Looking to diversify your investment portfolio? Convertible debentures might just be the answer you’re looking for. So, what are convertible debentures and their advantages? Convertible debentures are a type of corporate bond that can be converted into a specified number of shares of the issuing company’s stock. This unique feature offers investors the opportunity to potentially benefit from both the fixed income aspect of bonds and the potential upside of owning equity. In this blog article, we’ll delve deeper into the advantages of convertible debentures and explore why they can be a valuable addition to your investment strategy. Let’s jump right in.

What are Convertible Debentures and Their Advantages

When it comes to investing in financial instruments, it’s crucial to have a diverse portfolio that includes different types of assets. One such asset that investors often consider is convertible debentures. In this article, we will explore the ins and outs of convertible debentures, understand their advantages, and why they can be an attractive option for investors.

Understanding Convertible Debentures

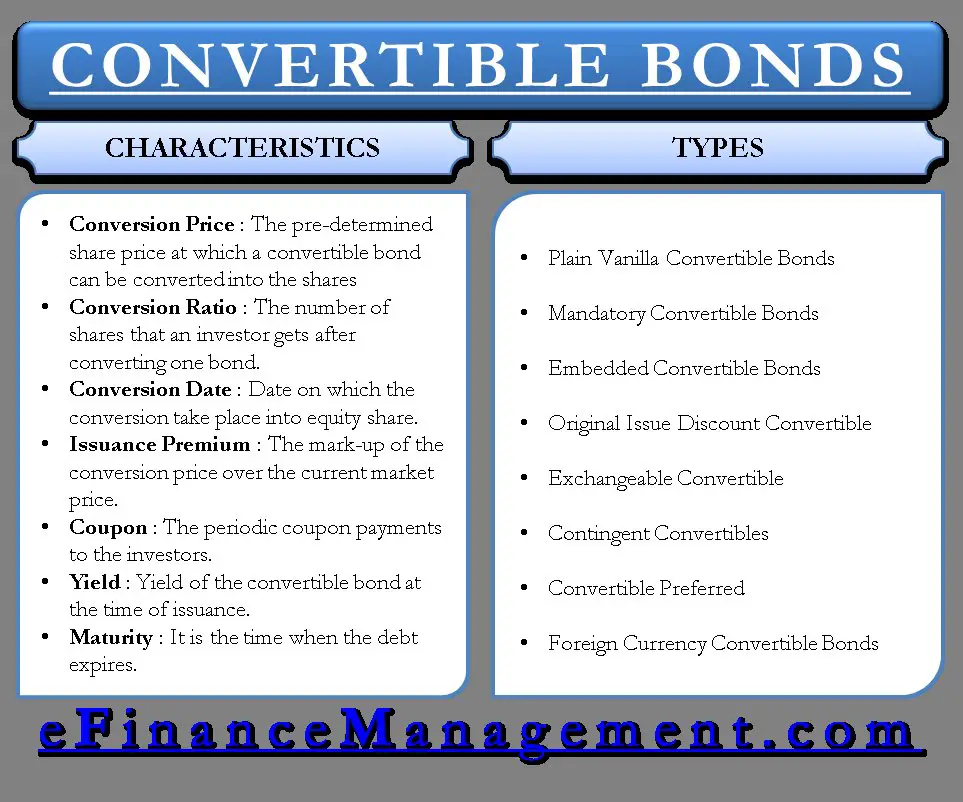

Before delving into the advantages of convertible debentures, let’s first understand what they are. A convertible debenture is a type of debt instrument that can be converted into equity shares at a later date. Essentially, it combines features of both debt and equity, offering investors the potential for capital appreciation in addition to regular interest payments.

Unlike traditional bonds or debentures, convertible debentures provide the investor with the option to convert them into shares of the issuing company. This feature allows investors to participate in any future upside potential of the company’s stock, while still enjoying the benefits of fixed interest payments. It’s important to note that the conversion of debentures into shares is subject to certain terms and conditions outlined in the debenture agreement.

Advantages of Convertible Debentures

Convertible debentures offer several advantages that make them an attractive investment option for both issuers and investors. Let’s explore some of these advantages in detail:

1. Potential for Capital Appreciation

One of the primary advantages of convertible debentures is the potential for capital appreciation. As mentioned earlier, if the issuer’s stock price rises, the debenture holder has the option to convert their debentures into equity shares. By doing so, they can benefit from the increase in the stock’s value over time. This potential upside makes convertible debentures an intriguing investment option, especially for those seeking both fixed income and potential capital gains.

2. Regular Interest Payments

Similar to traditional bonds or debentures, convertible debentures offer investors regular interest payments. These payments provide a predictable stream of income, making them an attractive option for income-focused investors. The interest rate on convertible debentures is typically higher than that of regular bonds or debentures due to the potential conversion feature. Investors can enjoy these interest payments until the debentures mature or until they choose to convert them into equity shares.

3. Diversification of Portfolio

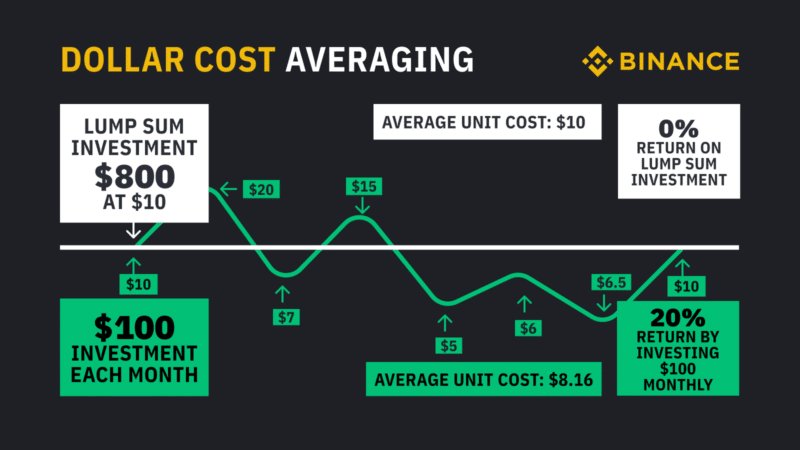

Investing in convertible debentures can be an effective way to diversify an investment portfolio. By including different asset classes, such as equities and fixed-income securities, investors can spread their risk and potentially enhance their overall returns. Convertible debentures provide an opportunity to gain exposure to both debt and equity markets simultaneously, offering a balanced approach that can help mitigate risk.

4. Flexibility in Investment Strategy

Convertible debentures offer flexibility to investors in terms of their investment strategy. Depending on the market conditions and the performance of the issuing company, investors can choose to convert their debentures into shares or hold onto them until maturity. This flexibility allows investors to adapt their investment approach based on their assessment of market trends and their personal financial goals.

5. Priority in Liquidation

In the event of a company’s liquidation or bankruptcy, convertible debenture holders often have priority over equity shareholders. This means that if there are any remaining assets to be distributed, debenture holders will be given preference in receiving their investment back before shareholders. This priority in liquidation adds a layer of security to the investment, reducing the potential downside risk.

6. Potential Tax Benefits

In some jurisdictions, convertible debentures may offer certain tax advantages. For example, interest payments received from debentures may be taxed at a lower rate than dividends received from equity shares. It’s important to consult with a tax professional to understand the specific tax implications of investing in convertible debentures based on your jurisdiction and personal tax situation.

7. Attractive to Startups and Growing Companies

Convertible debentures are often utilized by startups and growing companies as a form of fundraising. These companies may choose to issue convertible debentures to raise capital while providing investors with the potential for future equity ownership. By offering this investment option, companies can attract investors who are looking for a combination of fixed income and potential capital appreciation.

Convertible debentures offer a unique investment opportunity, combining the benefits of fixed income with the potential for capital appreciation. The advantages of convertible debentures include the potential for capital gains, regular interest payments, portfolio diversification, flexibility in investment strategy, priority in liquidation, potential tax benefits, and attractiveness to startups and growing companies. However, like any investment, it’s important to carefully assess the risks and rewards associated with convertible debentures and consider your individual investment objectives and risk tolerance before making any investment decisions.

Advantages of Convertible debentures

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are convertible debentures?

Convertible debentures are a type of loan instrument issued by a company that can be converted into equity shares at a later point in time. They are essentially a hybrid security that combines features of both debt and equity.

What are the advantages of convertible debentures?

Convertible debentures offer several advantages, including:

1. Can convertible debentures provide higher returns compared to other investment options?

Yes, convertible debentures can provide higher returns compared to traditional debt instruments. As they can be converted into equity shares, investors have the potential to benefit from any future increase in the company’s share price.

2. Is there a fixed interest rate associated with convertible debentures?

Yes, convertible debentures typically offer a fixed interest rate, providing investors with a regular income stream. This interest rate is usually higher than what is offered by other debt instruments.

3. Are convertible debentures less risky compared to common shares?

Convertible debentures are considered less risky than common shares because they offer a fixed income component. In case the share price doesn’t increase or the conversion option doesn’t materialize, investors still receive interest payments.

4. Can convertible debentures help diversify my investment portfolio?

Yes, convertible debentures can be a useful tool for diversification. By investing in both debt and equity markets through a single security, investors can spread their risk across different asset classes.

5. Are there any tax advantages associated with convertible debentures?

Convertible debentures may offer certain tax advantages depending on the jurisdiction. Investors should consult with a tax advisor to understand the specific tax implications in their region.

6. Can convertible debentures be traded in the market?

Yes, convertible debentures are typically listed on stock exchanges, allowing investors to buy and sell them in the secondary market. This provides liquidity and flexibility to investors.

7. Can companies benefit from issuing convertible debentures?

Yes, companies can benefit from issuing convertible debentures as they allow them to raise capital at a lower interest rate compared to traditional debt instruments. Additionally, it provides an opportunity to attract investors who are interested in both debt and equity investments.

8. Can convertible debentures be converted into shares at any time?

Convertible debentures usually have a predetermined conversion period or specific conditions for conversion. Investors need to carefully review the terms and conditions mentioned in the prospectus or offering documents to understand the conversion timeline.

Final Thoughts

Convertible debentures are a type of investment instrument that offer investors the option to convert their debentures into equity shares of the issuing company. These debentures have gained popularity due to their unique advantages. Firstly, they provide a fixed income stream through regular interest payments. Secondly, investors have the opportunity to participate in the company’s growth by converting their debentures into shares. This allows them to benefit from potential capital gains. Lastly, convertible debentures offer a level of downside protection as they can be redeemed for their face value if not converted. In conclusion, convertible debentures offer a compelling investment opportunity, combining the stability of fixed income with the potential for equity participation.