Junk bonds, also known as high-yield bonds, carry a higher level of risk compared to investment-grade bonds. These bonds are issued by companies with a lower credit rating, indicating a higher probability of default. Now, you might be wondering what exactly are junk bonds and what are the risks involved in investing in them?

Let’s dive into the world of junk bonds and explore their risks. By understanding the nature of these bonds and the potential pitfalls, you’ll be equipped with valuable knowledge to make informed investment decisions. So, let’s explore the realm of junk bonds and their associated risks together, shall we?

What Are Junk Bonds and Their Risks?

Junk bonds, also known as high-yield bonds, are fixed-income securities issued by companies or governments with lower credit ratings. These bonds offer higher interest rates compared to investment-grade bonds to compensate for the increased risk. While they may seem attractive due to their higher yields, investors should be aware of the potential risks involved.

Understanding Junk Bonds

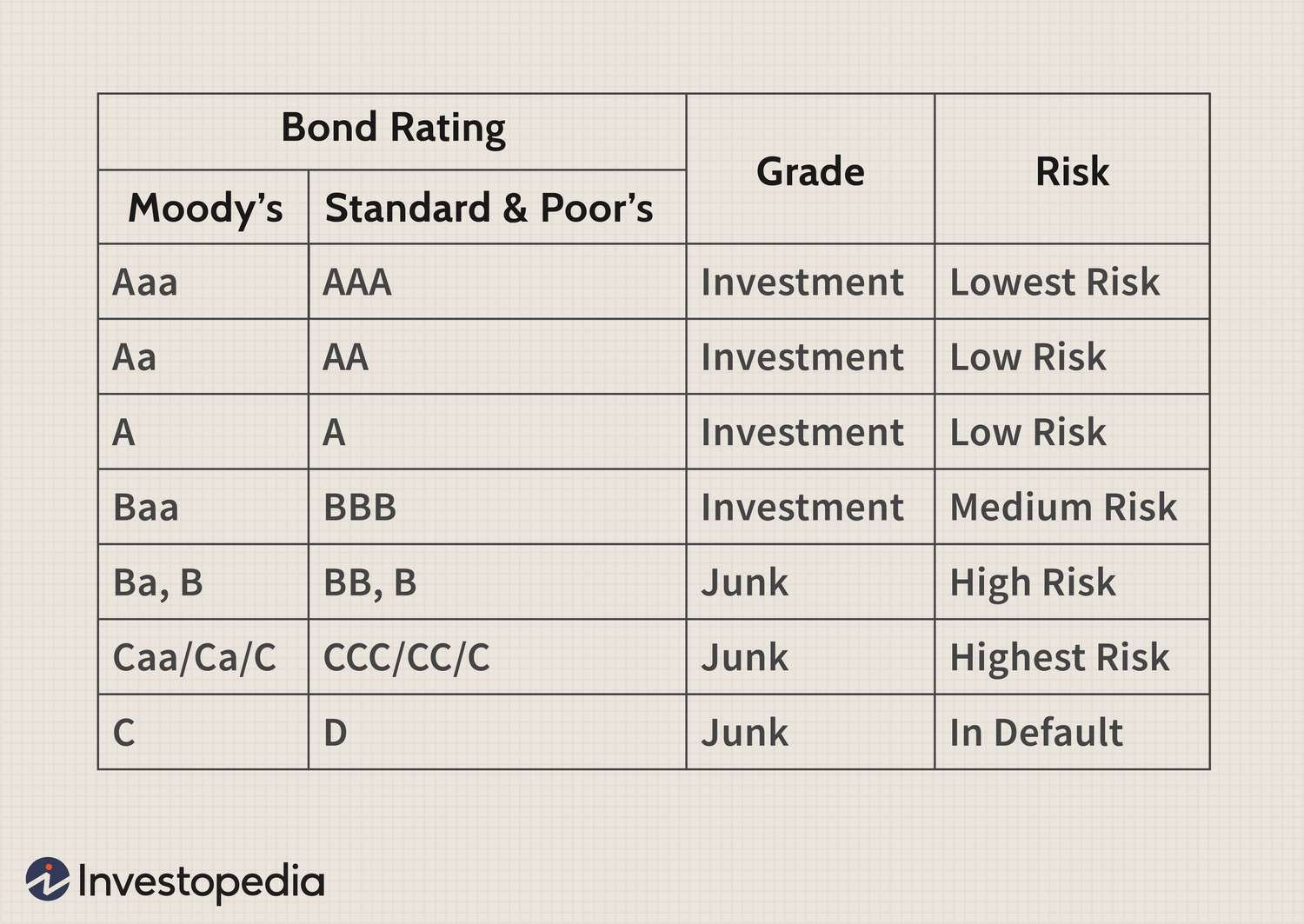

Junk bonds are typically issued by companies with below-average credit ratings or those going through financial difficulties. These ratings are given by credit rating agencies like Standard & Poor’s or Moody’s, where lower ratings indicate a higher risk of default. Due to the higher risk, these bonds carry higher interest rates to attract investors.

Companies may issue junk bonds to fund various activities, such as mergers and acquisitions, restructuring debt, or financing growth initiatives. Governments may also issue junk bonds to finance infrastructure projects or other public expenditures.

The Risks Associated with Junk Bonds

Investing in junk bonds can be lucrative, but it is important to understand the risks involved before diving in. Here are some key risks associated with junk bonds:

Default Risk

Default risk is the primary concern when investing in junk bonds. Since these bonds are issued by companies or governments with lower credit ratings, there is a higher chance of defaulting on the debt. If the issuer fails to meet its payment obligations, investors may not receive the full principal or interest payments.

Market Risk

Junk bonds are subject to market risk, which refers to the possibility of losing value due to changes in interest rates or economic conditions. When interest rates rise, the value of existing bonds tends to decrease, leading to potential losses for bondholders. Economic downturns or industry-specific challenges can also impact the price and liquidity of junk bonds.

Liquidity Risk

Junk bonds are generally less liquid compared to investment-grade bonds. This means that it can be more challenging to buy or sell these bonds at desired prices. In times of market stress, the liquidity of junk bonds may decrease further, making it difficult for investors to exit their positions.

Reinvestment Risk

When investing in bonds with fixed interest rates, there is a risk of reinvestment. If the bondholder receives periodic interest payments, they may need to reinvest those funds at lower interest rates when the bond matures or gets called. This reinvestment risk can impact the overall return on investment.

Call Risk

Junk bonds may have call features that allow the issuer to redeem the bonds before the maturity date. If the issuer calls the bonds, investors may face the challenge of reinvesting the redeemed funds at potentially lower interest rates or finding similar investment opportunities.

Increased Volatility

Due to their lower credit ratings and higher risk profiles, junk bonds tend to exhibit increased price volatility compared to investment-grade bonds. The prices of these bonds can fluctuate significantly based on changes in market conditions, creditworthiness, and investor sentiment.

Currency Risk (for International Junk Bonds)

If investors are considering investing in international junk bonds, they should be aware of the additional risk associated with currency fluctuations. Exchange rate movements can impact the returns on these bonds when converted back into the investor’s home currency.

Benefits of Investing in Junk Bonds

Despite the risks mentioned above, there are potential benefits to investing in junk bonds:

- Higher Yields: Junk bonds offer higher interest rates compared to investment-grade bonds, potentially providing investors with a greater income stream.

- Diversification: Including junk bonds in a well-diversified portfolio can help spread risk across different asset classes and enhance overall portfolio performance.

- Opportunity for Capital Appreciation: If the credit quality of a company improves over time, the price of its junk bonds may rise, offering the potential for capital appreciation.

- Access to Growth Companies: Many growth-oriented companies may have lower credit ratings initially but have the potential to improve their financial position and creditworthiness over time. Investing in their junk bonds can provide exposure to these companies at an earlier stage.

Assessing Junk Bond Investments

When considering investing in junk bonds, investors should conduct thorough research and analysis. Here are some key factors to consider:

Credit Quality

Evaluating the credit quality of the issuer is crucial when investing in junk bonds. Analyze the issuer’s financial statements, credit rating reports, and industry trends to assess the likelihood of default and the potential recovery in case of default.

Yield Spread

Compare the yield offered by a junk bond with similar investment-grade bonds to determine whether the extra yield compensates for the additional risk. A narrower yield spread may indicate that the bond is overvalued, while a wider spread suggests a higher-risk investment.

Industry and Economic Factors

Evaluate the issuer’s industry and the overall economic conditions that may impact its financial performance. Industries prone to cyclicality or facing significant challenges may carry higher risk for junk bond investors.

Issuer’s Management Team

Assess the competence and track record of the issuer’s management team. A strong management team with a successful history of navigating challenging situations may increase the likelihood of favorable outcomes for bondholders.

Exit Strategy

Plan an exit strategy before investing in junk bonds. Determine under what circumstances you would sell the bonds and at what price. Be prepared for potential challenges in selling the bonds based on liquidity factors.

Junk bonds can be attractive to investors seeking higher yields, but they come with inherent risks. Understanding these risks and conducting thorough due diligence is crucial before investing in junk bonds. By carefully evaluating credit quality, yield spreads, industry factors, and management teams, investors can make informed decisions and potentially benefit from the yield and growth opportunities offered by these bonds. However, it is essential to remember that junk bonds are not suitable for all investors and should be approached with caution.

What is a junk bond?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are junk bonds?

Junk bonds, also known as high-yield bonds, are corporate bonds that have a lower credit rating compared to investment-grade bonds. These bonds are issued by companies with a higher risk of defaulting on their debt payments.

What are the risks associated with junk bonds?

Investing in junk bonds comes with certain risks, including:

– Higher default risk: Junk bonds are issued by companies with lower credit ratings, indicating a higher likelihood of defaulting on payments.

– Price volatility: Junk bonds often experience greater price fluctuations compared to investment-grade bonds, making them more susceptible to market volatility.

– Limited liquidity: Junk bonds may have limited trading volumes, which can make it challenging to buy or sell them quickly without impacting their market prices.

– Higher interest rates: Due to their higher risk profile, junk bonds offer higher interest rates to compensate investors. However, if interest rates rise, the value of these bonds may decline.

– Subordinated claim: In case of bankruptcy or liquidation, junk bondholders have lower priority compared to other creditors. This means they may receive only a portion of their investment or nothing at all.

How do junk bonds differ from other types of bonds?

Junk bonds differ from other types of bonds in several ways:

– Credit rating: Junk bonds have a lower credit rating, indicating a higher risk of default compared to investment-grade bonds.

– Interest rates: Junk bonds offer higher interest rates due to their higher risk profile, while investment-grade bonds have lower rates.

– Issuer profile: Junk bonds are issued by companies with weaker financials or lower creditworthiness, whereas investment-grade bonds are issued by financially stable companies.

– Investor base: Junk bonds are typically purchased by investors seeking higher yields but are willing to take on more risk. On the other hand, investment-grade bonds attract more conservative investors.

Who typically invests in junk bonds?

Junk bonds are typically favored by investors who seek higher yields and are willing to take on greater risk. This can include institutional investors, hedge funds, and individuals looking to diversify their investment portfolios. It’s important to note that investing in junk bonds requires careful consideration and risk tolerance.

Are junk bonds suitable for conservative investors?

Junk bonds are generally considered unsuitable for conservative investors due to their higher risk profile. Conservative investors typically prioritize capital preservation and may opt for investment-grade bonds, which offer lower risk and more stable returns. However, individual investment goals and risk tolerance should be evaluated before making any investment decisions.

How can one mitigate the risks associated with junk bonds?

To mitigate the risks associated with junk bonds, investors can consider the following strategies:

– Diversification: Spreading investments across multiple issuers and industries can help reduce the impact of individual bond defaults.

– Research and analysis: Conducting thorough research on the issuer’s financial health, industry trends, and creditworthiness can provide valuable insights before investing.

– Professional advice: Consulting with a financial advisor who specializes in fixed-income investments can help assess the risk-reward tradeoff and make informed investment decisions.

– Constant monitoring: Regularly monitoring both macroeconomic factors and issuer-specific developments can help identify potential risks and take appropriate actions.

What is the historical performance of junk bonds?

Historically, junk bonds have offered higher yields compared to investment-grade bonds. However, they have also exhibited greater volatility and higher default rates. The performance of junk bonds is influenced by various factors, including economic conditions, interest rates, and credit risk. It’s important to note that past performance does not guarantee future results, and individual investment experiences may vary.

Where can one buy junk bonds?

Junk bonds can be purchased through various channels, including:

– Brokerage firms: Many brokerage firms offer access to a wide range of bonds, including junk bonds, through their trading platforms.

– Bond mutual funds or ETFs: Investors can gain exposure to a diversified portfolio of junk bonds through bond mutual funds or exchange-traded funds (ETFs).

– Over-the-counter (OTC) market: Some junk bonds may be traded directly through the OTC market, although liquidity may be limited.

– Investment banks: Large institutional investors may access junk bonds through investment banks, which participate in the primary issuance and secondary trading of these bonds.

Please note that the availability and accessibility of junk bonds may vary based on factors such as investor qualifications and regulatory requirements.

Final Thoughts

Junk bonds, also known as high-yield bonds, are risky investment instruments. These bonds are issued by companies with lower credit ratings, making them more susceptible to defaults and bankruptcy. The risks associated with junk bonds include higher default rates, market volatility, and less liquidity compared to investment-grade bonds. Investors should carefully consider these risks before investing in junk bonds. While they offer the potential for higher returns, it’s crucial to be aware of the elevated credit risk and the possibility of losing some or all of the invested capital. Understanding what are junk bonds and their risks is essential for making informed investment decisions.