Looking for a way to diversify your investment portfolio? Curious about asset-backed securities (ABS) and how they work? Look no further! In this article, we’ll delve into the world of ABS and uncover what they are, how they function, and why they can be a valuable addition to your investment strategy. So, let’s jump right in and explore the fascinating realm of asset-backed securities.

What are Asset-Backed Securities (ABS)?

Asset-backed securities (ABS) are a type of investment product that represent ownership in a pool of underlying assets. These assets can include various forms of debt, such as auto loans, mortgages, credit card receivables, and student loans. ABS are created through a process called securitization, where these financial assets are packaged together and sold to investors.

How Asset-Backed Securities Work

The process of creating asset-backed securities involves several steps:

1. Asset Pooling: The first step in the securitization process is gathering a pool of similar assets. For example, a mortgage lender might pool together a group of mortgages with similar characteristics, such as interest rates and maturities.

2. Special Purpose Vehicle (SPV) Creation: To separate the assets from the originating institution, a Special Purpose Vehicle (SPV) is created. The SPV is a legal entity that holds the assets and issues the ABS to investors.

3. Asset Transfer: The assets are transferred to the SPV, typically in exchange for cash or other forms of consideration. Once the assets are in the SPV, they are no longer on the books of the originating institution.

4. Structuring: The ABS are organized into different tranches, which represent different levels of risk and return. Each tranche has a predefined priority of repayment and corresponding interest rate. Investors can choose the tranches that align with their risk appetite and return expectations.

5. Securities Offering: The ABS are then offered for sale to investors through a securities offering. These offerings can be public or private, depending on the jurisdiction and regulations in place.

6. Payment Structure: The underlying assets generate cash flows, such as monthly mortgage payments or credit card payments. These cash flows are used to make periodic interest and principal payments to the ABS investors.

Benefits of Asset-Backed Securities

Asset-backed securities offer several benefits to both investors and issuers:

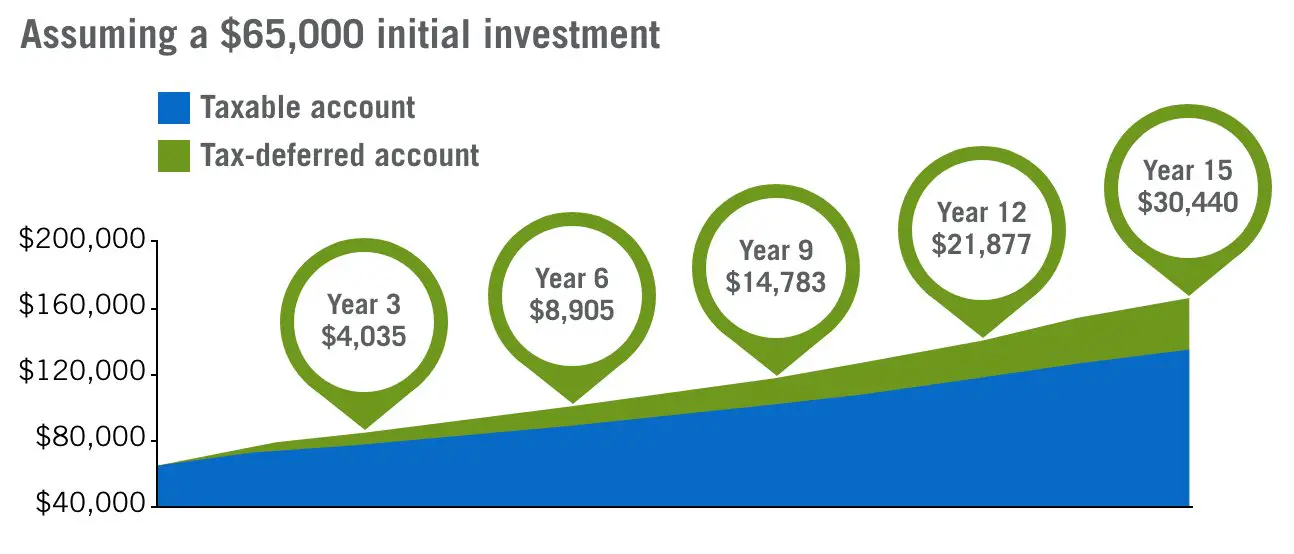

1. Diversification: ABS allow investors to diversify their portfolios by gaining exposure to a pool of different assets. This diversification can help reduce risk since the performance of the ABS is not solely dependent on a single asset.

2. Enhanced Liquidity: By pooling assets and converting them into tradable securities, ABS provide enhanced liquidity. Investors have the ability to buy or sell these securities in secondary markets, providing a more liquid investment compared to holding individual loans.

3. Potential Higher Returns: ABS can offer higher yields compared to traditional fixed-income securities. The different tranches of ABS allow investors to choose the level of risk and return that suits their investment goals.

4. Transfer of Risk: Asset-backed securities enable the transfer of risk from the originating institution to the investors. This helps financial institutions manage their risk exposure and free up capital to support further lending activities.

Types of Asset-Backed Securities

There are various types of asset-backed securities, each backed by different underlying assets:

1. Mortgage-backed Securities (MBS): MBS are asset-backed securities where the underlying assets are residential or commercial mortgages. Investors in MBS receive cash flows from the interest and principal payments made by the mortgage holders.

2. Auto Loan ABS: Auto loan ABS are backed by a pool of auto loans. Payments made by borrowers on their auto loans generate cash flows to the investors of these ABS.

3. Credit Card ABS: Credit card ABS are created by pooling credit card receivables. The cash flows are generated from the interest and principal payments made by credit cardholders.

4. Student Loan ABS: Student loan ABS are backed by pools of student loans. The cash flows come from the monthly payments made by the borrowers.

5. Collateralized Debt Obligations (CDOs): CDOs are asset-backed securities that can include a mix of different types of debt, such as mortgages, auto loans, and credit card receivables. These securities are organized into different tranches with varying levels of risk and return.

Risks Associated with Asset-Backed Securities

While asset-backed securities offer attractive benefits, it’s important to understand the associated risks:

1. Credit Risk: The performance of ABS is closely tied to the creditworthiness of the underlying assets. If the borrowers default on their loans, it can impact the cash flows and the ability of the ABS to make interest and principal payments to investors.

2. Interest Rate Risk: Changes in interest rates can affect the value and performance of ABS. For example, if interest rates rise, the value of fixed-rate ABS may decrease, making them less attractive to investors.

3. Liquidity Risk: Market conditions can impact the liquidity of asset-backed securities. During periods of market stress, it may become challenging to buy or sell ABS, which can result in higher transaction costs or difficulty in exiting an investment.

4. Prepayment Risk: For securities backed by loans, such as mortgages, there is a risk of prepayment. If borrowers pay off their loans earlier than expected, it can impact the cash flows and the expected returns for ABS investors.

5. Structural Risk: The structure of the ABS, including the priority of repayment for different tranches, can impact the risk and return characteristics. Understanding the structure is crucial to assessing the potential risks involved.

Asset-backed securities are complex financial instruments that provide investors with exposure to diversified pools of underlying assets. These securities offer benefits such as diversification, enhanced liquidity, and potential higher returns. However, it’s important for investors to be aware of the associated risks, including credit risk, interest rate risk, and liquidity risk. By understanding how asset-backed securities work and conducting thorough analysis, investors can make informed decisions about including ABS in their portfolios.

What are Asset Backed Securities?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are asset-backed securities (ABS)?

Asset-backed securities (ABS) are financial instruments that represent ownership in a pool of assets, such as mortgage loans, auto loans, or credit card receivables. These securities are backed by the cash flows generated from the underlying assets and are typically structured as bonds.

How do asset-backed securities (ABS) work?

Asset-backed securities (ABS) work by pooling together a group of assets, such as loans or receivables, and creating tradable securities backed by the cash flows generated by those assets. These cash flows are then passed through to the investors who hold the securities, providing them with a return on their investment.

What are the benefits of investing in asset-backed securities (ABS)?

Investing in asset-backed securities (ABS) can offer several benefits, including diversification, potentially higher yields compared to traditional bonds, and the opportunity to gain exposure to specific asset classes, such as mortgages or auto loans.

Are asset-backed securities (ABS) risky investments?

Like any investment, asset-backed securities (ABS) carry a certain level of risk. The risk associated with ABS can vary depending on factors such as the quality of the underlying assets, the structure of the securities, and market conditions. It’s important for investors to carefully evaluate the risks before investing in ABS.

Who issues asset-backed securities (ABS)?

Asset-backed securities (ABS) can be issued by various entities, including banks, financial institutions, or special purpose vehicles (SPVs) specifically set up for this purpose. These issuers package the underlying assets and sell the securities to investors in the capital markets.

What is the role of credit enhancements in asset-backed securities (ABS)?

Credit enhancements are mechanisms used to mitigate the risk associated with asset-backed securities (ABS). They can include things like overcollateralization, which is when the value of the underlying assets exceeds the value of the securities issued, or the use of reserve accounts to cover any potential losses.

How can investors evaluate the quality of asset-backed securities (ABS)?

Investors can evaluate the quality of asset-backed securities (ABS) by considering factors such as the creditworthiness of the underlying assets, the historical performance of similar ABS, the issuer’s reputation, and any credit enhancements in place. It’s also important to review the offering documents and any available ratings from credit rating agencies.

Can individual investors buy asset-backed securities (ABS)?

Yes, individual investors can buy asset-backed securities (ABS) through brokerage firms or investment platforms that offer access to the bond market. However, it’s important for individual investors to carefully assess their risk tolerance and investment objectives before investing in ABS.

Final Thoughts

Asset-backed securities (ABS) are financial instruments that offer investors a unique opportunity to diversify their portfolios while also providing a stable income stream. These securities are backed by a pool of underlying assets, such as loans, leases, or receivables, which generate the cash flows necessary for repayment. ABS offer investors the chance to invest in specific sectors, such as real estate or auto loans, and can be an attractive option for those seeking higher returns. Overall, asset-backed securities provide a way for investors to access various asset classes, adding flexibility and potentially higher yields to their investment strategies.