Alternative investments offer a unique opportunity to diversify your portfolio beyond traditional stocks and bonds. Wondering what are alternative investments and their risks? Well, these investments encompass a wide range of assets, such as real estate, commodities, private equity, hedge funds, and more. Unlike traditional investments, alternative investments often require a different set of strategies and carry their own set of risks. In this article, we will delve into the world of alternative investments, explore their risks, and provide insights on how to navigate this exciting yet challenging landscape. So, let’s dive in!

What Are Alternative Investments and Their Risks?

When it comes to investing, most people are familiar with traditional options such as stocks, bonds, and cash. However, there is another category of investment known as alternative investments. These investment options are different from the traditional ones and can provide diversification and potentially higher returns. In this article, we will explore what alternative investments are and the risks associated with them.

Different Types of Alternative Investments

Alternative investments encompass a wide range of assets that are not typically found in traditional investment portfolios. Some of the common types of alternative investments include:

1. Real Estate

Real estate investments involve purchasing and owning properties, such as residential homes, commercial buildings, or even vacant land. Investors can generate income through rental payments or make profits by buying and selling properties.

2. Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold, such as precious metals, oil, natural gas, or agricultural products like wheat or cotton. Investing in commodities can provide a hedge against inflation and diversify a portfolio.

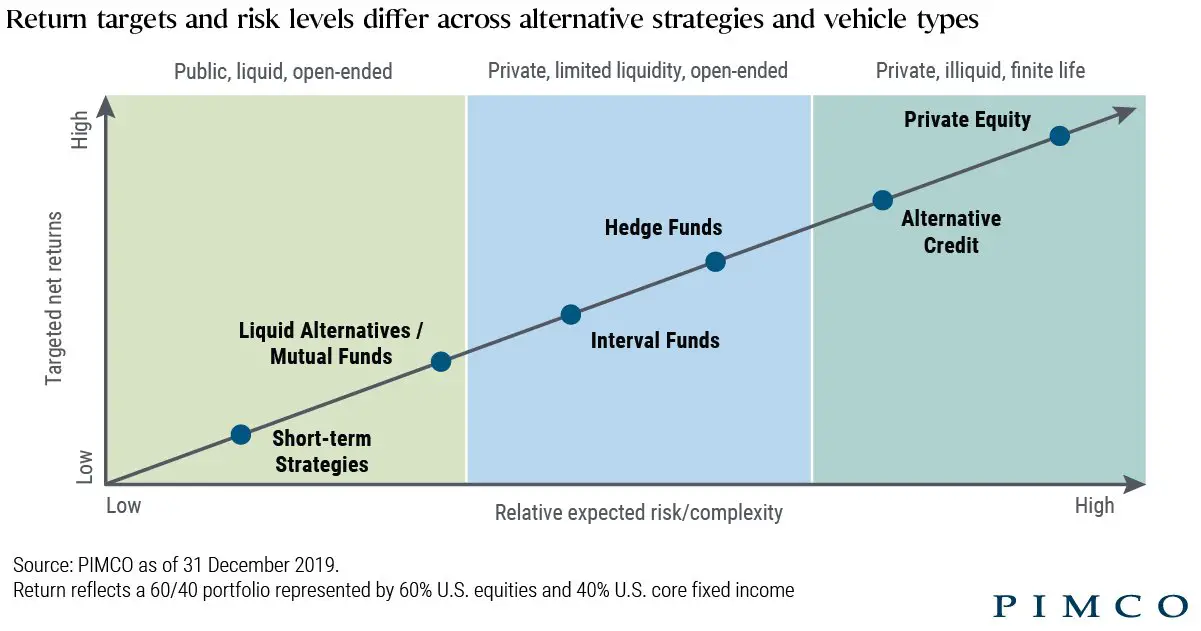

3. Hedge Funds

Hedge funds pool money from multiple investors and use various investment strategies to generate returns. These funds can invest in a wide range of assets, including stocks, bonds, derivatives, and real estate. Hedge funds are typically available only to accredited investors due to their complexity and high investment minimums.

4. Private Equity

Private equity involves investing in private companies or acquiring stakes in existing companies that are not publicly traded. Investors typically provide capital to these companies in exchange for an ownership interest. Private equity investments are often made by institutional investors and high-net-worth individuals.

5. Venture Capital

Venture capital focuses on investing in early-stage and high-growth potential companies that are typically not yet profitable. These investments carry a higher risk but can offer substantial returns if the invested company succeeds. Venture capital is commonly associated with technology startups and innovative businesses.

6. Cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum, and others have gained popularity as an alternative investment option. These digital assets are decentralized and rely on blockchain technology. Cryptocurrencies are known for their volatility and speculative nature, offering the potential for significant gains but also carrying high risks.

The Risks of Alternative Investments

While alternative investments can provide diversification and potentially higher returns, they also come with unique risks that investors need to consider. These risks include:

1. Illiquidity

Many alternative investments, such as real estate or private equity, have a long-term nature and can be challenging to sell quickly. Unlike stocks or bonds that can be easily traded on stock exchanges, alternative investments often require a longer holding period, limiting your ability to access your funds when needed.

2. Volatility

Certain alternative investments, such as commodities or cryptocurrencies, can be highly volatile. Prices can fluctuate significantly within a short period, resulting in substantial gains or losses. Investors need to be prepared for the potential ups and downs associated with these investments.

3. Lack of Transparency

Alternative investments, particularly hedge funds and private equity, are generally less regulated and less transparent compared to traditional investments. Investors may not have access to detailed information about the investments held by these funds, making it challenging to assess the level of risk and performance accurately.

4. Complexity

Alternative investments often involve complex structures and strategies. Understanding the intricacies of these investments requires a higher level of financial knowledge and expertise. Investors may need to rely on professional advice or work with specialized investment managers to navigate the complexities effectively.

5. High Minimum Investments

Some alternative investments, such as hedge funds and private equity, often come with high minimum investment requirements. This can limit access to these investment opportunities for smaller or individual investors who may not meet the minimum thresholds.

6. Lack of Regulation

Compared to traditional investments that are subject to extensive regulations, alternative investments often have fewer regulatory requirements. This lack of oversight can expose investors to a higher risk of fraud, mismanagement, or improper practices. Due diligence becomes essential when considering alternative investments.

Alternative investments can be an attractive option for investors looking to diversify their portfolios and potentially enhance returns. However, it is crucial to understand the risks associated with these investments. Illiquidity, volatility, lack of transparency, complexity, high minimum investments, and limited regulation are some of the risks that investors need to carefully consider. Before investing in alternative assets, it is advisable to assess your risk tolerance, seek professional advice, and conduct thorough research to make informed investment decisions.

Alternative Investments Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are alternative investments and their risks?

Alternative investments refer to non-traditional investment assets that differ from traditional stocks, bonds, and cash. They include assets such as hedge funds, private equity, real estate, commodities, and more. While alternative investments can offer potential benefits, they also come with their own set of risks. It’s important to understand these risks before considering alternative investments.

What are the main risks associated with alternative investments?

Alternative investments carry several risks, including:

- Higher volatility: Alternative investments can be more volatile than traditional assets due to factors like limited liquidity and market fluctuations.

- Lack of transparency: Some alternative investments have limited disclosure requirements, making it difficult for investors to assess their true value.

- Higher fees: Alternative investments often have higher management and performance fees compared to traditional investments.

- Limited regulation: Unlike traditional investments, alternative investments are subject to less regulatory oversight, increasing the potential for fraud and market manipulation.

Are alternative investments suitable for all investors?

No, alternative investments may not be suitable for all investors. They often have higher risk profiles and require a deeper understanding of the asset class. It’s crucial for individuals to assess their investment goals, risk tolerance, and overall financial situation before considering alternative investments.

How can investors mitigate the risks associated with alternative investments?

While it’s impossible to eliminate all risks, investors can take certain steps to mitigate them:

- Diversification: Spreading investments across different alternative asset classes can help reduce risk exposure.

- Thorough research: Conducting extensive due diligence on the investment opportunity, including the fund manager’s track record and investment strategy, can provide valuable insights.

- Working with professionals: Consulting with financial advisors or experts who specialize in alternative investments can help navigate the complexities and mitigate risk.

What are some examples of alternative investments?

Alternative investments encompass a wide range of assets, including:

- Hedge funds

- Private equity

- Venture capital

- Real estate investment trusts (REITs)

- Commodity futures

- Art and collectibles

- Cryptocurrencies

Can alternative investments provide better returns compared to traditional investments?

Alternative investments have the potential to deliver higher returns compared to traditional investments. However, it’s important to note that higher returns often come with higher risks. Past performance does not guarantee future results, so careful consideration and due diligence are necessary before investing in alternative assets.

What role do alternative investments play in portfolio diversification?

Alternative investments play a crucial role in portfolio diversification. By adding non-traditional assets to a portfolio, investors can reduce their dependence on traditional stock and bond markets. This diversification can potentially enhance risk-adjusted returns and provide a hedge against market volatility.

How can I get started with alternative investments?

Getting started with alternative investments involves several steps:

- Educate yourself: Learn about different alternative asset classes, their characteristics, and associated risks.

- Assess risk tolerance: Evaluate your risk tolerance to determine the level of exposure you are comfortable with.

- Consult professionals: Seek advice from financial advisors or investment experts who specialize in alternative investments.

- Research investment opportunities: Conduct thorough research into specific alternative investments before making any decisions.

- Monitor and manage: Regularly review and monitor your alternative investments to ensure they align with your investment goals.

Final Thoughts

Alternative investments are a diverse range of investment options beyond traditional stocks, bonds, and cash. They can include real estate, private equity, hedge funds, commodities, and more. While these investments offer potential for higher returns, they also carry unique risks. One risk is liquidity, as alternative investments may not be easily bought or sold. Another risk is higher volatility, as they can be subject to market fluctuations or changes in investor sentiment. Additionally, alternative investments may have higher fees and require a longer time horizon. Therefore, it is crucial for investors to carefully assess the risks involved and diversify their portfolio accordingly when considering alternative investments.