Subprime loans have been making headlines in recent years, and understanding their risks is crucial for anyone involved in the world of finance. So, what exactly are subprime loans and their risks? Subprime loans are loans that are granted to borrowers with low credit scores, typically below 600. These loans often come with high-interest rates and may require less stringent financial documentation. However, the risks associated with subprime loans are significant. They have been known to contribute to financial crises and can lead to borrowers facing foreclosure. In this article, we will delve deeper into the world of subprime loans and examine the potential risks they pose.

What Are Subprime Loans and Their Risks

Subprime loans are a type of loan that are offered to borrowers with a less-than-perfect credit history. These loans typically carry higher interest rates and fees compared to prime loans, which are offered to borrowers with good credit scores. While subprime loans can provide borrowing opportunities for individuals who may not qualify for traditional loans, they also come with significant risks that both borrowers and lenders need to be aware of.

The Origins of Subprime Loans

The concept of subprime lending can be traced back to the early 20th century when lenders started offering loans to borrowers with high credit risk. However, it wasn’t until the late 1990s and early 2000s that subprime lending became more prevalent and widely accessible.

During this period, lenders began to relax their lending standards and offer subprime loans to a larger pool of borrowers. This was driven by several factors, including a booming housing market, low interest rates, and financial innovations that allowed mortgage-backed securities to be bundled and sold to investors.

As a result, subprime loans became more attractive to lenders seeking to profit from the growing demand for mortgage loans. Unfortunately, this period also saw an increase in risky lending practices, which ultimately led to the subprime mortgage crisis in 2008.

The Risks of Subprime Loans

While subprime loans can provide access to credit for individuals with poor credit scores, they carry significant risks for both borrowers and lenders. It’s crucial to understand these risks before considering a subprime loan.

1. Higher Interest Rates

Subprime loans typically come with higher interest rates compared to prime loans. This is because lenders view borrowers with poor credit histories as higher-risk borrowers who are more likely to default on their loans. The higher interest rates help compensate lenders for the increased risk they take on.

Higher interest rates can result in significantly higher monthly payments for borrowers, making it more challenging to keep up with loan repayment. This can lead to financial strain and potential default on the loan.

2. Fees and Penalties

In addition to higher interest rates, subprime loans may also come with additional fees and penalties. Lenders may charge origination fees, application fees, and prepayment penalties, among other charges. These fees can add up, making the overall cost of the loan much higher than expected.

Borrowers need to carefully read and understand the terms and conditions of subprime loans to avoid any unexpected fees or penalties. It’s essential to factor in these additional costs when evaluating the affordability of the loan.

3. Increased Risk of Default

Due to their higher interest rates and fees, subprime loans carry an increased risk of default. Borrowers who are already financially vulnerable may struggle to make timely payments, increasing the chances of falling behind on their loan.

If a borrower defaults on a subprime loan, it can have severe consequences. The lender may initiate foreclosure proceedings, resulting in the borrower losing their home or other collateral used to secure the loan. Defaulting on a loan can also negatively impact the borrower’s credit score, making it even more challenging to access credit in the future.

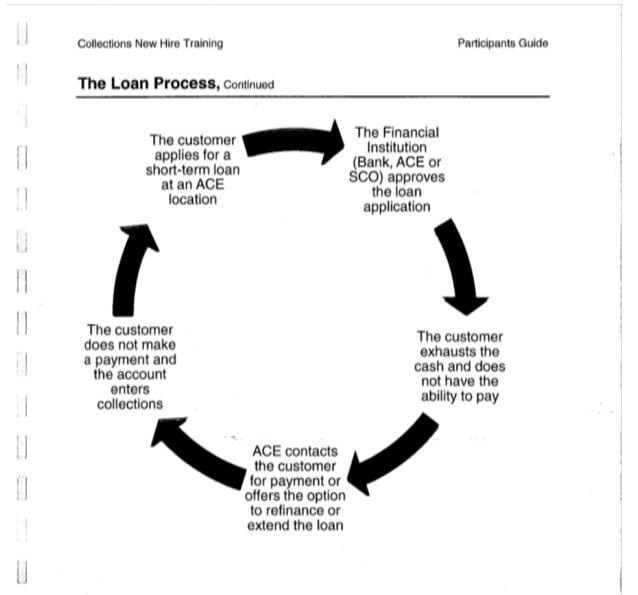

4. Potential for Predatory Lending

Another risk associated with subprime loans is the potential for predatory lending practices. Some lenders may take advantage of borrowers’ limited financial knowledge and desperate need for credit by offering loans with unfavorable terms and conditions.

These predatory lenders may employ deceptive tactics, such as hidden fees or misleading information, to trap borrowers in high-cost loans they cannot afford. It’s crucial for borrowers to be vigilant and carefully research and compare loan offers before committing to any subprime loan.

5. Impact on Financial Stability

Subprime loans and the associated risks played a significant role in the 2008 financial crisis. The widespread default on subprime mortgages triggered a chain reaction that led to a collapse of the housing market, the failure of several financial institutions, and a global recession.

While regulations and reforms have been implemented to prevent a similar crisis, the risks associated with subprime loans can still impact financial stability on a smaller scale. A sudden increase in delinquencies and defaults on subprime loans could have repercussions on the broader economy and financial markets.

Managing the Risks

While subprime loans come with inherent risks, there are steps that both borrowers and lenders can take to mitigate these risks.

For Borrowers:

- Improve Credit Score: Taking steps to improve your credit score can help qualify for better loan terms in the future.

- Shop Around: Compare loan offers from different lenders to ensure you’re getting the best possible terms and avoiding predatory lending practices.

- Create a Realistic Budget: Assess your financial situation and create a budget that allows you to comfortably make loan payments. Avoid borrowing more than you can afford.

- Understand the Terms: Carefully read and understand the terms and conditions of the loan before signing any agreements. Seek professional advice if needed.

- Consider Credit Counseling: If you’re struggling with debt, credit counseling agencies can provide guidance and support in managing your finances.

For Lenders:

- Responsible Lending Practices: Lenders should adhere to responsible lending practices and ensure borrowers have the ability to repay the loan without facing undue financial hardship.

- Educate Borrowers: Provide clear and transparent information about loan terms, fees, and potential risks to help borrowers make informed decisions.

- Avoid Predatory Practices: Lenders should refrain from engaging in predatory practices that exploit borrowers’ financial vulnerabilities.

- Risk Assessment: Conduct thorough credit assessments and risk analyses to accurately evaluate borrowers’ creditworthiness.

- Compliance with Regulations: Stay up to date with relevant regulations and comply with all legal requirements to ensure fair lending practices.

Subprime loans can provide access to credit for individuals with poor credit histories, but they also come with significant risks. Higher interest rates, fees, increased risk of default, potential for predatory lending, and their impact on financial stability are all factors to consider when evaluating subprime loans.

Whether you’re a borrower or a lender, it’s essential to be aware of these risks and take steps to mitigate them. Borrowers should improve their credit scores, compare loan offers, create realistic budgets, and seek professional advice if needed. Lenders, on the other hand, should adhere to responsible lending practices, educate borrowers, and avoid predatory practices.

By understanding the risks and taking appropriate measures, subprime lending can be approached more cautiously, ensuring a more stable and fair lending environment for all parties involved.

Subprime loans explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are subprime loans?

Subprime loans are loans that are offered to borrowers with low credit ratings or a history of financial difficulties. These borrowers are considered to be higher risk, and as a result, subprime loans often have higher interest rates and less favorable terms compared to prime loans.

What are the risks associated with subprime loans?

Subprime loans carry several risks, including:

– Higher interest rates: Borrowers with low credit scores are charged higher interest rates, resulting in higher monthly payments.

– Adjustable rates: Subprime loans may have adjustable interest rates that can increase over time, making it difficult for borrowers to manage their payments.

– Predatory lending: Some lenders exploit vulnerable borrowers by offering subprime loans with hidden fees, excessive charges, or unfair terms.

– Potential default: Due to the higher risk nature of subprime loans, borrowers are more likely to default on their payments, which can lead to foreclosure and financial instability.

– Negative impact on credit: Defaulting on a subprime loan can significantly damage a borrower’s credit score, making it harder to obtain future credit.

Can anyone apply for a subprime loan?

Yes, anyone with a low credit score or a history of financial difficulties can apply for a subprime loan. However, it’s important to carefully consider the risks associated with such loans before making a decision.

Why would someone choose a subprime loan?

Individuals may choose subprime loans when they are unable to qualify for prime loans due to their credit history. It may be their only option to access financing, especially during emergencies or when they have limited alternatives.

Are subprime loans only available for mortgages?

No, subprime loans are not limited to mortgages. They can also be offered for other types of loans, such as auto loans, personal loans, and credit cards.

How can borrowers mitigate the risks associated with subprime loans?

Borrowers can mitigate the risks of subprime loans by:

– Improving their credit score: Taking steps to improve creditworthiness can help borrowers qualify for prime loans with better terms and lower interest rates.

– Researching lenders: Thoroughly researching and comparing different lenders can help borrowers find reputable ones who offer fair terms and reasonable interest rates.

– Reading loan agreements carefully: It is essential to read and understand all terms and conditions of the loan agreement before signing. Borrowers should be aware of any hidden fees or potential risks.

– Exploring other financing options: If possible, borrowers should explore alternative financing options, such as credit unions or community development financial institutions (CDFIs), which may offer more favorable terms.

What are the long-term consequences of defaulting on a subprime loan?

Defaulting on a subprime loan can have significant long-term consequences, including:

– Damage to credit score: Defaulting on a loan will drastically lower a borrower’s credit score, making it harder to obtain future loans or credit.

– Difficulty in obtaining housing: A default can make it challenging to secure rental housing or qualify for a mortgage in the future.

– Collection efforts: Lenders can pursue collection efforts, including wage garnishment and legal proceedings, to recover the unpaid debt.

– Foreclosure or repossession: If the subprime loan is for a house or a car, defaulting could lead to foreclosure or repossession of the property.

Are subprime loans illegal?

No, subprime loans are not illegal. However, certain lending practices associated with subprime loans, such as predatory lending or intentionally misleading borrowers, may be illegal and subject to regulatory action. It is crucial to work with reputable lenders and be aware of your rights as a borrower.

Can subprime loans help rebuild credit?

While subprime loans can provide access to credit for individuals with poor credit histories, they may not be the best option for rebuilding credit. It is advisable to explore other means, such as secured credit cards or credit builder loans, which are specifically designed for credit rebuilding purposes.

Final Thoughts

Subprime loans are loans offered to borrowers with low credit scores or a high risk of defaulting on their payments. These loans come with higher interest rates and fees compared to prime loans. The risks associated with subprime loans are significant. Borrowers may struggle to make their monthly payments, leading to foreclosure and financial instability. Lenders, who often bundle and sell these loans as mortgage-backed securities, may face losses if borrowers default. The subprime mortgage crisis in 2008 demonstrated the severe consequences when subprime loans are not properly regulated. It is crucial for both borrowers and lenders to be aware of the risks involved in subprime loans to make informed decisions and ensure financial stability.