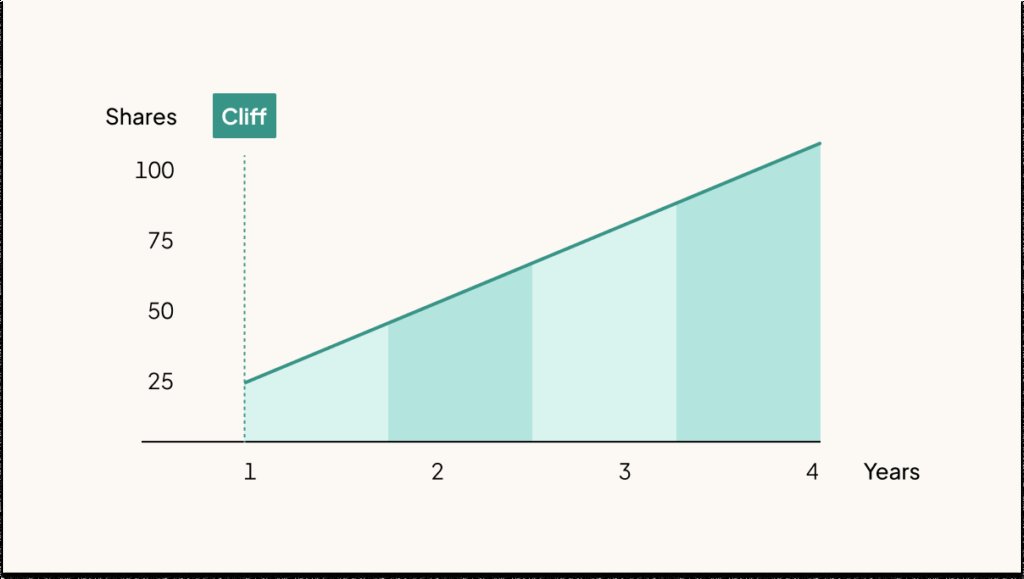

Liquidity Risk

Liquidity risk refers to the potential for an investment to be difficult to sell or convert into cash without incurring a significant loss. It is particularly relevant for investments in less-traded securities, such as certain stocks, bonds, or alternative investments. Understanding liquidity risk is essential to ensure that you can access your investment funds when needed. Consider the following points about liquidity risk:

- Investments with higher liquidity risk may offer higher potential returns due to the associated challenges.

- Less liquid investments may require holding periods or penalties for early withdrawal.

- Diversifying investments across different asset classes can help manage liquidity risk.

- Investors should consider their short-term and long-term liquidity needs when making investment decisions.

In conclusion, understanding the various types of investment risks is crucial for any investor. By being aware of market risk, inflation risk, interest rate risk, credit risk, and liquidity risk, you can make informed investment choices that align with your financial goals and risk tolerance. Remember that diversification and staying informed about market conditions are essential strategies to manage these risks effectively. Stay diligent, continuously educate yourself, and consult with a financial advisor to make informed investment decisions.

Investment Risk and Its Types

Investment Risk and Its Types

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the different types of investment risks?

Investment risks can include market risk, inflation risk, interest rate risk, credit risk, liquidity risk, and political risk.

How does market risk affect investments?

Market risk refers to the possibility of losing money due to changes in the overall market conditions, such as fluctuations in stock prices or market downturns. It affects various types of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

What is inflation risk and how does it impact investments?

Inflation risk is the potential loss of purchasing power due to the eroding value of money over time. Investments that fail to keep pace with inflation can result in a decrease in real returns. It is crucial to consider investments that provide a hedge against inflation, such as real estate or inflation-protected securities.

How does interest rate risk affect investment portfolios?

Interest rate risk refers to the impact of changing interest rates on the value of fixed-income investments, such as bonds and certificates of deposit (CDs). When interest rates rise, the value of existing fixed-rate bonds decrease, which can lead to losses for investors.

What is credit risk and how does it affect investments?

Credit risk is the risk of a borrower defaulting on their debt obligations. It primarily affects investments in bonds or other fixed-income securities. Investors who hold bonds issued by entities with low credit ratings face a higher risk of default and potential loss of principal.

What is liquidity risk and why is it important to consider?

Liquidity risk refers to the possibility of not being able to sell an investment quickly and at a fair price. Investments with low liquidity may have limited buyers, resulting in potential delays or even losses when trying to sell. It is important to assess the liquidity of an investment before committing funds.

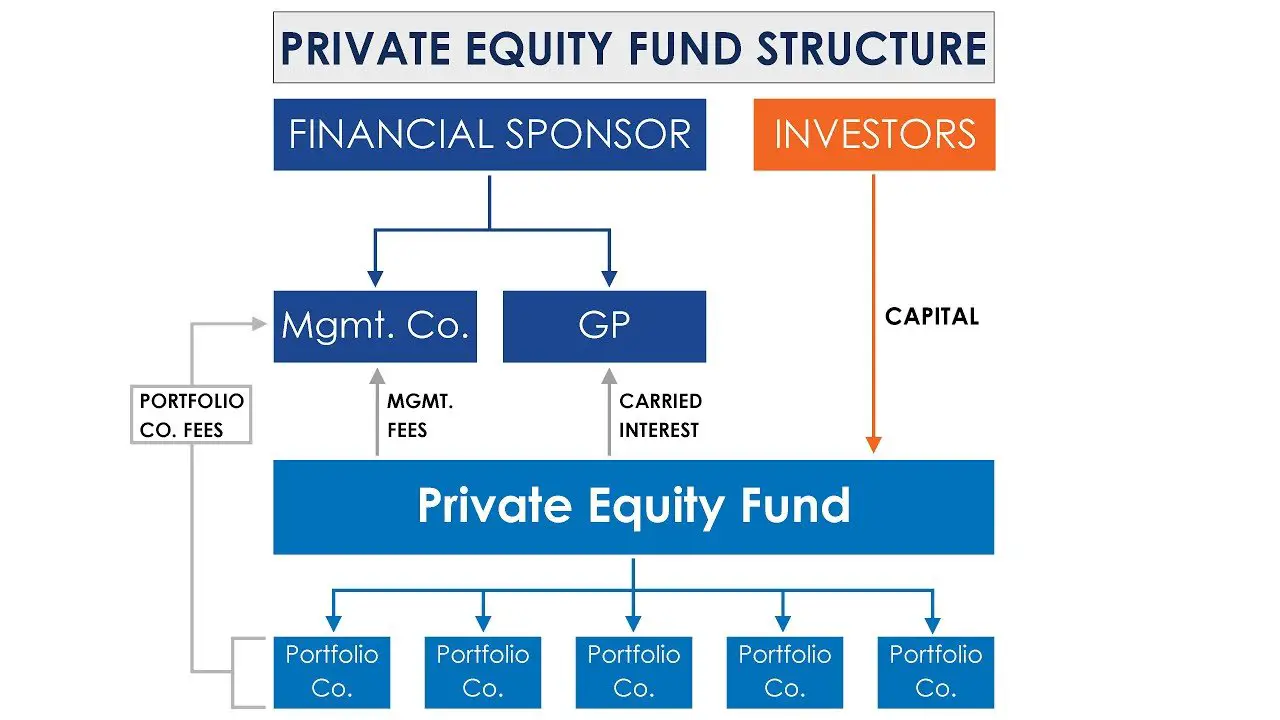

How does political risk impact investments?

Political risk relates to the potential impact of political changes or instability on investments. Factors such as changes in government policies, regulations, or geopolitical conflicts can lead to increased uncertainty and potential losses for investors in affected regions or industries.

Are there ways to mitigate investment risks?

Yes, there are several strategies to mitigate investment risks. Diversification, where you spread your investments across different asset classes and industries, is one effective approach. Additionally, conducting thorough research, staying updated on market trends, and seeking professional advice can help minimize risks.

Final Thoughts

Understanding various types of investment risks is essential for any investor. It enables individuals to make informed decisions and minimize potential losses. By assessing risks such as market volatility, inflation, credit default, and liquidity, investors can develop strategies to mitigate these challenges. Additionally, understanding the risk-return relationship helps investors align their investment goals with their risk tolerance. Proper risk management is crucial to achieving long-term financial objectives and maximizing returns. Overall, comprehending the various types of investment risks empowers investors to navigate the complex world of finance confidently.