Looking to understand what stock options are and how they work? You’re in the right place! Stock options can be a fascinating and potentially lucrative tool for investors, but understanding their ins and outs can seem complex at first. Don’t worry, though – we’re here to simplify things for you. In this article, we’ll break down the concept of stock options, explain how they function, and shed light on the opportunities they offer. So, let’s dive in and demystify the world of stock options!

What Are Stock Options and How Do They Work?

When it comes to investing in the stock market, there are various ways to potentially grow your wealth. One popular investment tool that offers unique opportunities is stock options. Stock options are financial contracts that give the holder the right, but not the obligation, to buy or sell a specific amount of stock at a predetermined price within a set timeframe. In this article, we will explore what stock options are, how they work, and why they can be a valuable addition to an investor’s portfolio.

Understanding Stock Options

Stock options are derivative contracts, meaning their value is derived from an underlying stock. They are typically traded on exchanges, allowing investors to buy and sell these contracts similar to stocks. However, instead of owning shares of the company directly, options holders have the right to buy or sell the stock at a specified price, known as the strike price.

There are two main types of stock options:

1. Call Options: A call option gives the holder the right to buy the underlying stock at the strike price within a specific time period. If the stock price rises above the strike price, the option holder can “call” the stock and profit from the difference.

2. Put Options: A put option, on the other hand, gives the holder the right to sell the underlying stock at the strike price within a specific time period. If the stock price falls below the strike price, the option holder can “put” the stock and profit from the difference.

How Do Stock Options Work?

To better understand how stock options work, let’s walk through an example:

Imagine you have been granted a call option for Company XYZ. The option has a strike price of $50 and an expiration date of three months from now. Currently, Company XYZ’s stock is trading at $45 per share. Here’s what could happen:

1. Scenario 1: Stock Price Increases: If Company XYZ’s stock price rises to $60, you can exercise your call option. By exercising the option, you can purchase Company XYZ’s stock at the predetermined strike price of $50, even though the current market price is higher. You can then sell the stock at $60, earning a profit of $10 per share.

2. Scenario 2: Stock Price Decreases: However, if Company XYZ’s stock price falls to $40, you would most likely choose not to exercise your call option. Since the market price is lower than the strike price, it would not make sense to buy the stock at $50 when you could purchase it for a lower price on the open market.

It’s important to note that stock options have an expiration date. If you do not exercise your option before the expiration date, the option becomes worthless and you lose the premium paid for the contract.

Benefits of Stock Options

Stock options offer several benefits that attract both individual and institutional investors. Here are some key advantages of trading stock options:

1. Potential for Higher Returns: Stock options allow investors to leverage their investments, potentially generating higher returns compared to buying shares outright. Options holders can profit from price movements without committing as much capital.

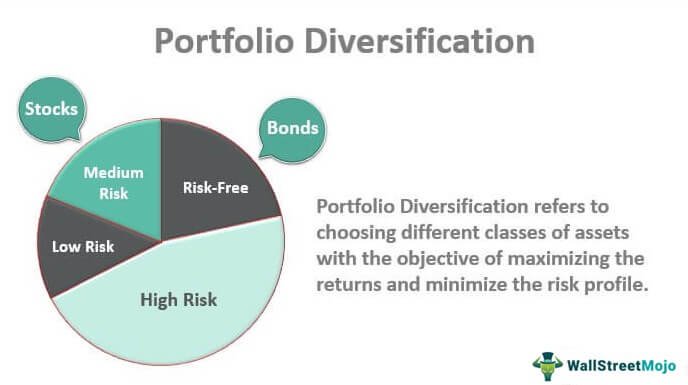

2. Hedging Against Market Volatility: Stock options can serve as a hedging tool to protect against potential losses. For example, if you own shares of a company and are concerned about a potential decrease in its stock price, you can purchase put options as insurance. If the stock price falls, the put options will increase in value, offsetting the losses on your shares.

3. Income Generation: Experienced options traders can generate income by writing (selling) options. By receiving the premium from the buyer of the option, writers can profit if the option expires worthless or if the stock price remains below the strike price for call options.

Risks of Stock Options

While stock options offer potential rewards, they also come with risks that investors should be aware of. Here are some important risks associated with trading stock options:

1. Limited Timeframe: Options contracts have expiration dates, which means you must be correct in your market timing to profit from them. If the stock price doesn’t move as expected within the specified timeframe, the options may expire worthless.

2. Volatility: Options trading can be more volatile than investing in stocks directly. Prices can fluctuate rapidly, and sudden market movements can significantly impact the value of options contracts.

3. Complexity: Options trading involves a level of complexity that may be challenging for novice investors to understand. It’s crucial to educate yourself and seek advice from professionals before engaging in options trading.

Stock options provide investors with additional opportunities to profit from the stock market. Whether to hedge against potential losses, generate income, or leverage investments, options can be a valuable tool in a well-rounded investment strategy. However, they also come with risks, and it’s essential to fully understand how options work before trading them. As with any investment, careful consideration and thorough research are key to making informed decisions.

Stock Options Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are stock options?

Stock options are financial contracts that give individuals the right, but not the obligation, to buy or sell shares of a company’s stock at a predetermined price within a specific time period.

How do stock options work?

When a company offers stock options to its employees or investors, they are providing them with the opportunity to purchase shares of the company’s stock at a set price, known as the exercise price or strike price. These options usually have an expiration date, after which they become worthless if not exercised.

Who can use stock options?

Stock options are commonly used by both employees of a company, as part of their compensation package, and by investors looking to take advantage of potential price increases in a stock.

What is the benefit of stock options?

Stock options offer the potential for significant financial gain. If the price of the stock increases above the exercise price, the option holder can purchase the stock at a lower price and sell it at the market price, pocketing the difference as profit.

What is the difference between call and put options?

Call options give the holder the right to buy shares at the exercise price, while put options give the holder the right to sell shares at the exercise price. Call options are typically used in bullish markets, where investors anticipate stock price increases, while put options are used in bearish markets, where investors expect stock price decreases.

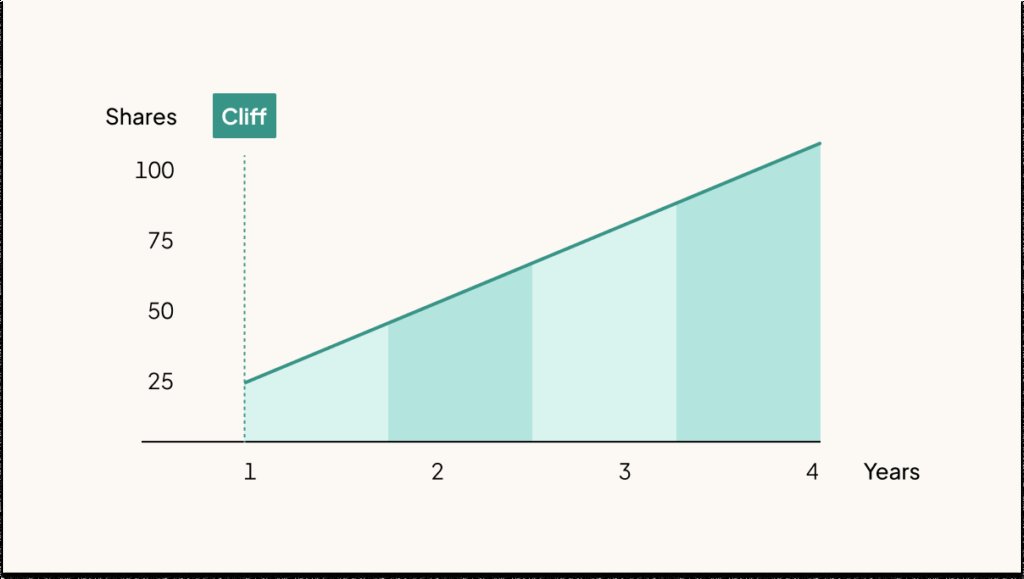

How are stock options granted to employees?

Companies grant stock options to employees as a form of incentive or compensation. These options usually come with a vesting period, during which the employee must continue working for the company to become eligible to exercise the options. The exercise price and the number of options granted are determined by the company.

What is vesting period?

The vesting period is the length of time an employee must work for a company before being able to exercise their stock options. It is a way for companies to motivate employees to stay with the company and align their interests with the company’s success.

What happens if the stock price goes below the exercise price?

If the stock price falls below the exercise price of the stock options, the options may become worthless. In this case, the option holder is not obligated to exercise the options and can simply let them expire.

Can stock options be traded on the stock market?

Yes, stock options can be traded on the stock market, allowing investors to buy and sell options contracts without actually owning the underlying stock. This provides an opportunity for traders to speculate on the price movements of the options themselves.

Final Thoughts

Stock options are a popular form of compensation that companies offer to their employees or as a way for investors to participate in the market. These options give the holder the right, but not the obligation, to buy or sell a specific number of shares at a predetermined price within a certain timeframe. By purchasing a call option, the holder can profit from a rise in the stock’s price, while a put option allows them to profit from a decline. Stock options provide flexibility and leverage, allowing individuals to potentially earn higher profits than by buying or selling the stock directly. Understanding stock options and how they work is essential for anyone looking to invest in the market or explore new career opportunities.