Looking to invest your hard-earned money but unsure about the best options? Well, look no further! Blue-chip stocks are here to provide a secure and lucrative investment opportunity. So, what are blue-chip stocks and their benefits? Blue-chip stocks are shares of large, well-established companies known for their consistent performance and stable earnings. These companies often have a long history of success, making them reliable investments. In this article, we will delve into the world of blue-chip stocks and explore the various benefits they offer to investors. Are you ready to embark on an exciting journey into the world of blue-chip stocks? Let’s dive in!

What are Blue-Chip Stocks and Their Benefits

Blue-chip stocks are considered the crème de la crème of the stock market. These stocks belong to well-established companies with a history of reliable performance, stable earnings, and a strong market presence. Often associated with large-cap companies, blue-chip stocks are known for their stability and reliability. In this article, we will explore what blue-chip stocks are and discuss the various benefits they offer to investors.

The Characteristics of Blue-Chip Stocks

Blue-chip stocks possess certain characteristics that set them apart from other stocks. Understanding these traits can help investors make informed decisions when considering blue-chip stocks.

1. Established and Reputable Companies

Blue-chip stocks are typically associated with established and reputable companies. These companies are often leaders in their respective industries, with decades of successful operation and a proven track record. Examples of blue-chip companies include multinational corporations like Apple, Microsoft, and Coca-Cola.

2. Large Market Capitalization

Blue-chip stocks tend to have a large market capitalization. Market capitalization, or market cap, is calculated by multiplying the number of outstanding shares by the current stock price. Companies with large market capitalizations are often more stable and less volatile, making them attractive to many investors.

3. Consistent Dividend Payments

Many blue-chip stocks offer dividends to their shareholders. Dividends are a distribution of a company’s profits to its shareholders, typically paid quarterly. Blue-chip companies are known for their consistent dividend payments, making them popular among income-focused investors seeking regular cash flow.

4. Resilient Performance

Blue-chip stocks are known for their ability to weather market downturns and economic uncertainties. These companies have proven their resilience over time and have a history of bouncing back from challenging periods. While no investment is entirely risk-free, blue-chip stocks are generally considered more stable and less volatile compared to smaller, riskier companies.

5. Strong Market Presence

Blue-chip companies typically enjoy a strong market presence and often dominate their respective industries. They may have well-known brands, extensive customer bases, and global reach. This market dominance can provide a competitive advantage, creating barriers for new entrants and contributing to the steady growth and stability of these companies.

The Benefits of Investing in Blue-Chip Stocks

Investing in blue-chip stocks can offer a range of benefits to investors. Let’s explore some of the main advantages that come with investing in these high-quality stocks.

1. Stability and Reliability

One of the key advantages of blue-chip stocks is their stability and reliability. These stocks tend to be less volatile than smaller or riskier investments, making them a suitable choice for conservative investors or those nearing retirement. Blue-chip companies typically have strong balance sheets, lower debt levels, and established business models that can provide a steady stream of income.

2. Dividend Income

Blue-chip stocks are often known for their consistent dividend payments. As mentioned earlier, many blue-chip companies offer dividends as a way to share their profits with shareholders. For income-oriented investors, these dividends can provide a reliable income stream, making blue-chip stocks an attractive option for those looking to supplement their regular earnings or retirement income.

3. Potential for Long-Term Growth

While the primary appeal of blue-chip stocks lies in their stability and reliability, they can also offer the potential for long-term growth. Although the growth rates of blue-chip companies may not match those of smaller, high-growth stocks, their established market presence and steady performance can lead to gradual appreciation in stock value over time. This makes blue-chip stocks a popular choice for investors seeking a balance between stability and growth.

4. Defensive Investment Strategy

Blue-chip stocks are often considered a defensive investment strategy, especially during times of market volatility or economic uncertainty. Their stable earnings and strong market presence can help insulate investors from severe market downturns. When other riskier investments experience significant declines, blue-chip stocks tend to hold their value better, providing a sense of security for investors.

5. Diversification

Investing in blue-chip stocks can also contribute to diversification within an investor’s portfolio. Diversification involves spreading investment capital across different asset classes and sectors to reduce risk. Including blue-chip stocks in a well-diversified portfolio can provide a stable foundation alongside other investments such as bonds, international stocks, or growth-oriented holdings. This diversification helps mitigate risk while potentially enhancing overall returns.

6. Potential for Capital Preservation

Blue-chip stocks are often considered a more conservative investment option that prioritizes capital preservation over rapid capital appreciation. While their growth rates may be more modest compared to smaller, riskier stocks, blue-chip stocks generally provide a reliable store of value. This can be appealing to investors who prioritize the preservation of their invested capital while still benefiting from potential long-term appreciation.

Blue-chip stocks offer investors a combination of stability, reliable dividends, and the potential for long-term growth. These stocks belong to well-established companies with a history of strong performance, market dominance, and consistent dividend payments. Investing in blue-chip stocks can provide stability and diversification to a portfolio, making them an attractive option for conservative investors or those seeking reliable income streams. By understanding the characteristics and benefits of blue-chip stocks, investors can make informed investment decisions and potentially achieve their financial goals.

What Are Blue Chip Stocks and what are the Advantages of Investing in Them?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are blue-chip stocks and their benefits?

Blue-chip stocks are shares of well-established and financially stable companies with a long track record of success. These companies are typically leaders in their respective industries and have a market capitalization in the billions. Investing in blue-chip stocks has several benefits:

What criteria define a blue-chip stock?

Blue-chip stocks are characterized by their strong financials, stable earnings, and consistent dividend payments. These stocks often have a history of outperforming the market and tend to be less volatile compared to smaller companies.

Why should I consider investing in blue-chip stocks?

Investing in blue-chip stocks can offer long-term stability and potential growth. These companies have proven themselves in the market and are often considered safer investments compared to smaller, riskier companies.

What are the key advantages of blue-chip stocks?

Blue-chip stocks provide investors with the advantage of capital appreciation, regular dividend income, and the potential for long-term wealth accumulation. These stocks are often seen as defensive investments, as they tend to be more resilient during market downturns.

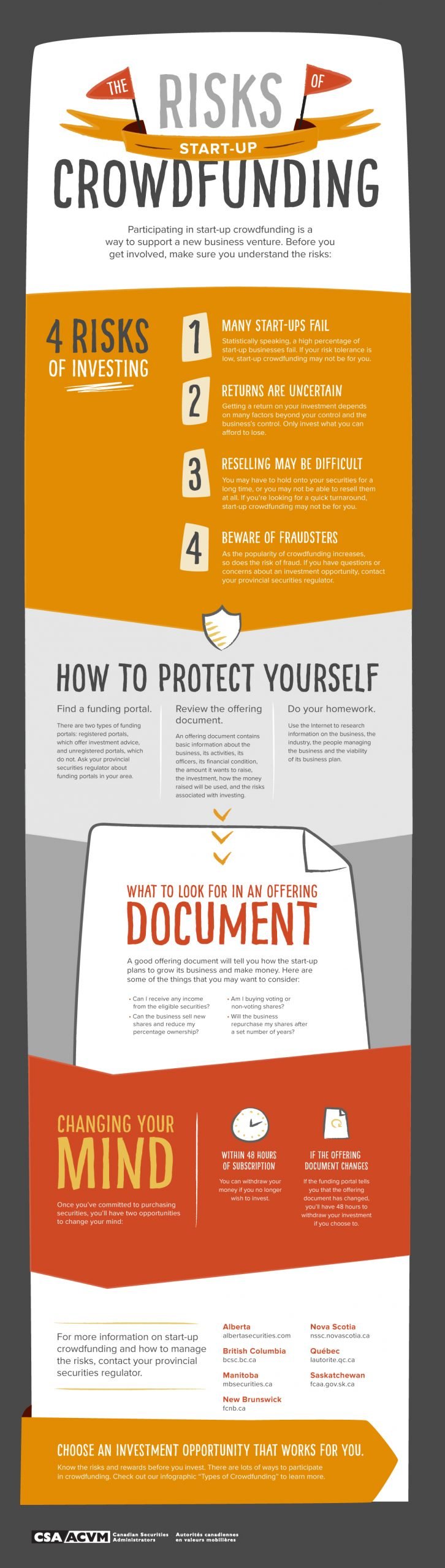

Do blue-chip stocks carry any risks?

While blue-chip stocks are generally considered less risky than smaller stocks, they are not entirely risk-free. Factors such as economic downturns, industry-specific challenges, and company-specific issues can affect the performance of blue-chip stocks. It’s important to diversify your portfolio to mitigate risks.

Can blue-chip stocks provide regular income?

Yes, blue-chip stocks are known for their ability to provide regular income through dividends. Many established companies with blue-chip status distribute a portion of their earnings to shareholders in the form of dividends, offering a steady stream of income for investors.

Are blue-chip stocks suitable for long-term investors?

Yes, blue-chip stocks are often considered suitable for long-term investors. These stocks have a history of stability and steady growth, making them attractive for those looking to build wealth over an extended period. Their consistent dividends can also be reinvested for compounded returns.

What are some examples of blue-chip stocks?

Some well-known examples of blue-chip stocks include companies like Apple, Microsoft, Coca-Cola, Procter & Gamble, Johnson & Johnson, and Visa. These companies have a strong market presence and have consistently demonstrated their ability to generate revenue and profits.

How can I start investing in blue-chip stocks?

To start investing in blue-chip stocks, you can open an investment account with a brokerage firm, either traditional or online. Research different blue-chip companies, analyze their financials, and evaluate their performance. Once you have selected the stocks you want to invest in, place an order through your brokerage account to purchase shares.

Final Thoughts

Blue-chip stocks are well-established, financially stable companies that provide stable returns over time. Investing in blue-chip stocks offers several benefits. Firstly, these stocks have a long track record of consistent performance, making them a reliable choice for investors seeking stability. Additionally, blue-chip stocks often pay dividends, providing a regular stream of income. Furthermore, these stocks tend to weather market downturns better than smaller companies, offering a level of resilience during economic uncertainties. Overall, blue-chip stocks are an attractive investment option for those looking for stability, consistent returns, and potential dividend income.