Secured loans are a popular financial option that can provide individuals with the funds they need while offering numerous benefits. In simple terms, a secured loan requires the borrower to pledge collateral, such as a property or vehicle, as a guarantee for repayment. This added security for the lender opens up opportunities for borrowers to access larger loan amounts, lower interest rates, and longer repayment terms. Whether you’re looking to consolidate debt, fund a home renovation, or cover unexpected expenses, secured loans can offer a practical and advantageous solution. Let’s dive deeper into what secured loans are and explore their captivating benefits.

What are Secured Loans and Their Benefits

When it comes to borrowing money, there are various options available to individuals and businesses. One such option is a secured loan. In this article, we will explore what secured loans are and delve into the benefits they offer. Whether you’re looking to finance a major purchase or consolidate debt, understanding secured loans can help you make an informed decision. So, let’s dive in!

Understanding Secured Loans

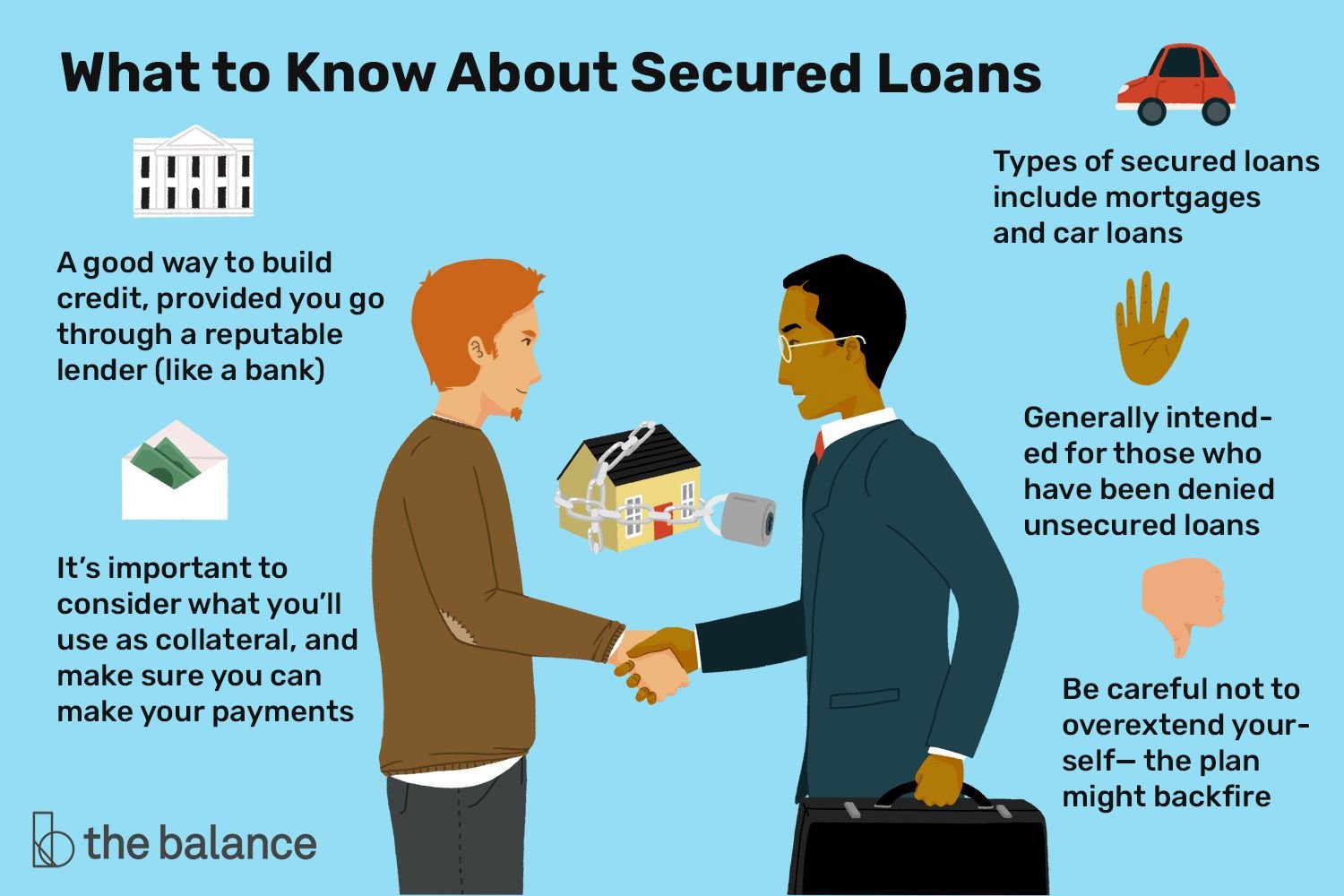

A secured loan is a type of loan that is backed by collateral, which is an asset that you pledge as security for the loan. This collateral can be in the form of a property, such as a house or a car, or other valuable assets. By providing collateral, borrowers offer a form of security to the lender, reducing the risk involved in lending money.

Secured loans are different from unsecured loans, where no collateral is required. The presence of collateral in secured loans often leads to more favorable terms and lower interest rates compared to unsecured loans. Lenders are generally more willing to offer larger loan amounts and longer repayment periods for secured loans.

The Benefits of Secured Loans

Secured loans offer several advantages to both borrowers and lenders. Let’s take a closer look at some of the key benefits:

1. Lower Interest Rates

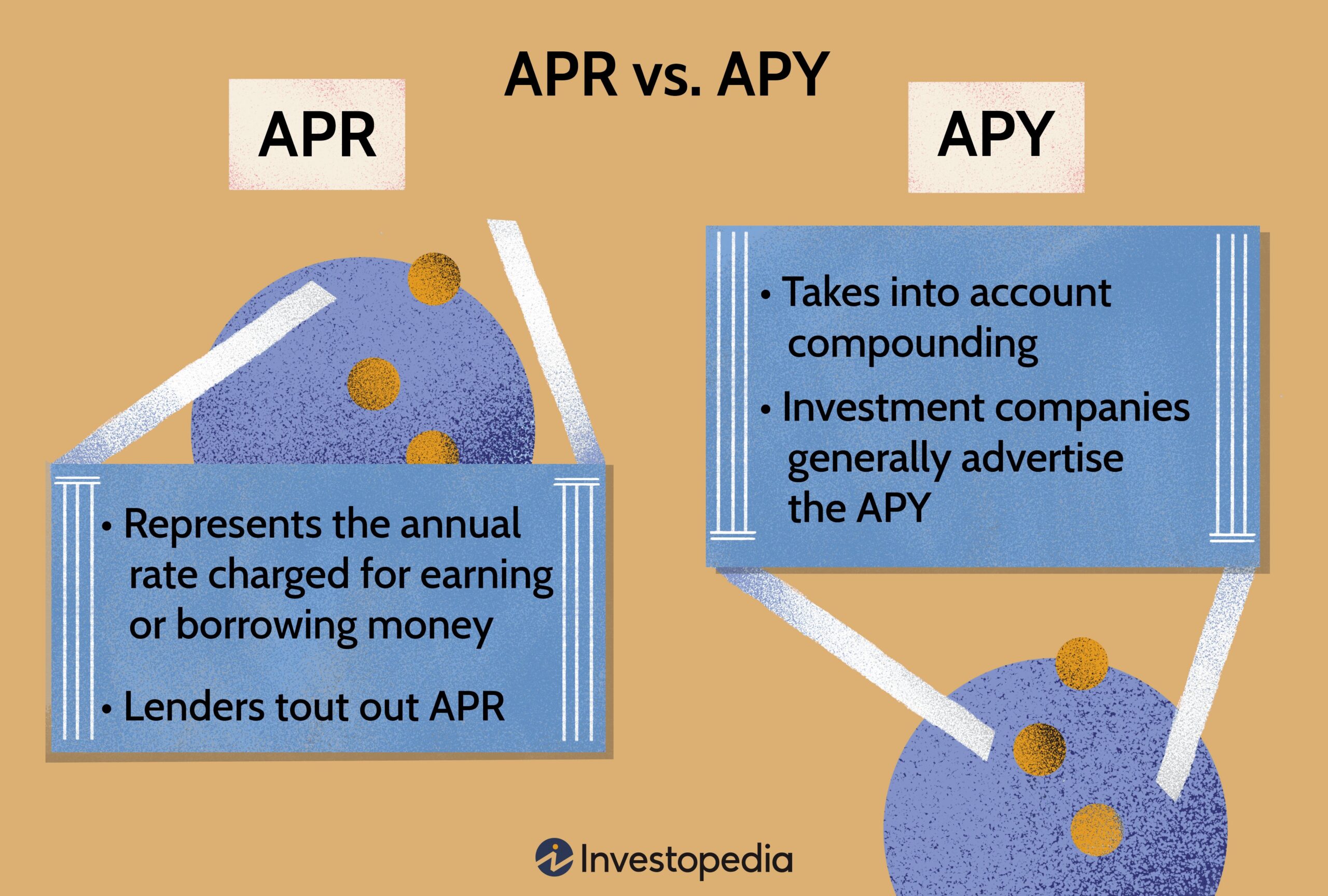

One of the significant advantages of secured loans is the lower interest rates compared to unsecured loans. Since lenders have collateral to seize in case of default, they are more willing to offer lower interest rates on secured loans. This means that borrowers can save money in the long run by paying less interest over the life of the loan.

2. Access to Larger Loan Amounts

Secured loans often allow borrowers to access larger loan amounts compared to unsecured loans. The presence of collateral assures lenders that they have a means to recover their money in case of default. This increased borrowing capacity can be beneficial for those who need to finance substantial expenses, such as home renovations or starting a business.

3. Longer Repayment Periods

Secured loans typically come with longer repayment periods, making monthly payments more manageable for borrowers. Unsecured loans, on the other hand, may have shorter repayment terms. The extended repayment period can be particularly advantageous for those who require a more flexible payment schedule or prefer smaller monthly installments.

4. Easier Approval Process

Secured loans often have a more straightforward approval process compared to unsecured loans. The presence of collateral provides lenders with reassurance, reducing the risk involved in lending money. This increased security can make secured loans more accessible, especially for individuals with lower credit scores or a limited credit history.

5. Improved Credit Opportunities

Taking out a secured loan and making regular payments can help improve your credit score over time. By consistently meeting your financial obligations, you demonstrate your creditworthiness to lenders. This can open up doors to better credit opportunities in the future, such as lower interest rates on other loans or credit cards.

6. Versatile Use of Funds

Secured loans offer flexibility in how the funds can be used. Whether you need to consolidate debt, cover medical expenses, fund education, or invest in a new business venture, secured loans give you the freedom to allocate the funds as needed. This versatility makes secured loans a popular choice for various financial needs.

7. Potential Tax Benefits

In some cases, the interest paid on a secured loan may be tax-deductible. Depending on your circumstances and the purpose of the loan, you could potentially benefit from tax deductions. It’s important to consult with a tax professional to understand the specific tax implications of your secured loan.

In conclusion, secured loans offer numerous benefits such as lower interest rates, larger loan amounts, longer repayment periods, easier approval processes, improved credit opportunities, versatile use of funds, and potential tax benefits. They are a viable option for individuals and businesses looking for financial assistance while leveraging valuable assets as collateral. However, it’s important to carefully consider the terms and conditions of the loan and ensure that you can meet the repayment obligations to avoid any negative consequences.

Secured Loans Explained – A quick guide to what you need to know before you borrow

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are secured loans?

Secured loans are loans that require collateral, such as property or a vehicle, to secure the loan. In case the borrower fails to repay the loan, the lender can seize and sell the collateral to recover the loan amount.

What are the benefits of secured loans?

Secured loans offer several benefits, including:

Can I get a lower interest rate with a secured loan?

Yes, one of the benefits of secured loans is that they often come with lower interest rates compared to unsecured loans. This is because the collateral reduces the risk for the lender.

How does a secured loan affect my credit score?

Secured loans can have a positive impact on your credit score if you make regular, timely payments. By demonstrating responsible borrowing behavior, you can improve your credit history and raise your credit score.

What assets can be used as collateral for a secured loan?

Different types of assets can be used as collateral for secured loans. Common examples include real estate, vehicles, savings accounts, and valuable possessions like jewelry or artwork.

What happens if I default on a secured loan?

If you default on a secured loan, the lender has the right to take possession of the collateral used to secure the loan. They can sell the collateral to recover the remaining loan balance.

Can I use a secured loan to consolidate my debts?

Yes, secured loans can be used for debt consolidation. By taking out a secured loan and using the funds to pay off multiple debts, you can consolidate your debts into one monthly payment, potentially at a lower interest rate.

What are the common types of secured loans?

Common types of secured loans include mortgage loans, auto loans, home equity loans, and secured personal loans. These loans are usually used for specific purposes and require collateral to secure the financing.

Final Thoughts

Secured loans provide borrowers with a means of accessing funds by offering collateral, such as a property or vehicle, to secure the loan. These loans often come with lower interest rates compared to unsecured loans, as the lender has the guarantee of the collateral. Additionally, secured loans allow borrowers to access larger loan amounts and have longer repayment periods. The benefits of secured loans include lower interest rates, larger loan amounts, longer repayment periods, and the ability for borrowers with less-than-perfect credit to access funding. With secured loans, individuals can obtain the financial support they need while enjoying favorable terms and conditions.