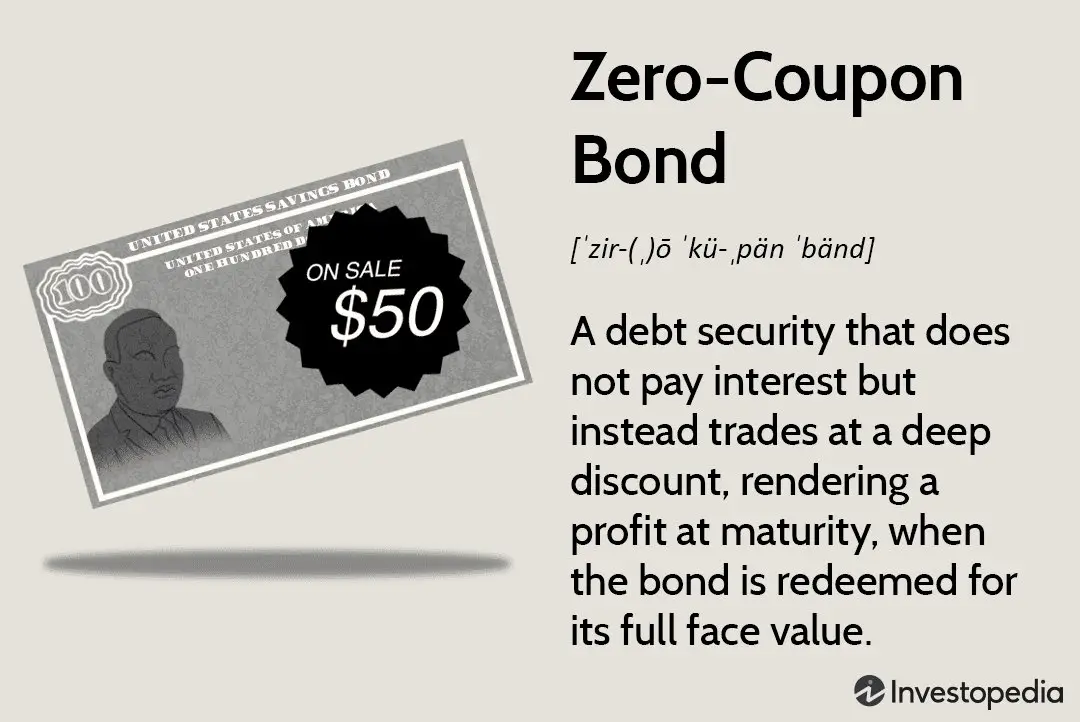

Looking to diversify your investment portfolio? Zero-coupon bonds might just be the answer. These unique financial instruments offer a compelling alternative for investors seeking steady returns over a fixed period of time. So, what are zero-coupon bonds and their benefits? Essentially, they are bonds that do not make periodic interest payments like traditional bonds. Instead, investors purchase these bonds at a discount to their face value and receive the full face value at maturity. In this blog article, we will delve into the fascinating world of zero-coupon bonds and explore the advantages they bring to investors.

What Are Zero-Coupon Bonds and Their Benefits

Zero-coupon bonds, also known as discount bonds or deep discount bonds, are fixed-income securities that do not pay periodic interest or coupon payments throughout their duration. Instead, these bonds are sold at a significant discount to their face value and provide a lump-sum payment at maturity. Zero-coupon bonds offer a unique investment opportunity with several benefits for both individual investors and institutional investors. In this article, we will delve into the details of zero-coupon bonds, exploring their features, advantages, and potential risks.

How Do Zero-Coupon Bonds Work?

Zero-coupon bonds are issued by governments, municipalities, corporations, and other entities to raise capital. Unlike traditional bonds that make periodic interest payments, zero-coupon bonds are issued at a deep discount to their face value. The discount represents the interest earned over the bond’s term. Investors purchase these bonds at a discounted price and receive the full face value of the bond upon maturity.

For example, if a zero-coupon bond with a face value of $1,000 is issued with a maturity period of 10 years and a discount rate of 5%, an investor might purchase the bond for $613.91. At the end of the 10-year period, the investor will receive the full face value of $1,000, earning a return of 5% annually.

The Benefits of Zero-Coupon Bonds

Investing in zero-coupon bonds can provide several advantages for investors, depending on their financial goals and risk tolerance. Let’s explore some of the key benefits associated with zero-coupon bonds:

1. Fixed Return on Investment

Zero-coupon bonds offer a fixed return on investment. As the bonds are sold at a discount and redeemed at face value, the investor’s return is predetermined. This fixed return can be appealing to risk-averse investors who prefer predictable outcomes and want to secure their investment return.

2. Compounding Effect

The deep discount at which zero-coupon bonds are sold allows investors to benefit from the compounding effect. Since no periodic interest payments are made, the interest is reinvested and compounded until the bond matures. This compounding effect can amplify returns over the investment horizon.

3. Diversification

Zero-coupon bonds offer diversification benefits to investors’ portfolios. As they have different characteristics than traditional bonds, investing in zero-coupon bonds can help balance the overall risk profile of a portfolio. By diversifying across different asset classes, including zero-coupon bonds, investors can potentially reduce their exposure to market fluctuations.

4. Tax Advantages

Zero-coupon bonds may provide tax advantages depending on their issuers. In some cases, the interest accrued each year, despite not being paid out, may be subject to federal, state, or local taxes. However, certain types of zero-coupon bonds, such as municipal zero-coupon bonds, may be exempt from federal taxes or offer tax advantages for investors in specific locations. It’s important to consult with a tax advisor to understand the tax implications of investing in zero-coupon bonds.

Risks Associated with Zero-Coupon Bonds

While zero-coupon bonds offer enticing benefits, it’s crucial to consider the potential risks involved. Understanding these risks can help investors make informed decisions. Let’s explore some of the risks associated with zero-coupon bonds:

1. Interest Rate Risk

Zero-coupon bonds are highly sensitive to changes in interest rates. As these bonds do not provide periodic interest payments, their value is heavily influenced by prevailing interest rates. When interest rates rise, the value of zero-coupon bonds typically decreases, as investors can earn higher returns from other fixed-income investments. Conversely, when interest rates decline, the value of zero-coupon bonds tends to rise.

2. Inflation Risk

Zero-coupon bonds are also exposed to inflation risk. Inflation erodes the purchasing power of future cash flows, including the face value of zero-coupon bonds. If the rate of inflation exceeds the bond’s yield, the investor may experience a real loss on their investment, even though they receive the full face value at maturity. Investors should be mindful of inflation trends when considering zero-coupon bonds.

3. Liquidity Risk

Zero-coupon bonds are known for their lack of liquidity compared to other types of fixed-income securities. Since the bonds do not provide periodic interest payments, there may be limited secondary market demand for them. Investors holding zero-coupon bonds may find it challenging to sell them before maturity, potentially impacting their ability to access funds when needed.

Who Should Consider Investing in Zero-Coupon Bonds?

Zero-coupon bonds can be suitable for a range of investors, depending on their financial goals and risk appetite. Here are some investor profiles that might find zero-coupon bonds appealing:

1. Long-Term Investors

Investors with a long-term investment horizon may benefit from investing in zero-coupon bonds. These bonds are designed to be held until maturity, allowing investors to lock in a fixed return over a predetermined period.

2. Retirement Planning

Zero-coupon bonds can be a useful tool for retirement planning. By purchasing bonds with maturities that coincide with their retirement date, individuals can create a predictable income stream in the future. The compounding effect and fixed return make zero-coupon bonds an attractive option for long-term retirement planning.

3. Risk-Averse Investors

Investors who prioritize capital preservation and prefer low-risk investments may find zero-coupon bonds appealing. The fixed return and reduced exposure to market fluctuations can provide peace of mind for risk-averse individuals.

4. Tax-Sensitive Investors

Tax-sensitive investors can benefit from specific types of zero-coupon bonds that offer tax advantages. Municipal zero-coupon bonds, for example, may provide tax-exempt income, helping investors reduce their overall tax burden.

Zero-coupon bonds offer unique investment opportunities with attractive benefits. They provide a fixed return on investment, the potential for compounded growth, diversification advantages, and potential tax benefits. However, investors should be aware of the risks associated with these bonds, such as interest rate risk, inflation risk, and liquidity risk. Before investing, individuals should consider their financial goals, risk tolerance, and consult with a financial advisor or tax professional to determine if zero-coupon bonds align with their investment strategy. Overall, zero-coupon bonds can be a valuable addition to a well-diversified investment portfolio.

Zero-Coupon Bond vs Regular Bond 11340

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are zero-coupon bonds?

Zero-coupon bonds, also known as discount bonds, are fixed-income securities that do not pay any periodic interest. They are issued at a discount to their face value and mature at par value.

How do zero-coupon bonds work?

Zero-coupon bonds are purchased at a discounted price and do not provide regular interest payments. Instead, the bondholder receives the full face value of the bond at maturity. The difference between the discounted purchase price and the face value represents the interest earned.

What are the benefits of investing in zero-coupon bonds?

Investing in zero-coupon bonds offers several benefits, including:

1. Diversification: Zero-coupon bonds can provide diversification to an investment portfolio, as they generally have different risk and return characteristics compared to other investments.

2. Fixed return: Investors are guaranteed a fixed return at maturity, as the bonds are typically issued with a predetermined face value.

3. Minimal reinvestment risk: Since there are no periodic interest payments, there is no need to reinvest those payments, reducing the risk of reinvesting at unfavorable rates.

4. Tax advantages: The interest earned on zero-coupon bonds is typically taxed as capital gains, which may provide tax advantages for certain investors.

5. Long-term planning: Zero-coupon bonds can be useful for long-term financial planning, as the fixed maturity date allows investors to accurately estimate the final value of their investment.

Are zero-coupon bonds risk-free?

While zero-coupon bonds are generally considered to be less risky than stocks, they do carry certain risks. The main risk associated with zero-coupon bonds is interest rate risk. If interest rates rise, the value of the bond may decline in the secondary market.

How are zero-coupon bonds taxed?

The interest earned on zero-coupon bonds is subject to taxation as capital gains. The tax rate depends on various factors, including the investor’s tax bracket and the holding period of the bond. It is advisable to consult a tax advisor for specific tax implications.

Can zero-coupon bonds be sold before maturity?

Yes, zero-coupon bonds can be sold before maturity. However, their value in the secondary market will fluctuate based on prevailing interest rates and market conditions. Selling before maturity may result in a capital gain or loss.

Who should consider investing in zero-coupon bonds?

Zero-coupon bonds may be suitable for investors who:

– Have a long-term investment horizon.

– Seek a fixed return at a future date.

– Are willing to withstand fluctuations in market value.

– Are comfortable with the potential tax implications.

Are zero-coupon bonds suitable for income-seeking investors?

Zero-coupon bonds are generally not suitable for income-seeking investors, as they do not provide regular interest payments. These bonds are more suitable for investors who prioritize long-term capital appreciation over current income.

Final Thoughts

Zero-coupon bonds are fixed-income securities that do not pay interest during their tenure but are issued at a significant discount to their face value. These bonds provide investors with the opportunity to buy at a discount and receive a lump sum payment at maturity. The benefit of zero-coupon bonds lies in their potential for capital appreciation and the ability to customize investment strategies. They offer a predictable, long-term investment option and can be used for various financial goals, such as retirement planning or funding education. These bonds are particularly appealing for investors seeking to diversify their portfolios and generate future cash flow. In conclusion, zero-coupon bonds provide an attractive investment opportunity with their unique characteristics and potential benefits.