Margin accounts can be a powerful tool for investors, allowing them to borrow funds from their broker to amplify their buying power. However, with great power comes great risk. Understanding what are margin accounts and their risks is vital for anyone considering using them. In this article, we will delve into the world of margin accounts, exploring how they work and the potential pitfalls that investors should be aware of. So, if you’re looking to harness the potential of margin accounts while managing the associated risks, you’ve come to the right place. Let’s dive in!

What are Margin Accounts and Their Risks?

Introduction to Margin Accounts

Margin accounts are investment accounts that allow investors to borrow money from a brokerage firm to purchase securities such as stocks, bonds, or mutual funds. With a margin account, investors can potentially increase their buying power and take advantage of investment opportunities that they wouldn’t have been able to afford with their own funds alone. However, margin accounts come with a set of risks that investors should be aware of before deciding to use them.

How Margin Accounts Work

When opening a margin account, investors are required to deposit a certain amount of their own funds known as the initial margin. This amount is usually a percentage of the total value of the securities being purchased. The brokerage firm then lends the investor the remaining funds needed to complete the purchase.

One of the key features of margin accounts is the concept of leverage. Leverage allows investors to control a larger position in the market than their own funds would allow. For example, let’s say an investor wants to buy $10,000 worth of a particular stock. With a 50% initial margin requirement, the investor would need to deposit $5,000 and the brokerage firm would provide the remaining $5,000.

Margin Calls and Maintenance Margin

While margin accounts offer the potential for increased returns, they also carry the risk of margin calls. A margin call occurs when the value of the securities held in a margin account falls below a certain level known as the maintenance margin. This triggers a request from the brokerage firm for the investor to deposit additional funds or sell some of the securities in the account.

The maintenance margin is set by regulatory bodies and brokerage firms to ensure that investors have enough equity in their margin accounts to cover potential losses. If the value of the securities falls below this threshold, the brokerage firm will take action to protect its interests and ensure that the investor can meet their financial obligations.

Calculating Maintenance Margin

The calculation of maintenance margin is typically based on a percentage of the total value of the securities in the margin account. This percentage can vary depending on the type of securities and the brokerage firm’s internal policies. For example, a brokerage firm might set a maintenance margin requirement of 30% for stocks and 40% for bonds.

To calculate the maintenance margin, you would multiply the total value of the securities in the account by the maintenance margin requirement percentage. If the resulting value is less than the initial margin, a margin call may be triggered.

Example of a Margin Call

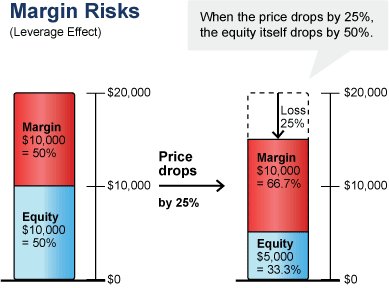

Let’s say an investor opens a margin account with $10,000 and decides to purchase $20,000 worth of stocks with a 50% initial margin requirement. The investor would deposit $10,000, and the brokerage firm would provide the additional $10,000.

However, if the value of the stocks in the account drops to $15,000, the investor’s equity would be $5,000 ($15,000 – $10,000). If the maintenance margin requirement is set at 30%, the investor’s equity would fall below the maintenance margin of $4,500 ($15,000 * 0.3).

In this scenario, the investor would receive a margin call from the brokerage firm, requesting additional funds to bring the equity back above the maintenance margin or to liquidate some of the securities in the account.

Risks of Margin Accounts

Margin accounts can offer investors the ability to leverage their investments and potentially increase their returns. However, they also present significant risks that investors should carefully consider:

1. Market Volatility

Market volatility can greatly impact the value of securities held in a margin account. If the value of the securities declines, an investor may face a margin call. Volatile markets can lead to sudden and large price swings, increasing the likelihood of margin calls.

2. Amplified Losses

Leverage can amplify both gains and losses. While margin accounts can magnify potential profits, they can also significantly increase losses. If the value of the securities in a margin account drops below the amount borrowed, investors are still responsible for repaying the borrowed funds.

3. Interest Charges

When investors borrow money from brokerage firms, they are charged interest on the borrowed funds. These interest charges can add up quickly, especially if the borrowed amount is significant. Investors should carefully consider the cost of borrowing and factor it into their investment strategy.

4. Liquidity Risks

Margin accounts rely on the value of the securities held as collateral. If the value of these securities decreases significantly, it may be challenging to sell them at a fair price quickly. This liquidity risk can make it difficult to meet margin calls and could result in forced liquidation of securities at unfavorable prices.

5. Psychological Factors

Using a margin account introduces additional psychological factors that can impact decision-making. The risk of margin calls and potential losses may lead investors to make impulsive or irrational investment choices, which can further exacerbate losses.

Managing Risks in Margin Accounts

While there are inherent risks associated with margin accounts, investors can take steps to manage and mitigate these risks:

1. Understand Margin Requirements

Investors should thoroughly understand the margin requirements before opening a margin account. Knowledge of initial margin percentages and maintenance margin requirements is essential for making informed investment decisions.

2. Regular Monitoring

Regularly monitoring the value of the securities held in a margin account is crucial to identify potential margin call risks. Staying informed about market trends and volatility can help investors make timely decisions.

3. Risk Management Strategies

Implementing risk management strategies such as setting stop-loss orders can help limit potential losses. Stop-loss orders automatically sell securities if their value reaches a predetermined level, preventing further losses.

4. Diversification

Diversifying the investment portfolio across different asset classes and sectors can help spread risk. By avoiding concentration in a single security or sector, investors can reduce the impact of any individual security’s performance on the margin account.

5. Adequate Funds

Maintaining sufficient funds in a margin account can help prevent margin calls. By having a buffer of funds above the maintenance margin requirement, investors can withstand temporary declines in the value of their securities without triggering a margin call.

Margin accounts provide investors with the opportunity to increase their buying power by leveraging borrowed funds. While they offer potential benefits, margin accounts come with risks that should not be overlooked. Understanding the mechanics of margin accounts, the concept of leverage, and the associated risks is crucial for investors to make informed decisions and manage their investments effectively. By implementing risk management strategies and staying vigilant, investors can navigate the potential pitfalls of margin accounts and maximize their investment outcomes.

What is Margin | Margin Call Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a margin account?

A margin account is a type of brokerage account where an investor can borrow funds from the broker to purchase securities. It allows investors to leverage their investment capital and potentially increase their returns.

What are the risks associated with margin accounts?

While margin accounts can provide opportunities for increased profits, they also come with certain risks:

1. How does trading on margin work?

When trading on margin, investors can borrow money from the broker to buy securities. The margin account acts as collateral for the loan. If the value of the securities drops significantly, the investor may be required to deposit additional funds to maintain the minimum margin requirement.

2. What is a margin call?

A margin call occurs when the value of securities held in a margin account falls below the minimum margin requirement. The broker will then require the investor to deposit additional funds to bring the account back to the required level. Failure to meet a margin call can result in the forced sale of securities.

3. What is the minimum margin requirement?

The minimum margin requirement is the minimum amount of equity that must be maintained in a margin account. It is typically expressed as a percentage of the total value of the securities held in the account. The percentage requirement may vary depending on regulations and brokerage policies.

4. What is the potential for losses in a margin account?

Trading on margin amplifies both gains and losses. While it can increase potential profits, it can also lead to larger losses if the value of the securities declines. If the market moves against the investor’s position, they may need to repay the borrowed funds even if the securities become nearly worthless.

5. Can I lose more than my initial investment in a margin account?

Yes, it is possible to lose more than the initial investment in a margin account. If the value of the securities drops significantly, the investor may need to deposit additional funds to meet margin calls. Failing to do so may lead to the forced sale of securities at a loss.

6. Are there any interest charges for borrowing on margin?

Yes, borrowing funds on margin usually incurs interest charges. The rate of interest varies depending on the brokerage and the amount borrowed. It is important to consider the cost of borrowing on margin when evaluating potential returns.

7. Can I use a margin account for all types of investments?

Margin accounts are typically used for trading stocks, options, and futures. However, not all investments are eligible for margin trading. It is essential to check with your broker regarding which securities can be traded on margin.

8. How can I manage the risks associated with margin accounts?

To mitigate risks associated with margin accounts, it is crucial to have a solid understanding of the market and carefully monitor your investments. Setting strict risk management strategies, maintaining a diversified portfolio, and maintaining adequate funds to meet margin requirements are essential steps to manage these risks effectively.

Final Thoughts

Margin accounts can be a useful tool for investors, allowing them to borrow funds to potentially increase their returns. However, it is important to understand the risks associated with margin accounts. Firstly, the use of borrowed funds amplifies losses as well as gains, which can lead to significant financial losses. Additionally, margin calls can occur when the value of securities held in the account falls below a certain threshold, requiring additional funds to be deposited. This can lead to forced selling of securities at unfavorable prices. In conclusion, while margin accounts offer potential benefits, it is crucial for investors to understand and carefully manage the risks involved.