In a volatile financial market, knowing how to navigate a bear market is crucial for investors looking to protect their portfolios and make informed decisions. So, what exactly is a bear market and how can you navigate it? A bear market is a period of declining stock prices, typically accompanied by widespread pessimism and investor fear. But fear not, there are strategies you can employ to weather the storm and even potentially profit. In this article, we will delve into what a bear market entails and explore practical tips to help you navigate it with confidence.

What is a Bear Market and How to Navigate It

In the world of finance and investing, the term “bear market” is often used to describe a period of time when the prices of stocks, bonds, or other investment securities are falling. During a bear market, investors may experience significant losses and market sentiments are generally pessimistic. This can be a challenging time for investors, but with the right knowledge and strategies, it is possible to navigate a bear market successfully.

Understanding the Basics of a Bear Market

A bear market is typically characterized by a sustained decline in stock prices, usually accompanied by a negative overall market sentiment and a lack of investor confidence. During this period, prices of stocks and other assets may fall by 20% or more from their recent highs. Bear markets can be caused by a variety of factors, including economic downturns, geopolitical events, or even market speculation.

Causes and Indicators of Bear Markets

Bear markets can be triggered by various factors. Some common causes include:

- Economic slowdown or recession: A significant decline in overall economic activity can lead to a bear market. This can be due to factors such as rising interest rates, high unemployment rates, or a decrease in consumer spending.

- Geopolitical events: Political instability, trade tensions, or global conflicts can create uncertainty in the markets and contribute to a bearish sentiment.

- Market speculation: Speculative bubbles and excessive optimism in the markets can lead to a bear market when reality sets in and prices start to fall.

- Corporate scandals or financial crises: Negative news about companies or the financial system as a whole can erode investor confidence and trigger a bear market.

There are several indicators that can help identify a bear market:

- Market indexes: Significant downward movements in popular market indexes, such as the S&P 500 or Dow Jones Industrial Average, can indicate the beginning of a bear market.

- Volume trends: An increase in trading volume during a period of declining prices can signal a bear market, as it suggests a higher level of selling pressure.

- Sentiment indicators: Investor sentiment plays a crucial role in the direction of the market. Negative sentiment, as reflected in surveys or sentiment indicators, can indicate a bearish market environment.

Navigating a Bear Market

While a bear market can be challenging, there are strategies that investors can employ to navigate it effectively and potentially even profit from it. Here are some key considerations:

1. Stay Calm and Emotionally Resilient

One of the most important things to remember during a bear market is to stay calm and avoid making impulsive decisions based on fear or panic. Emotional decision-making can often lead to poor investment choices and unnecessary losses. Instead, it’s essential to maintain a long-term perspective and focus on the underlying fundamentals of your investments.

2. Reassess Your Investment Goals and Risk Tolerance

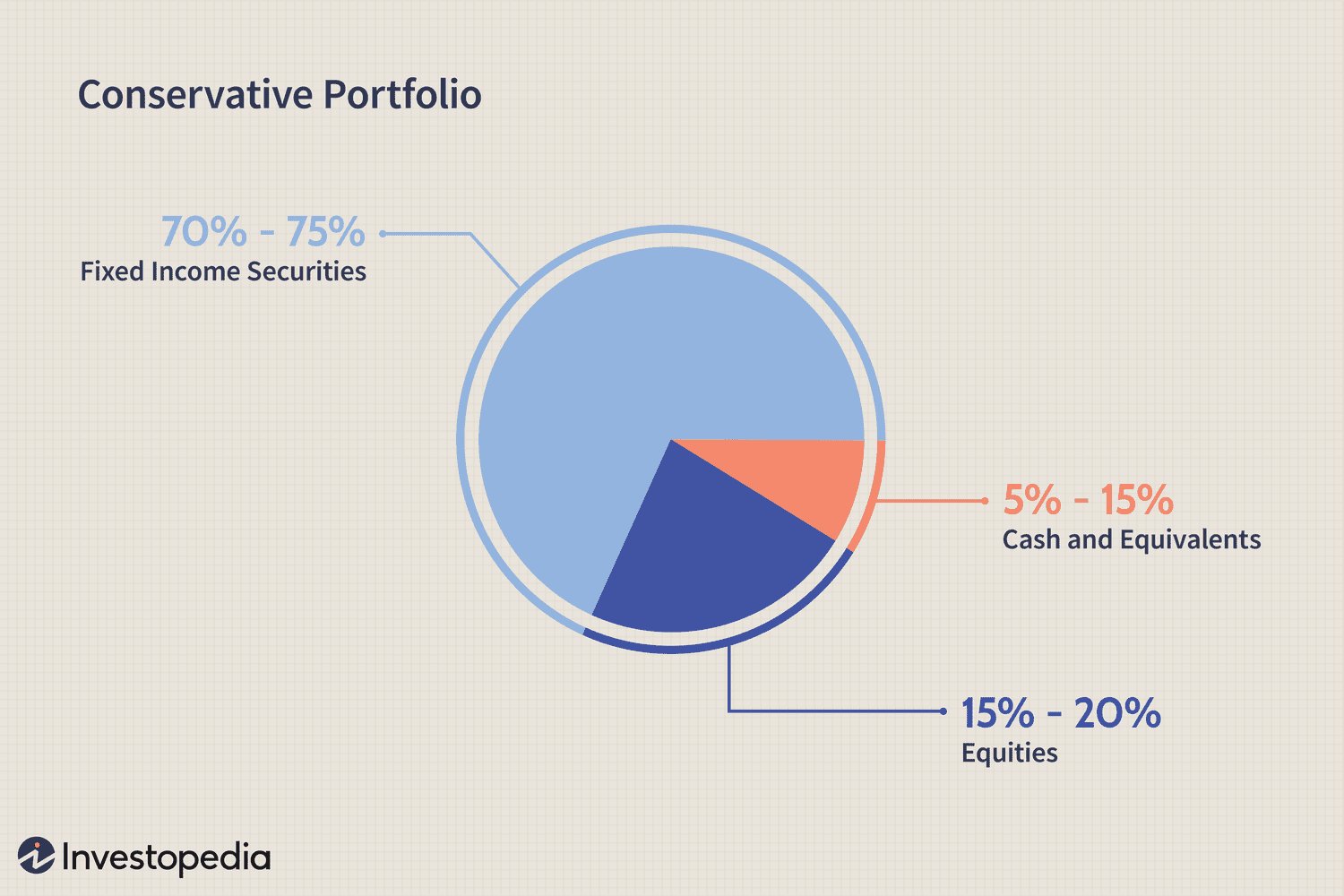

A bear market can be a good time to reevaluate your investment goals and risk tolerance. Determine whether your current portfolio aligns with your long-term objectives and if it still matches your risk appetite. Adjusting your asset allocation or diversifying your holdings can help reduce risk and potentially improve your chances of weathering the storm.

3. Diversify Your Portfolio

Diversification is a time-tested strategy that can help reduce risk during a bear market. By spreading your investments across different asset classes, sectors, and geographic regions, you can minimize the impact of a single investment’s poor performance. Diversification can help cushion the overall impact of a bear market on your portfolio.

4. Consider Defensive Investments

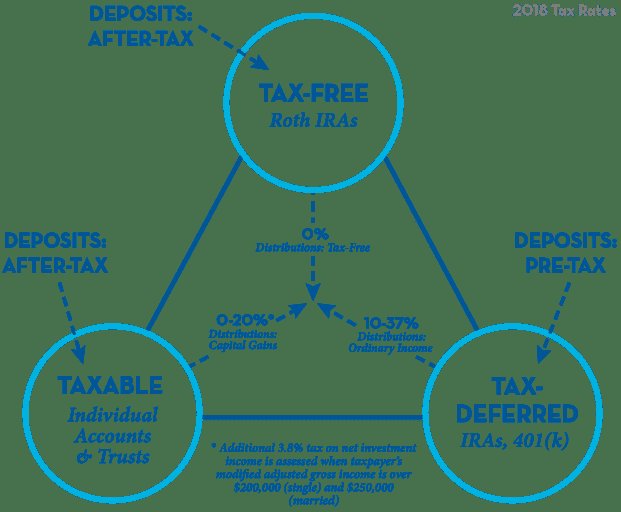

During a bear market, some investments tend to fare better than others. Defensive investments, such as bonds, cash equivalents, or dividend-paying stocks, may provide more stability and potential income during market downturns. These assets typically exhibit lower volatility and can act as a buffer against significant losses.

5. Take Advantage of Opportunities

Bear markets can also present unique investment opportunities for those willing to take a contrarian approach. As prices decline, certain stocks or sectors may become undervalued, offering attractive buying opportunities. Conduct thorough research, identify companies with strong fundamentals, and consider investing in them at discounted prices.

6. Implement Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach can help mitigate the impact of short-term market fluctuations and potentially allow you to accumulate more shares when prices are low. Over time, dollar-cost averaging can smooth out the effect of market volatility and potentially lead to favorable long-term returns.

7. Stay Informed and Seek Professional Advice

Stay informed about market trends and developments during a bear market. Read reputable financial news sources, follow market experts, and seek professional advice if needed. Consulting a qualified financial advisor can provide valuable insights and help you make well-informed investment decisions based on your specific financial situation and goals.

By implementing these strategies and maintaining a disciplined approach, investors can navigate a bear market with greater confidence and potentially even find opportunities for growth. Remember, successful investing is a long-term endeavor, and staying focused on your goals is key to weathering the ups and downs of the market.

(Please note that the information provided in this article is for educational purposes only and should not be considered as financial advice. Investing in the stock market involves risk, and individuals should consult with a qualified financial advisor before making any investment decisions.)

Navigating A Bear Market

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a bear market?

A bear market refers to a period of time in the financial market when prices of securities, such as stocks, are falling or are expected to fall. It is characterized by pessimism, investor selling, and a general decline in market value.

How long does a bear market usually last?

The duration of a bear market can vary, but they tend to be shorter than bull markets. On average, bear markets last around 9 to 18 months. However, some bear markets can be shorter, lasting just a few months, while others can last longer, extending beyond two years.

What causes a bear market?

Bear markets can be triggered by various factors, such as economic recessions, geopolitical tensions, changes in government policies, or negative investor sentiment. These factors can lead to a decrease in demand for stocks and other investments, resulting in falling prices.

How can investors navigate a bear market?

1. Diversify your portfolio: Spread your investments across different asset classes to mitigate risk.

2. Stay informed: Keep up with market news and analysis to make informed decisions.

3. Maintain a long-term perspective: Remember that markets are cyclical and historically recover from bear markets.

4. Consider defensive investments: Allocate some of your portfolio to defensive stocks like utilities or consumer staples.

5. Review your goals: Assess your financial objectives and adjust your investment strategy accordingly.

6. Focus on quality: Look for fundamentally sound companies with strong balance sheets and competitive advantages.

7. Avoid panic-selling: Stay disciplined and avoid making impulsive decisions based on short-term market movements.

8. Seek professional advice: Consider consulting with a financial advisor who can provide guidance tailored to your specific situation.

Are bear markets a good time to invest?

While bear markets can be challenging for investors, they also present opportunities. Prices of stocks and other investments often become undervalued, offering long-term investors the chance to buy assets at lower prices. However, it is crucial to carefully assess potential investments and have a long-term investment horizon.

How can one protect their investments during a bear market?

To protect investments during a bear market:

1. Diversify: Spread investments across different asset classes.

2. Consider bonds: Some bonds tend to perform well during market downturns.

3. Set stop-loss orders: These automatically sell your investments if they reach a predetermined price.

4. Use hedging strategies: Options or short selling can help offset potential losses.

5. Stay vigilant: Regularly review and adapt your investment strategy based on market conditions.

Can bear markets impact retirement savings?

Yes, bear markets can have a significant impact on retirement savings, especially for individuals nearing retirement. A prolonged bear market can erode the value of investment portfolios, potentially delaying retirement or requiring adjustments to retirement plans. It is crucial to regularly review and rebalance retirement portfolios to minimize risks.

Should I continue investing in a bear market?

Continuing to invest during a bear market can be a prudent strategy, especially if you have a long-term investment horizon. By investing consistently, you can take advantage of lower prices and potentially generate higher returns in the future. However, it is important to carefully assess your risk tolerance and consult with a financial advisor.

Final Thoughts

In conclusion, a bear market is a period of declining stock prices accompanied by pessimism and investor uncertainty. Navigating a bear market requires a strategic approach. Firstly, it’s important to stay calm and avoid emotional decision-making. Secondly, diversify your portfolio to minimize risk and consider defensive stocks. Additionally, keeping a long-term perspective and staying invested can help ride out the market downturn. Regularly reviewing and adjusting your investment strategy, staying informed, and seeking professional advice when needed are also crucial in navigating a bear market successfully. By following these strategies, investors can weather the storm and potentially even find opportunities amidst the challenging market conditions. So, understanding what a bear market is and how to navigate it is essential for any investor.