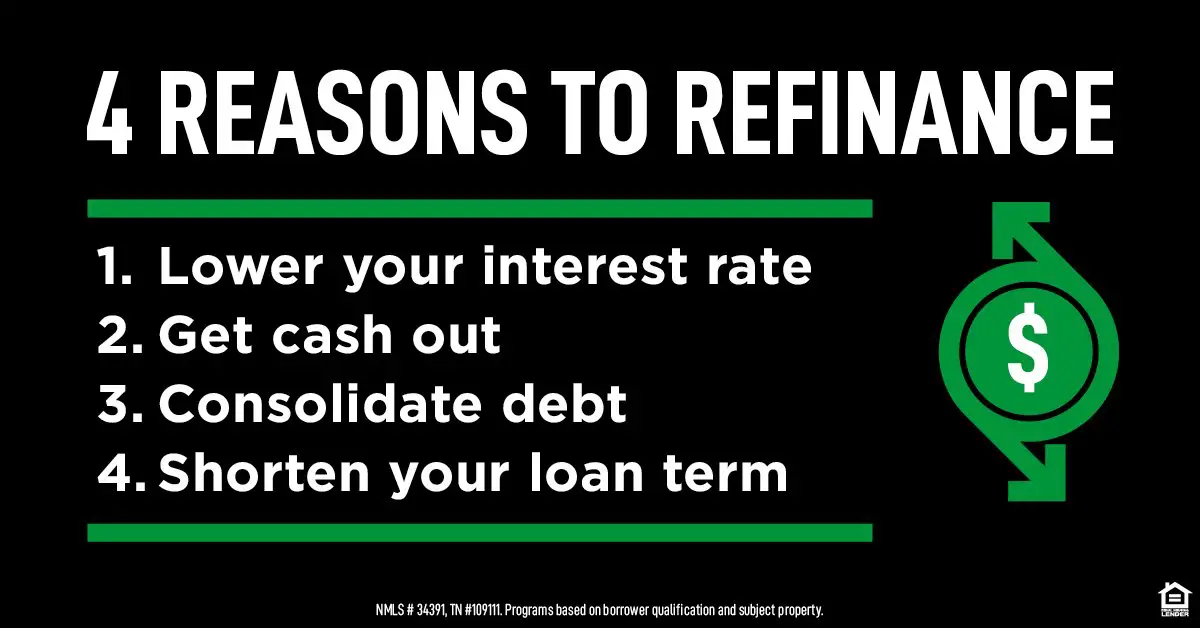

Looking to lower your mortgage payments? Wondering how to make the most out of your biggest investment? Well, refinancing a mortgage might be the solution you’ve been searching for. What are the benefits of refinancing a mortgage, you ask? This article will delve into the compelling advantages that come with refinancing, providing you with all the information you need to make an informed decision. From reducing your interest rates to accessing cash for other important expenses, refinancing a mortgage is a powerful tool that can help you achieve your financial goals. So, let’s explore the possibilities together.

What Are the Benefits of Refinancing a Mortgage?

Refinancing a mortgage can be a smart financial move for homeowners. It involves replacing an existing mortgage with a new one, usually to take advantage of better terms or to free up funds for other purposes. In this article, we will explore the various benefits of refinancing a mortgage, from obtaining a lower interest rate to reducing monthly payments and even accessing home equity. So, let’s dive in!

1. Lower Interest Rates

One of the primary reasons homeowners choose to refinance their mortgage is to secure a lower interest rate. When prevailing interest rates drop significantly from the time you took out your original mortgage, refinancing can help you save a substantial amount of money over the life of your loan. Lower interest rates mean reduced monthly payments and more money in your pocket.

Example:

Let’s say you have a $300,000 mortgage with a 30-year term and an interest rate of 5%. By refinancing to a new loan with a rate of 3.5%, you could potentially save over $100,000 in interest payments over the life of the loan.

2. Reduced Monthly Payments

Refinancing can also lead to lower monthly mortgage payments. Along with obtaining a lower interest rate, extending the loan term can spread out the principal balance over a longer period, reducing the monthly burden on your finances.

Example:

Suppose you have a $200,000 mortgage with a 20-year term and an interest rate of 4.5%. By refinancing to a new 30-year loan with a rate of 3.75%, your monthly payments could decrease by $200 or more. This extra cash flow can be used to pay off other debts, save for retirement, or fund home improvements.

3. Shorter Loan Term

On the flip side, refinancing can also allow you to shorten the term of your mortgage. By transitioning from a longer-term to a shorter-term loan, you can pay off your mortgage sooner and potentially save thousands of dollars in interest payments.

Example:

Assume you have a $250,000 mortgage with a 30-year term and an interest rate of 4%. By refinancing to a new 15-year loan with a rate of 2.75%, you could pay off your mortgage 15 years earlier and save around $90,000 in interest.

4. Cash-Out Opportunities

Refinancing can enable homeowners to tap into their home equity and access cash for various purposes. This is known as a cash-out refinance. It allows you to borrow against the equity you have built in your home and receive a lump sum payment at closing. This cash can be used for home renovations, debt consolidation, investment opportunities, or other important expenses.

Example:

Suppose your home is currently valued at $400,000, and your outstanding mortgage balance is $250,000. By refinancing through a cash-out refinance at an 80% loan-to-value ratio, you could potentially access up to $70,000 in cash.

5. Debt Consolidation

Refinancing can also be an effective strategy for consolidating high-interest debts, such as credit cards or personal loans. By utilizing the equity in your home through a cash-out refinance, you can pay off these debts and streamline your monthly payments into a single manageable mortgage payment with a lower interest rate.

Example:

Let’s say you have $50,000 in credit card debt with an average interest rate of 18%. By refinancing your mortgage and consolidating this debt, you can save a significant amount of money on interest payments and simplify your finances.

6. Switching from Adjustable Rate to Fixed Rate

If you have an adjustable-rate mortgage (ARM), you may want to consider refinancing into a fixed-rate mortgage. ARMs typically offer lower initial interest rates but can increase over time, potentially leading to higher monthly payments. Refinancing to a fixed-rate mortgage provides stability and peace of mind, as your interest rate and monthly payments remain constant throughout the loan term.

7. Removal of Private Mortgage Insurance (PMI)

Many homeowners are required to pay private mortgage insurance (PMI) if they initially put less than 20% down when purchasing their home. However, once you have built up enough equity in your property, refinancing can help eliminate the need for PMI. This can result in significant monthly savings.

Example:

Suppose your home is valued at $300,000, and your outstanding mortgage balance is $240,000. With an original down payment of $30,000 (10%), you were required to pay PMI. However, if your home has appreciated in value and you now have at least 20% equity, refinancing can help you remove the PMI requirement and reduce your monthly expenses.

8. Simplified Finances

Refinancing can simplify your finances by consolidating multiple mortgages or home equity loans into a single loan. By combining these loans, you only have one monthly payment to keep track of, making it easier to manage your budget and stay organized.

9. Access to Expertise and Additional Services

When refinancing your mortgage, you have the opportunity to work with mortgage professionals who can provide valuable advice and guidance tailored to your financial goals. They can help you navigate the refinancing process, analyze your options, and choose the best loan product for your specific needs.

In conclusion, refinancing a mortgage can offer numerous benefits to homeowners. Whether it’s obtaining a lower interest rate, reducing monthly payments, accessing cash for various purposes, or simplifying your financial situation, refinancing can be a smart move to improve your overall financial well-being. It is important to carefully analyze the potential savings and consider your long-term goals before proceeding with refinancing.

Is Refinancing Your Mortgage Worth It?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the benefits of refinancing a mortgage?

Refinancing a mortgage can offer several benefits, including:

How does refinancing a mortgage save money?

By refinancing a mortgage at a lower interest rate, borrowers can save money on their monthly mortgage payments. This can result in significant savings over the life of the loan.

Can refinancing a mortgage lower my monthly payments?

Yes, refinancing a mortgage can potentially lower your monthly payments if you secure a lower interest rate or extend the loan term. However, it’s important to consider closing costs and fees associated with refinancing.

Will refinancing my mortgage affect my credit score?

Refinancing a mortgage may have a temporary impact on your credit score. When you apply for refinancing, it typically involves a hard inquiry on your credit report. However, as you make timely payments on the new mortgage, your credit score can improve over time.

What is cash-out refinancing?

Cash-out refinancing allows homeowners to access the equity built up in their property by taking out a new mortgage for more than the existing loan balance. The excess money can be used for various purposes, such as home improvements or debt consolidation.

Can refinancing help me pay off my mortgage faster?

Refinancing to a shorter loan term, such as switching from a 30-year mortgage to a 15-year mortgage, can help you pay off your mortgage faster. However, it’s important to consider if the higher monthly payments fit within your budget.

What is a fixed-rate mortgage?

A fixed-rate mortgage is a type of mortgage where the interest rate remains the same throughout the entire loan term. Refinancing to a fixed-rate mortgage can provide stability and protection against future interest rate increases.

Is it possible to consolidate debt through mortgage refinancing?

Yes, consolidating debt through mortgage refinancing is possible. By taking out a new mortgage with a lower interest rate, homeowners can use the extra funds to pay off higher-interest debt such as credit cards or personal loans, potentially saving money on interest payments.

Final Thoughts

Refinancing a mortgage offers several benefits. Firstly, it allows homeowners to obtain a lower interest rate, resulting in reduced monthly payments and potential savings in the long run. Additionally, refinancing can provide an opportunity to shorten the loan term, enabling borrowers to become debt-free sooner. Another advantage is the possibility to tap into home equity and use the funds for various purposes such as home renovations, debt consolidation, or investment opportunities. Moreover, refinancing may lead to the consolidation of multiple debts into one manageable payment. In summary, the benefits of refinancing a mortgage include obtaining lower interest rates, reducing monthly payments, accessing home equity, and consolidating debts.