Looking to understand the world of investments? Curious about the risks associated with callable bonds? You’re in the right place! In this blog article, we’ll delve into what callable bonds are and explore the potential risks they pose to investors. So, whether you’re a seasoned investor or just starting out, join us as we demystify what are callable bonds and their risks. Let’s dive in!

What Are Callable Bonds and Their Risks

When it comes to investing in bonds, there are various types to choose from. One such type is known as callable bonds. In this article, we will explore what callable bonds are, how they work, and the potential risks associated with them. Whether you are an experienced investor or just starting out, understanding callable bonds and their risks can help you make informed investment decisions.

Understanding Callable Bonds

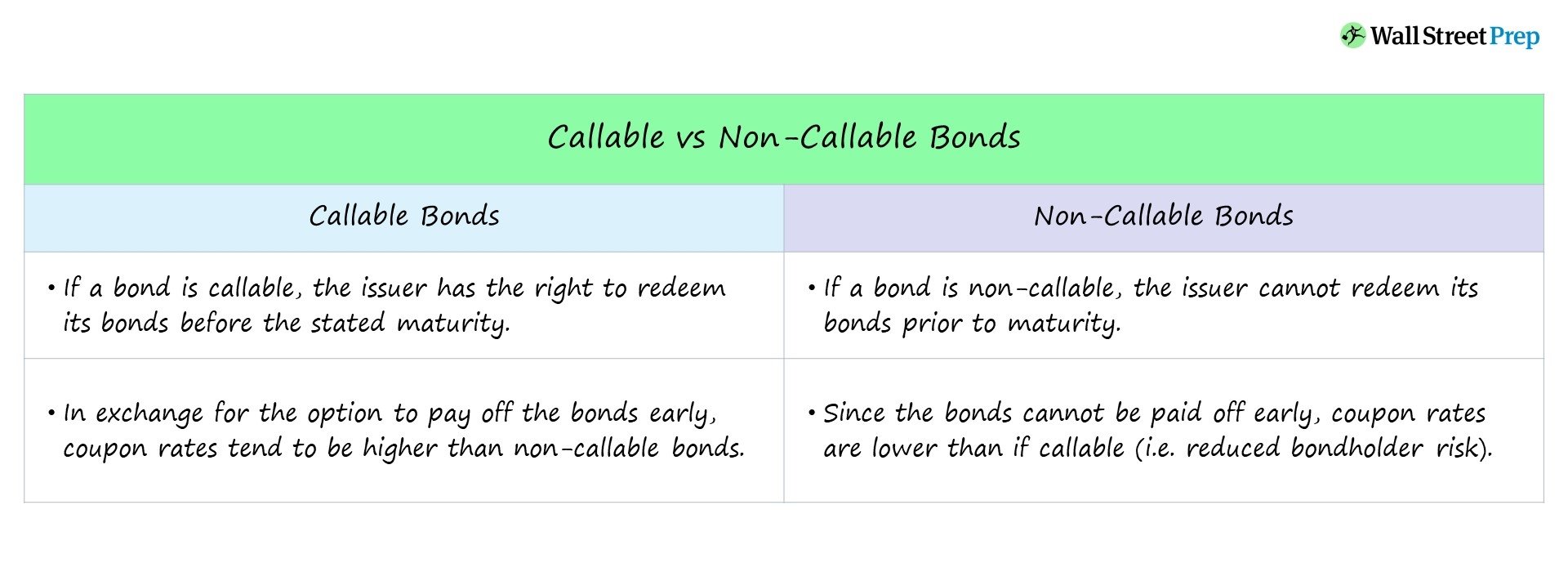

A callable bond, also known as a redeemable bond, is a type of bond that gives the issuer the right to redeem the bond before its maturity date. In other words, the issuer can choose to call back the bond and repay the investors before the scheduled maturity date.

Callable bonds are often issued by companies and governments as a way to take advantage of potential interest rate changes. If interest rates decline, the issuer may choose to call back the bonds and issue new bonds with lower interest rates, thereby reducing their borrowing costs. This flexibility allows issuers to manage their debt efficiently and reduce financial burdens.

Callable bonds typically have a call price, which is the price at which the issuer can redeem the bond. The call price is usually higher than the face value of the bond, creating an incentive for investors to sell their bonds back to the issuer. The call price may also decrease over time, providing an additional incentive for early redemption.

Benefits of Investing in Callable Bonds

Callable bonds can offer several benefits for both issuers and investors:

- Higher Yield: Callable bonds often come with higher coupon rates compared to non-callable bonds. This higher yield can be attractive to investors looking for potentially higher returns.

- Flexibility for Issuers: Callable bonds provide issuers with the flexibility to manage their debt and react to changing market conditions.

- Early Repayment: Investors have the opportunity to receive their principal back earlier if the issuer decides to call the bonds.

While these benefits can be appealing, it is important to understand the potential risks associated with investing in callable bonds.

Risks of Investing in Callable Bonds

Before deciding to invest in callable bonds, it is crucial to consider the following risks:

1. Interest Rate Risk

Callable bonds are particularly sensitive to interest rate changes. If interest rates decrease after purchasing a callable bond, there is a higher likelihood that the issuer will call back the bond to refinance at a lower rate. This can result in the investor receiving the call price, which may be lower than the market value of the bond.

Conversely, if interest rates rise, the issuer is less likely to call back the bond, potentially trapping the investor in a lower-yielding investment.

2. Reinvestment Risk

When a callable bond is called back, investors are faced with the challenge of reinvesting their principal at potentially lower interest rates. This can impact the overall return on investment, especially in a low-interest-rate environment.

3. Price Volatility

Callable bonds are subject to price volatility, especially when interest rates fluctuate. As interest rates change, the price of a callable bond can fluctuate, making it difficult to predict the market value of the bond if the issuer decides to call it back.

4. Lost Income

If a callable bond is called back before its scheduled maturity date, investors may lose out on potential future interest income. This can impact the overall return on investment, particularly if the bond is called back early in its life.

Managing Callable Bond Risks

While callable bonds carry certain risks, there are strategies investors can employ to manage these risks:

1. Research and Analysis

Conduct thorough research on the issuer, including their financial health, creditworthiness, and potential likelihood of calling back the bonds. Understanding the issuer’s history of calling bonds can provide insights into their future behavior.

2. Diversification

Diversify your bond portfolio by investing in a mix of callable and non-callable bonds. This can help mitigate the risks associated with callable bonds by spreading them across different issuers and bond types.

3. Yield-to-Call Analysis

Perform a yield-to-call analysis to assess the potential return if the bond is called back. This analysis considers the call price, coupon payments, and the remaining time until the bond’s call date. It can help investors make an informed decision about whether the potential return justifies the associated risks.

4. Stay Informed

Keep track of interest rate movements and market conditions. Staying informed allows investors to anticipate potential call activity and adjust their investment strategy accordingly.

Callable bonds can be an attractive investment option, offering potentially higher yields and flexibility for issuers. However, they also come with risks, including interest rate risk, reinvestment risk, price volatility, and the potential loss of future income. By understanding these risks and implementing appropriate risk management strategies, investors can make informed decisions when considering callable bonds as part of their investment portfolios.

Callable Bond Explained – Definition, Benefits & Risks

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are callable bonds?

Callable bonds are a type of bond that allows the issuer to redeem or “call back” the bond before its maturity date. When a bond is called, the issuer repays the bondholder the principal amount along with any remaining interest payments.

Why do companies issue callable bonds?

Companies issue callable bonds to have the flexibility to refinance debt at lower interest rates in the future. By including a call provision in the bond, the issuer can take advantage of declining interest rates and potentially reduce their borrowing costs.

What risks are associated with callable bonds?

Callable bonds carry certain risks for investors:

- Call risk: The main risk for bondholders is the possibility that the issuer will call back the bonds before their maturity. This can lead to reinvestment risk, where the investor may have to reinvest the proceeds at lower interest rates.

- Yield-to-call risk: Investors also face the risk that the bond’s yield-to-call, which reflects the potential return if the bond is called, may be lower than anticipated due to changes in interest rates or the issuer’s creditworthiness.

- Price risk: Callable bonds may experience greater price volatility compared to non-callable bonds. If interest rates fall, the likelihood of the bond being called increases, which can lead to a decline in the bond’s market value.

Are there any benefits for investors in callable bonds?

Callable bonds may offer higher interest rates compared to non-callable bonds to compensate investors for the additional risks they assume. Additionally, if interest rates rise, the bond is less likely to be called, allowing investors to continue receiving the higher interest payments.

Can investors refuse to sell their callable bonds?

No, investors cannot refuse to sell their callable bonds if the bond is called by the issuer. The call provision is a contractual agreement between the issuer and the bondholder, and the issuer has the right to redeem the bond at the specified call price.

How do investors determine the potential yield of callable bonds?

Investors can calculate the yield-to-call (YTC) of callable bonds by considering the bond’s call date, call price, and remaining interest payments. This measure gives investors an estimate of the potential return if the bond is called by the issuer.

What factors should investors consider before investing in callable bonds?

Before investing in callable bonds, investors should consider:

- The issuer’s creditworthiness and financial stability

- Current interest rate environment and the likelihood of rates falling

- The potential impact of the bond being called on their investment strategy

- The yield-to-call and potential return if the bond is called

Can the call price of a callable bond change?

No, the call price of a callable bond is predetermined and specified in the bond’s terms and conditions. The issuer cannot change the call price once it is set.

Are callable bonds suitable for risk-averse investors?

Callable bonds may not be suitable for risk-averse investors as they carry call risk, which can lead to reinvestment risk and potentially lower returns if the bond is called before maturity. Investors seeking more stable and predictable income may prefer non-callable bonds.

Final Thoughts

Callable bonds are a type of fixed-income security that give the issuer the option to redeem them before the maturity date. While they provide certain benefits for issuers, they pose risks for investors. One of the main risks is the potential for early redemption, which can result in the loss of future interest payments and potential capital gains. Another risk is that callable bonds tend to have higher yields compared to non-callable bonds, reflecting the compensation investors receive for taking on the call risk. Investors should carefully consider these risks before investing in callable bonds to ensure they align with their investment goals and risk tolerance.