Looking for a secure and flexible way to grow your savings? Money market accounts might just be the solution you’re looking for. What are money market accounts and their benefits? Well, they are a type of deposit account offered by financial institutions, typically providing higher interest rates than regular savings accounts. These accounts offer a balance of accessibility and earning potential, making them a popular choice for savers who want to maximize their returns while keeping their funds readily available. In this article, we will delve into the details of money market accounts and explore the various benefits they offer. So, let’s get started!

What are Money Market Accounts and Their Benefits?

Money market accounts are a type of savings account offered by financial institutions that provide a higher interest rate compared to regular savings accounts. These accounts combine the features of a checking and savings account, offering a safe and convenient way to save and grow your money.

In this article, we will explore the various benefits of money market accounts and how they can help individuals reach their financial goals.

The Basics of Money Market Accounts

Money market accounts are typically offered by banks, credit unions, and other financial institutions. They are FDIC insured, which means your deposits are protected up to $250,000 per account holder.

Here are some key features of money market accounts:

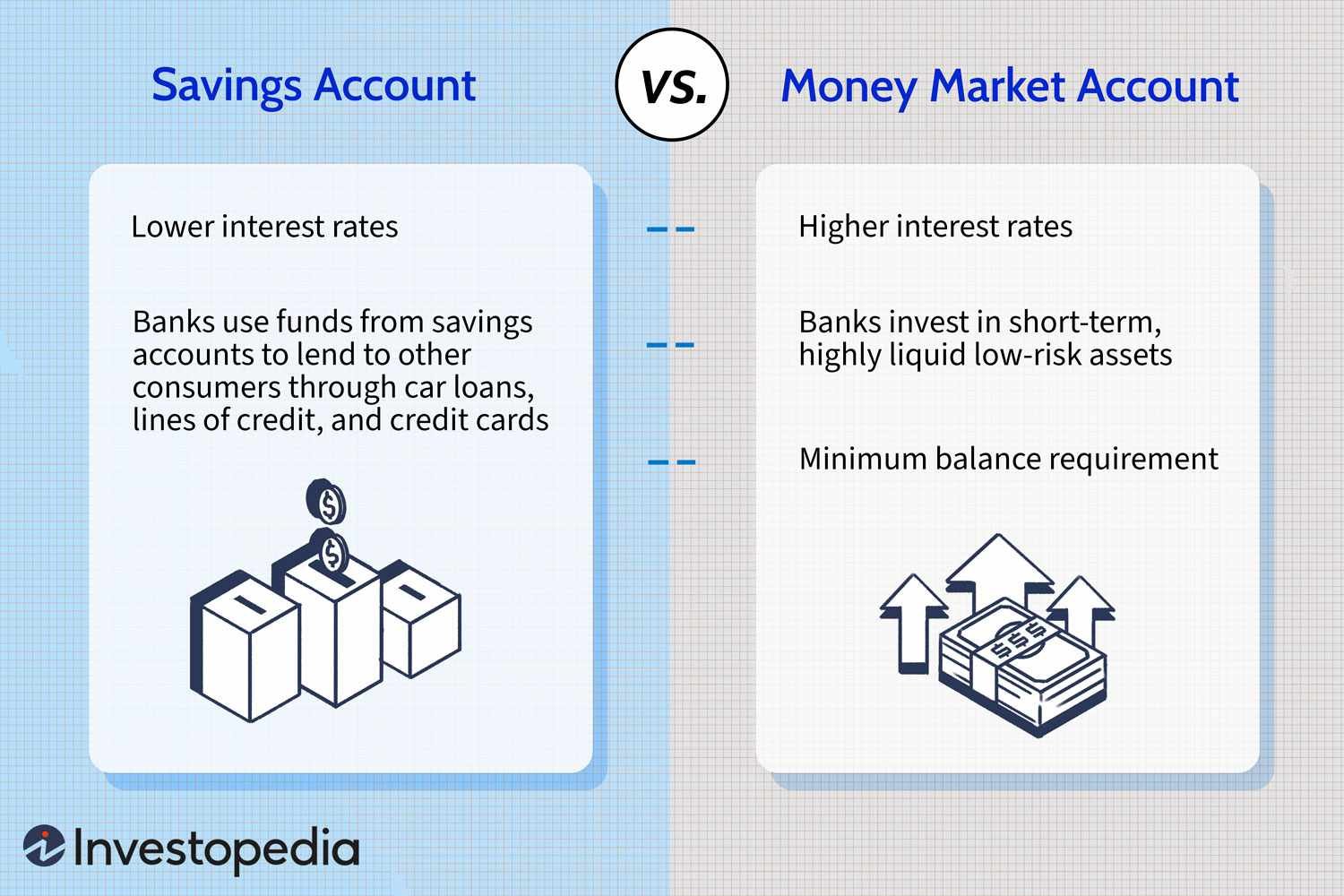

1. Higher Interest Rates: Money market accounts generally offer higher interest rates compared to regular savings accounts. These rates can vary depending on the financial institution and the current market conditions.

2. Limited Withdrawals: Money market accounts often come with certain limitations on the number of withdrawals you can make each month. This restriction helps maintain the account’s stability and allows the institution to invest the funds.

3. Minimum Balance Requirement: Financial institutions may require a minimum balance to open a money market account. If the balance falls below the required threshold, the account holder may incur fees or receive a lower interest rate.

4. Check Writing Privileges: Unlike traditional savings accounts, money market accounts usually provide check-writing privileges. This feature allows you to access your funds more easily when needed.

The Benefits of Money Market Accounts

Money market accounts offer several advantages that make them an attractive option for savers. Let’s delve into some of the key benefits:

1. Higher Interest Earnings: One of the primary benefits of money market accounts is the opportunity to earn higher interest on your savings. These accounts typically offer higher rates compared to regular savings accounts, making them a suitable choice for individuals looking to grow their money.

2. Liquidity: Money market accounts strike a balance between accessibility and earning potential. While they may have withdrawal limitations, they provide relatively easy access to your funds when compared to other investment options such as certificates of deposit (CDs) or bonds.

3. Safety and Security: Money market accounts offered by FDIC-insured banks and NCUA-insured credit unions are considered safe and secure. This insurance coverage protects your deposits in case the financial institution fails.

4. Flexibility: Money market accounts offer flexibility in managing your finances. The check-writing privileges associated with these accounts allow you to make payments or withdraw funds without hassle. Moreover, you can often link your money market account to your other accounts for seamless transfers.

5. Diversification: Money market accounts can serve as a tool for diversifying your investment portfolio. By keeping a portion of your savings in a money market account, you can balance your risk exposure and potentially earn more interest compared to having all your funds in low-yielding accounts.

6. Stability: Money market accounts are known for their stability. The underlying investments held by financial institutions, such as short-term government securities, certificates of deposit, and Treasury bills, are generally low-risk and provide a stable return on investment.

7. Emergency Funds: Money market accounts are often an excellent choice for emergency funds. The higher interest rates compared to regular savings accounts allow your emergency funds to grow over time, providing a cushion for unexpected expenses.

Choosing the Right Money Market Account

When selecting a money market account, consider the following factors:

1. Interest Rates: Compare the interest rates offered by different financial institutions. Look for accounts that offer competitive rates to maximize your earnings.

2. Fees and Minimum Balance Requirements: Be aware of any fees associated with the account and the minimum balance required to open and maintain it. Look for accounts that align with your financial situation and goals.

3. Access to Funds: Consider the ease of accessing your funds when needed. Check if the financial institution provides ATM access, online banking, or mobile banking options.

4. Customer Service: Look for a financial institution with reliable customer service to address any concerns or questions you may have.

5. Additional Benefits: Some money market accounts offer additional perks such as rewards, discounts, or preferred rates on loans. Consider these extra benefits when choosing an account.

Money market accounts provide individuals with a safe and convenient way to save and earn higher interest on their money. With their combination of liquidity, higher interest rates, and flexibility, these accounts can help individuals reach their financial goals while ensuring stability and security.

When considering a money market account, compare different financial institutions, evaluate interest rates and fees, and choose an account that aligns with your financial needs. With careful consideration and proper management, a money market account can be an essential tool in your financial journey.

What Is A Money Market Account?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a money market account?

A money market account is a type of savings account offered by banks and credit unions. It typically offers a higher interest rate compared to a regular savings account and allows limited check-writing capabilities.

How does a money market account work?

When you open a money market account, you deposit a certain amount of money in the account. The bank or credit union then invests that money in low-risk, short-term securities such as Treasury bills. The interest earned on these investments is passed on to you, the account holder.

What are the benefits of a money market account?

1. Higher interest rates: Money market accounts generally offer higher interest rates compared to regular savings accounts.

2. Easy access to funds: Money market accounts often come with check-writing abilities, allowing you to easily access your funds when needed.

3. Safety: Money market accounts are generally considered a safe place to keep your money as they are backed by the FDIC (Federal Deposit Insurance Corporation) or NCUA (National Credit Union Administration).

4. Low risk: Money market accounts invest in low-risk securities, reducing the risk of losing your principal investment.

5. Liquidity: Unlike some investments that have specific maturity dates, money market accounts provide liquidity, allowing you to easily withdraw funds without penalties.

What is the minimum balance required for a money market account?

The minimum balance required for a money market account varies depending on the financial institution. Some institutions may require a higher minimum balance to open an account and avoid monthly fees. It’s important to check with your bank or credit union for their specific requirements.

Are money market accounts FDIC insured?

Yes, money market accounts offered by banks are typically FDIC insured up to $250,000 per depositor. This means that if the bank fails, your money is protected up to that limit.

Can I write checks from a money market account?

Yes, most money market accounts allow check-writing capabilities. This feature allows you to conveniently pay bills or make purchases directly from your money market account.

Are there any fees associated with a money market account?

Some financial institutions may charge fees for maintaining a money market account or for certain transactions, such as excessive withdrawals. It’s important to review the account terms and conditions to understand any associated fees.

Can I access my money market account online?

Yes, many banks and credit unions offer online banking services for money market accounts. This allows you to conveniently manage your account, view balances, transfer funds, and more, from the comfort of your own home or anywhere with internet access.

Final Thoughts

Money market accounts are a type of savings account that offer higher interest rates compared to traditional savings accounts. They provide a secure and convenient way to save money while maintaining easy access to funds. With money market accounts, individuals can enjoy benefits such as competitive interest rates, FDIC insurance, check-writing privileges, and the ability to grow their savings without the risks associated with investments. These accounts are ideal for individuals who want to earn higher interest on their savings while still having the flexibility to withdraw funds when needed. So, what are money market accounts and their benefits? They are a smart choice for those seeking higher returns and liquidity in their savings.