Are you wondering what dividend reinvestment plans (DRIPs) are and how they can benefit you as an investor? Look no further! DRIPs are a brilliant investment strategy where instead of receiving cash dividends, you automatically reinvest them back into the company’s stock. This means you can steadily grow your investment over time without having to make additional purchases. In this article, we will delve into the ins and outs of DRIPs, exploring their advantages, considerations, and how you can make the most out of this powerful investment tool. Embark on this journey with us as we unravel the exciting world of dividend reinvestment plans!

What are Dividend Reinvestment Plans (DRIPs)?

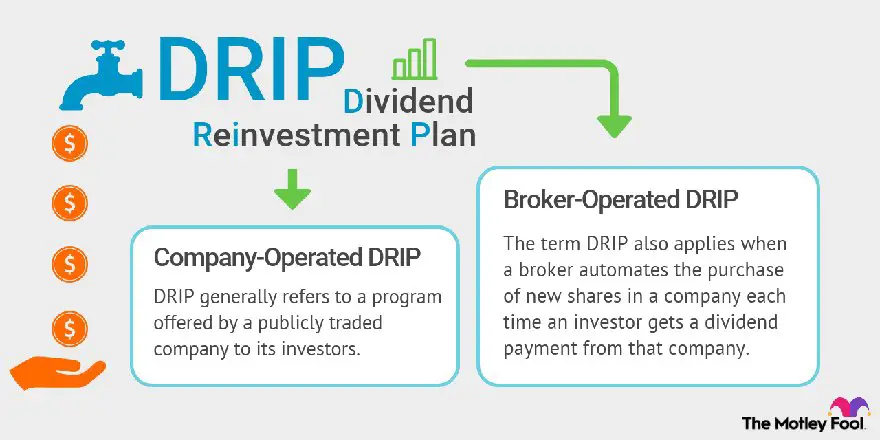

Dividend Reinvestment Plans, commonly known as DRIPs, are investment programs offered by publicly traded companies that allow shareholders to reinvest their cash dividends into additional shares of the company’s stock. These plans provide an opportunity for investors to accumulate more shares over time without incurring additional brokerage fees or commissions. DRIPs are a popular choice for long-term investors seeking to grow their investment portfolios and compound their returns.

How do Dividend Reinvestment Plans work?

When an investor participates in a DRIP, the cash dividends received from the company are automatically used to purchase additional shares of the company’s stock. Instead of receiving the dividends in cash, the investor receives additional fractional shares proportional to the amount of dividends reinvested. This process is usually facilitated by a transfer agent or a brokerage firm that administers the DRIP on behalf of the company.

Here’s a step-by-step breakdown of how DRIPs work:

1. Shareholder Enrollment: The first step is to enroll as a shareholder in the company’s DRIP. This can usually be done through the transfer agent or by contacting the investor relations department of the company.

2. Dividend Declaration: When the company declares a dividend, eligible shareholders will receive the dividend amount based on their ownership stake.

3. Dividend Reinvestment: Instead of receiving the cash dividends, the investor’s account is automatically credited with additional shares of the company’s stock. The number of shares received is based on the current market price of the stock and the amount of dividends reinvested.

4. Fractional Shares: If the dividend amount is not enough to purchase a whole share, the remaining cash is used to buy fractional shares. These fractional shares are aggregated until they reach a full share, at which point they are credited to the investor’s account.

5. Cost Basis and Taxes: The cost basis of the reinvested shares is determined based on the market price at the time of reinvestment. Investors should keep track of their cost basis for tax purposes, as it will affect their capital gains or losses when the shares are eventually sold.

The Benefits of Dividend Reinvestment Plans

Investing in DRIPs offers several advantages for investors, including:

1. Compound Returns: By reinvesting dividends, investors can take advantage of compounding returns. As more shares are acquired through dividend reinvestment, future dividends will be based on a larger share ownership, leading to an accelerated growth in the investment over time.

2. Cost Efficiency: DRIPs eliminate the need for investors to pay brokerage fees or commissions when reinvesting dividends. This allows for a more cost-effective way to accumulate shares compared to traditional stock purchases.

3. Dollar-Cost Averaging: DRIPs provide a built-in dollar-cost averaging strategy. Through regular dividend reinvestment, investors automatically buy more shares when prices are low and fewer shares when prices are high. This averaging of purchase prices can help smooth out the volatility of the stock market.

4. Long-Term Focus: DRIPs are particularly suitable for long-term investors who are focused on accumulating wealth over an extended period. By reinvesting dividends, investors can stay committed to the underlying company and benefit from its long-term growth prospects.

5. Dividend Growth Potential: Many companies consistently increase their dividends over time. By participating in a DRIP, investors have the potential to accumulate a larger number of shares as dividends increase, leading to a higher income stream in the future.

Considerations for Dividend Reinvestment Plans

While DRIPs offer numerous benefits, investors should also consider the following factors:

1. Volatility and Risk: The value of a company’s stock can fluctuate significantly, and dividends are not guaranteed. Investors should carefully evaluate the stability and financial health of the company before participating in its DRIP.

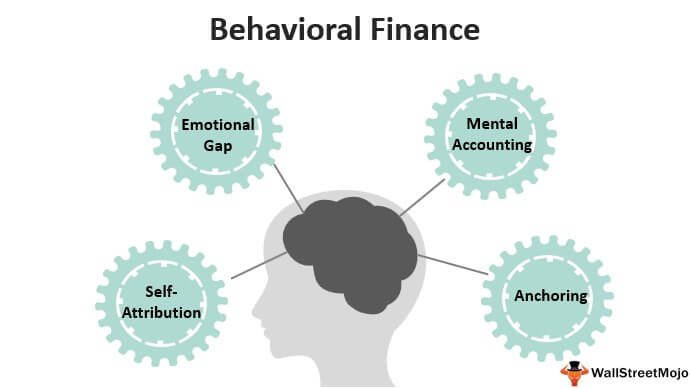

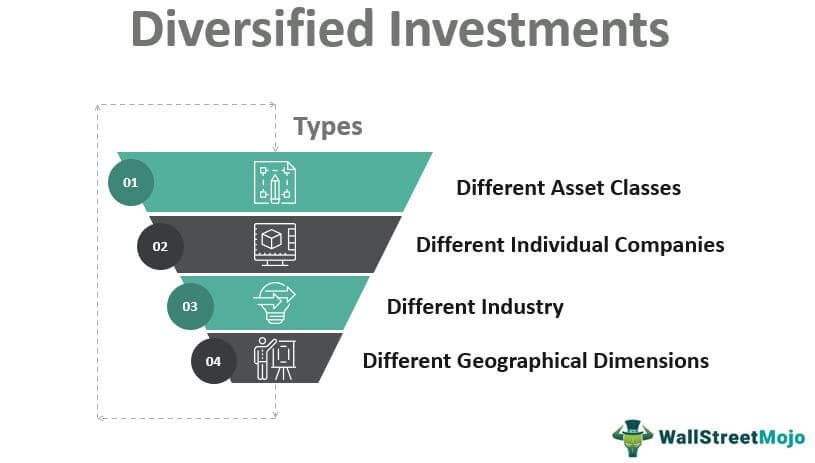

2. Diversification: Investing solely in one company’s stock through a DRIP may lack diversification. It is important to assess the overall risk of the investment portfolio and consider diversifying across different stocks or asset classes.

3. Tax Implications: Reinvested dividends are typically subject to taxes, even though they are not received as cash. Investors should consult with a tax advisor to understand the tax implications of participating in DRIPs and how to accurately report and track cost basis for tax purposes.

4. Administration Fees: Some DRIPs may charge minimal fees for administration or account maintenance. Investors should be aware of any associated fees and evaluate their impact on overall investment returns.

5. Liquidity: Unlike traditional stock investments, shares acquired through DRIPs may not be as easily sold or traded. It is important to consider the liquidity needs and potential restrictions associated with DRIP investments.

Popular Dividend Reinvestment Plans

Several companies offer DRIPs for their shareholders, including well-known corporations in various sectors. Some popular DRIPs include:

– Coca-Cola

– Procter & Gamble

– Johnson & Johnson

– Exxon Mobil

– Verizon Communications

– McDonald’s

– Walmart

The availability and terms of DRIPs can vary between companies, so investors should consult the company’s investor relations materials or website for specific details.

Dividend Reinvestment Plans (DRIPs) provide investors with an opportunity to compound their returns over time by reinvesting dividends into additional shares of a company’s stock. By eliminating brokerage fees and commissions, DRIPs offer a cost-effective way to accumulate shares and benefit from dollar-cost averaging. However, investors should carefully evaluate the risks, consider tax implications, and assess the diversification of their investment portfolio before participating in DRIPs. Overall, DRIPs can be a valuable tool for long-term investors seeking to grow their wealth and take advantage of the power of compounding returns.

What is a Dividend Reinvestment Plan (DRIP)? | Dividend Definitions #7

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a dividend reinvestment plan (DRIP)?

A dividend reinvestment plan (DRIP) is an investment program that allows shareholders to automatically reinvest their dividends to purchase additional shares of the same company’s stock, rather than receiving the dividends in cash.

How do dividend reinvestment plans work?

In a dividend reinvestment plan (DRIP), when a company declares dividends, instead of receiving the dividends as cash, they are automatically used to purchase additional shares of the company’s stock at the market price. These additional shares are then credited to the shareholder’s account.

What are the benefits of participating in a dividend reinvestment plan?

Participating in a dividend reinvestment plan (DRIP) can offer several benefits. It allows for the compounding of returns, as the reinvested dividends buy more shares that can generate additional dividends. DRIPs also provide a cost-effective method of reinvesting dividends without incurring brokerage fees.

Are dividend reinvestment plans available for all companies?

No, not all companies offer dividend reinvestment plans (DRIPs). It is up to each individual company to decide whether to establish and offer a DRIP to their shareholders.

Can I join a dividend reinvestment plan if I don’t already own shares in the company?

Most dividend reinvestment plans (DRIPs) require shareholders to already own shares in the company before they can participate in the plan. However, some companies offer direct stock purchase plans (DSPPs) that allow investors to buy their shares and enroll in the DRIP simultaneously.

Do dividend reinvestment plans provide any tax advantages?

Dividend reinvestment plans (DRIPs) do not provide any specific tax advantages. The reinvested dividends are still subject to taxation, similar to regular dividends. It is advisable to consult a tax professional regarding the tax implications of participating in DRIPs.

Can I sell the shares acquired through a dividend reinvestment plan?

Yes, the shares acquired through a dividend reinvestment plan (DRIP) can be sold. The shares can be sold on the open market, just like any other shares. It’s important to note that any gains or losses from the sale of these shares may be subject to capital gains tax.

Can I opt out of a dividend reinvestment plan?

Yes, shareholders can usually opt out of a dividend reinvestment plan (DRIP) if they wish to receive cash dividends instead of reinvesting them. The exact process may vary depending on the company, so it is advisable to contact the company’s transfer agent or investor relations department for specific instructions.

Final Thoughts

Dividend reinvestment plans (DRIPs) are an excellent way for investors to maximize their returns. By automatically reinvesting the dividends received from their investments, individuals can purchase additional shares of the same stock without incurring any transaction fees. This strategy allows investors to take advantage of compounding growth and potentially increase their overall investment value over time. DRIPs offer a convenient and hassle-free method for investors to reinvest their dividends and steadily grow their portfolios. With DRIPs, investors have the opportunity to compound their wealth and potentially achieve long-term financial goals.