A bear market – it’s a term that you may have heard thrown around in financial discussions, but what exactly does it mean? In simple terms, a bear market is a period of time in the stock market when prices are falling, and investor confidence is low. It’s a time when pessimism dominates, and fear of further losses can lead to selling pressure outweighing buying pressure. Understanding what a bear market is and how it can impact your investments is crucial in navigating the sometimes volatile world of finance. So, let’s dive deeper into what a bear market entails and how it can affect you.

What is a Bear Market?

A bear market is a financial market condition where the prices of securities, such as stocks and bonds, experience a prolonged period of decline. It is characterized by negative sentiment among investors, resulting in a downward trend in the overall market.

During a bear market, there is typically a decrease in investor confidence, leading to a sell-off of securities. This sell-off can be attributed to a variety of factors, including economic downturns, geopolitical tensions, or negative news impacting specific industries or companies. As a result, the demand for stocks and other assets decreases, causing their prices to fall.

Key Characteristics of a Bear Market

Bear markets are distinct from short-term market fluctuations and can last for several months or even years. Here are some key characteristics of a bear market:

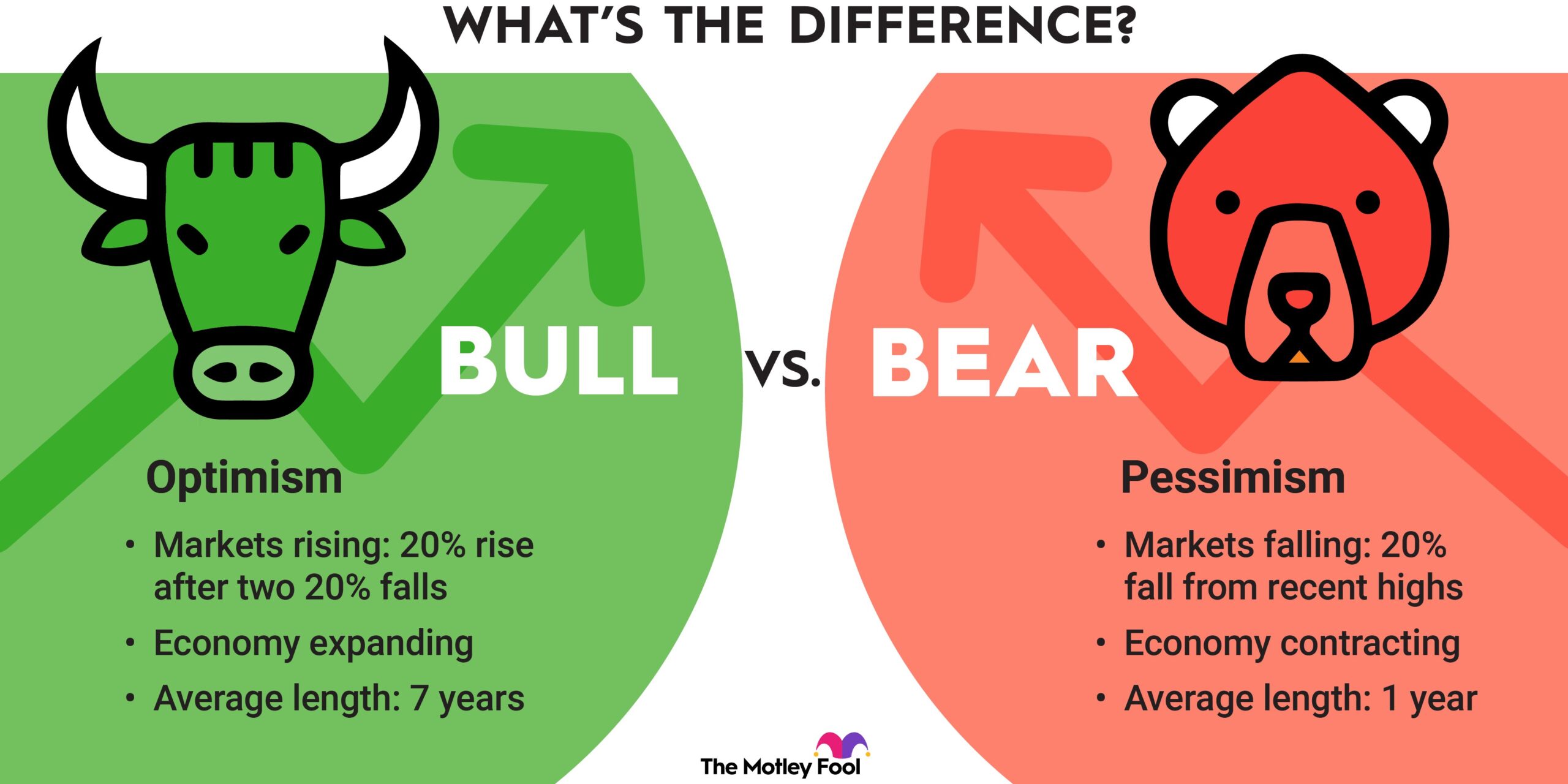

1. Declining Prices: The primary characteristic of a bear market is the decline in asset prices, with stock prices falling at least 20% from their recent highs. This drop in prices is often accompanied by high trading volumes as investors rush to sell their holdings.

2. Negative Investor Sentiment: In a bear market, investor sentiment turns pessimistic due to a variety of factors, such as economic uncertainty, corporate earnings reports, or changes in government policies. This negative sentiment further fuels the selling pressure on securities.

3. Increased Volatility: Bear markets are usually accompanied by increased market volatility. This means that prices can fluctuate widely over short periods, reflecting the uncertainty and fear prevalent in the market.

4. Reduced Trading Activity: In a bear market, trading activity tends to decline as investors become more cautious. This can be attributed to a lack of buying interest and a reluctance to enter the market amidst the prevailing negative sentiment.

Causes of Bear Markets

Bear markets can have various causes, including:

1. Economic Downturns: Economic recessions or slowdowns often trigger bear markets. During these periods, factors such as rising unemployment, falling GDP growth rates, or declining consumer spending can negatively impact corporate earnings and investor sentiment.

2. Geopolitical Concerns: Political instability, trade disputes, or conflicts between nations can create uncertainty in the markets and lead to a bearish sentiment. Investors may become hesitant to invest in stocks or other assets, fearing the potential impact of these geopolitical events on the global economy.

3. Industry-Specific Issues: Bear markets can also be driven by problems within specific industries. For example, a decline in oil prices could lead to a bear market in the energy sector. Similarly, regulatory changes or technological disruptions can significantly impact specific industries, causing a decline in their stock prices.

4. Market Bubbles: Speculative bubbles, where asset prices surge to unsustainable levels, can eventually burst, leading to a bear market. These bubbles are often fueled by excessive optimism and investor speculation. Once the bubble bursts, prices plummet as the market corrects itself.

Investing Strategies during Bear Markets

While bear markets can be challenging for investors, there are strategies that can help navigate this downturn and potentially capitalize on opportunities. Here are a few strategies to consider:

1. Diversification: Having a diversified investment portfolio can help mitigate the impact of a bear market. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to any single downturn.

2. Long-Term Perspective: It’s important to maintain a long-term perspective and avoid making impulsive investment decisions based on short-term market movements. Historically, bear markets have been followed by periods of recovery and growth.

3. Value Investing: During a bear market, some stocks may become undervalued due to market pessimism. Value investors look for these opportunities, focusing on stocks with strong fundamental metrics and reasonable valuations. Buying stocks at discounted prices can potentially lead to significant gains when the market recovers.

4. Asset Allocation: Adjusting asset allocation by reducing exposure to equities and increasing exposure to fixed income or defensive assets (such as bonds or cash) can help minimize losses during a bear market. However, investors should consider their risk tolerance and long-term goals when making such adjustments.

5. Regular Portfolio Review: Regularly reviewing and rebalancing your investment portfolio can ensure it remains aligned with your risk tolerance and financial objectives. Rebalancing involves selling investments that have become overweight and reinvesting in underweight assets, maintaining the desired asset allocation.

It’s crucial to remember that investing during a bear market carries risks, and seeking professional financial advice is advisable. Additionally, investors should consider their individual circumstances, risk tolerance, and investment goals before implementing any specific investment strategies.

In conclusion, bear markets are challenging periods characterized by declining asset prices, negative investor sentiment, increased volatility, and reduced trading activity. They can be caused by economic downturns, geopolitical concerns, industry-specific issues, or market bubbles. While bear markets present challenges, they also offer opportunities for investors to capitalize on undervalued assets and potentially generate long-term returns. By diversifying portfolios, maintaining a long-term perspective, and employing investment strategies suited for bear markets, investors can navigate these downturns with greater confidence.

Defining a Bear Market

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a bear market?

A bear market refers to a condition in the financial market characterized by falling prices and a pessimistic sentiment among investors. It is typically accompanied by widespread selling of securities, decline in market indices, and a generally negative economic outlook.

How long does a bear market last?

The duration of a bear market varies and is influenced by numerous factors such as economic conditions, investor behavior, and market trends. Some bear markets may last for a few months, while others can extend over several years.

What causes a bear market?

Bear markets can be triggered by various factors, including economic downturns, geopolitical tensions, changes in government policies, corporate scandals, or major global events. These events often result in a loss of investor confidence and a subsequent decline in stock prices.

How can investors protect themselves during a bear market?

During a bear market, investors can take certain measures to mitigate potential losses. These include diversifying their investment portfolios, focusing on defensive sectors, having a long-term perspective, implementing stop-loss orders, and consulting with a financial advisor.

Are bear markets always bad for investors?

While bear markets are generally associated with negative market sentiment, they can also present opportunities for investors. Investors with a long-term perspective may see bear markets as a chance to buy quality assets at lower prices and potentially benefit from future price appreciation.

How does a bear market differ from a bull market?

A bear market is characterized by falling prices, pessimistic sentiment, and a generally declining market. Conversely, a bull market is marked by rising prices, optimistic sentiment, and a generally favorable economic outlook.

Can bear markets occur in specific sectors or asset classes?

Yes, bear markets can occur in specific sectors, industries, or asset classes. For example, a bear market can be limited to the technology sector while other sectors may experience different market conditions. It is essential for investors to be aware of sector-specific risks.

How can I identify if a bear market is occurring?

To identify a bear market, investors often look for certain indicators such as sustained declines in major market indices, increased selling pressure, rising volatility, and a general pessimistic sentiment among market participants. It is crucial to conduct thorough analysis and seek professional advice when assessing market conditions.

Final Thoughts

A bear market refers to a period of declining stock prices, marked by pessimism and investor uncertainty. It is characterized by an overall downward trend and negativity in the market. During a bear market, selling pressure is higher than buying pressure, leading to falling prices. Investors who believe a bear market is approaching may adopt defensive strategies to protect their investments. Diversification, careful stock selection, and a long-term investment approach can help mitigate the impact of a bear market. Understanding the concept of a bear market is crucial for investors to make informed decisions and navigate through challenging market conditions.