A balanced budget is a financial management principle that ensures expenses do not exceed income. It is a key aspect of responsible financial planning, offering numerous advantages for individuals, businesses, and governments alike. By maintaining a balanced budget, individuals can effectively allocate their income, avoid debt, and achieve long-term financial stability. Similarly, businesses can optimize their resources, invest strategically, and foster growth. On a broader scale, governments can provide essential services, reduce national debt, and promote economic stability. In this blog article, we will delve into what a balanced budget is and explore its various advantages. So, let’s dive right in!

What is a Balanced Budget and Its Advantages

Understanding a Balanced Budget

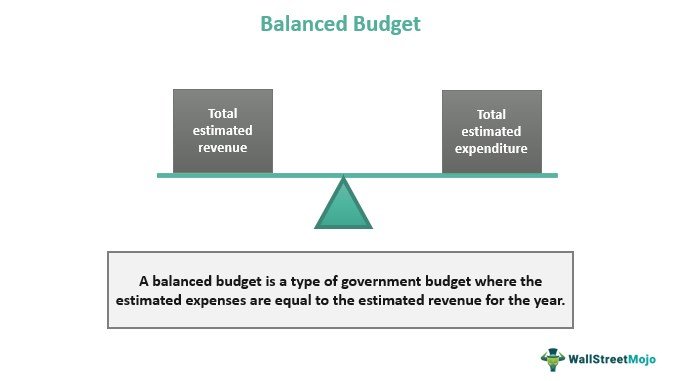

A balanced budget is a financial plan that ensures the income and spending of an individual, organization, or government is equal. It revolves around the concept of living within one’s means and not spending more than what is earned. In simple terms, a balanced budget signifies that expenses are in line with income, resulting in a net-zero deficit or surplus.

Advantages of a Balanced Budget

Maintaining a balanced budget offers several advantages, both on an individual and a larger scale. Let’s explore these benefits in detail:

1. Financial Stability

A balanced budget provides a foundation for financial stability. By ensuring that expenses do not exceed income, individuals and organizations can avoid accumulating unnecessary debt and improve their overall financial health. This stability creates a sense of security, alleviating stress and allowing for better planning and decision-making.

2. Debt Reduction

One of the significant advantages of a balanced budget is its potential to reduce debt. When income is equal to or greater than expenses, there is no need to rely on credit cards or loans to cover the shortfall. By avoiding unnecessary borrowing, individuals can allocate more funds towards paying off existing debts, leading to increased financial freedom and a lower debt burden.

3. Improved Credit Score

A balanced budget plays a crucial role in establishing and maintaining a good credit score. Consistently meeting financial obligations and keeping debts in check demonstrates responsible financial behavior to creditors and lenders. As a result, individuals with balanced budgets are more likely to qualify for loans with favorable interest rates, enabling them to meet their financial goals efficiently.

4. Enhanced Saving Potential

When expenses are kept in line with income, there is room for savings. A balanced budget allows individuals to allocate a portion of their earnings towards savings, whether it’s for emergencies, future goals, or retirement. Regular saving not only builds a safety net but also provides financial flexibility and the opportunity for future investments.

5. Financial Independence

A balanced budget is a pathway to financial independence. By consciously managing spending and prioritizing financial goals, individuals can gain control over their money. This control allows for the realization of long-term aspirations, such as owning a home, starting a business, or pursuing higher education, without relying on others for financial support.

6. Better Decision-Making

Maintaining a balanced budget requires careful consideration of expenses and income. This mindset fosters better decision-making skills, as individuals must prioritize their spending and evaluate the value of each expense. Budgeting encourages mindful consumption, enabling individuals to make informed choices that align with their overall financial goals.

7. Increased Financial Awareness

A balanced budget enhances financial awareness by providing a clear picture of income, expenses, and savings. When individuals actively track their spending, they become more conscious of their financial habits, identifying areas where they can cut back or invest more. This increased awareness promotes a healthier relationship with money and facilitates long-term financial success.

8. Economic Stability

On a larger scale, implementing a balanced budget is crucial for achieving economic stability. Governments that maintain balanced budgets can better manage public finances, reducing the risk of economic crises and fostering sustainable growth. This stability leads to greater confidence among investors, which in turn stimulates business activity and job creation.

9. Reduced Inflation and Interest Rates

Balanced budgets contribute to controlling inflation and interest rates. When governments keep their spending in check and avoid excessive borrowing, they can better manage monetary policy. This responsible approach helps stabilize the economy and prevents inflationary pressures, ensuring that interest rates remain manageable for businesses and individuals.

10. Long-Term Economic Growth

By maintaining a balanced budget, governments can allocate resources more efficiently and invest in infrastructure, education, and other sectors that drive long-term economic growth. Additionally, fewer financial constraints allow governments to implement effective fiscal policies, ensuring stability and fostering an environment conducive to business expansion and innovation.

In conclusion, a balanced budget offers numerous advantages, including financial stability, debt reduction, improved credit scores, enhanced saving potential, and financial independence. It also promotes better decision-making, increased financial awareness, economic stability, reduced inflation and interest rates, and long-term economic growth. Whether on an individual or government level, embracing the principles of a balanced budget can pave the way for a brighter financial future.

Should the U.S. Government Balance Its Budget?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a balanced budget and why is it important?

A balanced budget is a financial plan where the total amount of money spent by an individual, organization, or government does not exceed the total income or revenue generated. It is important because it helps ensure fiscal discipline, stability, and sustainability in managing finances.

How does a balanced budget benefit individuals?

A balanced budget benefits individuals by ensuring they are not spending more than they earn. This helps in avoiding debt, maintaining financial stability, and working towards achieving long-term financial goals.

What are the advantages of a balanced budget for businesses?

A balanced budget offers several advantages for businesses. It helps them avoid unnecessary expenses, manage cash flow effectively, reduce debt, increase savings, and strengthen their financial position. Moreover, it allows businesses to plan for future investments and expansion with greater confidence.

How does a balanced budget contribute to economic stability?

A balanced budget contributes to economic stability by controlling inflation, reducing the risk of fiscal crises, and maintaining a stable currency. It ensures that the government or organization is not overspending, which helps in creating a sustainable and predictable economic environment.

What measures can be taken to achieve a balanced budget?

To achieve a balanced budget, one can consider implementing measures such as controlling expenses, increasing revenue through sound financial practices, reducing unnecessary expenditures, and prioritizing financial goals. It is also crucial to regularly review and adjust the budget to ensure it remains balanced.

What are the long-term benefits of maintaining a balanced budget?

Maintaining a balanced budget brings long-term benefits such as financial stability, reduced debt burden, increased savings, improved creditworthiness, and the ability to allocate resources effectively. It also provides a solid foundation for future financial growth and resilience.

How does a balanced budget contribute to government sustainability?

A balanced budget contributes to government sustainability by ensuring that public finances are managed responsibly. It helps prevent excessive borrowing, reduces the need for austerity measures, instills investor confidence, and allows governments to fund essential services without burdening future generations with excessive debt.

Can a balanced budget hinder economic growth?

While maintaining a balanced budget is important, it is possible that stringent adherence to it without considering economic conditions could hinder economic growth in certain scenarios. However, with proper planning and flexibility, a balanced budget can be achieved while still allowing room for strategic investments and initiatives that stimulate economic growth.

Final Thoughts

A balanced budget is a financial plan that ensures total expenses do not exceed total income. It allows individuals, businesses, and governments to maintain financial stability and avoid debt. The advantages of a balanced budget are numerous. Firstly, it promotes fiscal responsibility by encouraging responsible spending and saving habits. Secondly, it facilitates better financial planning and allocation of resources. Thirdly, it reduces the risk of financial crises and provides a safety net during economic downturns. Overall, a balanced budget is crucial for achieving long-term financial stability and sustainability. It helps to mitigate financial risks and fosters a healthy financial environment for individuals and organizations alike.